With the main indexes seeing new highs, the VIX remains trundling around in the low teens, settling +1.3% @ 13.33. Near term outlook is a VIX that will likely spike no higher than 15/16, before another wave lower to the 11s, even 10s before year end.

VIX'60min

VIX'daily3

Summary

There is virtually nothing to add. The main equity market remains strong, and the VIX looks set to remain in the low teens for the rest of the year.

--

more later..on the indexes

Tuesday, 22 October 2013

Closing Brief

The main indexes broke new highs, with the sp +10pts @ 1754, having peaked at 1759. The two leaders - Trans/R2K, closed +0.8% and +0.3% respectively. Near term trend remains bullish, but we're obviously getting over-stretched.

sp'60min

Summary

For the equity bulls out there, another great day. Regardless of any minor down cycle in the remainder of the week, with the market breaking new highs - across most indexes, the trend looks ever more secure to the upside.

-

more later..on the VIX

sp'60min

Summary

For the equity bulls out there, another great day. Regardless of any minor down cycle in the remainder of the week, with the market breaking new highs - across most indexes, the trend looks ever more secure to the upside.

-

more later..on the VIX

3pm update - another day, another high

The main indexes are holding comfortably in new territory, with the sp' making a play for a daily close in the 1760s..which would be extremely impressive. Bears are utterly powerless, with mainstream consensus now realising QE-taper won't happen until at least spring 2014.

sp'60min

Summary

*precious metals holding gains, whilst Oil is very weak, having broken support a few days ago.

--

Whether we close in the sp'1750/60s..entirely irrelevant. What does matter...primary trend remains to the upside, and those sp'1800s are viable in November.

What I find surprising is just how overly cautious even the cheer leaders are on clown finance TV about the current rally.

--

NFLX remains a fascinating one to watch. Big opening reversal...net losses, and now we'll see how many bull chasers want to come in again in the low 300s.

A closing hour ramp for NFLX looks very viable. All the big selling has already been done.

sp'60min

Summary

*precious metals holding gains, whilst Oil is very weak, having broken support a few days ago.

--

Whether we close in the sp'1750/60s..entirely irrelevant. What does matter...primary trend remains to the upside, and those sp'1800s are viable in November.

What I find surprising is just how overly cautious even the cheer leaders are on clown finance TV about the current rally.

--

NFLX remains a fascinating one to watch. Big opening reversal...net losses, and now we'll see how many bull chasers want to come in again in the low 300s.

A closing hour ramp for NFLX looks very viable. All the big selling has already been done.

2pm update - more of the same

The main market is comfortably holding moderate gains, with the sp' in the 1750s. The NYSE composite is back in the 10000s, for the first time since Oct'2007. Anyone touting big declines in the near term needs to have their trading screens...removed.

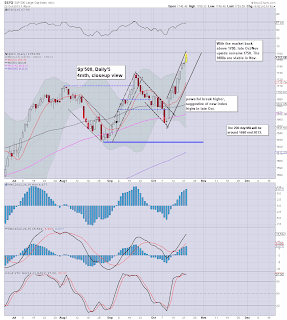

sp'daily5

NYSE comp, monthly

Summary

Little to add, trend is up.

Shear lunacy for anyone to be top calling with price action/structure as we currently have.

-

Ohh, but some will highlight divergences on the bigger monthly charts. Yet, price is what matters, and price is going UP..

sp'daily5

NYSE comp, monthly

Summary

Little to add, trend is up.

Shear lunacy for anyone to be top calling with price action/structure as we currently have.

-

Ohh, but some will highlight divergences on the bigger monthly charts. Yet, price is what matters, and price is going UP..

1pm update - afternoon chop

The main indexes are holding moderate gains. Most notable, the NYSE Comp' broke 10k today, with the Trans' coming within 25pts of hitting the big 7k level. Regardless of any minor weakness in the remainder of the week, underlying upward pressure is strong.

sp'60min

Summary

A baby bull flag on the hourly index charts? There is an obvious gap in the low 1730s, and maybe that will be filled later this week. Yet..that minor downside doesn't merit a short-side trade, Overly risky, whilst the broader trend is strongly upward.

-

However you want to count this nonsense, this remains a VERY powerful up wave from the sp'1646 low..which as of this morning was 113pts lower!

-

NFLX looks floored on the micro 5/15min cycles...

5min cycle

A late day ramp to 355/360...would be the natural target.

1.20pm.. sp' holding the 1750s pretty well. With QE tomorrow, equity bulls should be charging for a break into the 1760s, although a daily/weekly close >1760 will be real tough.

NFLX remains entertaining to watch...its holding the 330s..and there is real risk of late day closing ramp. Prime time for a snap higher...2.30pm or so.

sp'60min

Summary

A baby bull flag on the hourly index charts? There is an obvious gap in the low 1730s, and maybe that will be filled later this week. Yet..that minor downside doesn't merit a short-side trade, Overly risky, whilst the broader trend is strongly upward.

-

However you want to count this nonsense, this remains a VERY powerful up wave from the sp'1646 low..which as of this morning was 113pts lower!

-

NFLX looks floored on the micro 5/15min cycles...

5min cycle

A late day ramp to 355/360...would be the natural target.

1.20pm.. sp' holding the 1750s pretty well. With QE tomorrow, equity bulls should be charging for a break into the 1760s, although a daily/weekly close >1760 will be real tough.

NFLX remains entertaining to watch...its holding the 330s..and there is real risk of late day closing ramp. Prime time for a snap higher...2.30pm or so.

12pm update - truly tiresome

Whilst the main indexes continue to battle higher, the top callers are at it again. After all, we've already pulled back from the earlier sp'1759 high, its all downhill from here..right? The same old nonsense is being touted again..despite NOTHING changing. QE continues, that is all that matters.

sp'daily5

Summary

I'm beyond tired of this crap today.

Same old people calling a top, who will no doubt be doing the same thing next month..and for what will probably be another few YEARS before the current cycle is complete.

-

I see 'springheel jack' is open to my hyper-bullish outlook. At least someone else out there is starting to consider the unthinkable.

-

I'm almost tempted to just throw an 'sp'4000' chart out there EVERY day for the next month, if only to annoy the idiots still calling tops (are you listening Daneric?).

Mainstream and QE-taper

In the past few days the mainstream has really turned around, and consensus is now shifting to QE remaining at $85bn until the spring. No doubt, when we get to spring 2014...it'll be 'ohh, taper might start in June'. Tiresome huh?

-

VIX update from Mr T

time for lunch. I sincerely hope that improves my mood. Urghhh

sp'daily5

Summary

I'm beyond tired of this crap today.

Same old people calling a top, who will no doubt be doing the same thing next month..and for what will probably be another few YEARS before the current cycle is complete.

-

I see 'springheel jack' is open to my hyper-bullish outlook. At least someone else out there is starting to consider the unthinkable.

-

I'm almost tempted to just throw an 'sp'4000' chart out there EVERY day for the next month, if only to annoy the idiots still calling tops (are you listening Daneric?).

Mainstream and QE-taper

In the past few days the mainstream has really turned around, and consensus is now shifting to QE remaining at $85bn until the spring. No doubt, when we get to spring 2014...it'll be 'ohh, taper might start in June'. Tiresome huh?

-

VIX update from Mr T

time for lunch. I sincerely hope that improves my mood. Urghhh

11am update - here they come again

The main indexes are holding moderate gains, with the sp peaking at 1759. That could very easily be the peak of the week, certainly, we're scraping along the upper bol' on the weekly charts. Regardless of any minor down cycle, the primary trend remains powerfully to the upside.

sp'weekly8

Summary

No doubt we'll see a truckload of posters across today, and particularly after the close touting a 'this really is it this time' top calling.

It is ALL nonsense.

-

Even more laughable..we could pull back to sp'1730/20s...and I can just imagine the bearish hysteria out there.

I don't see sub 1700s viable for rest of the year.

-

NFLX, 5min....interesting trading action

The opening black candle warned of trouble. Looks like we have a spike floor, and things should stabilise from here.

Congrats to those shorting from the $390s, and who exited in the 370/350 zone this morning. Risky though, whilst the primary trend remains strongly bullish

sp'weekly8

Summary

No doubt we'll see a truckload of posters across today, and particularly after the close touting a 'this really is it this time' top calling.

It is ALL nonsense.

-

Even more laughable..we could pull back to sp'1730/20s...and I can just imagine the bearish hysteria out there.

I don't see sub 1700s viable for rest of the year.

-

NFLX, 5min....interesting trading action

The opening black candle warned of trouble. Looks like we have a spike floor, and things should stabilise from here.

Congrats to those shorting from the $390s, and who exited in the 370/350 zone this morning. Risky though, whilst the primary trend remains strongly bullish

10am update - welcome to the 1750s

The main indexes continue to push higher, with the sp' breaking into the 1750s. A great many out there are seeking a mid, even long-term cycle top in the 1750/60 zone, but frankly..there is absolutely zero reason why that will be the case. The sp'1800s look very likely next month.

sp'60min

sp'daily5

Summary

More than anything, I realise a lot of good chartists out there are calling a top in the current zone, but really, it makes ZERO sense to me why this freight train of a market will stop here.

How many times are we going to see people call a top whilst the QE continues?

-

Stock of the day... NFLX

The hysteria is back in full...and the $400s look likely. whether later today, tomorrow, or whenever.

The opening black candle is kinda interesting, but really, anyone want to short against the primary up trend? Urghh

-

10.22am.. hourly MACD cycle goes positive, and the 1760s now likely in the immediate term.

ZERO reason why this will stop. There is NO power on the bearish side.

QE continues. This market is going...UP !

sp'60min

sp'daily5

Summary

More than anything, I realise a lot of good chartists out there are calling a top in the current zone, but really, it makes ZERO sense to me why this freight train of a market will stop here.

How many times are we going to see people call a top whilst the QE continues?

-

Stock of the day... NFLX

The hysteria is back in full...and the $400s look likely. whether later today, tomorrow, or whenever.

The opening black candle is kinda interesting, but really, anyone want to short against the primary up trend? Urghh

-

10.22am.. hourly MACD cycle goes positive, and the 1760s now likely in the immediate term.

ZERO reason why this will stop. There is NO power on the bearish side.

QE continues. This market is going...UP !

Pre-Market Brief

Good morning. Futures are moderately higher, sp +4pts, we're set to open around 1748. Metals are higher, Gold +$13 (1.0%). Oil is again weak, -0.2%. Market looks set to break into the 1750s today, the hourly charts are even offering the 1760s late today/early Wednesday.

sp'60min

Summary

*monthly jobs data for Sept': 142k job gains, headline rate, falls to 7.2%. The gains are a clear 40k shy of what the market was looking for.

--

So...a lousy jobs number, but hey, that means QE will just continue longer...which is bullish, right?

*notable movers; NFLX +$30 @ 385 (although that is $10 below the AH high), APPL +6 @ 527

9.33am.. after an opening bell that seemed to last hours...sp'1750s.

So...the top callers will be out in force across today/tomorrow.

ZERO reason why the market will see a multi-month top at this level.

sp'60min

Summary

*monthly jobs data for Sept': 142k job gains, headline rate, falls to 7.2%. The gains are a clear 40k shy of what the market was looking for.

--

So...a lousy jobs number, but hey, that means QE will just continue longer...which is bullish, right?

*notable movers; NFLX +$30 @ 385 (although that is $10 below the AH high), APPL +6 @ 527

9.33am.. after an opening bell that seemed to last hours...sp'1750s.

So...the top callers will be out in force across today/tomorrow.

ZERO reason why the market will see a multi-month top at this level.

Moving higher into November

US equities remain on a very broad upward trend, that extends back to the Oct'2011 low of sp'1074. The sp'1800s look viable in November, and if the mainstream get a little more confident, the 1900s are briefly viable before some understandable year end profit taking.

sp'weekly8 - mid term bullish outlook

Summary

The weekly rainbow charts are showing the third consecutive green candle, and this market is unquestionably outright bullish. A weekly close in the 1755/65 zone looks very likely, with the 1800s viable in November.

Netflix - the hysteria returns in full

With EPS of 52 cents, NFLX has soared in AH trading, settling around $40 (11%) higher at $394. There seems little doubt the $400s will be hit early tomorrow, and then you'll start to see the mainstream wonder about $500 next year.

As I noted earlier today, no doubt some bears who were short this hysteria-stock on margin, will have seen their trading accounts get blown up. The thing is, its not like the primary trend in NFLX is down! Why would anyone consider shorting it at all?

A final note on the EPS of 52 cents. Lets call it 50, x4.. giving $2 per year. With a $400 stock price, that is a PE ratio of 200. I could drone on about 'fair value' for page after page, suffice to say, in any 'normal' market, NFLX would be trading around a tenth of the current price.

NFLX, $40, with a PE of 20, and that ladies and gentleman..would indeed be a normal price in a normal market, but of course..we sure as hell don't have that right now.

World Equity indexes continue to look very strong

I could pick any of the ten indexes that I regularly highlight, they all look pretty much outright bullish. Even the imploded Greek economy has a market that is soaring...

Greece, monthly, 20yr

As I noted over a week ago, first target zone is 1200/1300, after that...2500. The other EU PIIGS of Italy and Spain look much the same. For those with eyes on the bigger picture, I think the direction for the US market is pretty clear.

Looking ahead

Tomorrow will see the release of the delayed Sept' jobs data. Market is seeking 185k gains, with a static rate of 7.3%. Those are not bold targets.

*next QE-pomo is not until Wednesday.

--

Goodnight from London

sp'weekly8 - mid term bullish outlook

Summary

The weekly rainbow charts are showing the third consecutive green candle, and this market is unquestionably outright bullish. A weekly close in the 1755/65 zone looks very likely, with the 1800s viable in November.

Netflix - the hysteria returns in full

With EPS of 52 cents, NFLX has soared in AH trading, settling around $40 (11%) higher at $394. There seems little doubt the $400s will be hit early tomorrow, and then you'll start to see the mainstream wonder about $500 next year.

As I noted earlier today, no doubt some bears who were short this hysteria-stock on margin, will have seen their trading accounts get blown up. The thing is, its not like the primary trend in NFLX is down! Why would anyone consider shorting it at all?

A final note on the EPS of 52 cents. Lets call it 50, x4.. giving $2 per year. With a $400 stock price, that is a PE ratio of 200. I could drone on about 'fair value' for page after page, suffice to say, in any 'normal' market, NFLX would be trading around a tenth of the current price.

NFLX, $40, with a PE of 20, and that ladies and gentleman..would indeed be a normal price in a normal market, but of course..we sure as hell don't have that right now.

World Equity indexes continue to look very strong

I could pick any of the ten indexes that I regularly highlight, they all look pretty much outright bullish. Even the imploded Greek economy has a market that is soaring...

Greece, monthly, 20yr

As I noted over a week ago, first target zone is 1200/1300, after that...2500. The other EU PIIGS of Italy and Spain look much the same. For those with eyes on the bigger picture, I think the direction for the US market is pretty clear.

Looking ahead

Tomorrow will see the release of the delayed Sept' jobs data. Market is seeking 185k gains, with a static rate of 7.3%. Those are not bold targets.

*next QE-pomo is not until Wednesday.

--

Goodnight from London

Daily Index Cycle update

The main indexes closed largely unchanged, with the sp' fractionally higher at 1744. The two leaders - Trans/R2K, closed +0.4% and -0.2% respectively. The broader market trend remains very bullish, and the sp'1800s look viable in November.

sp'daily5

R2K

Trans

Summary

A very quiet day to start the week, and the closing Doji candle on the sp'500 was somewhat appropriate.

No doubt, many traders are just waiting for the delayed Sept' jobs data.

--

a little more later..

sp'daily5

R2K

Trans

Summary

A very quiet day to start the week, and the closing Doji candle on the sp'500 was somewhat appropriate.

No doubt, many traders are just waiting for the delayed Sept' jobs data.

--

a little more later..

Subscribe to:

Comments (Atom)