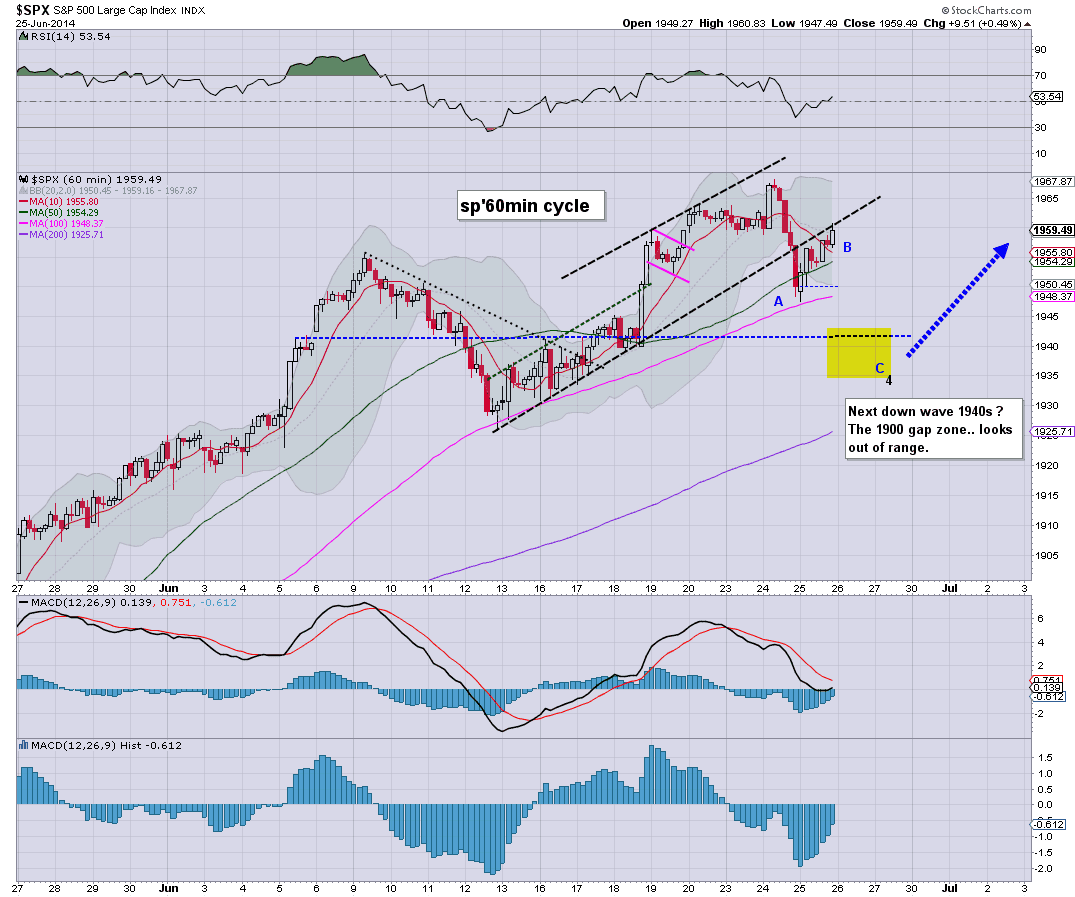

US equities closed moderately mixed, sp -0.9pts @ 1960. The two leaders - Trans/R2K, settled higher by 0.3% and 0.2% respectively. Near term outlook offers the low 1940s (at best).. before new historic highs in mid July. Metals held moderate gains, Gold +$11, whilst Oil slipped -0.3%.

sp'60min

Summary

*I don't much like the attached count on the hourly chart, but that is the best I can come up with.

Certainly though, it seems utterly pointless for anyone to attempt to short the indexes - or go long VIX this week.

Before we know it, it'll be Thursday 1pm..and it'll be a rather long weekend.

-

Time for kick off... Germany vs Algeria...

a full daily/monthly wrap... later at 8pm EST.

Monday, 30 June 2014

3pm update - minor chop into the close

There is little reason why the broader market will do anything different in the last hour of today. A daily close in the low sp'1960s... with 1975/80 viable by the early Thursday close. Trading vol' will remain increasingly light.. ahead of the 3 day July'4 weekend.

sp'60min

Summary

*I don't much like the attached count on the hourly, but its all I got right now.

--

I'm somewhat dismissive of even the 1940s this week.

Regardless, primary trend is UP... and market looks set for few weeks higher. I'm still guessing 2000 is out of range..at least in the current multi-week up cycle.

-

Notable strength: RIG, +1.3%.. and the 48/50 zone remains viable in July.

-

3.05pm.. New QE schedule

We have sig' QE tomorrow of $3bn.. so.. that will most certainly help the bulls tomorrow

sp'60min

Summary

*I don't much like the attached count on the hourly, but its all I got right now.

--

I'm somewhat dismissive of even the 1940s this week.

Regardless, primary trend is UP... and market looks set for few weeks higher. I'm still guessing 2000 is out of range..at least in the current multi-week up cycle.

-

Notable strength: RIG, +1.3%.. and the 48/50 zone remains viable in July.

-

3.05pm.. New QE schedule

We have sig' QE tomorrow of $3bn.. so.. that will most certainly help the bulls tomorrow

2pm update - R2K headed for the 1200s

The Rus'2000 small cap is set for very strong monthly gains of around 5%. The 1200s look viable this week.. or next.. with new historic highs (>1212) by mid July. Metals are building gains, Gold +$6

R2K, monthly

R2K, daily

Summary

The second market leader continues to warn of underlying market upside.

-

*France did well, now.. can Germany do as well later?

R2K, monthly

R2K, daily

Summary

The second market leader continues to warn of underlying market upside.

-

*France did well, now.. can Germany do as well later?

1pm update - sleepy Monday

US indexes continue to see very minor price chop. Metals are holding moderate gains, Gold +$2. There is notable increasing weakness in Oil, now -0.8%. VIX is seeing micro chop..stuck in the 11s.

sp'daily5

Summary

Little to add on what is indeed a very quiet day...and will be a quiet week.

The VIX weekly cycle is suggestive of sig' equity weakness in July..but more on that later.

--

Intraday update from Riley

--

back to France vs Nigeria.

sp'daily5

Summary

Little to add on what is indeed a very quiet day...and will be a quiet week.

The VIX weekly cycle is suggestive of sig' equity weakness in July..but more on that later.

--

Intraday update from Riley

--

back to France vs Nigeria.

12pm update - time for a game

US equities continue to see minor chop, and that could easily remain the case for the rest of this short 3.5 day trading week. Metals are slightly higher, Gold +$2, whilst Oil is slipping, -0.5%. Far more important though.. its time for another game.. France vs Nigeria.

sp'weekly8b

Summary

Well, minor index chop..and I most certainly welcome the first of today's two world cup games. It makes for a good distraction from the end month tedium of the casino.

--

VIX update from Mr P

--

Vive la France?

sp'weekly8b

Summary

Well, minor index chop..and I most certainly welcome the first of today's two world cup games. It makes for a good distraction from the end month tedium of the casino.

--

VIX update from Mr P

--

Vive la France?

11am update - no downside pressure

US equities remain seeing minor chop, but the underlying upward pressure is clearly still an issue. With the weekly cycle now offering sp'1975/80 in the immediate term, equity bears have little to look forward to until at least late July.

sp'monthly

Summary

*for much of today, I think I'll stick to bigger picture weekly/monthly charts. Seems little point in daily/hourly charts.

-

Little to add... on what looks set to be a relatively quiet 3.5 day trading week.

--

*we get the new QE-pomo schedule for July at 3pm.. something to check later, possible QE tomorrow, Wed, or Thursday.

--

Coal miners remain weak, BTU -2.1%

sp'monthly

Summary

*for much of today, I think I'll stick to bigger picture weekly/monthly charts. Seems little point in daily/hourly charts.

-

Little to add... on what looks set to be a relatively quiet 3.5 day trading week.

--

*we get the new QE-pomo schedule for July at 3pm.. something to check later, possible QE tomorrow, Wed, or Thursday.

--

Coal miners remain weak, BTU -2.1%

10am update - minor opening chop

US indexes start the shortened week with minor chop. Sp'500 has strong support in the 1945/35 zone, with viable upside to 1975/80 by this Thursday. VIX is higher, but only 3%.. in the 11s. Metals and Oil are both flat.

sp'weekly8b

Summary

*note the upper weekly bollinger has jumped into the mid 1970s.

Certainly, market looks viable for upside melt into the 1975/80 zone by late Thursday.

--

Chicago PMI 62.6.... a long long way above the 50 recessionary threshold. For the bulls out there, the PMI is highly suggestive that Q1 was an anomaly...and that Q2 will come in 2-3% growth.

Right now...I don't know what to make of this.

--

Notable weakness, coal miners, BTU -1.7%, WLT -3.3%

sp'weekly8b

Summary

*note the upper weekly bollinger has jumped into the mid 1970s.

Certainly, market looks viable for upside melt into the 1975/80 zone by late Thursday.

--

Chicago PMI 62.6.... a long long way above the 50 recessionary threshold. For the bulls out there, the PMI is highly suggestive that Q1 was an anomaly...and that Q2 will come in 2-3% growth.

Right now...I don't know what to make of this.

--

Notable weakness, coal miners, BTU -1.7%, WLT -3.3%

Pre-Market Brief

Good morning. Futures are fractionally lower, sp -1pt, we're set to open at 1959. Metals are weak, Gold -$5, with Silver -1.0%. Equity bulls look set to end another month with net gains of around 2% for the sp'500, and a VIX that remains crushed in the 11s.

sp'60min

Summary

*Chicago PMI @ 9.45am.. .that will be one to look out for, with some housing data at 10am.

--

So...it is month end, end of Q2..and the first half.

It has unquestionably been another good spell for the bull maniacs, breaking new historic highs on many indexes.

Most notable? Arguably, the VIX, which has repeatedly been knocked into the 10s.

For me, the only issue is whether we'll see VIX 9s before this latest multi-week up cycle is complete. I'd guess... probably, not least if sp'2000 is breached.

-

*two more big games today...

France vs Nigeria at 12pm EST

Germany vs Algeria at 4pm

Personally, I want to see both of the 'rias get through, that'd make for a real sporting upset.

-

Hunter with econ-doomer .. Martenson

Not surprisingly, it is much of the same doom chatter we've been hearing from Mr M' for a good 4-5 years. Make of that... what you will.

sp'60min

Summary

*Chicago PMI @ 9.45am.. .that will be one to look out for, with some housing data at 10am.

--

So...it is month end, end of Q2..and the first half.

It has unquestionably been another good spell for the bull maniacs, breaking new historic highs on many indexes.

Most notable? Arguably, the VIX, which has repeatedly been knocked into the 10s.

For me, the only issue is whether we'll see VIX 9s before this latest multi-week up cycle is complete. I'd guess... probably, not least if sp'2000 is breached.

-

*two more big games today...

France vs Nigeria at 12pm EST

Germany vs Algeria at 4pm

Personally, I want to see both of the 'rias get through, that'd make for a real sporting upset.

-

Hunter with econ-doomer .. Martenson

Not surprisingly, it is much of the same doom chatter we've been hearing from Mr M' for a good 4-5 years. Make of that... what you will.

Saturday, 28 June 2014

Weekend update - US weekly indexes

It was a week of minor chop for the US equity market, with net weekly changes ranging from -0.6% (Dow) to +0.7% (Nasdaq Comp'). The broader upward trend continues, with further upside of 2-3% likely in July.

Lets take our regular look at six of the main US indexes

sp'500

The sp'500 closed fractionally lower on the week. Next week, the weekly upper bollinger will jump into the 1970s, and the 1970s seem likely to be hit in the first half of July. By mid/late July, upper trend resistance will be in the 2000/2025 zone.

First (rising trend) support will be around 1875 next week, and that certainly looks out of range of the bears until late July. Underlying MACD (blue bar histogram) is on the upper end of its cycle, and will likely begin a new multi-week down cycle in no more than 3-5 weeks.

Nasdaq Comp'

The tech' gained 0.7%, and is decisively above the March highs. There looks to be further upside to the 4500/4600s in July.. which is a mere 10% shy from the historic high of the 5100s - the tech bubble high of spring 2000.

Dow

The mighty Dow slipped -0.6% this week, but is holding above the rather important 16600/500 zone. There will be viable upside to the 17200/300s by mid July. The Feb' low of 15340 should be a key initial objective for those who believe the market is due a multi-month wave lower this summer/autumn.

NYSE Comp'

The master index slipped -0.4%, but the broader upward trend remains fully intact. There looks to be fair upside to the 11200/300s in July.

R2K

The R2K is still lagging a little, gaining 0.1% this week, but looks set to take out the March high of 1212 in July. There looks to be upside to the 1230/50 zone.

Trans

The old leader slipped -0.4% this week, but the broader upward trend from late 2012 remains intact. There looks to be upside to the 8400/600 zone by mid July.

Summary

There is little to add on what was a relatively quiet week. All indexes are holding their primary upward trend. Most notable, the Nasdaq has broken above the March highs, with the R2K set to follow in July.

Still a moderate hope of something special

The market is a mere 8pts from historic highs, and there is little doubt we'll be trading somewhat higher in July. The 1970/80s seem an easy target. Whether we'll briefly surpass the giant 2000 threshold... difficult to say.

sp'weekly4

The above chart is effectively untouched from last summer... and here we are.. in my target zone for this giant wave from Oct'2011. I know I'm not the only one with that kind of inter'4 wave outlook.

Looking ahead

The week begins with Chicago PMI and some housing data. Tue' has PMI and ISM manu' data.

Wed' has ADP jobs and factory orders. However, probably more important, Yellen is talking at an IMF conference on monetary policy. That will likely receive some sig' media/market attention.

The short week concludes with the monthly jobs data on Thursday, along with PMI and ISM service sector data.

US equity markets will see an early close, Thursday 1pm.. and will reopen Monday July'7.

*the next QE-pomo schedule will be released Mon' Jun'30 at 3pm.

--

Looking to a key turn in mid July

It was almost a full year ago that I threw in the towel on the bigger 'doomer bear scenario', and since then, we've pushed higher from 1560 to 1960 - a full 400pts. Pretty incredible, and I am indeed not surprised.

At some point the giant wave from Oct'2011 - when sp' was a mere 1074, is going to conclude. A year ago, I was seeking a target high in the 1950/2050 zone. There are a fair few reasons why mid July would make for a natural turn. Certainly the weekly index cycles will be maxed out within another 2-4 weeks, so.. lets see where we are in late July/early August. If Q2 GDP disappoints the market (under 1% growth?), I'd be dismayed if we don't at least fall back under sp'1900.

back on Monday :)

Lets take our regular look at six of the main US indexes

sp'500

The sp'500 closed fractionally lower on the week. Next week, the weekly upper bollinger will jump into the 1970s, and the 1970s seem likely to be hit in the first half of July. By mid/late July, upper trend resistance will be in the 2000/2025 zone.

First (rising trend) support will be around 1875 next week, and that certainly looks out of range of the bears until late July. Underlying MACD (blue bar histogram) is on the upper end of its cycle, and will likely begin a new multi-week down cycle in no more than 3-5 weeks.

Nasdaq Comp'

The tech' gained 0.7%, and is decisively above the March highs. There looks to be further upside to the 4500/4600s in July.. which is a mere 10% shy from the historic high of the 5100s - the tech bubble high of spring 2000.

Dow

The mighty Dow slipped -0.6% this week, but is holding above the rather important 16600/500 zone. There will be viable upside to the 17200/300s by mid July. The Feb' low of 15340 should be a key initial objective for those who believe the market is due a multi-month wave lower this summer/autumn.

NYSE Comp'

The master index slipped -0.4%, but the broader upward trend remains fully intact. There looks to be fair upside to the 11200/300s in July.

R2K

The R2K is still lagging a little, gaining 0.1% this week, but looks set to take out the March high of 1212 in July. There looks to be upside to the 1230/50 zone.

Trans

The old leader slipped -0.4% this week, but the broader upward trend from late 2012 remains intact. There looks to be upside to the 8400/600 zone by mid July.

Summary

There is little to add on what was a relatively quiet week. All indexes are holding their primary upward trend. Most notable, the Nasdaq has broken above the March highs, with the R2K set to follow in July.

Still a moderate hope of something special

The market is a mere 8pts from historic highs, and there is little doubt we'll be trading somewhat higher in July. The 1970/80s seem an easy target. Whether we'll briefly surpass the giant 2000 threshold... difficult to say.

sp'weekly4

The above chart is effectively untouched from last summer... and here we are.. in my target zone for this giant wave from Oct'2011. I know I'm not the only one with that kind of inter'4 wave outlook.

Looking ahead

The week begins with Chicago PMI and some housing data. Tue' has PMI and ISM manu' data.

Wed' has ADP jobs and factory orders. However, probably more important, Yellen is talking at an IMF conference on monetary policy. That will likely receive some sig' media/market attention.

The short week concludes with the monthly jobs data on Thursday, along with PMI and ISM service sector data.

US equity markets will see an early close, Thursday 1pm.. and will reopen Monday July'7.

*the next QE-pomo schedule will be released Mon' Jun'30 at 3pm.

--

Looking to a key turn in mid July

It was almost a full year ago that I threw in the towel on the bigger 'doomer bear scenario', and since then, we've pushed higher from 1560 to 1960 - a full 400pts. Pretty incredible, and I am indeed not surprised.

At some point the giant wave from Oct'2011 - when sp' was a mere 1074, is going to conclude. A year ago, I was seeking a target high in the 1950/2050 zone. There are a fair few reasons why mid July would make for a natural turn. Certainly the weekly index cycles will be maxed out within another 2-4 weeks, so.. lets see where we are in late July/early August. If Q2 GDP disappoints the market (under 1% growth?), I'd be dismayed if we don't at least fall back under sp'1900.

back on Monday :)

Early summer doldrums

It was a relatively quiet week for the US equity market, with the sp' seeing a fractional net weekly decline of -1.9pts (-0.1%). Next week looks to be even quieter, since it is a 3.5 'holiday' trading week. Market outlook is for renewed upside into the week of July'14-18.

sp'weekly8b

Summary

*after all the minor chop..the weekly 'rainbow' candle turned back to green late Friday afternoon. Eleven consecutive green candles... since the key low of sp'1814..which is now a significant 146pts lower (7%)

--

Something for the late summer/autumn

The following is a 'best bear case' scenario, and assumes Dow 17100/300 zone in mid July..and then a multi-month down wave.

Dow'monthly'3

A major retracement of the Oct'2011 wave would make for a great down wave for the bears, but even more so... a great place to get long for 2015. I'm still largely resigned to 'general' upside into late 2015/early 2016.

--

Well, it was a relatively quiet week, and I think that will suffice for this week.

Have a good weekend...

... and goodnight from London

-

*the weekend update will be on the US weekly indexes

sp'weekly8b

Summary

*after all the minor chop..the weekly 'rainbow' candle turned back to green late Friday afternoon. Eleven consecutive green candles... since the key low of sp'1814..which is now a significant 146pts lower (7%)

--

Something for the late summer/autumn

The following is a 'best bear case' scenario, and assumes Dow 17100/300 zone in mid July..and then a multi-month down wave.

Dow'monthly'3

A major retracement of the Oct'2011 wave would make for a great down wave for the bears, but even more so... a great place to get long for 2015. I'm still largely resigned to 'general' upside into late 2015/early 2016.

--

Well, it was a relatively quiet week, and I think that will suffice for this week.

Have a good weekend...

... and goodnight from London

-

*the weekend update will be on the US weekly indexes

Daily Index Cycle update

US indexes closed the week moderately higher, sp +3pts @ 1960. The two leaders - Trans/R2K, settled higher by 0.3% and 0.7% respectively. There remains minor opportunity for a down wave to sp'1940, before new historic highs in July.

sp'daily5

R2K

Trans

Summary

The broader trend remains very much to the upside. I'm still somewhat suspicious that the market will see a minor test of the sp'1940 level early next Mon/Tuesday, but really, that is a mere 1% lower.

Certainly, there seems absolutely zero chance of the big 1900 threshold being broken in the near term... even by end July seems doubtful.

a little more later...

sp'daily5

R2K

Trans

Summary

The broader trend remains very much to the upside. I'm still somewhat suspicious that the market will see a minor test of the sp'1940 level early next Mon/Tuesday, but really, that is a mere 1% lower.

Certainly, there seems absolutely zero chance of the big 1900 threshold being broken in the near term... even by end July seems doubtful.

a little more later...

Friday, 27 June 2014

Volatility slips into the weekend

With US equities turning moderately higher in the late afternoon, the VIX turned lower, settling -3.3% @ 11.25 (intra high 12.04) Near term outlook is for the VIX to remain within the 13/10 zone. Across the week, the VIX gained 3.7%.

VIX'daily3

VIX'weekly

Summary

Suffice to say, VIX remains low, even the mid teens look out of range until late July.

The bigger question is can the VIX break into the 20s by late summer? VIX 22s would break last years high (21.90s), and would be highly suggestive of 'something new' in terms of downside equity price action.

For the moment, I've zero interest in picking up any VIX long positions...at least until mid July.

-

more later...on the indexes

VIX'daily3

VIX'weekly

Summary

Suffice to say, VIX remains low, even the mid teens look out of range until late July.

The bigger question is can the VIX break into the 20s by late summer? VIX 22s would break last years high (21.90s), and would be highly suggestive of 'something new' in terms of downside equity price action.

For the moment, I've zero interest in picking up any VIX long positions...at least until mid July.

-

more later...on the indexes

Closing Brief

US indexes closed moderately higher, sp +3pts @ 1960. The two leaders - Trans/R2K, settled higher by 0.3% and 0.7% respectively. Near term outlook still offers a minor wave lower to 1940, before new historic highs in July.

sp'60min

Summary

I'm somewhat dismissive of my own vain attempt at counting this nonsense......regardless.. the broader trend remains UP.

--

A pretty tiresome week. Equity bears still lack any sig' downside power, whilst the bulls are still able to grind broadly higher.

Thanks to all those who said hello this week :)

Have a good weekend everyone.

*The usual bits and pieces across the evening.. to wrap up the trading day.

-

**the weekend update will be on the US weekly indexes

sp'60min

Summary

I'm somewhat dismissive of my own vain attempt at counting this nonsense......regardless.. the broader trend remains UP.

--

A pretty tiresome week. Equity bears still lack any sig' downside power, whilst the bulls are still able to grind broadly higher.

Thanks to all those who said hello this week :)

Have a good weekend everyone.

*The usual bits and pieces across the evening.. to wrap up the trading day.

-

**the weekend update will be on the US weekly indexes

3pm update - time for a rebalancing

US indexes look set for minor chop, with perhaps a touch of weakness into the Friday close. There is a notable rebalancing of three of the Russell indexes..and that will likely result in huge trading vol' near the close (or shortly after).

sp'60min

Summary

*For details on the R2K rebalancing.. see HERE

--

In the scheme of things, a relatively dull week.

Next week will likely be...more dull.

A 4 day week.. and actually, next Thursday the market closes at 1pm.. so its really only a 3.5 day week.

I will be looking for a touch of minor weakness next Monday, and then melt to the Thursday close..with natural weakness in the VIX.

3.33pm.. another stupid micro ramp..taking out the morning high....

Tiresome...real... real..... tiresome.

3.56pm... time for some huge trade blocks to fly in the R2K...

back at the close...

sp'60min

Summary

*For details on the R2K rebalancing.. see HERE

--

In the scheme of things, a relatively dull week.

Next week will likely be...more dull.

A 4 day week.. and actually, next Thursday the market closes at 1pm.. so its really only a 3.5 day week.

I will be looking for a touch of minor weakness next Monday, and then melt to the Thursday close..with natural weakness in the VIX.

3.33pm.. another stupid micro ramp..taking out the morning high....

Tiresome...real... real..... tiresome.

3.56pm... time for some huge trade blocks to fly in the R2K...

back at the close...

2pm update - minor weakness

It remains a messy day of not much. US indexes are vulnerable to minor weakness into the close - as supported on the hourly/daily cycles. Primary 'best bear case' downside is a refined sp'1942/37..which seems viable next Monday. VIX is creeping higher in the low 12s.

sp'60min

Summary

*I've marginally redrawn the down channel on the hourly.

Best case for the bears...1942/37...which of course is barely 0.6% lower..not exactly exciting huh?

-

From there, upside into the July'4 weekend..and probably into the week of July 14-18.

sp'60min

Summary

*I've marginally redrawn the down channel on the hourly.

Best case for the bears...1942/37...which of course is barely 0.6% lower..not exactly exciting huh?

-

From there, upside into the July'4 weekend..and probably into the week of July 14-18.

1pm update - price structure is still a bear flag

It remains a day of subdued mild chop in the US equity market. Price structure on the hourly chart remains a rather clear bear flag, with what is a fractionally lower high from late Wed'. There is moderate possibility of latter day weakness.

sp'60min

Summary

To be clear, even if I was open to picking up another position, I'd not want to trade the short side.

Price structure is a bear flag, but price action doesn't much favour the bears.

--

Regardless... 'moderate' chance of weakness this afternoon, but I sure don't think its worth bothering with... even if we are in the 1940/35 zone on Monday.

VIX +1.5%...a weekly close in the low 12s....seems viable.

1.17pm... minor down wave... hmm.. Just need to take out 1953... and then another 10pts are on the table.

1.22pm.. and there goes the morning low. Hourly cycle will be bearish into the close..unless another stupid micro ramp appears out of nowhere.

Could do with the 1940s..just to keep me awake.

sp'60min

Summary

To be clear, even if I was open to picking up another position, I'd not want to trade the short side.

Price structure is a bear flag, but price action doesn't much favour the bears.

--

Regardless... 'moderate' chance of weakness this afternoon, but I sure don't think its worth bothering with... even if we are in the 1940/35 zone on Monday.

VIX +1.5%...a weekly close in the low 12s....seems viable.

1.17pm... minor down wave... hmm.. Just need to take out 1953... and then another 10pts are on the table.

1.22pm.. and there goes the morning low. Hourly cycle will be bearish into the close..unless another stupid micro ramp appears out of nowhere.

Could do with the 1940s..just to keep me awake.

12pm update - minor chop

US indexes continue to see minor chop, and with equity bears failing to show any power, market is in micro melt mode. A weekly close in the sp'1955/60 zone still seems likely, Metals are holding minor gains, Gold +$2.

sp'60min

Summary

Little to add.

Clearly, the 1940/35 is now off the agenda for today, but the weekly charts would certainly still offer it next Mon/Tuesday.

--

VIX update from Mr P. (I guess Jamie is busy shopping for a new mic).

--

..with no games today..its kinda empty...

I guess I might see what stocks the clowns on CNBC are trying to pump today.

-

time for lunch

sp'60min

Summary

Little to add.

Clearly, the 1940/35 is now off the agenda for today, but the weekly charts would certainly still offer it next Mon/Tuesday.

--

VIX update from Mr P. (I guess Jamie is busy shopping for a new mic).

--

..with no games today..its kinda empty...

I guess I might see what stocks the clowns on CNBC are trying to pump today.

-

time for lunch

11am update - tedious chop

The earlier moderate declines have failed even quicker than yesterday. Market appears stuck in the sp'1960/55 zone..and that will likely be the weekly close. Metals are holding slight gains, Gold +$2, whilst Oil is flat.

sp'weekly8b

Summary

*I'm still looking at the recent action as a sub'4, as seen on the weekly chart.

Now, its entirely possible..if not somewhat likely, we'll see a further minor wave lower early next Mon/Tuesday, before pushing back upward into Thursday July'3 - for the 3 day holiday weekend.

-

Mid July is still lining up to offer a possible intermediate top.

As ever..one day at a time, but for now...I ain't shorting anything for another 3 full weeks.

-

Naturally, WFM is making new multi-week lows..so...that makes for another pointless trading week in my world.

sp'weekly8b

Summary

*I'm still looking at the recent action as a sub'4, as seen on the weekly chart.

Now, its entirely possible..if not somewhat likely, we'll see a further minor wave lower early next Mon/Tuesday, before pushing back upward into Thursday July'3 - for the 3 day holiday weekend.

-

Mid July is still lining up to offer a possible intermediate top.

As ever..one day at a time, but for now...I ain't shorting anything for another 3 full weeks.

-

Naturally, WFM is making new multi-week lows..so...that makes for another pointless trading week in my world.

10am update - opening minor mess

US indexes open a little lower, but have already rebounded to flat. Daily charts look somewhat weak, and the hourly charts are still suggestive that the sp'1940/35 zone is viable. Equity bulls can easily sustain a weekly close in the 1940s without doing any sig' damage to the primary trend.

sp'60min

sp'daily5

Summary

So...is that it for the downside..or another wave?

As it is, I won't try to short this nonsense...the declines remain minor..and never last long.. as we've seen this week.

-

Pretty tiresome already.

10.03am... market wants to roll over. Just who is going to buy >1960 today.. especially into a weekend?

..awaiting the 1940s... again.

10.07am.. rolling over....

10.23am... urghh...back to chop.

Oh well, I ain't short anyway, none of it matters.

Notable weakness, TWTR -1.6%, but already 1% off the low, and still looks set for much higher levels in July.

sp'60min

sp'daily5

Summary

So...is that it for the downside..or another wave?

As it is, I won't try to short this nonsense...the declines remain minor..and never last long.. as we've seen this week.

-

Pretty tiresome already.

10.03am... market wants to roll over. Just who is going to buy >1960 today.. especially into a weekend?

..awaiting the 1940s... again.

10.07am.. rolling over....

10.23am... urghh...back to chop.

Oh well, I ain't short anyway, none of it matters.

Notable weakness, TWTR -1.6%, but already 1% off the low, and still looks set for much higher levels in July.

Pre-Market Brief

Good morning. Futures are moderately lower, sp -4pts, we're set to open at 1953. Metals are fractionally weak, Gold -$1. Mr Market looks set for another minor down wave today, there is viable downside to 1940/35.

sp'60min

Summary

Far more important than the market of course...the world cup...but there are no matches today, the first day in what seems like many weeks :(

The next games are tomorrow, see Schedule @ BBC.

--

Video update from the Permabull

--

Good wishes for Friday trading.

9.03am.. looks like we'll be in the 1940s early this morning....a lower low would make sense...regardless of how you might want to count this nonsense.

Market should be able to hold 1940/35 zone..before new highs in July.

9.42am.. looking at the daily index charts, I still think 1940/35 is viable... it'd make for a far better low..and then up.

sp'60min

Summary

Far more important than the market of course...the world cup...but there are no matches today, the first day in what seems like many weeks :(

The next games are tomorrow, see Schedule @ BBC.

--

Video update from the Permabull

--

Good wishes for Friday trading.

9.03am.. looks like we'll be in the 1940s early this morning....a lower low would make sense...regardless of how you might want to count this nonsense.

Market should be able to hold 1940/35 zone..before new highs in July.

9.42am.. looking at the daily index charts, I still think 1940/35 is viable... it'd make for a far better low..and then up.

Daily Wrap

US indexes saw some moderate weakness - much in the style of Tuesday, but it does nothing to dent the current multi-week upward trend. Even the sp'1930s tomorrow.. or early next week, won't do any significant damage to the bullish case, with further upside likely into mid July.

sp'weekly8b

VIX'daily3

Summary

So...minor declines for the indexes, and we have a blue candle on the weekly 'rainbow' chart. As it is, even a weekly closing blue candle will do nothing to dent the primary trend. Early next week, the sp'1935/25 zone would appear to be the very lowest the equity bears could manage, before we resume the upward trend.

Underlying MACD (green bar histogram) cycle is at the upper end of its cycle, and certainly, given another 2-4 weeks, I will be looking for the next multi-week down cycle. As ever though, we might only be looking at a very minor pull back on the order of 4-6%.

The importance of late July

In many ways, the rest of the trading year will be largely dependent on what Q2 GDP comes in at (July'30).... and of course how the market reacts to that.

We are already seeing revised GDP outlooks from some of the big institutions, and in another month, perhaps the market would be content with a number as low as 1% growth - which of course would do little to negate the huge Q1 decline of -2.9%.

Right now, I'm not entirely optimistic - from a bearish perspective. Even a July monthly close <1900 - the first key support, looks to be somewhat difficult.

Looking ahead

The only thing of note tomorrow is consumer sentiment data. I suppose if that comes in better than expected it might give the market an excuse to rally into the Friday close..although the sp'1970s look out of range.

There is also the annual re-balancing of the R2K, so expect some high vol' in the late afternoon.

*next sig' QE is not until at least next Tuesday.

-

Stuck in the trenches

Naturally, I'm still focused on WFM, which continues to struggle. Price action remains weak, although at least the daily MACD cycle is offering 'something' positive for next week.

WFM daily

As things are, I'd almost consider picking up an index-long, or even TWTR-long in the immediate term, but...I'm tired.. and until I'm out of WFM, I ain't much interested in adding to my problems.

Goodnight from London

sp'weekly8b

VIX'daily3

Summary

So...minor declines for the indexes, and we have a blue candle on the weekly 'rainbow' chart. As it is, even a weekly closing blue candle will do nothing to dent the primary trend. Early next week, the sp'1935/25 zone would appear to be the very lowest the equity bears could manage, before we resume the upward trend.

Underlying MACD (green bar histogram) cycle is at the upper end of its cycle, and certainly, given another 2-4 weeks, I will be looking for the next multi-week down cycle. As ever though, we might only be looking at a very minor pull back on the order of 4-6%.

The importance of late July

In many ways, the rest of the trading year will be largely dependent on what Q2 GDP comes in at (July'30).... and of course how the market reacts to that.

We are already seeing revised GDP outlooks from some of the big institutions, and in another month, perhaps the market would be content with a number as low as 1% growth - which of course would do little to negate the huge Q1 decline of -2.9%.

Right now, I'm not entirely optimistic - from a bearish perspective. Even a July monthly close <1900 - the first key support, looks to be somewhat difficult.

Looking ahead

The only thing of note tomorrow is consumer sentiment data. I suppose if that comes in better than expected it might give the market an excuse to rally into the Friday close..although the sp'1970s look out of range.

There is also the annual re-balancing of the R2K, so expect some high vol' in the late afternoon.

*next sig' QE is not until at least next Tuesday.

-

Stuck in the trenches

Naturally, I'm still focused on WFM, which continues to struggle. Price action remains weak, although at least the daily MACD cycle is offering 'something' positive for next week.

WFM daily

As things are, I'd almost consider picking up an index-long, or even TWTR-long in the immediate term, but...I'm tired.. and until I'm out of WFM, I ain't much interested in adding to my problems.

Goodnight from London

Thursday, 26 June 2014

Closing Brief

US indexes closed moderately weak, sp -2pts @ 1957, (intra low 1944). The two leaders - Trans/R2K, both settled lower by around 0.2%. Near term outlook continues to offer a further down wave to the sp'1940/35 zone.. before renewed broad upside across the first half of July.

sp'60min

Summary

*coming up...the last pair of games in the group stage, I think I'll be cheer leading the South Koreans.

-

So..a day of a few swings..and certainly, the opening drop did surprise many. Price structure is very similar to yesterday, and I'll be looking for another wave lower tomorrow morning.

A full daily wrap... later at 8pm EST.

time for kick off :)

sp'60min

Summary

*coming up...the last pair of games in the group stage, I think I'll be cheer leading the South Koreans.

-

So..a day of a few swings..and certainly, the opening drop did surprise many. Price structure is very similar to yesterday, and I'll be looking for another wave lower tomorrow morning.

A full daily wrap... later at 8pm EST.

time for kick off :)

3pm update - seeking weakness into the close

US indexes look vulnerable to renewed weakness into the close. Metals remain weak, Gold -$4. There is noticeable weakness in Oil, -0.9%. VIX looks set for minor net daily gains, somewhere in the 11.75/12.25 zone.

sp'60min

Summary

Hourly MACD cycle is suggestive we're due to see a new up wave begin tomorrow, but I'm somewhat skeptical of that.

As things are, its not a good setup for those wanting to short, aside from those with around 1960.

-

updates into the close...esp' if we start to roll over.

*TWTR still building gains, +6.1%

3.07pm...minor chop...and its getting kinda tiresome.

3.14pm.. price action much like yesterday... minor upward melt...

oh well, I'll be looking for weakness early tomorrow then...1940/35.

makes...no.... difference.

*I'd only drop the bear flag scenario if much above 1961

3.29pm.. 15min cycle...wants to roll over into the close. Bears need 1952 to confirm.

3.46pm.. price action/structure almost exactly like yesterday... bodes for the bears..tomorrow.

TWTR cooling, +4.8%

sp'60min

Summary

Hourly MACD cycle is suggestive we're due to see a new up wave begin tomorrow, but I'm somewhat skeptical of that.

As things are, its not a good setup for those wanting to short, aside from those with around 1960.

-

updates into the close...esp' if we start to roll over.

*TWTR still building gains, +6.1%

3.07pm...minor chop...and its getting kinda tiresome.

3.14pm.. price action much like yesterday... minor upward melt...

oh well, I'll be looking for weakness early tomorrow then...1940/35.

makes...no.... difference.

*I'd only drop the bear flag scenario if much above 1961

3.29pm.. 15min cycle...wants to roll over into the close. Bears need 1952 to confirm.

3.46pm.. price action/structure almost exactly like yesterday... bodes for the bears..tomorrow.

TWTR cooling, +4.8%

2pm update - mini surge into the 1960s?

US equities are trying to claw back to evens.. with the USA moving into the last 16 of the world cup. A daily close in the sp'1960s still looks difficult, and there remains threat of another down wave late today..or early tomorrow.

sp'60min

Summary

So...a little spike higher..but price action still looks kinda weak.

As for the C wave target box.... hmm, still viable....although I realise some might want to call this a 5 wave decline now.. with E into tomorrow.

Anyway....USA are through...they did well.

Notable strength: TWTR, +5.6%

2.24pm.. market looking vulnerable to weakness into the close... downside target remains 1940/35...but right now, that looks more likely tomorrow.

sp'60min

Summary

So...a little spike higher..but price action still looks kinda weak.

As for the C wave target box.... hmm, still viable....although I realise some might want to call this a 5 wave decline now.. with E into tomorrow.

Anyway....USA are through...they did well.

Notable strength: TWTR, +5.6%

2.24pm.. market looking vulnerable to weakness into the close... downside target remains 1940/35...but right now, that looks more likely tomorrow.

1pm update - baby bear flag

US indexes are naturally trading quietly.. with the second half of USA vs Germany, still ahead. Price structure is offering another bear flag, with downside into the low 1940s later today. Metals are weak, Gold -$3, whilst Oil is lower by a somewhat significant -1.0%.

sp'5min

Summary

*bear flag is very clear on the micro 5min cycle.

--

So...once again, its a case of do we break lower in the late part of today..or instead..early tomorrow.

Hard to call, but the 1960s look well out of range until late Friday at the earliest, if not next week.

--

Notable strength: TWTR, +4%... and headed for the big $50 by mid July.

stay tuned.

sp'5min

Summary

*bear flag is very clear on the micro 5min cycle.

--

So...once again, its a case of do we break lower in the late part of today..or instead..early tomorrow.

Hard to call, but the 1960s look well out of range until late Friday at the earliest, if not next week.

--

Notable strength: TWTR, +4%... and headed for the big $50 by mid July.

stay tuned.

12pm update - its game time

US indexes remain moderately lower, and look set for further declines later this afternoon. However, far more importantly, we have another game.. USA vs Germany. No doubt, many - especially those in market land, are going to be taking a two hour lunch break.

sp'60min

Summary

Suffice to say... minor chop..and considering the Tuesday down wave, I'd have to guess we'll see a few more hours of weakness late today..possibly stretching into early Friday.

Regardless, we should renewed upside into the Friday close..when the R2K gets a major rebalancing.

--

VIX update from Mr T....who needs a new mic'... and the June'25 date is wrong.

--

time for kick off!

sp'60min

Summary

Suffice to say... minor chop..and considering the Tuesday down wave, I'd have to guess we'll see a few more hours of weakness late today..possibly stretching into early Friday.

Regardless, we should renewed upside into the Friday close..when the R2K gets a major rebalancing.

--

VIX update from Mr T....who needs a new mic'... and the June'25 date is wrong.

--

time for kick off!

11am update - a little more time

US indexes have seen some moderate declines this morning, taking out the Wed' morning sp'1949 low. Market still looks set for a little further lower, to the 1940/35 zone, a prime time for that remains 2.30pm or so, and that should equate to VIX 13s.

sp'60min

Summary

*I'd guess market will be almost semi-closed during the USA/Germany game at 12pm EST.

--

So..we're lower this morning..the bear flag was confirmed, and based on the Monday down wave, I'd expect today's C wave to last until mid afternoon.

Friday looks set for net gains...at least by end of the day anyway.

--

Notable weakness, RIG, -2.5%

.. but I'd still hold to general upside to the 48/50 zone within a month.

time to shop.... back soon.

11.22am.. minor chop continues, and 1950 is offering resistance.

Long afternoon ahead for the bulls.... I'm still guessing we drift lower...1940/35.. and then... up.

sp'60min

Summary

*I'd guess market will be almost semi-closed during the USA/Germany game at 12pm EST.

--

So..we're lower this morning..the bear flag was confirmed, and based on the Monday down wave, I'd expect today's C wave to last until mid afternoon.

Friday looks set for net gains...at least by end of the day anyway.

--

Notable weakness, RIG, -2.5%

.. but I'd still hold to general upside to the 48/50 zone within a month.

time to shop.... back soon.

11.22am.. minor chop continues, and 1950 is offering resistance.

Long afternoon ahead for the bulls.... I'm still guessing we drift lower...1940/35.. and then... up.

10am update - opening weakness

US indexes are on the slide, and it is highly probable that we are seeing a minor C, 3, or whatever you wanna call it, down wave. Downside target remains the sp'1940/35 zone, which seems very viable this afternoon.

sp'60min

Summary

It looked like a bear flag yesterday....

..and with the break lower, it IS indeed a bear flag.

I like being right.... I just hope that train wreck WFM turns around before the July'4 weekend, I'm really somewhat in a real situation with that one. Urghhh

10.35am.. minor chop.

Time wise, I'd have to expect another little wave lower...into the afternoon.

I think its a case of 'lets see where we are at 2.30pm'.

sp'60min

Summary

It looked like a bear flag yesterday....

..and with the break lower, it IS indeed a bear flag.

I like being right.... I just hope that train wreck WFM turns around before the July'4 weekend, I'm really somewhat in a real situation with that one. Urghhh

10.35am.. minor chop.

Time wise, I'd have to expect another little wave lower...into the afternoon.

I think its a case of 'lets see where we are at 2.30pm'.

Pre-Market Brief

Good morning. Futures are fractionally lower, sp -1pt, we're set to open at 1958. Precious metals are moderately weak, Gold -$6, with Silver -0.5%. There is high potential for a further minor wave lower to the sp'1940/35 zone by late today/early Friday.

sp'60min

Summary

We have the big USA vs Germany game at 12pm EST, and frankly..my attention will be on that today.

Anyway, lets see if the market can break lower this morning, with weakness to the lower 1940s... we're only talking about a fall of 1% or so.

--

Video update from Carboni

--

Good wishes for Thursday trading

-

9.35am.. It is a bear flag... as I was noting yesterday.

In theory.. we should at least hit the low 1940s today...maybe a brief venture to 1935 or so, with VIX 13s

9.38am.. oh great, stockcharts is having 'issues' again.

9.40am.... bear flag is being provisionally confirmed.... looks like we'll see that 1940/35 zone today.

9.43am.. typically... I'll be looking for a floor around 2.30pm or so. VIX about to break into the 12s.

sp'60min

Summary

We have the big USA vs Germany game at 12pm EST, and frankly..my attention will be on that today.

Anyway, lets see if the market can break lower this morning, with weakness to the lower 1940s... we're only talking about a fall of 1% or so.

--

Video update from Carboni

--

Good wishes for Thursday trading

-

9.35am.. It is a bear flag... as I was noting yesterday.

In theory.. we should at least hit the low 1940s today...maybe a brief venture to 1935 or so, with VIX 13s

9.38am.. oh great, stockcharts is having 'issues' again.

9.40am.... bear flag is being provisionally confirmed.... looks like we'll see that 1940/35 zone today.

9.43am.. typically... I'll be looking for a floor around 2.30pm or so. VIX about to break into the 12s.

Daily Wrap

US indexes are due a further minor wave lower, but it will do nothing to dent the multi-week upward trend. The real question is how high might the market be by mid July?

sp'weekly8b

VIX'daily3

Summary

So... some moderate daily gains for all the main indexes, with borderline sig' gains of 0.9% and 0.8% respectively, for the Trans/R2K. VIX looks set to jump again, but only to the 12.75/13.25 zone... 14 on a spike - if sp'1930s.

Broader trend.. and price action remains bullish... for at least another 3-4 weeks.

Closing update from Riley

Looking ahead

There is the usual jobs data, but also pers' income/outlays.

There are two Fed officials talking during the day, Bullard and Lacker, both of whose comments could be used to knock the market lower.

*next sig' QE is not until at least next Tuesday (next QE schedule is due Mon' Jun'30).

-

Goodnight from London

sp'weekly8b

VIX'daily3

Summary

So... some moderate daily gains for all the main indexes, with borderline sig' gains of 0.9% and 0.8% respectively, for the Trans/R2K. VIX looks set to jump again, but only to the 12.75/13.25 zone... 14 on a spike - if sp'1930s.

Broader trend.. and price action remains bullish... for at least another 3-4 weeks.

Closing update from Riley

Looking ahead

There is the usual jobs data, but also pers' income/outlays.

There are two Fed officials talking during the day, Bullard and Lacker, both of whose comments could be used to knock the market lower.

*next sig' QE is not until at least next Tuesday (next QE schedule is due Mon' Jun'30).

-

Goodnight from London

Wednesday, 25 June 2014

Closing Brief

US equities closed moderately higher, sp +9pts @ 1959. The two leaders - Trans/R2K, settled higher by 0.9% and 0.8% respectively. Near term outlook is for moderate downside to 1940/35.. before renewed upside into July.

sp'60min

Summary

*Time for another pair of games... I'm going with the French game

--

Despite failing to roll lower into the close, it makes little difference.

Price structure is a very clear bear flag - call it a B wave if you like, and we're set for lower levels tomorrow. I'd not be surprised if we see sp'1940/35 tomorrow at some point, as part of a mini washout.

-

I'll post a full daily wrap at 8pm EST.

-

time for Ecuador vs France!

sp'60min

Summary

*Time for another pair of games... I'm going with the French game

--

Despite failing to roll lower into the close, it makes little difference.

Price structure is a very clear bear flag - call it a B wave if you like, and we're set for lower levels tomorrow. I'd not be surprised if we see sp'1940/35 tomorrow at some point, as part of a mini washout.

-

I'll post a full daily wrap at 8pm EST.

-

time for Ecuador vs France!

3pm update - weakness into the close

US equities are holding moderate gains, but look set for weakness into the close. Price structure is a near perfect bear flag, and equity bears should be seeking a break under 1955 to confirm a new way down is underway. Primary downside target remains 1940/35.

sp'60min

Summary

Well... 15/5min cycles are PRIME for breaking lower into the close.

Lets see how many of the rats want to exit into the close.

-

3.05pm... early warning sign... rolling over.... 1956

3.19pm.. micro chop...but the setup is there... we're due to fall from here...although downside is a mere 1%...not much more than that.

-

3.25pm.. a micro double top at 1958 ?

Regardless, we are due to fall....

-

notable strength: FB +2.5%

3.30pm... I see a double top....... invalid if 1959 ..

come on bears..where are you?

3.34pm.. they are selling the 1958s

.. 1959... fail. oh well.

-

3.39pm... and the short stops are getting hit... 1960..... VIX -5.9%...

3.46pm sp'1960... and just no downside pressure, but price structure remains a VERY clear bear flag.

3.52pm... so...still a bear flag.. and I'll be seeking sp'500 to lose 20/25pts in the near term.. by the Friday close.

sp'60min

Summary

Well... 15/5min cycles are PRIME for breaking lower into the close.

Lets see how many of the rats want to exit into the close.

-

3.05pm... early warning sign... rolling over.... 1956

3.19pm.. micro chop...but the setup is there... we're due to fall from here...although downside is a mere 1%...not much more than that.

-

3.25pm.. a micro double top at 1958 ?

Regardless, we are due to fall....

-

notable strength: FB +2.5%

3.30pm... I see a double top....... invalid if 1959 ..

come on bears..where are you?

3.34pm.. they are selling the 1958s

.. 1959... fail. oh well.

-

3.39pm... and the short stops are getting hit... 1960..... VIX -5.9%...

3.46pm sp'1960... and just no downside pressure, but price structure remains a VERY clear bear flag.

3.52pm... so...still a bear flag.. and I'll be seeking sp'500 to lose 20/25pts in the near term.. by the Friday close.

2pm update - churning before the next wave lower

US equities are holding moderate gains, but another down wave is likely in the near term.. possibly beginning before the close of today. Primary downside remains 1940/35 zone.. from where the market should rally into July.

sp'60min

Summary

A lightly labelled chart, and I am guessing we'll see a C wave begin late today...or tomorrow...it really makes little difference.

--

So...two hours to go...lets see if we roll over again.

sp'60min

Summary

A lightly labelled chart, and I am guessing we'll see a C wave begin late today...or tomorrow...it really makes little difference.

--

So...two hours to go...lets see if we roll over again.

Subscribe to:

Posts (Atom)