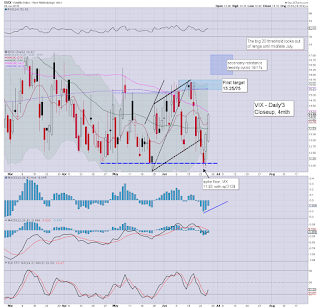

With equities closing broadly lower for a second day, the VIX was naturally on the rise, settling +6.3% @ 14.10. Near term outlook is for continued equity downside, and if sp'2060s, the VIX should be in the 16/17s.. if briefly. The big 20 threshold looks out of range in the current up cycle.

VIX'60min

VIX'daily3

Summary

Suffice to add, VIX is clearly on the rise... the 15s look due before the weekend.. the only issue is whether the market gets spooked into the 16/17s before the weekend... or after.

-

*I remain long VIX from 12.98... seeking an exit in the 15-17s.. no later than next Tuesday.

--

more later.. on the indexes

Thursday, 25 June 2015

Closing Brief

US equities closed broadly weak, sp -6pts @ 2102. The two leaders - Trans/R2K, settled -0.8% and u/c respectively. Near term outlook is very bearish into the weekly close, with viable further downside to the sp'2060s - with VIX 16/17s next Mon/Tuesday.

sp'60min

Summary

*closing hour was a little choppy... but still.. nothing for the bears to be concerned about.

---

With the second consecutive net daily decline, the market is looking highly vulnerable into the weekly close.

I see little reason why we won't be in the 2090/80 zone tomorrow.. and if the Greek leader starts whining about how its all the EU fault with talk of 'no deal'.. well.. then the market is floor less to the 2060/55 zone.

*I remain short INTC.. and long VIX, and have little concern about holding across into next week.

-

more later... on the VIX

sp'60min

Summary

*closing hour was a little choppy... but still.. nothing for the bears to be concerned about.

---

With the second consecutive net daily decline, the market is looking highly vulnerable into the weekly close.

I see little reason why we won't be in the 2090/80 zone tomorrow.. and if the Greek leader starts whining about how its all the EU fault with talk of 'no deal'.. well.. then the market is floor less to the 2060/55 zone.

*I remain short INTC.. and long VIX, and have little concern about holding across into next week.

-

more later... on the VIX

3pm update - bear flag confirmed

The baby bear flag that developed across today has already been confirmed, with renewed weakness to sp'2101... along with VIX 14s. Continued broad.. and more powerful downside looks due into the coming weekly close. First target is the sp'2090/80 zone.. with 'best case' of the 2060s next Mon/Tuesday.

sp'60min

vix'60min

Summary

It is always pleasing to see price structure pan out as expected. Today is going rather well for those in bear land.

Clearly, the declines are still only moderate, but the stronger action looks due tomorrow.. and probably into next week.

notable weakness, NFLX -3.2%... outlook looks rough... 600min... maybe 525/500 by Sept/Oct... pre-split levels of course.

-

3.08pm. some minor chop.... sp'2106...

Oh look... something to avoid...

--

Meanwhile.. Gartman is on now... lol... what a cartoon character.

-

3.44pm.. weakness into the close... the only issue is whether VIX 14s... for a daily close.

sp'60min

vix'60min

Summary

It is always pleasing to see price structure pan out as expected. Today is going rather well for those in bear land.

Clearly, the declines are still only moderate, but the stronger action looks due tomorrow.. and probably into next week.

notable weakness, NFLX -3.2%... outlook looks rough... 600min... maybe 525/500 by Sept/Oct... pre-split levels of course.

-

3.08pm. some minor chop.... sp'2106...

Oh look... something to avoid...

--

Meanwhile.. Gartman is on now... lol... what a cartoon character.

-

3.44pm.. weakness into the close... the only issue is whether VIX 14s... for a daily close.

2pm update - price structure is bearish

US equities are broadly flat, unable to climb above the opening high of sp'2115 (with VIX intra low of 12.92). A net daily decline for most indexes remains very viable, but regardless of the exact close, price structure is a very clear bear flag.. offering a weekly close in the sp'2090/80 zone.. with VIX 15s.

sp'60min

VIX'60min

Summary

Little to add.

Certainly, the bear flag does not need to break today... there is no hurry, and these things tend to drag out longer than I usually expect.

What the short term traders should now be asking themselves is.. do I want to hold long across the weekend?

--

meanwhile... its another fine day in the city...

-

2.29pm.. a clear break and confirmation of the bear flag.

Market unravelling with increasing concern of no Greek deal.

A daily close <sp'2100 is now on the menu... and that is a bonus for today.

sp'60min

VIX'60min

Summary

Little to add.

Certainly, the bear flag does not need to break today... there is no hurry, and these things tend to drag out longer than I usually expect.

What the short term traders should now be asking themselves is.. do I want to hold long across the weekend?

--

meanwhile... its another fine day in the city...

|

| Blue skies for the bears into Sept/Oct |

2.29pm.. a clear break and confirmation of the bear flag.

Market unravelling with increasing concern of no Greek deal.

A daily close <sp'2100 is now on the menu... and that is a bonus for today.

1pm update - baby bear flag

Yesterday saw the big ascending wedge broken, and after some morning chop, we now have a baby bear flag. More significant weakness into the weekly close.. and stretching across into next week looks probable.

The sp'2060s (if briefly) should equate to VIX in the 16/17s.

sp'60min

VIX'60min

Summary

A rather clear flag. Certainly threat of another minor wave higher this afternoon, but overall.. it certainly bodes for more significant weakness tomorrow.

After all, who the hell wants to be long across the coming weekend? Should be a powerful instance of 'rats selling into the weekend'.

notable weakness: NFLX -3.1% @ $657 ... the entertainment continues... in more ways than one!

--

back at 2pm

The sp'2060s (if briefly) should equate to VIX in the 16/17s.

sp'60min

VIX'60min

Summary

A rather clear flag. Certainly threat of another minor wave higher this afternoon, but overall.. it certainly bodes for more significant weakness tomorrow.

After all, who the hell wants to be long across the coming weekend? Should be a powerful instance of 'rats selling into the weekend'.

notable weakness: NFLX -3.1% @ $657 ... the entertainment continues... in more ways than one!

--

back at 2pm

12pm update - chop chop

US equities remain in minor chop mode... before the downside resumes. Late day weakness looks probable, with a net daily decline across most indexes. Transports remains notably weak... seemingly headed for 8K... secondary target is the Oct' low of 7700.

Trans, daily

sp'weekly

Summary

On the bigger weekly cycle, the sp'500 sure looks tired. A weekly close <2100 (probable.. in my view).. would make for a pretty bearish weekly candle.. offering further downside next week.

A hit of the lower weekly bol' - currently @ 2057 (with the 200 day MA lurking nearby), would open up a more sig' bearish wave (under the giant 2K threshold) later this summer, but more on that.. if we get there.

notable weakness, BTU -4.1% in the $2.30s... just another day of horror for the coal miners.

--

VIX update from Mr T. due

*seemingly not appearing

--

time for lunch

12.28pm.... baby bear flag on the hourly cycle.... market does look maxed out from 2115... weakness into the close

Trans, daily

sp'weekly

Summary

On the bigger weekly cycle, the sp'500 sure looks tired. A weekly close <2100 (probable.. in my view).. would make for a pretty bearish weekly candle.. offering further downside next week.

A hit of the lower weekly bol' - currently @ 2057 (with the 200 day MA lurking nearby), would open up a more sig' bearish wave (under the giant 2K threshold) later this summer, but more on that.. if we get there.

notable weakness, BTU -4.1% in the $2.30s... just another day of horror for the coal miners.

--

VIX update from Mr T. due

*seemingly not appearing

--

time for lunch

12.28pm.... baby bear flag on the hourly cycle.... market does look maxed out from 2115... weakness into the close

11am update - minor chop

US equities are seeing some minor chop, with a probable high of day at sp'2115. VIX is broadly flat in the low 13s. Daily MACD cycles are swinging in favour of the equity bears, a very significant equity down day looks probable.. tomorrow.. or more likely... next Monday.

sp'daily5

VIX'daily3

Summary

I am trying to not get lost in the minor noise.. and for this hour.. a reminder of the daily charts.

At current rate, we should see a more significant move within the next day or two.

--

notable weakness: NFLX -3% @ $658... the 706 high now looks a long way up.

strength: INTC, +0.9% @ $32.20... price structure remains a large bear flag though... and I remain short.

sp'daily5

VIX'daily3

Summary

I am trying to not get lost in the minor noise.. and for this hour.. a reminder of the daily charts.

At current rate, we should see a more significant move within the next day or two.

--

notable weakness: NFLX -3% @ $658... the 706 high now looks a long way up.

strength: INTC, +0.9% @ $32.20... price structure remains a large bear flag though... and I remain short.

10am update - opening reversal

US equity indexes open higher, but the gains have quickly faded. The VIX has turned positive, and looks set for the 14/15s (at least) before the weekend. Metals are a little weak, Gold -$1, with Silver -0.3%. Oil continues to cool, -0.9% in the $59s.

sp'60min

VIX'60min

Summary

*Classic opening reversal... with black-fail candles all over the place.

--

So much for the overnight gains... we're set for further weakness today... and into the weekend.

I remain waiting for more whining and bitching from Greek leader Tsipras. He is clearly looking to hold out for more concessions from the Troika... as the clock ticks closer to end month.

--

notable weakness, NFLX

Daily chart looks plain ugly.... first target is the little price gap zone around $600, which is a full 10% lower.

sp'60min

VIX'60min

Summary

*Classic opening reversal... with black-fail candles all over the place.

--

So much for the overnight gains... we're set for further weakness today... and into the weekend.

I remain waiting for more whining and bitching from Greek leader Tsipras. He is clearly looking to hold out for more concessions from the Troika... as the clock ticks closer to end month.

--

notable weakness, NFLX

Daily chart looks plain ugly.... first target is the little price gap zone around $600, which is a full 10% lower.

Pre-Market Brief

Good morning. Futures are moderately higher, sp + 7pts, we're set to open at 2115. USD remains weak, -0.1% in the DXY 95.20s. Metals are a touch weak, Gold -$1. The Greek drama is set to rumble on across today, equity bears should be battling for a daily close under the sp'2100 threshold.

sp'60min

Summary

Futures have cooled somewhat from earlier highs as sporadic headlines about Greece continue to give concern to some traders.

A Greek deal looks as far away as ever.. and the clock is ticking.

-

All things considered, there is little reason why the opening gains will be able to hold... I expect a second net daily decline. VIX 14s would offer further clarity that things will continue to unravel into next week.

notable early weakness, NFLX -1.0% @ $671... now a fair way lower than yesterdays opening spike high of $706.

--

Update from Oscar

--

Overnight action: China, -3.5% @ 4527.. having fallen apart in the late afternoon. Again.. the day to day swings are increasingly wild... a break <4K looks very probable. I remain somewhat bemused that many are not highlighting the 3400s as a downside target.

Have a good Thursday

8.31am jobless claims 271k.... remaining very stable. Next up.. PMI service sector data (9.45am).

sp +5pts.. 2113. Still slowly cooling from earlier gains.

-

9.35am.. Opening reversal candle on the VIX..... equity indexes highly vulnerable to turning red.

Opening black-fail candle in the R2K.... again, suggestive this market is going to struggle today.

9.39am.. some waves of selling.... VIX turns positive

9.43am... and the indexes are turning negative.

notable weakness: NFLX -2.6%... major sell side underway

sp'60min

Summary

Futures have cooled somewhat from earlier highs as sporadic headlines about Greece continue to give concern to some traders.

A Greek deal looks as far away as ever.. and the clock is ticking.

-

All things considered, there is little reason why the opening gains will be able to hold... I expect a second net daily decline. VIX 14s would offer further clarity that things will continue to unravel into next week.

notable early weakness, NFLX -1.0% @ $671... now a fair way lower than yesterdays opening spike high of $706.

--

Update from Oscar

--

Overnight action: China, -3.5% @ 4527.. having fallen apart in the late afternoon. Again.. the day to day swings are increasingly wild... a break <4K looks very probable. I remain somewhat bemused that many are not highlighting the 3400s as a downside target.

Have a good Thursday

8.31am jobless claims 271k.... remaining very stable. Next up.. PMI service sector data (9.45am).

sp +5pts.. 2113. Still slowly cooling from earlier gains.

-

9.35am.. Opening reversal candle on the VIX..... equity indexes highly vulnerable to turning red.

Opening black-fail candle in the R2K.... again, suggestive this market is going to struggle today.

9.39am.. some waves of selling.... VIX turns positive

9.43am... and the indexes are turning negative.

notable weakness: NFLX -2.6%... major sell side underway

USD resumes cooling

Despite renewed concern that there will be no Greek deal agreed by end month, the USD saw a net daily decline of -0.2% @ DXY 95.48. The secondary target zone of 92/90 remains very viable, it will likely require some kind of last minute Greek deal. Regardless of the short term, the DXY 120s are coming.

USD, daily2

USD,monthly3

Summary

*I remain looking to go long the USD via UUP in the low $24s. For now, I'm content to wait another few weeks, not least if a Greek deal is arranged around end month.

-

Nothing has occurred to change my broader view for King Dollar. It would still seem the USD has built a giant multi-month bull flag, having seen a very natural retrace from the high of DXY 100.71 in mid March.

I am aware of a fair few analysts who note resistance at DXY 105, but really, once we break new multi-year highs, it should be a broadly straight hyper-ramp to the 120s into next year.

Looking ahead

Thursday will see the usual weekly jobs, pers' income/outlays, PMI service sector.

*two fed officials will be speaking, but I don't believe the issues to be discussed will be relevant.

--

Goodnight from London

USD, daily2

USD,monthly3

Summary

*I remain looking to go long the USD via UUP in the low $24s. For now, I'm content to wait another few weeks, not least if a Greek deal is arranged around end month.

-

Nothing has occurred to change my broader view for King Dollar. It would still seem the USD has built a giant multi-month bull flag, having seen a very natural retrace from the high of DXY 100.71 in mid March.

I am aware of a fair few analysts who note resistance at DXY 105, but really, once we break new multi-year highs, it should be a broadly straight hyper-ramp to the 120s into next year.

Looking ahead

Thursday will see the usual weekly jobs, pers' income/outlays, PMI service sector.

*two fed officials will be speaking, but I don't believe the issues to be discussed will be relevant.

--

Goodnight from London

Daily Index Cycle update

US equity indexes closed broadly weak, sp -15pts @ 2108 (intra low 2009).

The two leaders - Trans/R2K, settled lower by -1.8% and -0.9% respectively.

Near term outlook is bearish, with viable downside to the 2060s by end

month. From there... if the Greek can is successfully kicked... upside

across July and into August.

sp'daily5

Nasdaq comp'

Trans

Summary

*fractional new historic high in the Nasdaq comp'

---

A useful day for the equity bears. We have a clear break lower on all the main US indexes. Further weakness looks due into early next week.

Not surprisingly, the Transports was particularly weak today, and that was despite WTIC Oil prices seeing a net daily decline of -1.4% @ $60.27. Next support is the big 8K threshold, and that is another 3.7% lower... which would probably equate to sp'2060s.

--

a little more later..

sp'daily5

Nasdaq comp'

Trans

Summary

*fractional new historic high in the Nasdaq comp'

---

A useful day for the equity bears. We have a clear break lower on all the main US indexes. Further weakness looks due into early next week.

Not surprisingly, the Transports was particularly weak today, and that was despite WTIC Oil prices seeing a net daily decline of -1.4% @ $60.27. Next support is the big 8K threshold, and that is another 3.7% lower... which would probably equate to sp'2060s.

--

a little more later..

Subscribe to:

Comments (Atom)