Whilst the main indexes remain moderately choppy, what does stand out today are the metals. Gold is down around $30, with Silver declining over 4% -$1.40. These are the biggest moves in a long while, but certainly are not unexpected.

GLD, daily

SLV, daily

Summary

An interesting day so far, not least because of the dynamic moves in the metals market.

Moody Gold bugs

No doubt the gold maniacs - those insane non-traders who only tolerate talk of 'Gold will go UP', will be touting 'its the cartel'. Err, no..its a natural move..and certainly was predictable from a technical chart-perspective.

Gold is testing the 158s...but since SLV is already below the equivalent support level, GLD probably won't be able to hold the 158s, at least on a multi-week basis.

-

As for the main market....

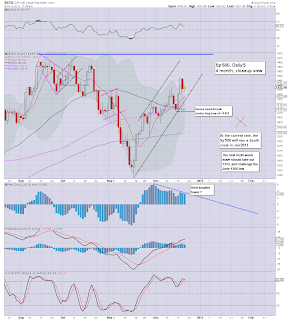

sp'daily5

Nothing exciting yet, but a close in the 1420s seems very possible.

time for lunch

--

UPDATE 12.50pm I'm looking for a second spiky weekly candle. I could tolerate 1425 tomorrow, but anything 1415< would be much better.

As things are, I still think if we can take out the key 1398 low, we have a real chance at freefall to the 200 MA @ 1200 in early January.

That would make for one hell of a 'buy the dip' level in anticipation of increased QE from the Bernanke and Draghi in early Spring.

UPDATE - Euro.

Today is panning out much like yesterday, opening gains, but the Euro is weakening, and the USD is picking up a little strength into the affternoon.

Seeking 1.29s by end year