With equities broadly weak for a second day, the VIX saw a second day of gains, settling +5.7% @ 15.12 (intra high 16.36). Near term outlook offers the sp'2040/30 zone before the weekend, which will likely equate to VIX maxing out somewhere in the 18/20 zone. The big 20 threshold still remains difficult to break/hold.

VIX'60min

VIX'daily3

Summary

With the equity bears taking control for a second day, the VIX has now climbed from the low 12s to the 16s.

However, this is of course still a very low VIX.. and even if sp'2040/30 zone within the next day or two, VIX won't likely be able to break/hold the key 20 threshold in the current up cycle.

Next best opportunity for VIX 20s is more likely mid June.... after a marginal new historic high (for some indexes).

--

more later... on the indexes

Wednesday, 6 May 2015

Closing Brief

US equities closed moderately weak, sp -9pts @ 2080 (intra low 2067). The two leaders - Trans/R2K, settled higher by 0.2% and 0.3% respectively. Near term outlook is bearish to the 2040/30 zone before the weekend. There still remains significant threat of marginal new highs in late May/early June.

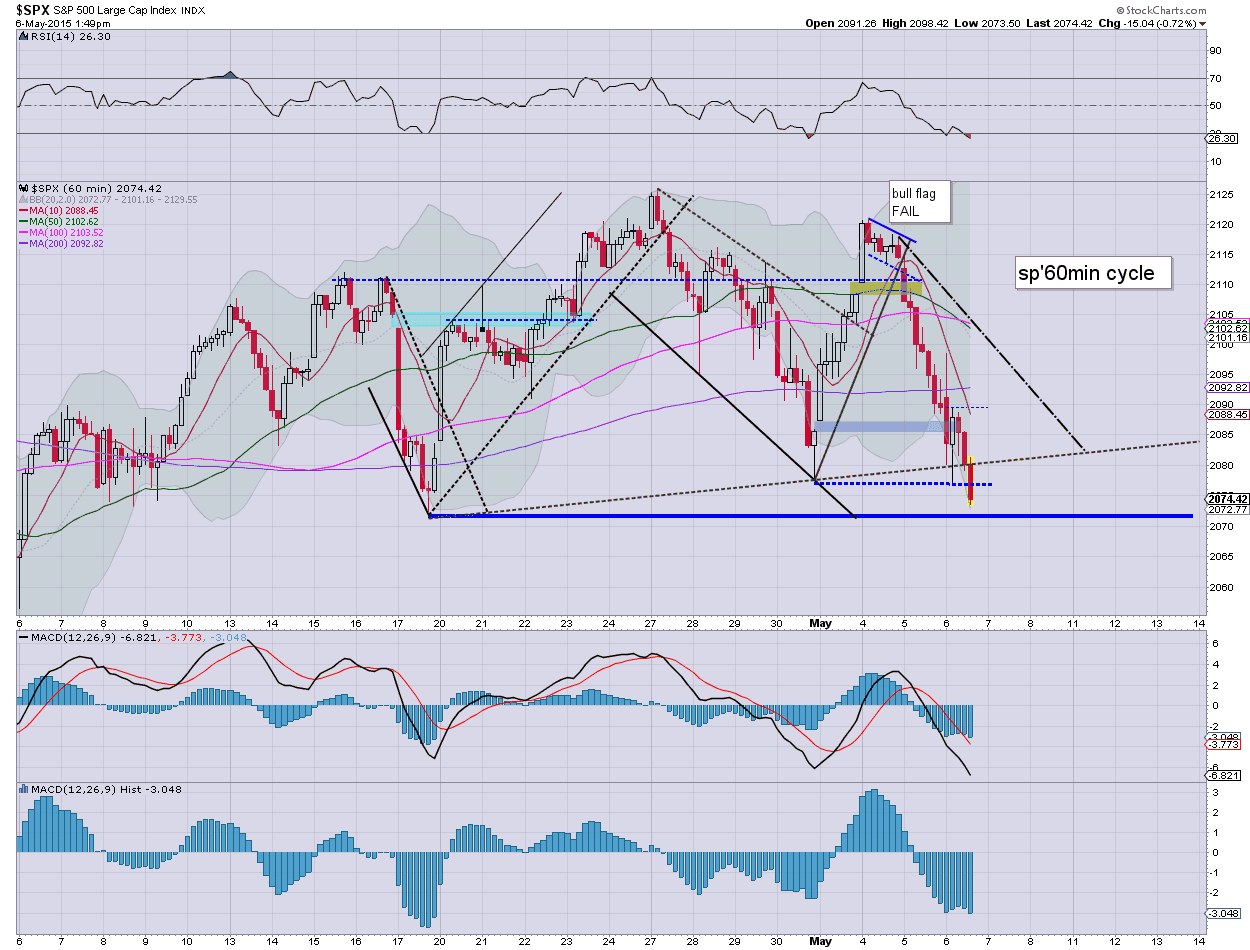

sp'60min

Summary

*a closing hour short-stop cascade, from 2069, but still... it does not negate the technical damage, seen across most indexes today.

--

Today was the second consecutive victory for the equity bears. The opening gains lasted mere minutes, before a rather severe reversal.. as the Yellen started muttering about equities.

--

Earnings, WFM, earnings inline: EPS of 43 cents, but market is not happy as rev' is a touch light, initial stock reaction -10%.

TSLA, earnings beat... stock swings moderately higher. Underlying issue is one of persistent losses, on what is very low sales of $1bn.

--

more later... on the VIX

sp'60min

Summary

*a closing hour short-stop cascade, from 2069, but still... it does not negate the technical damage, seen across most indexes today.

--

Today was the second consecutive victory for the equity bears. The opening gains lasted mere minutes, before a rather severe reversal.. as the Yellen started muttering about equities.

--

Earnings, WFM, earnings inline: EPS of 43 cents, but market is not happy as rev' is a touch light, initial stock reaction -10%.

TSLA, earnings beat... stock swings moderately higher. Underlying issue is one of persistent losses, on what is very low sales of $1bn.

--

more later... on the VIX

3pm update - ohh noes

US equities have decisively failed to hold the April 17th low of sp'2072. Next support is not until the 2040/30 zone, where the 200dma will be lurking this Friday morning. VIX is reflecting a market will some mild concern, breaking into the 16s. Metals remain a little lower, Gold -$2. Oil is still set to close net higher by around 1%.

sp'daily5

VIX'daily3

Summary

*VIX is confirming the equity declines, with the break into the 16s.. the door is open to a 'VERY brief' attempt to challenge the key 20 threshold. However, VIX 19/20s would make for a very natural spike high.. along with sp'2040/30.. whether tomorrow.. or early Friday.

--

Yes.. I'm surprised at the loss of the sp'2070s... but infinately more important... what is important is there is now a clear 1% empty air.. at least 2040.

Those touting the 2040s last night... congrats with that slightly bold call... we're on track for that now.. before the weekend.

--

In respect to the fifth anniversary of the infamous flash crash...

Much like Khan.. the bull maniacs will be back... bears.. beware!

--

*I remain short Gold.. will likely hold into early Friday.

-

3.05pm... something to look forward to...

Earnings at the close... TSLA, WFM... amongst a few others.

-

3.14pm.. A little chop around sp'2070... the damage has been done though.. and market looks set for another 1.5% lower by early Friday. A brief test of the 200dma is possible.. if 'good jobs news' is seen as 'omg, rates might actually rise this year'.

notable weakness: TSLA -1.5%.. ahead of earnings...

-

3.29pm.. BABA has earnings early tomorrow... currently +0.2% in the $79s. With the recent failure to hold the big $80 threshold.. outlook is bearish tomorrow.... viable downside to 70/68.

-

sp'2073... regardless of the exact close... a second day for the bears....

sp'daily5

VIX'daily3

Summary

*VIX is confirming the equity declines, with the break into the 16s.. the door is open to a 'VERY brief' attempt to challenge the key 20 threshold. However, VIX 19/20s would make for a very natural spike high.. along with sp'2040/30.. whether tomorrow.. or early Friday.

--

Yes.. I'm surprised at the loss of the sp'2070s... but infinately more important... what is important is there is now a clear 1% empty air.. at least 2040.

Those touting the 2040s last night... congrats with that slightly bold call... we're on track for that now.. before the weekend.

--

In respect to the fifth anniversary of the infamous flash crash...

Much like Khan.. the bull maniacs will be back... bears.. beware!

--

*I remain short Gold.. will likely hold into early Friday.

-

3.05pm... something to look forward to...

Earnings at the close... TSLA, WFM... amongst a few others.

-

3.14pm.. A little chop around sp'2070... the damage has been done though.. and market looks set for another 1.5% lower by early Friday. A brief test of the 200dma is possible.. if 'good jobs news' is seen as 'omg, rates might actually rise this year'.

notable weakness: TSLA -1.5%.. ahead of earnings...

-

3.29pm.. BABA has earnings early tomorrow... currently +0.2% in the $79s. With the recent failure to hold the big $80 threshold.. outlook is bearish tomorrow.... viable downside to 70/68.

-

sp'2073... regardless of the exact close... a second day for the bears....

2pm update - renewed weakness

Equities are still weak, and have broken a marginally lower low.. to sp'2075. Next support is the April 17'th low of 2072. After that.. there really isn't anything until the 200dma.. @ 2028. Metals remain weak, Gold -$2.. and looking vulnerable. Even Oil is now battling to stay positive, +0.6%.

sp'60min

GLD, 60min'2

Summary

*I am short GLD, price structure remains a large H/S formation, within the broader down trend from 2011. Considering the weaker USD, Gold is performing exceptionally poorly.

--

So much for the double floor of sp'2077... we're clearly still slipping lower.

Where are the buyers?

Can the bull maniacs really blame the Yellen this morning with her equity comments?

--

notable strength: BABA +0.4%.. ahead of Thursday morning earnings. Despite the current gain though, the break of the $80 threshold yesterday is extremely bearish.. and the door is open to $70/68.. which is around 15% lower.

2.21pm.. approaching afternoon turn time of 2.30pm (don't ask why.. it just often is)....

Market with a soft floor of sp'2073... regardless of where we close.. and even tomorrow.. now its a case of how the Friday jobs data is perceived.

notable weakness: AAPL, -1.5% in the $123s.

-

2.37pm... most indexes taking out the April 17'th low (equiv' to sp'2072)...

A daily close <2072 would be very bearish, and suggestive of weakness to the 2040/30 zone.. where the 200dma will soon be lurking.

Regardless of the close... some notable technical damage has now been done on the daily/weekly cycles.

VIX reflecting the concern... +12% in the 16s.

sp'60min

GLD, 60min'2

Summary

*I am short GLD, price structure remains a large H/S formation, within the broader down trend from 2011. Considering the weaker USD, Gold is performing exceptionally poorly.

--

So much for the double floor of sp'2077... we're clearly still slipping lower.

Where are the buyers?

Can the bull maniacs really blame the Yellen this morning with her equity comments?

--

notable strength: BABA +0.4%.. ahead of Thursday morning earnings. Despite the current gain though, the break of the $80 threshold yesterday is extremely bearish.. and the door is open to $70/68.. which is around 15% lower.

2.21pm.. approaching afternoon turn time of 2.30pm (don't ask why.. it just often is)....

Market with a soft floor of sp'2073... regardless of where we close.. and even tomorrow.. now its a case of how the Friday jobs data is perceived.

notable weakness: AAPL, -1.5% in the $123s.

-

2.37pm... most indexes taking out the April 17'th low (equiv' to sp'2072)...

A daily close <2072 would be very bearish, and suggestive of weakness to the 2040/30 zone.. where the 200dma will soon be lurking.

Regardless of the close... some notable technical damage has now been done on the daily/weekly cycles.

VIX reflecting the concern... +12% in the 16s.

1pm update - battling to hold the floor

The equity market sees another minor wave lower.. back to sp'2080, but the earlier 2077 floor should hold. USD remains weak, but off the low, -0.8% @ 94.20s. Metals remain moderately weak, Gold -$2. Oil looks set for another sig' net daily gain, +1.5%.

sp'60min

Summary

Despite the little wave lower this hour... I'd guess the earlier low will hold.

Thursday looks set for moderate chop... as the market will likely be in a holding pattern ahead of the monthly jobs data (Friday, 8.30am).

--

Gold remains interesting...

15min cycle

I'm still looking for another little up wave before I'll seriously considering getting involved (short side). Of course, if the USD keeps recovering this afternoon... Gold will not likely be able to claw much higher.

-

1.40pm.. I am SHORT Gold, via GLD @ $114.30.... will look to hold into Friday.

sp'60min

Summary

Despite the little wave lower this hour... I'd guess the earlier low will hold.

Thursday looks set for moderate chop... as the market will likely be in a holding pattern ahead of the monthly jobs data (Friday, 8.30am).

--

Gold remains interesting...

15min cycle

I'm still looking for another little up wave before I'll seriously considering getting involved (short side). Of course, if the USD keeps recovering this afternoon... Gold will not likely be able to claw much higher.

-

1.40pm.. I am SHORT Gold, via GLD @ $114.30.... will look to hold into Friday.

12pm update - spike floor candles

The market is battling to hold the earlier floor of sp'2077. The most recent 3 hourly candles are all offering spike floors... highly suggestive that the down wave from 2125 is complete. USD remains very weak, -1.0% @ DXY 94.10s. Metals are a touch weak, Gold -$2. Oil has significantly cooled.. now just +0.7%.

sp'60min

sp'daily5

Summary

So.. we're still moderately lower, but all things considered, it looks like the market wants to build a double floor of sp'2077.

It would seem Mr Market wants to sell lower into the monthly jobs data.. and then rally on it. Regardless of what the data is this Friday morning, it'd seem to be a case of 'isn't everything great again?'

notable weakness: CHK -6.8% after earnings which beat (11 cents vs 4 exp).. but still.. 11 cents is a lousy number.. and its not surprising the stock is selling lower.

-

*I continue to have eyes for Gold-short, will consider in the 2pm hour...

--

VIX update from Mr T.

-

time for lunch

sp'60min

sp'daily5

Summary

So.. we're still moderately lower, but all things considered, it looks like the market wants to build a double floor of sp'2077.

It would seem Mr Market wants to sell lower into the monthly jobs data.. and then rally on it. Regardless of what the data is this Friday morning, it'd seem to be a case of 'isn't everything great again?'

notable weakness: CHK -6.8% after earnings which beat (11 cents vs 4 exp).. but still.. 11 cents is a lousy number.. and its not surprising the stock is selling lower.

-

*I continue to have eyes for Gold-short, will consider in the 2pm hour...

--

VIX update from Mr T.

-

time for lunch

11am update - provisional floor

US equities have put in a reasonably secure floor of sp'2077.. having swung from an opening high of 2098. There is notable weakness in the USD, -1.2% in the DXY 93.90s (primary target from 100.71). Metals have swung moderately lower, Gold -$2. Oil is holding sig' gains of 2.6%.. as inventories are negative!

sp'60min

Summary

We have a pretty clear floor of sp'2077.. and the current hourly candle is offering a double floor.. from the low of April 30'th.

VIX is naturally cooling.. having maxed out at 15.66.

For the equity bears out there... that is probably it for this cycle... having fallen from 2125.

--

I'm not surprised Gold has turned lower (opening black-fail candle).. but am currently suffering from a mild case of trader paralysis. Oh well, at least I'm not losing money.

Will consider a GLD short on the next micro up cycle into the afternoon.

-

re: USD - via UUP

We're just about at the start of primary target zone of 93/92s...

If main market can rally to sp'2170s or so... perhaps that equate sto DXY 90/89... before the next hyper wave to the 120s?

sp'60min

Summary

We have a pretty clear floor of sp'2077.. and the current hourly candle is offering a double floor.. from the low of April 30'th.

VIX is naturally cooling.. having maxed out at 15.66.

For the equity bears out there... that is probably it for this cycle... having fallen from 2125.

--

I'm not surprised Gold has turned lower (opening black-fail candle).. but am currently suffering from a mild case of trader paralysis. Oh well, at least I'm not losing money.

Will consider a GLD short on the next micro up cycle into the afternoon.

-

re: USD - via UUP

We're just about at the start of primary target zone of 93/92s...

If main market can rally to sp'2170s or so... perhaps that equate sto DXY 90/89... before the next hyper wave to the 120s?

10am update - opening reversal

US equities open higher to sp'2098, but almost immediately collapse back. Next support is around 2080/77. Metals are a little higher.. but look vulnerable for rest of the week, Gold +$3. Oil is holding sig' gains of 2.4%

sp'60min

Summary

Well, that is quite an interesting opening swing!

Market should be able to level out in the 2080/77 zone. Any move <2077 would be a problem, and suggestive of a challenge of the 200dma.

notable weakness, TWTR -1.4% in the $36s.... the Dec' low ain't far off now.

-

I have eyes on Gold - as a viable short.

15min

--

stay tuned!

10.01am Viable floor of sp'2080.... on soft rising support.... bears... beware!

10.11am. ohoh.. sp'2077... this is starting to be a problem....

Yellen needs to stop talking and start hitting the ES mini BUY button !

10.15am.. Its ironic that despite the USD breaking multi-month lows... equities are not benefiting.

USD -1.1% in the DXY 93s... at primary target zone!

-

notable weakness: DISCA (Discovery), -2.5%.. as the bigger bearish formation remains intact (downside this summer would 25/22 zone)

10.34am... Oil inventories... -3.9 million !

WTIC +3.2%... in the $62s... headed for 65/67

sp'60min

Summary

Well, that is quite an interesting opening swing!

Market should be able to level out in the 2080/77 zone. Any move <2077 would be a problem, and suggestive of a challenge of the 200dma.

notable weakness, TWTR -1.4% in the $36s.... the Dec' low ain't far off now.

-

I have eyes on Gold - as a viable short.

15min

--

stay tuned!

10.01am Viable floor of sp'2080.... on soft rising support.... bears... beware!

10.11am. ohoh.. sp'2077... this is starting to be a problem....

Yellen needs to stop talking and start hitting the ES mini BUY button !

10.15am.. Its ironic that despite the USD breaking multi-month lows... equities are not benefiting.

USD -1.1% in the DXY 93s... at primary target zone!

-

notable weakness: DISCA (Discovery), -2.5%.. as the bigger bearish formation remains intact (downside this summer would 25/22 zone)

10.34am... Oil inventories... -3.9 million !

WTIC +3.2%... in the $62s... headed for 65/67

Pre-Market Brief

Good morning. Futures are moderately higher, sp +7pts, we're set to open at 2096 - back over the 50dma of 2090. Metals are a little higher, Gold +$2, with Silver +0.4%. Oil continues to soar, +2.6% in the $62s.

sp'60min

Summary

*ADP jobs: 169k, vs 205k expected... a clear miss, and again, indicative of softness in the economy. Naturally, the market might take this as 'bad news is good news', as chances of a rate hike at the FOMC of June 17'th are now surely close to zero.

--

Opening gains are not entirely surprising... however, there is high opportunity for the equity bears to turn things lower after the morning turn time of 11am. A second consecutive net daily decline looks very viable.

Next downside target is the recent low of sp'2077. After that.. there really isn't much until the 200dma in the 2020s.

However, with the jobs data this Friday, I expect another up cycle into late May/June, that might end up tagging the upper bol' on the giant monthly cycle... currently in the sp'2160/80 zone.

--

I have eyes on Gold... it looks vulnerable into end of the week. Price structure is a large bearish wedge.

GLD, 60min

Broader downside target remains Gold $1000.. which would cut GLD down to $95.

--

Doomer chatter.. Hunter with Fitts

--

Have a good Wednesday!

-

8.38am... It is notable that China overnight fell -1.6%... @ 4229... well on the way to the psy' level of 4K. Such a decline would certainly help the US equity bears a little.

sp'60min

Summary

*ADP jobs: 169k, vs 205k expected... a clear miss, and again, indicative of softness in the economy. Naturally, the market might take this as 'bad news is good news', as chances of a rate hike at the FOMC of June 17'th are now surely close to zero.

--

Opening gains are not entirely surprising... however, there is high opportunity for the equity bears to turn things lower after the morning turn time of 11am. A second consecutive net daily decline looks very viable.

Next downside target is the recent low of sp'2077. After that.. there really isn't much until the 200dma in the 2020s.

However, with the jobs data this Friday, I expect another up cycle into late May/June, that might end up tagging the upper bol' on the giant monthly cycle... currently in the sp'2160/80 zone.

--

I have eyes on Gold... it looks vulnerable into end of the week. Price structure is a large bearish wedge.

GLD, 60min

Broader downside target remains Gold $1000.. which would cut GLD down to $95.

--

Doomer chatter.. Hunter with Fitts

--

Have a good Wednesday!

-

8.38am... It is notable that China overnight fell -1.6%... @ 4229... well on the way to the psy' level of 4K. Such a decline would certainly help the US equity bears a little.

Oil breaks into the $60s

Whilst the broader market saw increasing weakness across the day, there was notable strength in WTIC Oil, which saw a net daily gain of $1.38 (2.3%) @ $60.40. Continued upside into the summer looks due, with Oil set to battle into the secondary target zone of $67/75.

WTIC, weekly'2

Summary

So, WTIC Oil has now broken through the psy' resistance of $60. Most now recognise that the mid/upper $60s are due by late May/early June.

For me, the only issue is whether Oil gets stuck around $67.. or can briefly break into the $70s.. .before the next rollover.

Whether Oil can eventually take out the March low of $42.41 is very difficult to guess.

What is clear.. we've already seen over half of the expected bounce/retrace.

-

China... a clear break lower

The Tuesday net daily decline of -4.1% @ 4298 is very decisive, and opens the door to a likely test of the psy' level of 4K.

Things really only get interesting if 4K is lost... next support would be the multi-year breakout zone of 3500/400s. Regardless of any near/mid term weakness, the giant 5K threshold looks a given this year.

*I will consider going long China around 4K.. via the ETF of FXI.

--

Looking ahead

Wed' will see ADP jobs, productivity/costs.

*Amongst a number of Fed officials on the loose tomorrow, most notable will be Yellen speaking in the early morning.

--

Goodnight from London

WTIC, weekly'2

Summary

So, WTIC Oil has now broken through the psy' resistance of $60. Most now recognise that the mid/upper $60s are due by late May/early June.

For me, the only issue is whether Oil gets stuck around $67.. or can briefly break into the $70s.. .before the next rollover.

Whether Oil can eventually take out the March low of $42.41 is very difficult to guess.

What is clear.. we've already seen over half of the expected bounce/retrace.

-

China... a clear break lower

The Tuesday net daily decline of -4.1% @ 4298 is very decisive, and opens the door to a likely test of the psy' level of 4K.

Things really only get interesting if 4K is lost... next support would be the multi-year breakout zone of 3500/400s. Regardless of any near/mid term weakness, the giant 5K threshold looks a given this year.

*I will consider going long China around 4K.. via the ETF of FXI.

--

Looking ahead

Wed' will see ADP jobs, productivity/costs.

*Amongst a number of Fed officials on the loose tomorrow, most notable will be Yellen speaking in the early morning.

--

Goodnight from London

Daily Index Cycle update

US equities closed significantly weak, sp -25pts @ 2089. The two leaders

- Trans/R2K, settled lower by -1.6% and -1.4% respectively. With the loss

of the 50dma, next soft support is the recent low of 2077. Core support

is the 200dma of 2027/28.. and then the giant 2K threshold.

sp'daily5

R2K

Trans

Summary

*the R2K has notably taken out the recent low, and looks headed for the 1200 threshold. A hit of the 200dma will not be easy though.

--

Little to add.. broader price action remains very choppy.. but we do have the two leaders - Trans/R2K, leading the way lower.. with the Nasdaq following.

-

a little more later...

sp'daily5

R2K

Trans

Summary

*the R2K has notably taken out the recent low, and looks headed for the 1200 threshold. A hit of the 200dma will not be easy though.

--

Little to add.. broader price action remains very choppy.. but we do have the two leaders - Trans/R2K, leading the way lower.. with the Nasdaq following.

-

a little more later...

Subscribe to:

Comments (Atom)