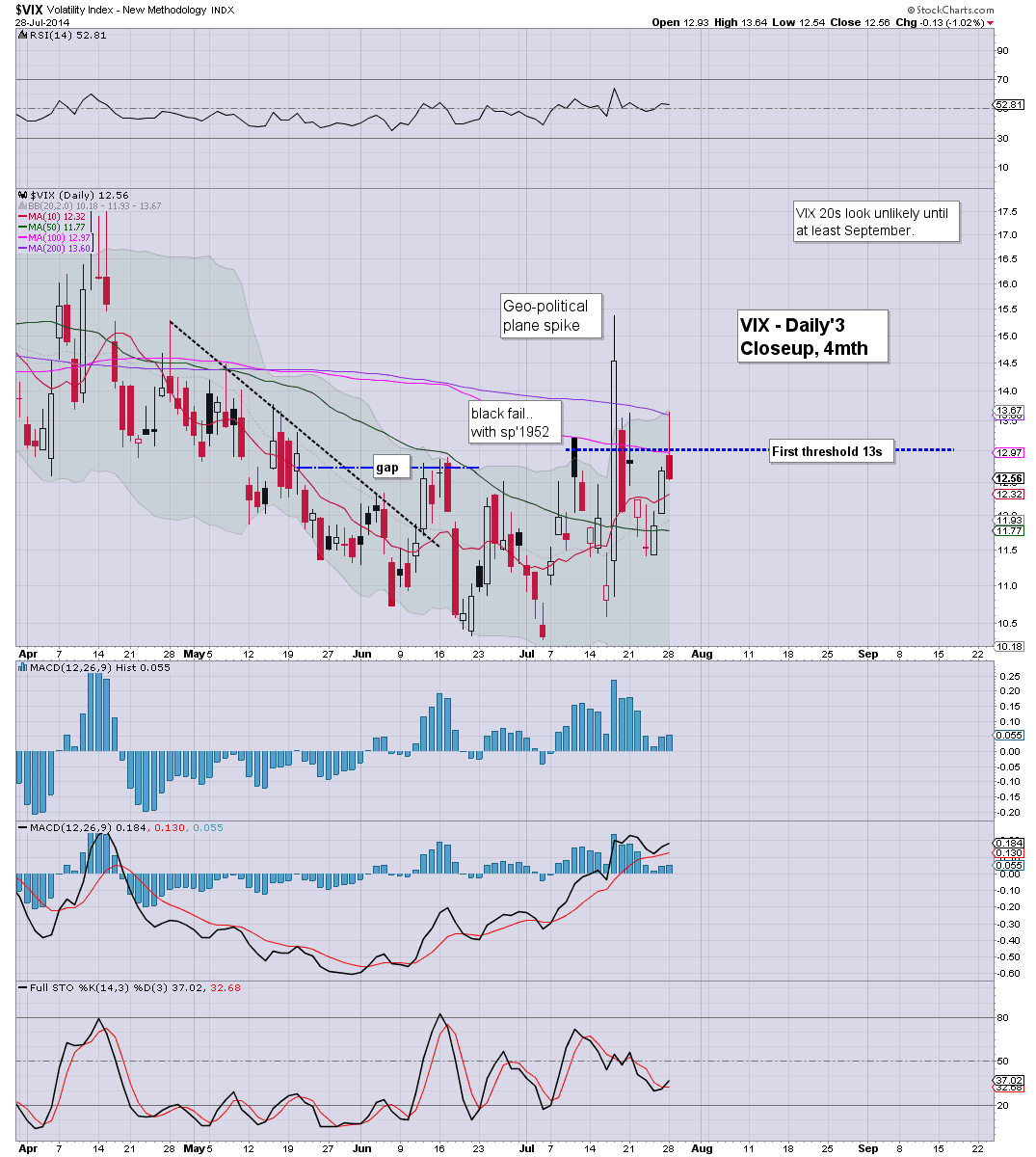

With US equities seeing a latter day recovery, the VIX failed to hold the moderate gains (intra high 13.64), settling -1.0% @ 12.56. Near term outlook is for the VIX to melt back into the 10s.. and eventually single digit VIX this summer.

VIX'60min

VIX'daily3

Summary

*the daily VIX candle is particularly bearish, a red close with a spike, and a failure at the 200 dma, which itself continues to tick slowly lower.

--

So, some morning gains in the VIX, but it merely makes for a lower spike high. The 10s look due by end of this week.

VIX 20s look unlikely for some considerable time, and I have ZERO interest in being long the VIX.

--

more later... on the indexes

Monday, 28 July 2014

Closing Brief

US equities started the day weak, but ended the day with fractional gains, sp +0.5pts @ 1978. The two leaders - Trans/R2K, settled lower by -1.1% and 0.4% respectively. Near term outlook is for minor churn... before a rather important Wednesday.

sp'60min

Summary

*VIX closed fractionally red, and certainly shouldn't inspire the equity bears.

--

So..a broadly flat close for the sp'500, not exactly surprising.

The one concern for the bulls should be the R2K, but even that lagging index is 5% above critical support. R2K 1080 would probably equate to sp'1900.. and I sure don't expect either of those to be hit in the near term.

--

more later.. on the VIX

sp'60min

Summary

*VIX closed fractionally red, and certainly shouldn't inspire the equity bears.

--

So..a broadly flat close for the sp'500, not exactly surprising.

The one concern for the bulls should be the R2K, but even that lagging index is 5% above critical support. R2K 1080 would probably equate to sp'1900.. and I sure don't expect either of those to be hit in the near term.

--

more later.. on the VIX

3pm update - a close in the 1980s?

US equities have seen some moderate swings today, the only issue is whether a close fractionally above..or below sp'1980. Regardless of which side of 1980, Mr Market looks set to settle into minor churn until 'big action' Wednesday.

sp'15min

Summary

*second baby bull flag of the day... with the hourly cycles as they are, I wouldn't bet against another wave higher into the close.

--

Certainly, there is no real downside power... even in the R2K/Trans, which were both -1% earlier this morning.

-

Personally, I'd rather skip tomorrow.. and just jump straight ahead to Wednesday.

sp'15min

Summary

*second baby bull flag of the day... with the hourly cycles as they are, I wouldn't bet against another wave higher into the close.

--

Certainly, there is no real downside power... even in the R2K/Trans, which were both -1% earlier this morning.

-

Personally, I'd rather skip tomorrow.. and just jump straight ahead to Wednesday.

2pm update - flag confirmed

US equities confirm a small.. but clear baby bull flag.. with a break into the sp'1980s. Whether the bulls can attain a daily close in the 1980s...is another matter. Mr Market looks set to move into nano churn mode.. ahead of 'big Wednesday'.

sp'15min

R2K, 60min

Summary

*price action confirmed, with a VIX that has turned fractionally red.

--

Suffice to say... equity bears had a bonus opportunity to exit this morning, and we're now barely 0.5% from breaking a new historic high.

All the bulls need is to see the R2K break >1965, which would really nail anyone who has been short since last week.

sp'15min

R2K, 60min

Summary

*price action confirmed, with a VIX that has turned fractionally red.

--

Suffice to say... equity bears had a bonus opportunity to exit this morning, and we're now barely 0.5% from breaking a new historic high.

All the bulls need is to see the R2K break >1965, which would really nail anyone who has been short since last week.

1pm update - baby bull flag

US indexes are making a play to turn positive (although yes, the R2K/Trans remain very weak today). A daily close in the sp'1980s looks viable. Metals remain moderately weak, Gold -$4. VIX is battling to hold the 13s.

sp'15min

Summary

Without getting lost in the minor noise (it remains a tough battle)... we have a micro bull flag on the 5/15min cycles.

A high chance of at least briefly breaking into the 1980s.

Yet...market will likely move into super churn mode tomorrow...when the FOMC meeting begins.

-

A definitive break out of the 1990/50 zone looks unlikely until at least Wednesday..but more likely... Friday.

Notable weakness: Oil/gas drillers, SDRL -2.7%

1.43pm... stupid spike.... nasty market.... sp'1980s... bears being routed out.

Baby bull flag.... confirmed.... VIX red.

sp'15min

Summary

Without getting lost in the minor noise (it remains a tough battle)... we have a micro bull flag on the 5/15min cycles.

A high chance of at least briefly breaking into the 1980s.

Yet...market will likely move into super churn mode tomorrow...when the FOMC meeting begins.

-

A definitive break out of the 1990/50 zone looks unlikely until at least Wednesday..but more likely... Friday.

Notable weakness: Oil/gas drillers, SDRL -2.7%

1.43pm... stupid spike.... nasty market.... sp'1980s... bears being routed out.

Baby bull flag.... confirmed.... VIX red.

12pm update - relatively stuck

US indexes remain stuck within the sp'1990/50 zone, that is now a full three weeks in duration. The broader weekly/monthly cycles remain outright bullish, and a break to the upside still seems likely. VIX is offering a spike top of 13.64.

sp'60min

vix'60min

Summary

*the down channel is pretty clear, equity bulls need the 1980s...which will open up the giant 2000 threshold later this week - more likely...Friday.

---

I realise many are still getting overly hysterical about every time little down wave..whether -0.5%..or even a full -1%.

Overall though, this is the same style of price action that we've seen for a very long time. Until something dramatic happens, default view is to assume the upward trend will resume... its just a matter of when.

I for one, am looking at higher levels by this Friday close.... the start of August.

--

VIX update from Mr T.

--

time for lunch

12.13pm.. Watching clown finance TV.. with Faber...they are naturally on his case about yet another 'crash call'... but I'd give him credit for the miners.. he even highlighted GDXJ.

We'll doubtless get a major 20% drop at some point, but right now... I'd still seeking the 2100s..first.

12.33pm.. baby bull flag on the 15min cycle...so long as we hold 1972

sp'60min

vix'60min

Summary

*the down channel is pretty clear, equity bulls need the 1980s...which will open up the giant 2000 threshold later this week - more likely...Friday.

---

I realise many are still getting overly hysterical about every time little down wave..whether -0.5%..or even a full -1%.

Overall though, this is the same style of price action that we've seen for a very long time. Until something dramatic happens, default view is to assume the upward trend will resume... its just a matter of when.

I for one, am looking at higher levels by this Friday close.... the start of August.

--

VIX update from Mr T.

--

time for lunch

12.13pm.. Watching clown finance TV.. with Faber...they are naturally on his case about yet another 'crash call'... but I'd give him credit for the miners.. he even highlighted GDXJ.

We'll doubtless get a major 20% drop at some point, but right now... I'd still seeking the 2100s..first.

12.33pm.. baby bull flag on the 15min cycle...so long as we hold 1972

11am update - morning turn

US equities remain weak, with borderline significant declines in the R2K, -0.8% in the low 1130s. VIX has managed a minor spike into the mid 13s, but as ever.. is highly vulnerable to losing the gains.

sp'60min

Summary

Typical turn time... 11am... will any bulls want to buy the 1975/65 zone?

--

I see today.. and probably tomorrow as minor churn ahead of the main event.... FOMC/GDP Wednesday.

Until then... no clear direction in the short term

-

Okay..finally checked on the Transports... -1.2%...

The 'ascending wedge' crowd will be getting excited.

--

11.30am...Well, we're well off the lows now..but still in down channel.

Were I not doing updates, I'd switch off until Wed' morning for the GDP data.

VIX +2%.. back in the 12s.... not surprising.

sp'60min

Summary

Typical turn time... 11am... will any bulls want to buy the 1975/65 zone?

--

I see today.. and probably tomorrow as minor churn ahead of the main event.... FOMC/GDP Wednesday.

Until then... no clear direction in the short term

-

Okay..finally checked on the Transports... -1.2%...

The 'ascending wedge' crowd will be getting excited.

--

11.30am...Well, we're well off the lows now..but still in down channel.

Were I not doing updates, I'd switch off until Wed' morning for the GDP data.

VIX +2%.. back in the 12s.... not surprising.

10am update - moderate weakness

US indexes start the week moderately lower, with the Friday lows taken out, most notably on the R2K, -0.4%. Metals are a little weak, Gold -$2. Oil is -0.6%. VIX has managed to break into the low teens, +4% in the 13.20s.

sp'60min

VIX'60min

Summary

Price structure on the hourly cycle now looks a rather clear bearish pennant... with the Friday low of 1974 decisively busted.

Next key support, the low 1960s...

All things considered, I don't see any real power behind this opening weakness, and I can't take any of it seriously. Its the same style of price action we've been seeing for many.... many months.

-

Notable strength: AAPL +0.5%... on its way to the big $100... and if you think AAPL is going to $100.. then it should bode well for the broader market.

10.33am.. hmm... well, I gotta think the bears are getting a chance to exit in the 1960s before much higher levels later this week.

I realise some out there are of course top calling, and seeking much lower levels... but really, seems unlikely.

Sig' decline, R2K -1%... in the low 1130s... testing the July'19 low.

sp'60min

VIX'60min

Summary

Price structure on the hourly cycle now looks a rather clear bearish pennant... with the Friday low of 1974 decisively busted.

Next key support, the low 1960s...

All things considered, I don't see any real power behind this opening weakness, and I can't take any of it seriously. Its the same style of price action we've been seeing for many.... many months.

-

Notable strength: AAPL +0.5%... on its way to the big $100... and if you think AAPL is going to $100.. then it should bode well for the broader market.

10.33am.. hmm... well, I gotta think the bears are getting a chance to exit in the 1960s before much higher levels later this week.

I realise some out there are of course top calling, and seeking much lower levels... but really, seems unlikely.

Sig' decline, R2K -1%... in the low 1130s... testing the July'19 low.

Pre-Market Brief

Good morning. Futures are a touch lower, sp -1pt, we're set to start the week at 1977. Metals are a little higher, Gold +$2. This week will likely see QE-taper'6, a 'relatively' weak Q2 GDP number, but a 'reasonable' monthly jobs data point.

sp'weekly8

Summary

*we've two pieces of econ-data around 10am...

--

A very busy week ahead... especially Wednesday, and of course.. more corporate earnings.

All things considered, I do not see the weekly 10 MA being broken - which at today's open will jump into the low 1960s. On the flip side, a monthly close (Thursday) in the 1980/90s.. looks viable.

The first real opportunity of sp' 2000 looks to be this Friday.

--

update from an apparently tired Mr Permabull

-

Good wishes for the week ahead!

8.53am... market turning up... sp +2pts.... 1980... R2K +0.3%

Metals naturally slipping.. Gold -$3

9.39am.. opening black-fail VIX candle.... bodes badly for the bears.. if it sticks to 10am.

Minor chop, and there looks to be zero downside pressure...

awaiting some econ-data. 9.45/10am

9.49am... major fail... Friday lows taken out. ... but still..volume is light.

notable resilience.. AAPL, +0.2%

sp'weekly8

Summary

*we've two pieces of econ-data around 10am...

--

A very busy week ahead... especially Wednesday, and of course.. more corporate earnings.

All things considered, I do not see the weekly 10 MA being broken - which at today's open will jump into the low 1960s. On the flip side, a monthly close (Thursday) in the 1980/90s.. looks viable.

The first real opportunity of sp' 2000 looks to be this Friday.

--

update from an apparently tired Mr Permabull

-

Good wishes for the week ahead!

8.53am... market turning up... sp +2pts.... 1980... R2K +0.3%

Metals naturally slipping.. Gold -$3

9.39am.. opening black-fail VIX candle.... bodes badly for the bears.. if it sticks to 10am.

Minor chop, and there looks to be zero downside pressure...

awaiting some econ-data. 9.45/10am

9.49am... major fail... Friday lows taken out. ... but still..volume is light.

notable resilience.. AAPL, +0.2%

Subscribe to:

Comments (Atom)