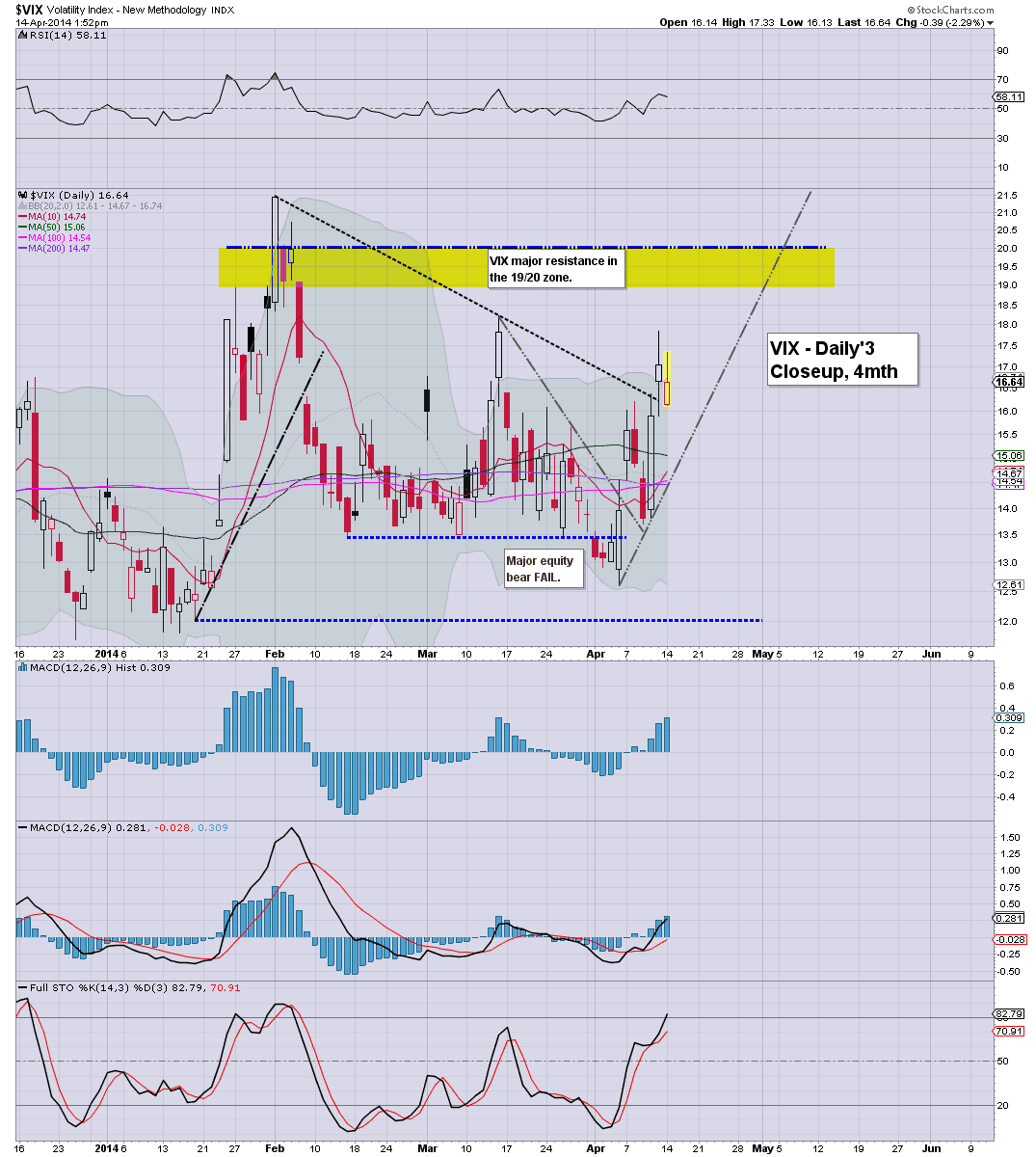

With US indexes seeing a late afternoon swing to the upside, the VIX settled -5.4% @ 16.11. However, near term outlook is still offering VIX in the low 20s - if sp'500 can break <1800. The mid/upper VIX 20s now look very much out of range until the early summer.

VIX'60min

VIX'daily3

Summary

The closing hour was a real mess, with the VIX seemingly due to close positive in the mid 17s, only to get whacked lower, as the sp' swing from 1815 to 1830.

The daily closing candle is a bit of a weird one, and this is the second spiky candle in two trading days. Have we already maxed out on the VIX, or is there one last gasp to the high teens later this week?

Certainly, I've abandoned any hope of a near term VIX leap...much beyond 19/20.

more later...on the indexes

Monday, 14 April 2014

Closing Brief

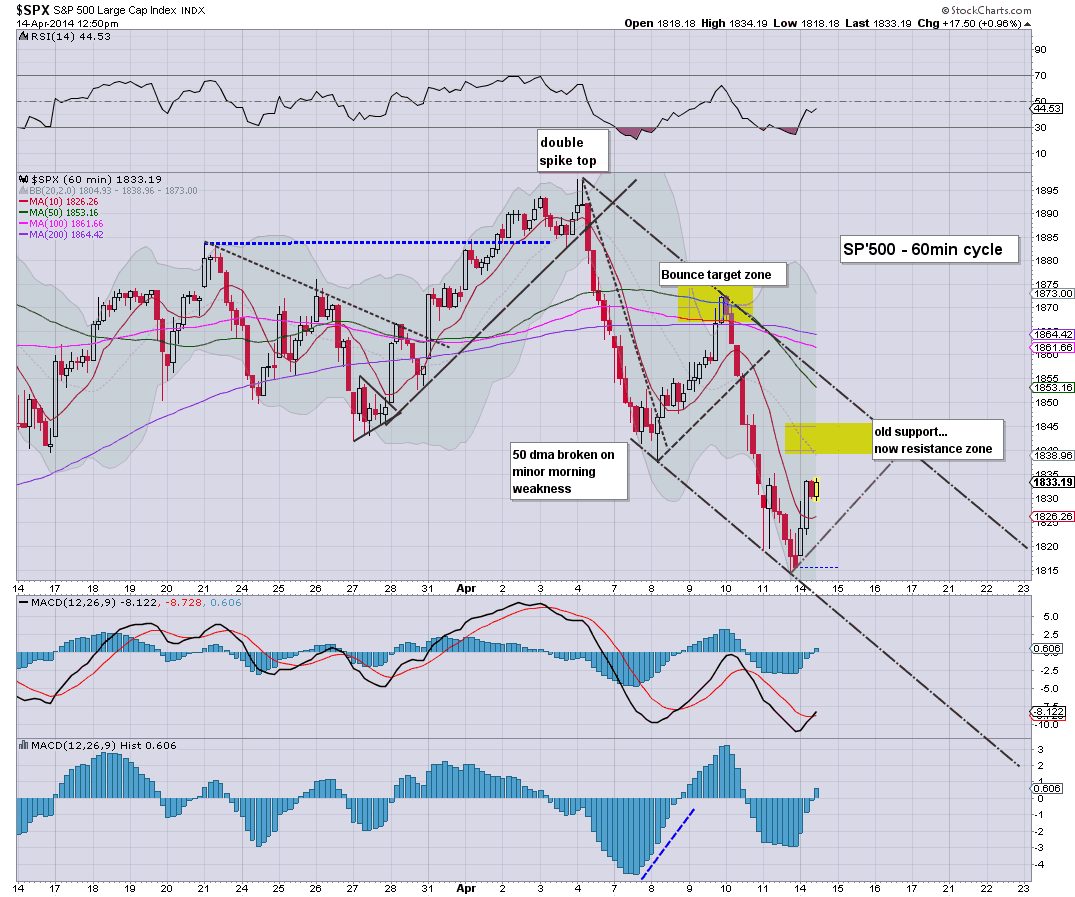

US indexes closed higher, sp +14pts @ 1830. The two leaders - Trans/R2K, settled higher by 0.3% and 0.5% respectively. Near term outlook is for renewed weakness (barring a break >1845/50), with a primary target zone still of sp'1770/60s, with VIX in the low 20s.

sp'60min

Summary

*with some weakness to sp'1815, I decided to bail on my 3 short-market blocks, not least my day-trade block (short from 1825 to 15)..not a bad day overall.

--

I had called for some 'weakness into the close', and we did indeed see a move from 1823 to 1815, but I sure didn't expect such a strong spike back to the upside.

No doubt many out there will have felt whipsawed by the closing hour price action, and frankly, I'm glad to have made a run for it (bailed on 3 short blocks around 1815/16).

The closing hour candle will surely have annoyed just about everyone. Perhaps I'm the only bear out there today who actually exited?

Tomorrow...won't be dull, but more on that later...

-

more later...on the VIX.

sp'60min

Summary

*with some weakness to sp'1815, I decided to bail on my 3 short-market blocks, not least my day-trade block (short from 1825 to 15)..not a bad day overall.

--

I had called for some 'weakness into the close', and we did indeed see a move from 1823 to 1815, but I sure didn't expect such a strong spike back to the upside.

No doubt many out there will have felt whipsawed by the closing hour price action, and frankly, I'm glad to have made a run for it (bailed on 3 short blocks around 1815/16).

The closing hour candle will surely have annoyed just about everyone. Perhaps I'm the only bear out there today who actually exited?

Tomorrow...won't be dull, but more on that later...

-

more later...on the VIX.

3pm update - weakness into the close

The equity bulls have managed a bounce from sp'1814 to 1834, and a bounce it almost certainly is. Primary downside remains Dow 15800/700s, with sp'1770/60s..which is still viable by late Wed/early Thursday, at which point, the current down wave will be exhausted.

sp'60min

vix'60min

Summary

An interesting..if somewhat annoying day.

*I will hold pretty heavy short-overnight, seeking my next exit in the 1800/1790 zone..preferably tomorrow!

--

Equity bears should be content with ANY daily close <1825, VIX in the low 17s would be ..useful

updates into the close.....

3.03pm.. some interesting weakness. Hourly lower bol' is offering 1808/06 for the close..but that would be a real shock to the bulls...

VIX trying to flip green..again.

3.16pm... Major FAIL for the bull maniacs..and its all turning nasty....... woo hoo

SEEKING an exit on the secondary short index block I picked up this morning...will surely get the boot...

*will STILL hold overnight, original two short blocks.

3.20pm.. EXITED second index-short..... still holding one other.

3.23pm.. EXITED VIX block...

3.24pm.. am tired...... have closed out ALL 3 short blocks....

will reassess overnight.. and see how we open tomorrow.

3.27pm.. call it whatever you like, but yes.. after today..I prefer to be on the sidelines overnight.

My day-trade worked out well in the end.. sig' gain...VIX was okay...first index block..minor loss. Overall...it'll do.

-

3.36pm.. Yeah, I sure do change my mind from time to time, not least when it comes to 'do I hold overnight'. As noted though, I'm tired..and I am no longer in the mood to hold overnight.

Overall...a somewhat okay day..but annoying.

I suppose there is still viable chance of 1840s..if so.....I'll pick up another index short ..and VIX-long tomorrow...so long as price action remains 'broadly weak'.

3.40pm.. something of a spike/double floor at 1814/15..... hmm

I'm still HIGHLY suspicious though, that if we hit the 1840s..we'll get another major FAIL there.

So....I'll start tomorrow afresh, and if the bull maniacs get stuck in the low 1840s...I'll start hit buttons.

3.46pm..Looks like I chose a 'lucky' exit at the afternoon floor.

Everything I sold is about 15% lower... Another 10/15% off tomorrow morning maybe...tempting re-shorts ;)

3.48pm.. I don't much like the current spike, it is a little too powerful for my liking.

I guess some might call it a B- wave low, but others a fifth wave floor, and up to the 1900s in May?

--

3.56pm.. what a nasty closing hour candle. Washing out the weak bulls.....only to then whipsaw back higher.....urghh

I'm glad to be out...will reassess ..overnight.

sp'60min

vix'60min

Summary

An interesting..if somewhat annoying day.

*I will hold pretty heavy short-overnight, seeking my next exit in the 1800/1790 zone..preferably tomorrow!

--

Equity bears should be content with ANY daily close <1825, VIX in the low 17s would be ..useful

updates into the close.....

3.03pm.. some interesting weakness. Hourly lower bol' is offering 1808/06 for the close..but that would be a real shock to the bulls...

VIX trying to flip green..again.

3.16pm... Major FAIL for the bull maniacs..and its all turning nasty....... woo hoo

SEEKING an exit on the secondary short index block I picked up this morning...will surely get the boot...

*will STILL hold overnight, original two short blocks.

3.20pm.. EXITED second index-short..... still holding one other.

3.23pm.. EXITED VIX block...

3.24pm.. am tired...... have closed out ALL 3 short blocks....

will reassess overnight.. and see how we open tomorrow.

3.27pm.. call it whatever you like, but yes.. after today..I prefer to be on the sidelines overnight.

My day-trade worked out well in the end.. sig' gain...VIX was okay...first index block..minor loss. Overall...it'll do.

-

3.36pm.. Yeah, I sure do change my mind from time to time, not least when it comes to 'do I hold overnight'. As noted though, I'm tired..and I am no longer in the mood to hold overnight.

Overall...a somewhat okay day..but annoying.

I suppose there is still viable chance of 1840s..if so.....I'll pick up another index short ..and VIX-long tomorrow...so long as price action remains 'broadly weak'.

3.40pm.. something of a spike/double floor at 1814/15..... hmm

I'm still HIGHLY suspicious though, that if we hit the 1840s..we'll get another major FAIL there.

So....I'll start tomorrow afresh, and if the bull maniacs get stuck in the low 1840s...I'll start hit buttons.

3.46pm..Looks like I chose a 'lucky' exit at the afternoon floor.

Everything I sold is about 15% lower... Another 10/15% off tomorrow morning maybe...tempting re-shorts ;)

3.48pm.. I don't much like the current spike, it is a little too powerful for my liking.

I guess some might call it a B- wave low, but others a fifth wave floor, and up to the 1900s in May?

--

3.56pm.. what a nasty closing hour candle. Washing out the weak bulls.....only to then whipsaw back higher.....urghh

I'm glad to be out...will reassess ..overnight.

2pm update - another daily close under 50dma

Despite the current gains, one of the most notable aspects is that today will be the third consecutive close under the important 50 day MA - currently @ sp'1844. With the weekly charts outright bearish, the bull maniacs face underlying weakness for the rest of this week.

sp'daily5

vix'daily3

Summary

*ignoring the minor waves for this hour....

--

Indeed, another daily close under the 50 day MA, and bounces should still be treated as...bounces.

I'm holding to the original outlook, seeking the sp'1770/60s, but yes..that won't be easy. Yet...we're only talking about 50/60pts or so...something we've seen done twice in the previous two down waves.

Bears..need to remain patient.

ps. note the reversal candle on the daily VIX...despite the current index gains.

-

2.01pm.. Equity bears should be content with any daily close <1825...I sure would be one of them!

-

2.16pm.. To me, the VIX remains the tell, it is only a little lower, -1.8% in the 16.70s..and a green close is very viable. Regardless, the index gains are not showing any kick - much like last Tue/Wed.

We're headed lower t his week, but the issue is how far?

Considering the earlier gains, I expect no lower than 1770/60s..and even then, that will be 'briefly'.

2.30pm.. VIX turning positive. Bulls...beware!

2.37pm... Check out the R2K,, daily... black-fail candle...ugly city for the small caps.

sp'daily5

vix'daily3

Summary

*ignoring the minor waves for this hour....

--

Indeed, another daily close under the 50 day MA, and bounces should still be treated as...bounces.

I'm holding to the original outlook, seeking the sp'1770/60s, but yes..that won't be easy. Yet...we're only talking about 50/60pts or so...something we've seen done twice in the previous two down waves.

Bears..need to remain patient.

ps. note the reversal candle on the daily VIX...despite the current index gains.

-

2.01pm.. Equity bears should be content with any daily close <1825...I sure would be one of them!

-

2.16pm.. To me, the VIX remains the tell, it is only a little lower, -1.8% in the 16.70s..and a green close is very viable. Regardless, the index gains are not showing any kick - much like last Tue/Wed.

We're headed lower t his week, but the issue is how far?

Considering the earlier gains, I expect no lower than 1770/60s..and even then, that will be 'briefly'.

2.30pm.. VIX turning positive. Bulls...beware!

2.37pm... Check out the R2K,, daily... black-fail candle...ugly city for the small caps.

1pm update - holding the gains

Equities continue to hold what have become somewhat significant gains, with the sp'500 creeping into the mid 1830s. First resistance remains the low 1840s, and barring a daily close >1845, there remains very high risk of a further wave lower.

sp'60min

VIX'60min

Summary

*Considering the index gains, the VIX is holding up relatively well.

--

This is an increasingly annoying bounce, but then...so was last Tue/Wednesday.

Worse case for the bears..this drags into tomorrow, and we briefly trade in the low 1840s, before the next turn.

-

As noted earlier, with the break above the hourly 10 EMA, any hopes of downside <1770 - most notably, the Feb' low of 1737, are now off the table.

-

1.31pm.. possible turn underway, but nothing definitive for at least TWO hours..so we're really not going to have much clarity until the close/early tomorrow.

Personally, I'd settle for any close <1825..considering the earlier gains.

sp'60min

VIX'60min

Summary

*Considering the index gains, the VIX is holding up relatively well.

--

This is an increasingly annoying bounce, but then...so was last Tue/Wednesday.

Worse case for the bears..this drags into tomorrow, and we briefly trade in the low 1840s, before the next turn.

-

As noted earlier, with the break above the hourly 10 EMA, any hopes of downside <1770 - most notably, the Feb' low of 1737, are now off the table.

-

1.31pm.. possible turn underway, but nothing definitive for at least TWO hours..so we're really not going to have much clarity until the close/early tomorrow.

Personally, I'd settle for any close <1825..considering the earlier gains.

12pm update - awaiting another bouncy top

US equities are holding borderline significant gains, but are still below the first major old support - now resistance, in the sp'1840s. Barring a daily close >sp'1845...today..or tomorrow, equity bears should probably treat this as just the same nonsense seen last Tue/Wed.

sp'60min

Summary

So...it remains a case of...do you think the key low is in...or is this just another bounce? No doubt some will be touting the 1900s. Indeed, if we don't hit the lower weekly bol', I'd be resigned to agreeing that new highs are still viable. Surely we'll hit 1800/1790 though?

--

VIX update from Mr T

*the video open is a bizarre Condor on a Bull...talk about twisted intro...

In tomorrows VIX update..a bear riding a unicorn, whilst still spewing out rainbows.. urghh

--

time for...tea :)

12.26pm...minor chop in the low 1830s..but clearly..no sign of a turn yet. This could drag out into tomorrow, but still...another wave lower looks a given. VIX is holding up relatively well, just -3%.

sp'60min

Summary

So...it remains a case of...do you think the key low is in...or is this just another bounce? No doubt some will be touting the 1900s. Indeed, if we don't hit the lower weekly bol', I'd be resigned to agreeing that new highs are still viable. Surely we'll hit 1800/1790 though?

--

VIX update from Mr T

*the video open is a bizarre Condor on a Bull...talk about twisted intro...

In tomorrows VIX update..a bear riding a unicorn, whilst still spewing out rainbows.. urghh

--

time for...tea :)

12.26pm...minor chop in the low 1830s..but clearly..no sign of a turn yet. This could drag out into tomorrow, but still...another wave lower looks a given. VIX is holding up relatively well, just -3%.

11am update - bouncing within a down trend

US indexes are battling to hold moderate gains, with the sp' back in the 1830s. VIX is lower, -4% in the 16.30s. Equity bulls need a close back above 1840 to have any confidence that the Friday low of 1814 was a key low. Metals are building gains, Gold +$12

sp'15min

Summary

Hmm..so...another bounce...and like Tuesday morning...this one is holding.

-

All things considered, I find it very difficult to believe last Friday was a key cyclical low of sp'1814, with VIX in the upper 17s.

Bears surely have Tue/Wed' still in their favour.

Will be interesting to see how we close today.

-

11.07am.. With a clear break >hourly 10 EMA, the super bearish outlook is...dropped.

I am still seeking a break <1800...based on recent price action, and the bigger weekly cycles.

Just need some patience....

11.22am.. worse case for those on the short side right now..the low 1840s, but that seems difficult. Who is going to be buying there?

sp'15min

Summary

Hmm..so...another bounce...and like Tuesday morning...this one is holding.

-

All things considered, I find it very difficult to believe last Friday was a key cyclical low of sp'1814, with VIX in the upper 17s.

Bears surely have Tue/Wed' still in their favour.

Will be interesting to see how we close today.

-

11.07am.. With a clear break >hourly 10 EMA, the super bearish outlook is...dropped.

I am still seeking a break <1800...based on recent price action, and the bigger weekly cycles.

Just need some patience....

11.22am.. worse case for those on the short side right now..the low 1840s, but that seems difficult. Who is going to be buying there?

10am update - opening gains... to fade?

US equities open moderately higher, but there are signs we'll still close the day net red. VIX is offering a clear reversal candle. Equity bulls are still fighting a primary down trend, as seen on the bigger daily/weekly charts. For the moment...the bounces are still to be shorted.

sp'15min

vix'60min

Summary

*It is an overly busy morning here in the London bunker. As builders continue to re-build my kitchen, I'm now battling window blinds that need fixing. Can today get any more tricky?

--

I'm considering picking up a secondary index short block, but frankly, I'm somewhat overloaded with household tasks, and might just be content with what I already hold.

Regardless, this bounce is...just a bounce - at least that is how I see it.

Primary target remains unchanged..... 1770/60s..by late Wednesday.

10.04am.. minor chop, and despite the green indexes... VIX is also occasionally green.

That does NOT bode well for the bulls.

10.09am... watching the 15min cycle...maybe the maniacs can hold it up until the morning turn time of 11am.

10.23am. SHORTED, indexes.. from sp'1825... seeking an exit later today/Tuesday.

..back to the window blinds...urghhhh

sp'15min

vix'60min

Summary

*It is an overly busy morning here in the London bunker. As builders continue to re-build my kitchen, I'm now battling window blinds that need fixing. Can today get any more tricky?

--

I'm considering picking up a secondary index short block, but frankly, I'm somewhat overloaded with household tasks, and might just be content with what I already hold.

Regardless, this bounce is...just a bounce - at least that is how I see it.

Primary target remains unchanged..... 1770/60s..by late Wednesday.

10.04am.. minor chop, and despite the green indexes... VIX is also occasionally green.

That does NOT bode well for the bulls.

10.09am... watching the 15min cycle...maybe the maniacs can hold it up until the morning turn time of 11am.

10.23am. SHORTED, indexes.. from sp'1825... seeking an exit later today/Tuesday.

..back to the window blinds...urghhhh

Pre-Market Brief

Good morning. Futures are moderately higher, sp +8pts, we're set to open at 1823. Precious metals are mixed, Gold +$7, with Silver -0.8%. Equity bears look set to continue controlling the near term, but there will be strong support in the 1770/60s, where there are multiple supports.

sp'60min1b -EMAs

Dow, daily'2

Summary

*I should first note, the probability of breaking under dow 15700 is pretty low, maybe just 15/20%. The bears are going to need some kind of catalyst to give the market a scare. Certainly, there is the ongoing Ukraine situation, but really, would that really be enough?

--

So..we're set to open moderately higher, and the next big target is a daily close <1800. That still seems possible later today.

I think the bears have until Wednesday afternoon to push this market lower.

The one thing in the bears favour this week, there is very little QE to prop things up. If we don't hit the lower weekly bollinger (sp'1770s), I'm going to be majorly disappointed. Such a failure would easily offer the threat of a higher high, although I still think the bulls hit a concrete wall of 'seasonal resistance' in May.

--

Video update from Oscar

I would agree with a fair bit in the latest video, but I have to sigh on the fed comments. The Fed has NEVER correctly forecasted anything, it has made the bubble highs..higher,...and the crashes deeper, never mind the issue of 'money out of nothing' as a solution to underlying structural problems.

Oscar knows day-trading, but I wish he'd be mute on matters of macro-economics.

-

What am I planning?

Considering we're opening somewhat higher, I'll consider adding a secondary index re-short, if only for a day-trade.

*ANY break above the 10EMA (probably 1827/30 at the open), and I'll drop any hopes of <1770s this week.

Good wishes for this Easter trading week!

9.33am... first resistance 1830 area....lets see if we get stuck there for a bit

9.37am... 10EMA is 1827/28..any move over there..and the more doomer outlook should get dropped.

sp'60min1b -EMAs

Dow, daily'2

Summary

*I should first note, the probability of breaking under dow 15700 is pretty low, maybe just 15/20%. The bears are going to need some kind of catalyst to give the market a scare. Certainly, there is the ongoing Ukraine situation, but really, would that really be enough?

--

So..we're set to open moderately higher, and the next big target is a daily close <1800. That still seems possible later today.

I think the bears have until Wednesday afternoon to push this market lower.

The one thing in the bears favour this week, there is very little QE to prop things up. If we don't hit the lower weekly bollinger (sp'1770s), I'm going to be majorly disappointed. Such a failure would easily offer the threat of a higher high, although I still think the bulls hit a concrete wall of 'seasonal resistance' in May.

--

Video update from Oscar

I would agree with a fair bit in the latest video, but I have to sigh on the fed comments. The Fed has NEVER correctly forecasted anything, it has made the bubble highs..higher,...and the crashes deeper, never mind the issue of 'money out of nothing' as a solution to underlying structural problems.

Oscar knows day-trading, but I wish he'd be mute on matters of macro-economics.

-

What am I planning?

Considering we're opening somewhat higher, I'll consider adding a secondary index re-short, if only for a day-trade.

*ANY break above the 10EMA (probably 1827/30 at the open), and I'll drop any hopes of <1770s this week.

Good wishes for this Easter trading week!

9.33am... first resistance 1830 area....lets see if we get stuck there for a bit

9.37am... 10EMA is 1827/28..any move over there..and the more doomer outlook should get dropped.

Subscribe to:

Comments (Atom)