After some moderate weakness in May/June, the US indexes are back on the rise. The sp'500 is just 56pts from breaking a new historic high, and now looks set to push into the 1700s by early August. Long term support is a fair way down, around sp'1500.

Lets take our regular look at the six main US indexes

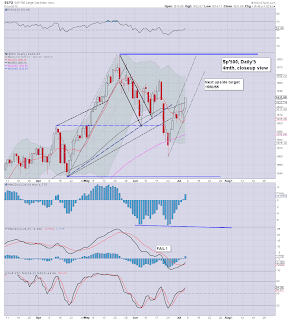

sp'500

It would seem 1560 was the cycle low, after a decline from 1687. The upper monthly bollinger is still only at 1665, a mere 2% higher, but if the bulls manage to close July in the 1660/70s, then the low 1700s should be viable in August. Underlying MACD cycle is still offering a rollover, but by the end of this month, that looks likely to be merely flat lining.

Nasdaq Comp

The tech' is already up over 2% this month, the 3500s are within easy reach, and the 3600/3700s look viable by August. The bulls should merely be wondering if 4000 is viable this year.

Dow'30

The mighty Dow is similarly looking pretty strong, with key support over 1000 points lower. Bulls look entirely in control, and Dow 16k is viable on the next push higher.

NYSE Comp

The master index suffered worse than any other index in June, hitting the monthly 10MA, but it has put in a spiky-floor candle for June, and looks to be back on the rise. The big target is the Oct'2007 high of 10387, but that's over 1100pts higher (12% or so). That will be difficult to hit this year, even with ongoing QE.

R2K

The Rus'2000 is cruising comfortably higher after briefly threatening to test the big 900 level. The bears embarrassingly only managed to hit the 950s, before the R2K snapped back higher, and the weekly close of 1005 is indeed, a new all time historic high. There is nothing bearish here, and the R2K looks set for the 1100s.

Trans

The old leader has been stuck in a rather tight range since March, and the bulls should consider a break into the 6600s as 'important'. If that is achieved, it should offer the low 7000s later this year.

Summary

So, it would seem sp'1560 is a key cycle low. Whether you want to label the recent downside action as a wave'4 of a giant '3, or even w'1 of initial big'1 down, what is clear is that the bears are..weak.

The fact we didn't even hit the lower bollinger on the weekly charts was a real surprise to me. It makes the recent declines even weaker than the down cycle from Sept-Nov'2012.

Despite the regular 'taper talk', the QE does continue in full, and that is a massive problem to those on the short side.

Near/Mid term outlook

I'm again inclined to post up the following - rather crazy bullish, outlook. Even if you disagree with the micro-count, the bullish style of the market is pretty clear in this rainbow chart. We closed the week with an outright bullish green candle, and that should scare the hell out of the bears, it certainly did me.

sp'weekly4, hyper-bullish outlook

--

In terms of the price outlook into August, I particularly like the following count/outlook...

sp'60min'3 - broad outlook

I am broadly assuming the recent downside action was a 4' (of big 3), and we are now due a 5 UP..into early August. I suppose the 5 could truncate <1687, but with QE, I'd have to guess..no.

I'm looking for a new cycle top somewhere in the 1700s within the first half of August. From there, I'd again be looking for a 6-10 week down cycle, and perhaps next time, it will hit the lower weekly bollinger, but by then, it'll be in the 1550/75 area.

Looking ahead

The main issues due this week are the FOMC minutes and Bernanke speaking, both on Wednesday.

*there is significant mid-sized QE on Tuesday and Wednesday.

--

With the weekly charts now back to at least a short term bullish outlook, I have indeed abandoned my remaining hope of any further downside. I am guessing there will now be broad upside into early August, with the market still very much propped up by continuing QE.

Considering the price action late Friday, it would not surprise me if we gap right into the 1640s at the Monday open. Regardless, I will be looking to take a new index-long position.

As ever, all comments are always appreciated. Good wishes for next week!

back on Monday :)

Saturday, 6 July 2013

Bulls back in control

The bulls fought hard this week, and successfully held the market above the big sp'1600 level. The Friday close, +1% @ sp'1631, sets up further gains for next week. Even more importantly, the weekly charts have turned back in favour of the bulls. Upside in early August to the mid sp'1700s now looks viable.

sp'weekly8 - bullish count

Summary

Well, a really lousy end to what was a very lousy week. Of course, that's coming from someone who is generally on the 'bearish' perspective.

For the bulls, it is merely a case of 'normal service has resumed'.

Chart weekly'8 is now what I will be following, with general upside into early August. Best guess, is somewhere in the sp'1700s, which will do serious damage to anyone who is short from current levels.

Having read around this evening, I'm somewhat struggling as to where we go from here, but here is an hourly chart...

sp'60min'3 - early August blue V' complete ?

Certainly, I see the recent action from May as more of a 123/ABC, than some kind of 5 wave. Considering the bigger weekly charts, another few 2-4 weeks of upside looks very likely. Even if it is a blue'5 up, it could fail to break a new high.

Anyway, there is a lot to consider this weekend, and thats just one of a number of ideas I am trying to keep in mind for next week.

Things will be complicated by the fact that Bernanke is speaking to the US House/Senate next Wed/Thursday. The past two times Benny has spoken (May'22, June'19), the market tanked pretty severely.

Goodnight from London

--

*next main post, late Saturday, on the US monthly indexes

sp'weekly8 - bullish count

Well, a really lousy end to what was a very lousy week. Of course, that's coming from someone who is generally on the 'bearish' perspective.

For the bulls, it is merely a case of 'normal service has resumed'.

Chart weekly'8 is now what I will be following, with general upside into early August. Best guess, is somewhere in the sp'1700s, which will do serious damage to anyone who is short from current levels.

Having read around this evening, I'm somewhat struggling as to where we go from here, but here is an hourly chart...

sp'60min'3 - early August blue V' complete ?

Certainly, I see the recent action from May as more of a 123/ABC, than some kind of 5 wave. Considering the bigger weekly charts, another few 2-4 weeks of upside looks very likely. Even if it is a blue'5 up, it could fail to break a new high.

Anyway, there is a lot to consider this weekend, and thats just one of a number of ideas I am trying to keep in mind for next week.

Things will be complicated by the fact that Bernanke is speaking to the US House/Senate next Wed/Thursday. The past two times Benny has spoken (May'22, June'19), the market tanked pretty severely.

Goodnight from London

--

*next main post, late Saturday, on the US monthly indexes

Daily Index Cycle update

The market saw some pretty strong chop to end the week. Yet, despite morning weakness, the market powered higher, with the sp' putting in a very important daily close above the 50 day MA, settling +1% @ 1631. Next week looks set for further upside into the 1650/60s.

sp'daily5

Summary

Suffice to say, a very bullish end to the week, and the bulls are firmly back in control, and even the weekly charts are turning back to a bullish outlook.

There looks to be very significant risk of a Monday gap higher, right into the 1640s, and that will offer 1650/60s by Wed/Thursday.

--

a little more later...

sp'daily5

Summary

Suffice to say, a very bullish end to the week, and the bulls are firmly back in control, and even the weekly charts are turning back to a bullish outlook.

There looks to be very significant risk of a Monday gap higher, right into the 1640s, and that will offer 1650/60s by Wed/Thursday.

--

a little more later...

Subscribe to:

Comments (Atom)