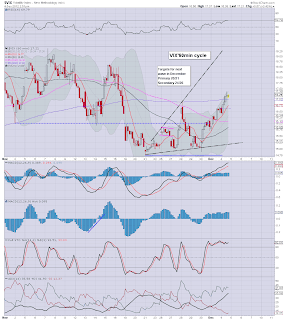

Whilst the indexes had a choppy day, closing moderately lower, the VIX managed a third day higher, +2.9%, to settle @ 17.12, the best closing level in over 2 weeks. It would seem very likely the VIX will be in the 19s within a day or two. The only issue is whether 20 can be breached.

VIX'60min

VIX'daily

Summary

The daily trading range in the VIX remains pretty low, but it IS trending to the upside, as those who trade options will especially be aware of.

I'm very confident we'll see 19s, but whether we can break 20, that is the great unknown.

More later, on the indexes.

Tuesday, 4 December 2012

Closing Brief

A choppy day in the market, but one where there was general weakness throughout the day, despite the repeated micro-rallies. First target remains sp'1385, where the 200 day MA is also lurking. The moderately higher VIX confirmed the underlying index weakness.

Dow'60min

Sp'60min

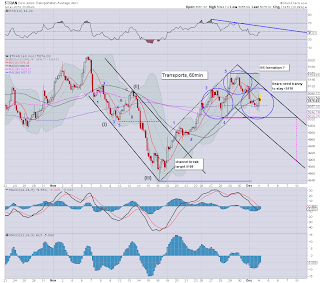

Trans

Summary

We are still waiting for the first significant push lower. So far, its just slow chop to the downside. Perhaps Wednesday will see a major gap lower?

Regardless, VIX is ticking higher on the daily charts, and indexes are looking weak.

The transports on the hourly chart looks especially dangerous for the bulls, with a possible H/S formation, target would be 4900 by end of the week, equating to sp'1370s.

More later

Dow'60min

Sp'60min

Trans

Summary

We are still waiting for the first significant push lower. So far, its just slow chop to the downside. Perhaps Wednesday will see a major gap lower?

Regardless, VIX is ticking higher on the daily charts, and indexes are looking weak.

The transports on the hourly chart looks especially dangerous for the bulls, with a possible H/S formation, target would be 4900 by end of the week, equating to sp'1370s.

More later

3pm update - Captain of the Indexes

Mr Market has a real problem in the days ahead. There are frankly, monumental downside risks ahead. A lack of fiscal cliff resolution, and Mr Market will have to adjust to GDP -2 to -4% lower in Q1 2013 - and that's assuming no other problematic economic issues.

sp'60min

vix'60min

Summary

There are dozens, if not a few hundred charts I could highlight, all say the same story. The AAPL daily chart alone should be enough to scare any tech sector permabull.

Wave'2 is 'probably' done, and we're on the way down.

We'll know soon enough, and more than anything, if we see VIX >20, it'll be a major red flag.

Something for the bears (over the age of 35) on this winters day..

Lets see how we close!

--

UPDATE 3.30pm, Baby bear flag on the Sp'500.

Bears wants a close at least <1412, preferably a break of the flag <1405

back after the close

sp'60min

vix'60min

Summary

There are dozens, if not a few hundred charts I could highlight, all say the same story. The AAPL daily chart alone should be enough to scare any tech sector permabull.

Wave'2 is 'probably' done, and we're on the way down.

We'll know soon enough, and more than anything, if we see VIX >20, it'll be a major red flag.

Something for the bears (over the age of 35) on this winters day..

Lets see how we close!

--

UPDATE 3.30pm, Baby bear flag on the Sp'500.

Bears wants a close at least <1412, preferably a break of the flag <1405

back after the close

2pm update - bulls trying...so hard

The market is still yet to break the big sp'1400 threshold, and the bulls are clearly getting desperate to at least close the market flat. A green close is possible, not that it should particularly concern those holding short into Wednesday.

trans'60min

sp'60min

Summary

We're seeing a little micro-wave higher, but still, its looking like sp'1385 will be hit tomorrow.

I could be wrong of course, but really, ALL the charts are supporting such an outlook, and 1385 is merely the first target, its not exactly calling for overly bearish outlook.

-

*lots of econ-data tomorrow, so, it is possible we'll gap open a little higher, either way, I don't care.

I'll hold comfortably overnight.

Anyone wanna still be long AAPL, with a looming Death Cross this Friday?

I didn't think so.

-

UPDATE 2.30pm Anyone think the VIX won't be in the 19s within a day or two?

We're going to the 19s,...aka sp'1385....the only issue is whether can break VIX 20'..and back into the sp'1370s.

--

trans'60min

sp'60min

Summary

We're seeing a little micro-wave higher, but still, its looking like sp'1385 will be hit tomorrow.

I could be wrong of course, but really, ALL the charts are supporting such an outlook, and 1385 is merely the first target, its not exactly calling for overly bearish outlook.

-

*lots of econ-data tomorrow, so, it is possible we'll gap open a little higher, either way, I don't care.

I'll hold comfortably overnight.

Anyone wanna still be long AAPL, with a looming Death Cross this Friday?

I didn't think so.

-

UPDATE 2.30pm Anyone think the VIX won't be in the 19s within a day or two?

We're going to the 19s,...aka sp'1385....the only issue is whether can break VIX 20'..and back into the sp'1370s.

--

1pm update - first target is sp'1385

It seems we are are going to break back into the sp'1380s within the next day or so. As many will realise, the 200 day MA is lurking at the previous low..also @ 1385. Any break into the 1370s opens up a challenge of the sp'1343 low. If that fails to hold....it'll be a scary (and probably fast) ride down into the mid 1200s.

trans'60min

sp'daily5

Summary

Its a little frustrating, the price action is choppy, but at least its consistantly weak.

RE: trans, H/S formation.

I am VERY pleased with this chart, if its right, it will really help across the rest of this week. As remains the case, tranny appears to have the cleanest waves, and thus I am using it as a guide to trade other indexes.

---

I remain short, and will most definately look to be short overnight. An exit on the first test of the 200 day MA @ 1385 would seem a very reasonable outlook.

UPDATE 1.20pm Strike'1 for the sp'500... if all 3, then sp'1260s.

Its looking rather good

trans'60min

sp'daily5

Summary

Its a little frustrating, the price action is choppy, but at least its consistantly weak.

RE: trans, H/S formation.

I am VERY pleased with this chart, if its right, it will really help across the rest of this week. As remains the case, tranny appears to have the cleanest waves, and thus I am using it as a guide to trade other indexes.

---

I remain short, and will most definately look to be short overnight. An exit on the first test of the 200 day MA @ 1385 would seem a very reasonable outlook.

UPDATE 1.20pm Strike'1 for the sp'500... if all 3, then sp'1260s.

Its looking rather good

12pm update - days of high....adventure!

There is a major smell of weakness in this market, and we could unravel significantly lower in the immediate term. The recent low of sp'1385 will be the first target, and that would be a very likely bounce zone for 10-15pts.. VIX showing strength...but $ still a touch lower.

Trans'60min

Sp'daily5

Summary

Everything is looking good, for sp'1380/70s within the next few days.

The big question remains, can we take out the sp'1343 low. That...I can't answer.

--

Days of high adventure.....indeed!

Time for lunch

--

UPDATE 12.20, seeking an exit @ sp'1400, this hour. Will likely re-short into the close, if so.

UPDATe 12.40 Tranny target is neckline @5030. I guess that will hold..at least for a bit.

Market is a bit of a chop-fest still, but the direction IS clear.

For the moment, I'm holding short, might jump out if tranny 5030 though, and re-short near the close.

Trans'60min

Sp'daily5

Summary

Everything is looking good, for sp'1380/70s within the next few days.

The big question remains, can we take out the sp'1343 low. That...I can't answer.

--

Days of high adventure.....indeed!

Time for lunch

--

UPDATE 12.20, seeking an exit @ sp'1400, this hour. Will likely re-short into the close, if so.

UPDATe 12.40 Tranny target is neckline @5030. I guess that will hold..at least for a bit.

Market is a bit of a chop-fest still, but the direction IS clear.

For the moment, I'm holding short, might jump out if tranny 5030 though, and re-short near the close.

11am update - a tunnel of terror..ahead ?

A choppy open, but once again, the underlying weakness is showing. With the daily chart now ticking lower on ALL indexes, it is a case of 'sell every minor intra-day' rally. I believe there is a very viable H/S formation on the transports, if correct, it suggest sp'1370s within the next few days.

Trans'60min

sp'60min

sp'daily5

Summary

An annoying open, but general trend remains DOWN.

I remain short, I will be tempted to exit around 1400/1395, if I can get it in the next 1-3 hrs.

In any case, I will still look to be short overnight, since we are due some kind of major gap lower in this new cycle, and I want to be part of that.

Bulls in a tunnel of terror, later this week?

more later..

UPDATE 11.15am. renewed weakness, sp'1400 not far away now.

I might exit, with the tranny on the H/S neckline, around 5040/30..

standing by.

Trans'60min

sp'60min

sp'daily5

Summary

An annoying open, but general trend remains DOWN.

I remain short, I will be tempted to exit around 1400/1395, if I can get it in the next 1-3 hrs.

In any case, I will still look to be short overnight, since we are due some kind of major gap lower in this new cycle, and I want to be part of that.

Bulls in a tunnel of terror, later this week?

more later..

UPDATE 11.15am. renewed weakness, sp'1400 not far away now.

I might exit, with the tranny on the H/S neckline, around 5040/30..

standing by.

10am update - messy open

The indexes are a mess, its choppy, and lacking direction. Underlying bias is to the downside, sp'1405/00 still seems possible within the next hour. VIX is weak, currently a little lower.

sp'60min

VIX'60min

Summary

I'm starting to get a bit annoyed, and its only 10am, urghh.

There is the threat of a move to 1415/18 within a few hours..before stronger downside into Wednesday.

-

As it is, I remain short.

--

Tranny has a giant bullish candle to start the day, but I don't think it'll last. So long as we stay <5120, shouldn't be a problem.

AAPL...death cross a'coming ! Target would be somewhere in the 475/425 range.

UPDATE 10.30am

Here is something new, and I've been wandering about it for a few days now...

Head/Shoulders...tranny...

Target would be 4900, later this week. That would equate to around sp'1375/65

sp'60min

VIX'60min

Summary

I'm starting to get a bit annoyed, and its only 10am, urghh.

There is the threat of a move to 1415/18 within a few hours..before stronger downside into Wednesday.

-

As it is, I remain short.

--

Tranny has a giant bullish candle to start the day, but I don't think it'll last. So long as we stay <5120, shouldn't be a problem.

AAPL...death cross a'coming ! Target would be somewhere in the 475/425 range.

UPDATE 10.30am

Here is something new, and I've been wandering about it for a few days now...

Head/Shoulders...tranny...

Target would be 4900, later this week. That would equate to around sp'1375/65

Pre-Market Brief

Good morning. Futures are a touch higher, the sp +2pts, we're set to open around 1411. I'm kinda surprised at the lack of a significant gap lower. Metals and Oil are especially weak, although the dollar is also weak, falling to USD 79.60s, this is a borderline break of a 2 year up channel. More on the latter..later.

sp'60min

sp'daily5

USD, monthly, rainbow

Summary

So, no big gap lower, but the near term trend does allow for some weakness this morning. We could still trundle down to 1405/00, with the VIX 17s.

Indeed, eyes on the VIX, which should be a rough guide to re-shorting (as necessary) across this week.

I am short, seeking my next around exit around 1395/85, although right now, I'd settle for 1400 !

*what will be important for the bears, no breaks back above 1420. The daily, and monthly charts argue against such a move anyway.

RE: dollar. I'm somewhat bemused at further $ weakness in pre-market. So far, its nothing too significant, but its pretty close to breaking what is a two year channel on the monthly chart. Anything <79.50, and the channel is surely busted, which frankly, would be a big deal.

More across the day!

--

UPDATE 8.50am. Indexes showing weakness, sp-2pts, set to open 1407.

I will look to (briefly) exit @ sp'1400 - if I can get it in the opening 30 minutes.

GOLD - $21... only another $60 to.go.

Be clear though, I'll merely re-short a few hours later though.

--

UPDATE 9.20am Stock of the week AAPL

It will be a news story later this week. 'Death Cross' on AAPL, as the 50 crosses under the 200MA.

This X' is likely to occur BEFORE this week ends. It will very likely become a news story that the clown networks run with, not least if the main indexes are also starting to unravel.

-

Futures..back to largely flat. Still looks like we'll get down to 1403/00 within the opening hour though.

sp'60min

sp'daily5

USD, monthly, rainbow

Summary

So, no big gap lower, but the near term trend does allow for some weakness this morning. We could still trundle down to 1405/00, with the VIX 17s.

Indeed, eyes on the VIX, which should be a rough guide to re-shorting (as necessary) across this week.

I am short, seeking my next around exit around 1395/85, although right now, I'd settle for 1400 !

*what will be important for the bears, no breaks back above 1420. The daily, and monthly charts argue against such a move anyway.

RE: dollar. I'm somewhat bemused at further $ weakness in pre-market. So far, its nothing too significant, but its pretty close to breaking what is a two year channel on the monthly chart. Anything <79.50, and the channel is surely busted, which frankly, would be a big deal.

More across the day!

--

UPDATE 8.50am. Indexes showing weakness, sp-2pts, set to open 1407.

I will look to (briefly) exit @ sp'1400 - if I can get it in the opening 30 minutes.

GOLD - $21... only another $60 to.go.

Be clear though, I'll merely re-short a few hours later though.

--

UPDATE 9.20am Stock of the week AAPL

It will be a news story later this week. 'Death Cross' on AAPL, as the 50 crosses under the 200MA.

This X' is likely to occur BEFORE this week ends. It will very likely become a news story that the clown networks run with, not least if the main indexes are also starting to unravel.

-

Futures..back to largely flat. Still looks like we'll get down to 1403/00 within the opening hour though.

Major wave lower underway?

A new week and month, and today may have seen the peak of what was probably a wave'2. If that is the case, then December will be all about market weakness, and nothing else. The monthly rainbow (Elder Impulse) charts are still signalling a provisional warning of trouble, and trouble is indeed what I'm expecting.

sp'monthly3, rainbow

sp'weekly2, rainbow

Summary

Today ended well for the bears. In some ways, it was good we opened a little higher - although I realise those bears who got stopped out, would not agree.

We have a good spike on the daily candles, we tested the 50 day MA - and failed, and hit (approx) the 61.8% fib retracement. The bears have a lot to be pleased about today.

Keeping an open mind

Now, I'm bearish for almost ALL of this week (I am admittedly concerned about Friday - jobs data), and I think its important to consider a few of the broader near term scenarios...

sp'daily5b three scenarios..

I can't see scenario A', the monthly charts argue against it.

I'm very much unsure whether we just fall straight down (B)- breaking the sp'1343 low, or we are yet to put in a B' wave (scenario C). I just don't know.

What will be of utmost importance, when we are trading in the 1380/70s, bears need to be very mindful, and personally, I will probably exit there, and see what happens. If market keeps falling, and takes out 1343, I'd merely rejoin the bear train.

Be absolutely clear, there is still the annoying possibility that this market might go to 1380/70..and then bounce again, perhaps even breaking into the 1430/40s. Although I will again note that the monthly charts STRONGLY argue against such an outlook.

A quick update on the daily Fib' chart.

Sp'daily7 - fibs

A break of the recent sp'1343 low, should in theory open up a test of the June low in the 1260s, and a standard 1.6x fib extension, would certainly suggest it.

Important days ahead

This week will indeed be important, not least if we can break under the 200 day MA @ sp'1385, and move into the 1370/60s. That seems a long way down, but it is viable, not least if the market gets increasinggly frustrated at the lack of a fiscal cliff agreement.After all, the clock is ticking.

Today was good, yet I have much higher (bearish) hopes for both tomorrow and Wednesday.

Goodnight from London

sp'monthly3, rainbow

sp'weekly2, rainbow

Summary

Today ended well for the bears. In some ways, it was good we opened a little higher - although I realise those bears who got stopped out, would not agree.

We have a good spike on the daily candles, we tested the 50 day MA - and failed, and hit (approx) the 61.8% fib retracement. The bears have a lot to be pleased about today.

Keeping an open mind

Now, I'm bearish for almost ALL of this week (I am admittedly concerned about Friday - jobs data), and I think its important to consider a few of the broader near term scenarios...

sp'daily5b three scenarios..

I can't see scenario A', the monthly charts argue against it.

I'm very much unsure whether we just fall straight down (B)- breaking the sp'1343 low, or we are yet to put in a B' wave (scenario C). I just don't know.

What will be of utmost importance, when we are trading in the 1380/70s, bears need to be very mindful, and personally, I will probably exit there, and see what happens. If market keeps falling, and takes out 1343, I'd merely rejoin the bear train.

Be absolutely clear, there is still the annoying possibility that this market might go to 1380/70..and then bounce again, perhaps even breaking into the 1430/40s. Although I will again note that the monthly charts STRONGLY argue against such an outlook.

A quick update on the daily Fib' chart.

Sp'daily7 - fibs

A break of the recent sp'1343 low, should in theory open up a test of the June low in the 1260s, and a standard 1.6x fib extension, would certainly suggest it.

Important days ahead

This week will indeed be important, not least if we can break under the 200 day MA @ sp'1385, and move into the 1370/60s. That seems a long way down, but it is viable, not least if the market gets increasinggly frustrated at the lack of a fiscal cliff agreement.After all, the clock is ticking.

Today was good, yet I have much higher (bearish) hopes for both tomorrow and Wednesday.

Goodnight from London

Daily Index Cycle update

The market closed moderately lower, after the opening minor gains. The closing hour was choppy, but closed somewhat bearish, and the declines were confirmed with a slightly higher VIX. It would appear we are now seeing a new down cycle underway, the only issue is how far down do we fall, and over what time span.

Dow

Nasdaq Comp

Sp'daily5

Trans

Summary

Well, that went pretty good after a somewhat annoying open. I was always concerned I was a day or two early when shorting last Thursday, and now we're past those two days, I think we are now finally seeing the underlying market weakness re-emerge.

First target for Tuesday is sp'1400, a break of that opens up a swift decline to the low from last Wednesday (remember that crazy morning reversal?) @ 1385.

The big question is can we break 1385, I believe we can 'sometime' this week, but most important, is taking out the key low of sp'1343.

Until 1343 is taken out, I will not be confident of my broader outlook, which is seeking a challenge of the June low of sp'1266.

Regardless, I am confidently holding short overnight.

A little more later

Dow

Nasdaq Comp

Sp'daily5

Trans

Summary

Well, that went pretty good after a somewhat annoying open. I was always concerned I was a day or two early when shorting last Thursday, and now we're past those two days, I think we are now finally seeing the underlying market weakness re-emerge.

First target for Tuesday is sp'1400, a break of that opens up a swift decline to the low from last Wednesday (remember that crazy morning reversal?) @ 1385.

The big question is can we break 1385, I believe we can 'sometime' this week, but most important, is taking out the key low of sp'1343.

Until 1343 is taken out, I will not be confident of my broader outlook, which is seeking a challenge of the June low of sp'1266.

Regardless, I am confidently holding short overnight.

A little more later

Subscribe to:

Comments (Atom)