With equities closing moderately mixed, the VIX was naturally in cooling mode, settling -6.6% @ 19.34. Near term outlook offers a little upside for equities, before breaking strongly lower. VIX looks set for at least the 24/25 zone, but if sp'1920/00s, then VIX briefly in the low 30s.

VIX'60min

VIX'daily3

Summary

Suffice to add.. a pretty subdued day in VIX land.

Despite closing back under the key 20 threshold, equities look set for renewed downside, and that will equate to VIX in the mid/upper 20s.

--

more later.... on the indexes

Tuesday, 5 January 2016

Closing Brief

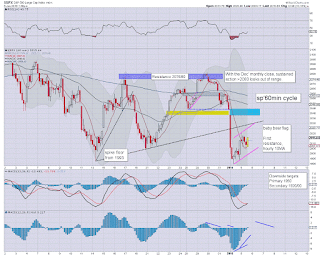

US equity indexes closed moderately mixed, sp +4pts @ 2016 (intra low 2004). The two leaders - Trans/R2K, both settled higher by around 0.2%. Near term outlook offers the 2030/40 zone, before a powerful move lower, at least to the 1960/50s. The bigger weekly/monthly cycles continue to offer 1920/00 zone.

sp'60min

Summary

*closing hour action: very minor chop, holding above the hourly 10MA.

--

Note the upper bollinger on the hourly cycle, now falling hard @ 2065. Those equity bulls who think we'll be trading above last weeks high at ANY point this month are likely in for a real surprise.

As things are, I'll look to pick up an index short tomorrow morning, as the weekly/monthly charts remain outright bearish.

--

more later... on the VIX

sp'60min

Summary

*closing hour action: very minor chop, holding above the hourly 10MA.

--

Note the upper bollinger on the hourly cycle, now falling hard @ 2065. Those equity bulls who think we'll be trading above last weeks high at ANY point this month are likely in for a real surprise.

As things are, I'll look to pick up an index short tomorrow morning, as the weekly/monthly charts remain outright bearish.

--

more later... on the VIX

3pm update - out of range

US equities remain in moderate chop mode, but clearly leaning on the upward side into early Wednesday. For the equity bull manaics, it remains a very frustrating market, as price action above sp'2080 looks out of range. Oil continues to decline, -2.7% in the $35s

sp'60min

Summary

*We've a bullish MACD cross on the hourly cycle.. and that looks set to remain the case into late tomorrow morning.

Indeed, I will be seeking the market to max out by 11am tomorrow.

--

Other than that... relatively quiet out there.. although there are certainly some dynamic individual movers...

-

*Here is the AAPL chart... with a fib'.... relating to DIS in the past hour.

If you start from the 2009 low.. it offers $85... which is a fair way below the current $103s.

--

Out of range...

I am guessing though, that unlike Sloth, the bull maniacs will not be strong enough to rip the chains from the wall and break upward.

--

back at the close

sp'60min

Summary

*We've a bullish MACD cross on the hourly cycle.. and that looks set to remain the case into late tomorrow morning.

Indeed, I will be seeking the market to max out by 11am tomorrow.

--

Other than that... relatively quiet out there.. although there are certainly some dynamic individual movers...

-

*Here is the AAPL chart... with a fib'.... relating to DIS in the past hour.

If you start from the 2009 low.. it offers $85... which is a fair way below the current $103s.

--

Out of range...

I am guessing though, that unlike Sloth, the bull maniacs will not be strong enough to rip the chains from the wall and break upward.

--

back at the close

2pm update - clawing upward

US equities remain moderately mixed, but leaning on the bullish side. A daily close in the sp'2022/27 zone looks probable, and that might be enough to cool the VIX back to the 18s. Price structure remains a clear bear flag, with renewed downside due to begin tomorrow. The sp'1950s look a very reasonable target.

sp'60min

Summary

Its not bold to assume given another 2 hrs... we'll be in the 2020s.. and settle there.

No doubt that will open the door to the 2030s.. even 40s tomorrow.

In either case.. I'm merely seeing it as an opportunity to short... having seen Dec' close bearish across the US and most other world markets.

After all, unless you think we're going to power upward.. beyond resistance of 2070/80s... it is merely a situation of shorting the rallies.

--

notable weakness....

DIS, monthly,

I added a temporary fib chart onto the monthly cycle. A fair retrace of the hyper-ramp from 2009 offers the $80/75 zone. That would be suggestive of sp'1600s or so.

... something to consider for a little while.

sp'60min

Summary

Its not bold to assume given another 2 hrs... we'll be in the 2020s.. and settle there.

No doubt that will open the door to the 2030s.. even 40s tomorrow.

In either case.. I'm merely seeing it as an opportunity to short... having seen Dec' close bearish across the US and most other world markets.

After all, unless you think we're going to power upward.. beyond resistance of 2070/80s... it is merely a situation of shorting the rallies.

--

notable weakness....

DIS, monthly,

I added a temporary fib chart onto the monthly cycle. A fair retrace of the hyper-ramp from 2009 offers the $80/75 zone. That would be suggestive of sp'1600s or so.

... something to consider for a little while.

1pm update - moderate cooling

US equities have cooled from an early spike high of sp'2020 to 2004. Despite the underlying weakness, another minor push higher looks due into the close/early Wednesday. Downside targets remain at the gap zone of 1954/51, and 1920/00 zone. Oil remains broadly weak, -2.0% in the $36s

sp'60min

Summary

The 1pm hour... so long as market doesn't trade <2K, the bear flag is merely still growing.. and I'd guess that will be the case.

Market is merely churning for a day and a bit before next wave.

--

Meanwhile, King was talking a little earlier.

SWHS

It is highly notable that since King took office, gun sales have soared, and that sure helped Smith and Wesson stock, higher by over 1000% since the lows in 2008/09.

--

back at 2pm

sp'60min

Summary

The 1pm hour... so long as market doesn't trade <2K, the bear flag is merely still growing.. and I'd guess that will be the case.

Market is merely churning for a day and a bit before next wave.

--

Meanwhile, King was talking a little earlier.

SWHS

|

| From the $2s to $25s |

--

back at 2pm

12pm update - the bear flag continues to grow

US equities remain moderately mixed, with a rather clear bear flag continuing to grow from the Monday low of sp'1989. The lower gap zone of 1954/51 remains an arguably straight forward downside target, whilst the bigger weekly/monthly cycles offer 1920/00.

sp'60min

sp'daily5

Summary

Rest of the day looks like more of the same.

A daily close somewhere around 2020/25 looks probable.. with 2030 early Wednesday.

Frankly, I think anything >2020 makes for a valid short. I'll likely pick up an index-short early tomorrow.... and am in no hurry today, as market is merely churning.

-

notable weakness..

AAPL -1.2%

DIS -1.7%

F -2.7%.. a stock that has struggled for a long.... long time.

Oil/gas drillers, RIG/SDRL, both lower by 4/5%. Capitulation in the energy sector is likely this spring/summer... when some of the mid tier names might disappear. Same for mining.

--

VIX update from Mr T.

--

time for tea

sp'60min

sp'daily5

Summary

Rest of the day looks like more of the same.

A daily close somewhere around 2020/25 looks probable.. with 2030 early Wednesday.

Frankly, I think anything >2020 makes for a valid short. I'll likely pick up an index-short early tomorrow.... and am in no hurry today, as market is merely churning.

-

notable weakness..

AAPL -1.2%

DIS -1.7%

F -2.7%.. a stock that has struggled for a long.... long time.

Oil/gas drillers, RIG/SDRL, both lower by 4/5%. Capitulation in the energy sector is likely this spring/summer... when some of the mid tier names might disappear. Same for mining.

--

VIX update from Mr T.

--

time for tea

11am update - chop chop

US equities are stuck in moderate chop mode. Price structure remains a bear flag, and that seems set to drag out into early Wednesday. VIX is holding above the key 20 threshold. Metals remain choppy, Gold +$1. Oil is -1.8% in the $36s.. ahead of the next pair of inventory reports.

sp'60min

Summary

So.. we're stuck in chop mode, as Mr Market is battling it out.

sp'1989 makes no sense as a key low, never mind the fact that yesterday saw key technical breaks all over the place.. not just the US. but across most world markets.

From a pure short term trading perspective, it is surely just a case of looking for a level to short from.. rather than 'buy the dip'... even in the higher quality companies like AAPL, INTC, or DIS.

Right now, sp'2030 looks an interesting level/junction early tomorrow.

--

notable weakness...

DIS, daily

The $100 threshold looks unlikely to hold. Next support is around 98/97. The bigger monthly chart offers $80, but that would require a Jan' close <$100.

--

time for an early lunch

sp'60min

Summary

So.. we're stuck in chop mode, as Mr Market is battling it out.

sp'1989 makes no sense as a key low, never mind the fact that yesterday saw key technical breaks all over the place.. not just the US. but across most world markets.

From a pure short term trading perspective, it is surely just a case of looking for a level to short from.. rather than 'buy the dip'... even in the higher quality companies like AAPL, INTC, or DIS.

Right now, sp'2030 looks an interesting level/junction early tomorrow.

--

notable weakness...

DIS, daily

The $100 threshold looks unlikely to hold. Next support is around 98/97. The bigger monthly chart offers $80, but that would require a Jan' close <$100.

--

time for an early lunch

10am update - opening gains

US equities open moderately higher, having broken above first soft resistance of the hourly 10MA. VIX is holding up relatively well, -1% in the 20s. Metals are choppy, Gold +$1, with Silver +0.7%. Oil remains broadly weak, -1.4% in the $36s.

sp'60min

VIX'60min

Summary

So.. we're a little higher, but clearly nothing significant.

I'd be real surprised if we make it back to the gap zone around sp'2040.

VIX is holding up rather well indeed, and that doesn't bode well for those equity bulls seeking renewed upside.

Seriously, anyone think we'll be trading >2050 any time soon?

-

Yes, its rather late, but its just been posted on YT.. and is still somewhat interesting....

Monday closing update from Riley

--

notable weakness...

AAPL, daily

Nothing bullish there. Sub $100 looks due.

--

stay tuned

sp'60min

VIX'60min

Summary

So.. we're a little higher, but clearly nothing significant.

I'd be real surprised if we make it back to the gap zone around sp'2040.

VIX is holding up rather well indeed, and that doesn't bode well for those equity bulls seeking renewed upside.

Seriously, anyone think we'll be trading >2050 any time soon?

-

Yes, its rather late, but its just been posted on YT.. and is still somewhat interesting....

Monday closing update from Riley

--

notable weakness...

AAPL, daily

Nothing bullish there. Sub $100 looks due.

--

stay tuned

Pre-Market Brief

Good morning. US equity futures are fractionally higher, sp +1pt, we're set to open at 2013. USD is +0.5% in the DXY 99.30s. Metals are continuing to bounce, Gold +$6. Oil remains broadly weak, -0.5% in the $36s.

sp'60min

Summary

Equity futures have seen some choppy overnight action... leaning on the weaker side.

It would seem VERY likely that the market will resume falling to sp'1950 this week, and that is a clear 60pts (3%) lower. The bigger weekly/monthly cycles offer the 1920/00 zone.

Perhaps the market will churn across today, but regardless, sp'1989 makes no sense as a key low.

--

Market chatter from Schiff

--

Overnight Asia action

Japan: choppy session, settling -0.4% @ 18374

China: The Shanghai comp' opened -100pts (3%) or so... but then the PBOC - and/or its agents, hit the BUY button sending the market moderately positive.

However, despite the meddling, the market still settled -0.3% @ 3287.

-

Have a good Tuesday

-

8.55am.. sp +4pts.. 2016.

Watching Cramer... seems the cheerleaders are deeply relieved at the market not imploding at the open for a second day.

Maybe they should go stare at a few of the bigger monthly world index charts. UK, Spain, China.... they all look deeply bearish into the spring.

sp'60min

Summary

Equity futures have seen some choppy overnight action... leaning on the weaker side.

It would seem VERY likely that the market will resume falling to sp'1950 this week, and that is a clear 60pts (3%) lower. The bigger weekly/monthly cycles offer the 1920/00 zone.

Perhaps the market will churn across today, but regardless, sp'1989 makes no sense as a key low.

--

Market chatter from Schiff

--

Overnight Asia action

Japan: choppy session, settling -0.4% @ 18374

China: The Shanghai comp' opened -100pts (3%) or so... but then the PBOC - and/or its agents, hit the BUY button sending the market moderately positive.

However, despite the meddling, the market still settled -0.3% @ 3287.

-

Have a good Tuesday

-

8.55am.. sp +4pts.. 2016.

Watching Cramer... seems the cheerleaders are deeply relieved at the market not imploding at the open for a second day.

Maybe they should go stare at a few of the bigger monthly world index charts. UK, Spain, China.... they all look deeply bearish into the spring.

The outlook for 2016

With a net yearly decline of -14.9pts (0.7%) to sp'2043, the market has seen the broad climb from 2009 stall. Could the rally resume into the spring, or will continuing commodity weakness cause increasing downward momentum for the US and other world equity markets?

Lets start with a brief look at a few of the key scenarios...

sp'monthly6 - scenarios

Summary

A - looks highly unlikely. Most world equity markets closed the year significantly lower, with bearish price structure.

B - its possible the market could continue to climb, but it seems overly difficult if Oil loses the $30 threshold.. along with other aspects of commodity deflation.

C - a washout into the summer, with renewed upside into year end, seems very reasonable.

Considering how terrified the central banks are about falling equity prices, increased QE from the ECB and BoJ seems a given. If the sp'500 falls into the 1600/1500s, I'd imagine the US Fed would launch QE4.

D - A sustained break under sp'1500 looks highly difficult, not least as central banks will be ready with helicopters.

A monthly close <1500 should sound CRASH alarm bells in all traders. First target would then be the 1100/1000 zone.

So... with that in mind... what is my guess?

sp'weekly8c

I'm going with scenario C.

I am seeking the 1600/1550 zone, no later than June/July, with a high probability of QE4 being launched. If Yellen does decide to spool the printers back up, hyper-recovery into end 2016 looks likely.

Assuming 1600 in June/July, it would be a tough battle to claw back above the 2000 threshold, but I'd imagine many would buy everything they could. That might just be enough to close the year moderately net higher, with some indexes (most likely... Dow, sp'500, and Nasdaq) breaking new historic highs.

Best guess for end 2016: sp'2185

--

Other notable predictions...

Oil to fall <$30 by late spring. From a pure chart perspective, next support is the Feb' 2009 low of $33.55. After that, its the 26/25 zone. Sustained price action <$20 looks extremely difficult.

Geo-political: there will clearly be high threat of sporadic 'terror attacks'.

Turkey/Russia remains a cauldron of disquiet. However, the real wild card remains Saudi Arabia. Tensions are again rising as the House of Saud are battling to keep a tight reign on any political opposition.

Any civil unrest or foreign incursions into SA would send Oil way past $50. For now, it remains one of those very unlikely, but wild card risks that those naked short Oil should be mindful of.

Gold: $900/875. If correct, Silver would likely be in the 12/11s. Copper $1.75/50.

-

Economic: the US could see Q4 GDP negative (based on Dec' PMI of 42). If the equity market does implode into summer 2016, there is a risk of a second negative quarter... bringing the US into an official (if moderate) recession.

Any such recession would give an excuse to the US Federal reserve...

1. stall any further rate hikes. Whether they'd hold rates at 25/50bps range, or cut back to 0-25bps... difficult to say.

2. If sp'1600s... it would seem highly likely QE4 would be initiated, probably on the order of at least 600/700bn.. with a min' duration to summer 2017.

US t-bonds would be an obvious purchase, but perhaps the Fed would be interested in buying up some of that student debt, for the 'good of the nation'... or some other such excuse.

--

sp'monthly3b - 10MA, red candles

---

Your targets

End 2016 – sp'500

Target, display name, comments

--

1475, TDD

1500, SPX- 2145, Charts suggest we entered a Bear on May/20th, 2015. We had a 12% decline for either an INT or Major W-A on August /24,2015. A strong Bounce for INT or Major W-B ending on November/3rd.

Now, this corrective wave is leading us to a strong and violent decline at the very beginning of 2016. IMO will see the bottom of this Bear Market possibly by October-November at the levels of 1200-1370 ending the year 2016 with the first stages of a new Bull Market around the 1500 area.

1600, Eddy_112, 1700 early in the year .. then a bounce and a lower low.(crash??) Finally another bounce that may take us till end of year. I expect a bear market and high volatility. Difficult to say how things will end the year.

1650, Doug, I'm guessing a S&P 500 Q1 closing low of 1850 (a near revisit of Aug '16 low), a bounce, an annual low of 1450 (down ~30%) probably in the late summer or autumn and a year-end close of 1650 (down ~20%). The basis of this guess is something like the following: recession in the US and world, multiple countries defaulting on their foreign debt, a big devaluation in China, one or two failed commodity trading houses, several serious terror attacks and no QE but a rate cut back to 0-0.25 Fed Funds rate. If we face another banking crisis with one or more large banks seeking emergency loans, then I'm probably optimistic and will end the year down 40%.

1680 GreedyKojiro - year's high: 2090 and year's low: 1570

1740, Bill, The market has topped in May 2015 at 2,134.72 . It's all downhill from here. The question is not whether the market will be down in 2016 but by how much. My best guess is for a 15 % drop of 300 points down to 1740. I guess my reasoning is that I see the market getting progressively worse after each subsequent interest rate rise. But I do not see the market hitting bottom until 2018 or maybe as late as 2019.

Another reason for my 1740 year end target is a Donald Trump victory in the US election which means no more bullshit or corporate welfare for Wall Street. Subsidies via low interest rates and QE are gone for good with a Donald Trump victory. With regard to oil and gold, I expect the decline to continue. Oil should break below $30 a barrel and trade in the 20s. Gold will decisively break below a $1000 an ounce and trade in the 900s comfortably.

1776.03, Stormchaser80

1825, Greenlander

1850, 200ma, The thought of QE4 has entered my train of thought as well as that of the Fed trying to take back the rate hike. I just don't see it happening in an election year. I am thinking we retest the February 2014 low by March. From there I wouldn't write off a possible higher high for targets sought in 2015 (2150,2173, and 2214 with an extreme nearer 2250). Year end closes around the December 2013 highs near 1850 if I can remain optimistic.

1870, G-Force

1899, hemivette, Defaults defaults defaults :)

1900, Frank Rizzo, Hola guys. I think the decline will be swift and heavy in the first quarter with a couple of failed rallies to be bottomed in the summer, maybe down 40% from today's close. That will take the fed into action to either stop the rate increases or a small round of QE in the fall. Then close the year at 1900.

1900, Marton Meszaros, In Q1 attempt at new highs will fail , followed by a pull back in Q2, followed by a collapse in Q3 down to 1550, support at the previous two cycle tops from 1999, 2007. Then QE4 will be launched and S&P will be propelled back to 1900.

1900, WavRider, intra low of 1790

1940, atraderfx, Thinking about the Olympics and the Summer flat spot that may create - my final call is a Finish 1940. I expect Yellen to help out the democrats to win US election and recover the market from heavy losses into year end.

1964.27, brelsa, YEAR HIGH: 2156.88 , YEAR LOW: 1822.29

2079.50, sutluc

2150, Binkius, My guess is that it all depends where QE4/RRR-0 dumps us all.

I'm thinking the route will be SP'2180/2200, then SP'1500, then QE4/RRR-0, then SP'2200, then year end. Assuming that QE4/RRR-0 stimulus will still be pumping strong at the end of 2016

2165, Brian Goldman, by April we should be down near 1700 or into 1700s...so by end of year we should have ATHs as the CBs will come back with some plan to pump it up prior to or just after the election. So 2150-2180.

2185, Permabear Doomster

2200, Benjamin

2275, VTrader

--

China, monthly

Hopeful that 2016 will be an exciting and dynamic year.

More than anything, I am hopeful we'll see a much more dynamic year for equities than the rather frustrating moderate chop of 2015. Certainly, today bodes well for those traders seeking higher volatility.

We know the central banks will fight like hell to prevent another global equity crash, so I'm not expecting a break <sp'1500 again... as in 'ever again'. Besides, there is always the issue of 'would you rather have a low/negative yield govt' bond, or some AAPL stock?'.Maybe the market could even manage to rally without QE4, but I'd be surprised if the Fed resisted.

Despite the current bearish outlook, adapting to whatever happens in the weeks and months ahead will be critically important.

Goodnight from London

Lets start with a brief look at a few of the key scenarios...

sp'monthly6 - scenarios

Summary

A - looks highly unlikely. Most world equity markets closed the year significantly lower, with bearish price structure.

B - its possible the market could continue to climb, but it seems overly difficult if Oil loses the $30 threshold.. along with other aspects of commodity deflation.

C - a washout into the summer, with renewed upside into year end, seems very reasonable.

Considering how terrified the central banks are about falling equity prices, increased QE from the ECB and BoJ seems a given. If the sp'500 falls into the 1600/1500s, I'd imagine the US Fed would launch QE4.

D - A sustained break under sp'1500 looks highly difficult, not least as central banks will be ready with helicopters.

A monthly close <1500 should sound CRASH alarm bells in all traders. First target would then be the 1100/1000 zone.

So... with that in mind... what is my guess?

sp'weekly8c

I'm going with scenario C.

I am seeking the 1600/1550 zone, no later than June/July, with a high probability of QE4 being launched. If Yellen does decide to spool the printers back up, hyper-recovery into end 2016 looks likely.

Assuming 1600 in June/July, it would be a tough battle to claw back above the 2000 threshold, but I'd imagine many would buy everything they could. That might just be enough to close the year moderately net higher, with some indexes (most likely... Dow, sp'500, and Nasdaq) breaking new historic highs.

Best guess for end 2016: sp'2185

--

Other notable predictions...

Oil to fall <$30 by late spring. From a pure chart perspective, next support is the Feb' 2009 low of $33.55. After that, its the 26/25 zone. Sustained price action <$20 looks extremely difficult.

Geo-political: there will clearly be high threat of sporadic 'terror attacks'.

Turkey/Russia remains a cauldron of disquiet. However, the real wild card remains Saudi Arabia. Tensions are again rising as the House of Saud are battling to keep a tight reign on any political opposition.

Any civil unrest or foreign incursions into SA would send Oil way past $50. For now, it remains one of those very unlikely, but wild card risks that those naked short Oil should be mindful of.

Gold: $900/875. If correct, Silver would likely be in the 12/11s. Copper $1.75/50.

-

Economic: the US could see Q4 GDP negative (based on Dec' PMI of 42). If the equity market does implode into summer 2016, there is a risk of a second negative quarter... bringing the US into an official (if moderate) recession.

Any such recession would give an excuse to the US Federal reserve...

1. stall any further rate hikes. Whether they'd hold rates at 25/50bps range, or cut back to 0-25bps... difficult to say.

2. If sp'1600s... it would seem highly likely QE4 would be initiated, probably on the order of at least 600/700bn.. with a min' duration to summer 2017.

US t-bonds would be an obvious purchase, but perhaps the Fed would be interested in buying up some of that student debt, for the 'good of the nation'... or some other such excuse.

--

sp'monthly3b - 10MA, red candles

|

| A red candle to start the year |

---

Your targets

End 2016 – sp'500

Target, display name, comments

--

1475, TDD

1500, SPX- 2145, Charts suggest we entered a Bear on May/20th, 2015. We had a 12% decline for either an INT or Major W-A on August /24,2015. A strong Bounce for INT or Major W-B ending on November/3rd.

Now, this corrective wave is leading us to a strong and violent decline at the very beginning of 2016. IMO will see the bottom of this Bear Market possibly by October-November at the levels of 1200-1370 ending the year 2016 with the first stages of a new Bull Market around the 1500 area.

1600, Eddy_112, 1700 early in the year .. then a bounce and a lower low.(crash??) Finally another bounce that may take us till end of year. I expect a bear market and high volatility. Difficult to say how things will end the year.

1650, Doug, I'm guessing a S&P 500 Q1 closing low of 1850 (a near revisit of Aug '16 low), a bounce, an annual low of 1450 (down ~30%) probably in the late summer or autumn and a year-end close of 1650 (down ~20%). The basis of this guess is something like the following: recession in the US and world, multiple countries defaulting on their foreign debt, a big devaluation in China, one or two failed commodity trading houses, several serious terror attacks and no QE but a rate cut back to 0-0.25 Fed Funds rate. If we face another banking crisis with one or more large banks seeking emergency loans, then I'm probably optimistic and will end the year down 40%.

1680 GreedyKojiro - year's high: 2090 and year's low: 1570

1740, Bill, The market has topped in May 2015 at 2,134.72 . It's all downhill from here. The question is not whether the market will be down in 2016 but by how much. My best guess is for a 15 % drop of 300 points down to 1740. I guess my reasoning is that I see the market getting progressively worse after each subsequent interest rate rise. But I do not see the market hitting bottom until 2018 or maybe as late as 2019.

Another reason for my 1740 year end target is a Donald Trump victory in the US election which means no more bullshit or corporate welfare for Wall Street. Subsidies via low interest rates and QE are gone for good with a Donald Trump victory. With regard to oil and gold, I expect the decline to continue. Oil should break below $30 a barrel and trade in the 20s. Gold will decisively break below a $1000 an ounce and trade in the 900s comfortably.

1776.03, Stormchaser80

1825, Greenlander

1850, 200ma, The thought of QE4 has entered my train of thought as well as that of the Fed trying to take back the rate hike. I just don't see it happening in an election year. I am thinking we retest the February 2014 low by March. From there I wouldn't write off a possible higher high for targets sought in 2015 (2150,2173, and 2214 with an extreme nearer 2250). Year end closes around the December 2013 highs near 1850 if I can remain optimistic.

1870, G-Force

1899, hemivette, Defaults defaults defaults :)

1900, Frank Rizzo, Hola guys. I think the decline will be swift and heavy in the first quarter with a couple of failed rallies to be bottomed in the summer, maybe down 40% from today's close. That will take the fed into action to either stop the rate increases or a small round of QE in the fall. Then close the year at 1900.

1900, Marton Meszaros, In Q1 attempt at new highs will fail , followed by a pull back in Q2, followed by a collapse in Q3 down to 1550, support at the previous two cycle tops from 1999, 2007. Then QE4 will be launched and S&P will be propelled back to 1900.

1900, WavRider, intra low of 1790

1940, atraderfx, Thinking about the Olympics and the Summer flat spot that may create - my final call is a Finish 1940. I expect Yellen to help out the democrats to win US election and recover the market from heavy losses into year end.

1964.27, brelsa, YEAR HIGH: 2156.88 , YEAR LOW: 1822.29

2079.50, sutluc

2150, Binkius, My guess is that it all depends where QE4/RRR-0 dumps us all.

I'm thinking the route will be SP'2180/2200, then SP'1500, then QE4/RRR-0, then SP'2200, then year end. Assuming that QE4/RRR-0 stimulus will still be pumping strong at the end of 2016

2165, Brian Goldman, by April we should be down near 1700 or into 1700s...so by end of year we should have ATHs as the CBs will come back with some plan to pump it up prior to or just after the election. So 2150-2180.

2185, Permabear Doomster

2200, Benjamin

2275, VTrader

--

China, monthly

|

| Price structure is a big bear flag |

Hopeful that 2016 will be an exciting and dynamic year.

More than anything, I am hopeful we'll see a much more dynamic year for equities than the rather frustrating moderate chop of 2015. Certainly, today bodes well for those traders seeking higher volatility.

We know the central banks will fight like hell to prevent another global equity crash, so I'm not expecting a break <sp'1500 again... as in 'ever again'. Besides, there is always the issue of 'would you rather have a low/negative yield govt' bond, or some AAPL stock?'.Maybe the market could even manage to rally without QE4, but I'd be surprised if the Fed resisted.

Despite the current bearish outlook, adapting to whatever happens in the weeks and months ahead will be critically important.

Goodnight from London

Subscribe to:

Comments (Atom)