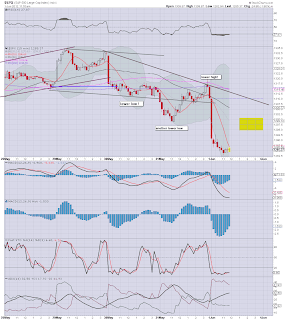

The VIX was something of a mystery today. With the indexes losing over 2% today, VIX 'only' closed up around 10%. The opening VIX move of 8% soon failed..and VIX even went red at 11.30am. The close was somewhat bullish volatility, but still, the VIX appears to either simply be lagging, or is warning that an index floor is about here.

VIX, 60min

VIX, daily, bullish outlook

VIX, weekly

Summary

VIX closed well into the close, and we are sitting in the target box on the daily chart. The VIX weekly cycle still offers slightly higher levels of 29/30 next week.

More later...looking at the daily index cycles.

Friday, 1 June 2012

Closing Brief - a reasonable week for the bears

I say 'reasonable', since it really wasn't that major a down week, around 3% for the sp' - of which most of that was today. So...a bearish week, but those bears getting excited need to keep things in perspective.

Lets look at how those hourly cycles closed...

IWM

Dow

SP

Summary

The usual intra-day bounce that the market usually provides after an initial gap down failed to occur. Instead, we saw a rare 'gap and go' day.

The VIX remains the mystery of the day though, it opened weak, went briefly red, and even though it closed +10%, that still is less than half of what I would have expected considering the index declines.

More on the VIX..later.

Lets look at how those hourly cycles closed...

IWM

Dow

SP

Summary

The usual intra-day bounce that the market usually provides after an initial gap down failed to occur. Instead, we saw a rare 'gap and go' day.

The VIX remains the mystery of the day though, it opened weak, went briefly red, and even though it closed +10%, that still is less than half of what I would have expected considering the index declines.

More on the VIX..later.

3pm update - time to wrap up another week

Well, the market has fallen lower than just about anyone suggested today. The break below sp'1284 - the 200 day MA, arguably suggest further downside next week.

There are two main count ideas out there, the first is that this is the conclusion of main wave'1..and now we 'somehow' rally for a few weeks, before a major wave'3 lower in mid June. The other idea is that we'll just keep falling to the low 1200s. From a chart perspective, the latter theory seems more likely - although I'm still looking for some kind of bounce.

Sp'60min

Vix'60min

Summary

I can't be short here, and the 60min cycle is too low to re-short, so I'm going to sit it out across the weekend.

More after the close*

--

*there are SO many bearish sell signals triggering today across the monthly charts, I really not sure what to cover in this weekends posts!

There are two main count ideas out there, the first is that this is the conclusion of main wave'1..and now we 'somehow' rally for a few weeks, before a major wave'3 lower in mid June. The other idea is that we'll just keep falling to the low 1200s. From a chart perspective, the latter theory seems more likely - although I'm still looking for some kind of bounce.

Sp'60min

Vix'60min

Summary

I can't be short here, and the 60min cycle is too low to re-short, so I'm going to sit it out across the weekend.

More after the close*

--

*there are SO many bearish sell signals triggering today across the monthly charts, I really not sure what to cover in this weekends posts!

2pm update - market really struggling

The market breaks the sp'1280 level, so low 1270s/60s would appear likely early next week. The cycle target of 1225/00 seems very viable within 5-7 trading days. VIX still weaker than it should be, but its just broken a new high...so maybe we'll just keep on falling into the close?

Sp'60min

vix'60min

Summary

I can't re-short with the 15/60min cycles as they currently are, there remains significant risk of a 1% bounce at any hour - as we saw only yesterday!

If we don't rally at least to 1295..I think I'll sit this out until next Monday. We could easily gap up 1% at the Monday open - whether for 'technical oversold' reasons or for some baseless nonsense rumour.

Bears merely need a close under 1300 to confirm the main daily trend, and besides, the monthly cycles are all warning of much lower levels to the low sp'1100s anyway.

Sp'60min

vix'60min

Summary

I can't re-short with the 15/60min cycles as they currently are, there remains significant risk of a 1% bounce at any hour - as we saw only yesterday!

If we don't rally at least to 1295..I think I'll sit this out until next Monday. We could easily gap up 1% at the Monday open - whether for 'technical oversold' reasons or for some baseless nonsense rumour.

Bears merely need a close under 1300 to confirm the main daily trend, and besides, the monthly cycles are all warning of much lower levels to the low sp'1100s anyway.

1pm update - still waiting

I'm still waiting for some kind of bounce, so far we're just not seeing it. Yet the VIX is still not adequately confirming todays drop in the indexes.

sp'15min

vix'15min

Summary

You can see the MACD (blue bar histogram) cycle on the Sp' has reset back to almost evens, so we're arguably already halfway in the cycle - with prices merely trading sideways.

So...I sit here waiting...target remains sp'1295/1300, although right now, 1300 seems out of range by 3pm.

*all the bigger monthly cycles today confirming my overall target of sp'1100. If you read my posting last night on the VEU, you'll know that is warning that 1100..will not hold as a floor.

More later

sp'15min

vix'15min

Summary

You can see the MACD (blue bar histogram) cycle on the Sp' has reset back to almost evens, so we're arguably already halfway in the cycle - with prices merely trading sideways.

So...I sit here waiting...target remains sp'1295/1300, although right now, 1300 seems out of range by 3pm.

*all the bigger monthly cycles today confirming my overall target of sp'1100. If you read my posting last night on the VEU, you'll know that is warning that 1100..will not hold as a floor.

More later

12pm update - bounce...underway

The day-trading bears have had all morning to cash in. We're still due a bounce to sp'1295/1300. Bears will be seeking a close at least under 1300 - which would open up targets of 1225/00 within 5-7 trading days

The VIX remains really bizarre, and was actually red just earlier. I'm not sure what to make of this. VIX 'should' in theory have opened up 20% to around 29. Instead, 8% to 26.

VIX'15min

Sp'15min

Summary

Today is interesting so far, the econ-data confirms my overall underlying view - and also my primary monthly cycle target of sp'1100 within a month or so.

I remain looking to re-short after 2pm...preferably sp'1295/1300 or higher.

The VIX remains really bizarre, and was actually red just earlier. I'm not sure what to make of this. VIX 'should' in theory have opened up 20% to around 29. Instead, 8% to 26.

VIX'15min

Sp'15min

Summary

Today is interesting so far, the econ-data confirms my overall underlying view - and also my primary monthly cycle target of sp'1100 within a month or so.

I remain looking to re-short after 2pm...preferably sp'1295/1300 or higher.

11am update - awaiting intra-day bounce

With the VIX failing to adequately confirm the decline in the indexes, I'm glad to be back to cash. This market is not to be trusted, and when I see a black candle on the VIX at the open - with reversal candles on the Rus'2000 index, that's a real warning that the bears probably have it 'as good as it gets'.

However, I'm still bearish into next week, and I remain looking to reshort after 2pm, maybe around sp'1295/1300.

Sp'15min

vix'15min

Summary

VIX is putting in a double top on the intra-day 15min - the indexes are arguably doing the same with a double floor.

Looking for mini ramp to sp' 1295/1300 by 2/3pm. We might not bounce strongly...but i don't think any bear should be short into the afternoon.

More later...

However, I'm still bearish into next week, and I remain looking to reshort after 2pm, maybe around sp'1295/1300.

Sp'15min

vix'15min

Summary

VIX is putting in a double top on the intra-day 15min - the indexes are arguably doing the same with a double floor.

Looking for mini ramp to sp' 1295/1300 by 2/3pm. We might not bounce strongly...but i don't think any bear should be short into the afternoon.

More later...

10am update - VIX is NOT confirming this move

Considering the mood out there, the VIX should be higher...much higher. Either the market has considerably further to fall today - with the VIX moving to +20%, or the lows for the day are already in.

The daily index cycles are of course important, and they do suggest much lower levels, yet....bears need to be careful today.

VIX, 60min

Sp'15min

Sp'60min

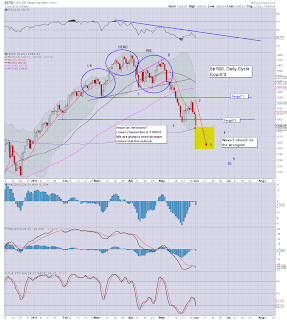

Sp' daily, bearish outlook, count'3

Summary

I remain short, but looking to exit this hour...and re-short after 1pm.

My basis to exit will be the 15min cycle...via MACD cycle.

--

UPDATE 10.05am : exited ALL index short positions sp'1290

More across the day.

The daily index cycles are of course important, and they do suggest much lower levels, yet....bears need to be careful today.

VIX, 60min

Sp'15min

Sp'60min

Sp' daily, bearish outlook, count'3

Summary

I remain short, but looking to exit this hour...and re-short after 1pm.

My basis to exit will be the 15min cycle...via MACD cycle.

--

UPDATE 10.05am : exited ALL index short positions sp'1290

More across the day.

Pre-Market Brief - BOOM

Good morning..and welcome to June. Jobs data disappoints market...SP' drops a further 10 handles in seconds...

Jobs data; 69k vs 150k expected

*there is also some key econ-data at 10am, so bears should look for a secondary down wave to begin around then. .

Sp'60min

Summary

Market looks set to open around 1285 0 the 200 day MA. A break under that...opens up 1270/60...today. - with VIX 27/29

I am short, looking for a temprorary exit around 1285 later this morning. I look to reshort by late afternoon, with new lower target of 1225/00 end of next week.

Good wishes for Friday..and all of June !

Jobs data; 69k vs 150k expected

*there is also some key econ-data at 10am, so bears should look for a secondary down wave to begin around then. .

Sp'60min

Summary

Market looks set to open around 1285 0 the 200 day MA. A break under that...opens up 1270/60...today. - with VIX 27/29

I am short, looking for a temprorary exit around 1285 later this morning. I look to reshort by late afternoon, with new lower target of 1225/00 end of next week.

Good wishes for Friday..and all of June !

The Giant H/S formation - major equity market collapse ahead

Since I started posting here - some three months ago, the world index monthly charts have become the foundation for my overall outlook. Since January we have seen the world indexes rollover one by one. The US indexes have remained stronger than the rest of the world (the Bernanke Put?), but even the US markets have shown a clear rollover since the April peak.

FTSE World Indexes

The above chart was inspired by an original by John Murphy from Stockcharts.com. I was not aware of 'VEU', but its actually something I will most certainly refer to regularly in the months ahead. The VEU gives a good summary of the world indexes - but excludes the US indexes.

SP, monthly

You can see a key difference between the world indexes (VEU) and the Sp'500 chart. The US H/S formation is very lop sided to the upside, whereas the world index H/S formation is flat. I suppose anyone could list many reasons why this might be so, but the main one is probably none other than 'him'....the Bernanke, and his regular bouts of QE..Yes the USA is a stronger economy than most out there - and thus should perform better, but still, I'm guessing we don't have a flat H/S formation because of the printer man.

Summary

The VEU chart I believe is starkly bearish, and should scare the hell out of anyone with long term stock holdings. We presently have a GIANT head/shoulders formation, just as we did in 2007/08 - before the collapse wave. Except the latest H/S formation started from a lower price level..and is twice as big in both price range and time scale.

I believe the VEU chart is clearly warning of a collapse wave - on a scale similar to that seen in 2008. As noted, the 35.0 level will be a critical level for the bulls to hold. A break under 35 will surely qualify as a giant red flag for investors across the world.

I hope this chart provokes some of you to consider the bigger picture of world equity markets, I do think its important, and I will return to it regularly - not least since its a great way to summarise 'the rest of the world' in one single chart.

Looking ahead

We have a busy Friday ahead (5 sets of econ-data) including the big monthly jobs data. Market is expecting 150,000 (although estimates have been dropping in recent days). I'd guess anything under 100k would disappoint the market, anything under 50k...and we should in theory be looking at sp -25/30pts by the close of trading. As ever, bears should look to the VIX for confirmation if the market is -1% or more.

Goodnight from London

FTSE World Indexes

The above chart was inspired by an original by John Murphy from Stockcharts.com. I was not aware of 'VEU', but its actually something I will most certainly refer to regularly in the months ahead. The VEU gives a good summary of the world indexes - but excludes the US indexes.

SP, monthly

You can see a key difference between the world indexes (VEU) and the Sp'500 chart. The US H/S formation is very lop sided to the upside, whereas the world index H/S formation is flat. I suppose anyone could list many reasons why this might be so, but the main one is probably none other than 'him'....the Bernanke, and his regular bouts of QE..Yes the USA is a stronger economy than most out there - and thus should perform better, but still, I'm guessing we don't have a flat H/S formation because of the printer man.

Summary

The VEU chart I believe is starkly bearish, and should scare the hell out of anyone with long term stock holdings. We presently have a GIANT head/shoulders formation, just as we did in 2007/08 - before the collapse wave. Except the latest H/S formation started from a lower price level..and is twice as big in both price range and time scale.

I believe the VEU chart is clearly warning of a collapse wave - on a scale similar to that seen in 2008. As noted, the 35.0 level will be a critical level for the bulls to hold. A break under 35 will surely qualify as a giant red flag for investors across the world.

I hope this chart provokes some of you to consider the bigger picture of world equity markets, I do think its important, and I will return to it regularly - not least since its a great way to summarise 'the rest of the world' in one single chart.

Looking ahead

We have a busy Friday ahead (5 sets of econ-data) including the big monthly jobs data. Market is expecting 150,000 (although estimates have been dropping in recent days). I'd guess anything under 100k would disappoint the market, anything under 50k...and we should in theory be looking at sp -25/30pts by the close of trading. As ever, bears should look to the VIX for confirmation if the market is -1% or more.

Goodnight from London

Daily Index Cycle Update - bearish!

Despite a crate of lousy econ-data this morning, the market still managed a latter day recovery, but closed marginally red - with the VIX closing flat in AH.

However you might like to count the waves, what IS clear is that we have a giant bear flag on the daily indexes...and the trend is warning of major downside in the coming days.

IWM, bearish outlook

Dow, daily

SP, daily, bearish outlook, count'2

Transports

Summary

The transports was the first to break the daily bear flag, the Dow did that today, the Sp/IWM were borderline breaks.

I remain bearish, and am holding short into Friday, and probably into next week.

--

How low do we go ?

I've not read around too much lately, but what I have seen are other chartists with targets in the 1280/70 range...and as low as 1225/00. Those make sense to me, and indeed, when we are at the 1280/70 zone, it will be interesting to see if the market can keep pushing lower.

Right now, I just don't know how low we might go. The monthly charts suggest much lower levels of sp'1100, but that might not be for a few months.

More later, with a very important chart coming to close the day!

However you might like to count the waves, what IS clear is that we have a giant bear flag on the daily indexes...and the trend is warning of major downside in the coming days.

IWM, bearish outlook

Dow, daily

SP, daily, bearish outlook, count'2

Transports

Summary

The transports was the first to break the daily bear flag, the Dow did that today, the Sp/IWM were borderline breaks.

I remain bearish, and am holding short into Friday, and probably into next week.

--

How low do we go ?

I've not read around too much lately, but what I have seen are other chartists with targets in the 1280/70 range...and as low as 1225/00. Those make sense to me, and indeed, when we are at the 1280/70 zone, it will be interesting to see if the market can keep pushing lower.

Right now, I just don't know how low we might go. The monthly charts suggest much lower levels of sp'1100, but that might not be for a few months.

More later, with a very important chart coming to close the day!

Subscribe to:

Comments (Atom)