The year ended on a broadly bullish note for world equity markets, with net monthly changes ranging from 11.4% (Russia), 5.3% (UK), 3.3% (USA - Dow), to -4.5% (China). The mid term outlook for most world markets remains outright bullish. Net yearly changes ranged from 51.9% (Russia), 14.4% (UK), 13.4% (USA - Dow), to -12.3% (China).

Lets take our monthly look at ten of the world equity markets

USA - Dow

US equities ended the year on a bullish note, with a net Dec' gain of 639pts (3.3%), settling @ 19726. This was an impressive rally from a Jan' low of 16466. There were two key higher lows... the BREXIT low of 17063, and the pre-election low of 17883.

For the year, the mighty Dow gained a significant 13.4%. Underlying MACD (green bar histogram) continues to tick higher, with the key 10MA in the 18300s.

There weren't quite enough buyers to push the Dow through the 20K threshold before year end, but it does seem probable in Jan'/Feb.

The next big fibonacci price target is 26702. Clearly, that is a very considerable way higher, and will take until at least the latter 3-4 months of 2017.

--

Germany

The economic powerhouse of the EU - Germany, saw its market end the year powerfully bullish, with a net Dec' gain of 840pts (7.9%). The late year surge made for a 2016 net gain of 6.9%. Underlying price momentum has turned positive for the first time since summer 2015. Next upside target is the April 2015 historic high of 12390.

For the wave counters out there, the DAX presents the cleanest price structure of all world markets. It could be argued the DAX is in a final fifth wave from the March 2009 low. If you like the notion that the next bear market will be on the order of 50%... and accept that old resistance of 8k is now long term support, then a basic upside target should be 15/16k. That is a realistic target by late 2017.

Japan

The BoJ fuelled Nikkei gained 805pts (4.4%) in Dec', which made for a net yearly gain of 0.04%. Indeed, considering the ongoing QE, its a pretty lame outcome for the central bankers. Underlying price momentum is set to turn positive in January, and that does bode for an eventual attempt to break above the June 2015 high.

China

The Chinese market was the big laggard this year, ending the year on a significantly bearish note, -146pts (4.5%) at 3103. This made for a net yearly decline of -12.3%. Its notable that the Shanghai comp' is still almost 50% below the Oct'2007 high. Another way to look at it... the Chinese market needs to almost double to break a new historic high. Clearly, that won't be easy. Broader price structure since the Jan' low of 2638 is arguably a very big bear flag. That will be negated though on any price action >3500.

Brazil

The Brazilian market ended the year on a weak note, -1679pts (2.7%) at 60227. However, that was still a massive 16877pts (38.9%) net higher for the year. There was a clear break above declining trend/channel in Oct', and despite Nov-Dec' weakness, the Bovespa looks strong. Things only turn provisionally bearish with a break under 50k.

Russia

The Russian market was the leader this year, with a net Dec' gain of 117pts (11.4%), which resulted in a 2016 gain of 51.9%. The grand down wave that began April 2011 has unquestionably concluded. Next big upside target are the 1600/1700s. If energy prices can broadly rally across 2017, the Russian market has a fair chance of trading around 2K by late 2017.

UK

The UK market ended the year strong, with a Dec' gain of 359pts (5.3%) at 7142. This made for a 2016 gain of 14.4%. The monthly close above multi-decade resistance of 7k is an extremely bullish sign for the UK, other EU markets, and to some extent... the US.

Much like the DAX, for those that believe the next bear market will be roughly 50%... if 7K is now long term support, the FTSE will need to rise to at least 13k or so... and that is a very long way higher.

France

The CAC settled strongly higher in Dec', +284pts (6.2%) to 4862, which made for a net 2016 gain of 4.8%. Next upside target is the 5000/100 zone, where there is very strong declining trend/resistance. Any price action above the April 2015 high of 5283 would offer a straight run to challenge the Sept'2000 high of 6944. Right now.. that is 42% higher.

Spain

One of the most problematic of the EU PIIGS - Spain, ended the year strong, +663pts (7.6%). That was still not enough to generate a net yearly gain, with the IBEX net lower by -192pts (2.0%). Underlying price momentum is set to turn positive in January. First big upside target is the 12k threshold. Its notable that despite ongoing QE from the ECB, the Nov'2007 bubble high of 16040 is almost double the current level.

Australia

The Australian market ended the year very bullish, +216pts (3.9%) to 5719... making a 2016 gain of 7.0%. The ASX comp' is now trading at core declining trend/resistance. Any price action >5800 in early 2017 would be decisive, and offer first soft target of the April 2015 high of 5963. More broadly, if commodity prices can climb across 2017, the Aus' market will have a very good chance of challenging the Nov'2007 high of 6873. Things only turn bearish with price action <5k in summer 2017.

--

December summary

Most world markets ended the year on an especially bullish note, lead higher by Russia and Germany. China and Brazil struggled into year end, but the latter was still massively higher for the year.

2016 summary

All world equity markets saw a key mid term low in Jan/Feb'.

The more commodity related markets of Russia and Brazil saw exceptionally strong net yearly gains, whilst China and Spain struggled.

A fair number of world markets are only just seeing underlying price momentum start to turn positive, and that does offer another basic 3-5 months of upside.

--

Looking ahead

Another short four day week, but there is plenty scheduled...

M - CLOSED

T - PMI/ISM manu', construction

W - vehicle sales, ADP jobs, FOMC mins (2pm)

T - weekly jobs, PMI/ISM serv, EIA report

F - monthly jobs, intl' trade, factory orders

*the only fed officials - Evans and Lacker, are due on Fri'.

--

Your outlook for 2017

There is still time to submit your outlook for the year ahead. I'm looking for an end 2017 target for the sp'500, and any of your thoughts for specific matters, whether GDP, inflation, etc.

--

This is post number 1267 for the year. If you value my content, subscribe to me @ permabeardoomster.com, where I continue my intraday postings.

Sincerely.... good wishes for 2017.

yours... PD, aka... Philip... in London city

--

*the next post on this page will appear Tuesday Jan'3rd 2017 @ 7pm EST

Saturday 31 December 2016

Another market year concludes

US equities closed moderately weak, sp -10pts @ 2238. The two leaders -

Trans/R2K, both settled lower by -0.4%. VIX settled +5.0% @ 14.04. Near term outlook is still

leaning weak. Any price action <2230 would offer a straight run to

the 2205/00 zone, before the broader bullish trend resumes.

sp'daily5

VIX'daily3

Summary

The market opened a little higher, but once again, the gains didn't last more than a few minutes. There was sustained (if moderate) weakness across the day, with a late afternoon low of 2233. The closing hour was naturally pretty choppy.

VIX closed notably higher for a sixth consecutive day.

The most bearish case for next week would be further weakness to around the sp'2200 threshold, which would equate to VIX in the 15.50/17.00 zone. The key 20 threshold still looks out of range for at least a month.

--

As for the outlook for 2017...

The outlook for 2017 is shrouded in cloud, but isn't it always?

Goodnight from an icy and foggy London

--

*the weekend post will appear Sat' 12pm EST, and will detail the world monthly indexes. Frankly, its my most important post of the month.... and year.

sp'daily5

VIX'daily3

Summary

The market opened a little higher, but once again, the gains didn't last more than a few minutes. There was sustained (if moderate) weakness across the day, with a late afternoon low of 2233. The closing hour was naturally pretty choppy.

VIX closed notably higher for a sixth consecutive day.

The most bearish case for next week would be further weakness to around the sp'2200 threshold, which would equate to VIX in the 15.50/17.00 zone. The key 20 threshold still looks out of range for at least a month.

--

As for the outlook for 2017...

The outlook for 2017 is shrouded in cloud, but isn't it always?

Goodnight from an icy and foggy London

--

*the weekend post will appear Sat' 12pm EST, and will detail the world monthly indexes. Frankly, its my most important post of the month.... and year.

Friday 30 December 2016

Still leaning weak

US equity indexes closed moderately mixed, sp' u/c @ 2249. The two

leaders - Trans/R2K, settled u/c and +0.2% respectively. VIX settled +3.2% @ 13.37. Near term

outlook threatens further weakness to 2232/31.. which should equate to

VIX 14s.

sp'daily5

VIX'daily3

Summary

It was a rather quiet trading day, with a lot of minor chop, as the market is naturally subdued ahead of another three day holiday weekend. Underlying MACD (blue bar histogram) continues to tick lower, as price momentum increasingly favours the bears.

VIX closed higher for a fifth consecutive day, the best run since early November. If sp'2230s... that should equate to VIX 14s. A further 2pt spike to the 15/16s looks a stretch, and would likely require downside to around sp'2200.

--

Don't forget to submit YOUR outlook for 2017.

Goodnight from London

sp'daily5

VIX'daily3

Summary

It was a rather quiet trading day, with a lot of minor chop, as the market is naturally subdued ahead of another three day holiday weekend. Underlying MACD (blue bar histogram) continues to tick lower, as price momentum increasingly favours the bears.

VIX closed higher for a fifth consecutive day, the best run since early November. If sp'2230s... that should equate to VIX 14s. A further 2pt spike to the 15/16s looks a stretch, and would likely require downside to around sp'2200.

--

Don't forget to submit YOUR outlook for 2017.

Goodnight from London

Thursday 29 December 2016

Submit your outlook for 2017

US equity indexes closed broadly lower, sp -18pts @ 2249. The two

leaders - Trans/R2K, both settled lower by -1.2%. VIX settled higher by 8.0% @ 12.95. Near term outlook

offers further weakness to sp'2232/31, where there are multiple aspects

of support.

sp'daily5

VIX'daily3

Summary

Ohh the humanity! US equity indexes almost closed significantly lower today.

Seriously... some weakness was due, and we're seeing a little of it. With just two trading days left of the year, there are clearly some 'end year' trading issues, not least within the giant pension funds which are due some re-balancing.

VIX is reflecting a touch of market concern. At best though, if sp'2230s... VIX 14s. The key 20 threshold looks out of range for at least another month.

--

Looking ahead to 2017

Its that time of year again... where I'd like to hear YOUR outlook for the year ahead.

Primarily... what is your end 2017 target for the sp'500 ?

Secondary: ANY other issues you'd like to raise.. whether equity indexes or individual stocks, GDP, jobs, inflation, oil, gold/silver/copper, bonds. You can even highlight anything socio-political.

Recently... CBNC highlighted...

I remain inclined to broad upside for next year. Frankly, the 2400/500s seem a realistic target by next summer. I'll only turn provisonally bearish if we see a monthly close under the 10MA, and that will be in the 2200s by next spring. I'll post my outlook in early Jan', and its likely to be somewhere around 2700/800.

So.. what is YOUR outlook?

--

For those curious.. here are last years submissions: http://permabeardoomster.blogspot.co.uk/2016/01/the-outlook-for-2016.html I will post a review of those... in early January.

--

I'm not sure when I'll post your submissions up - along with my own, perhaps not until the weekend of Jan' 7/8.

In any case, I hope to hear from some of you out there. Submissions, preferably by end of this weekend please.

Goodnight from London

sp'daily5

VIX'daily3

Summary

Ohh the humanity! US equity indexes almost closed significantly lower today.

Seriously... some weakness was due, and we're seeing a little of it. With just two trading days left of the year, there are clearly some 'end year' trading issues, not least within the giant pension funds which are due some re-balancing.

VIX is reflecting a touch of market concern. At best though, if sp'2230s... VIX 14s. The key 20 threshold looks out of range for at least another month.

--

Looking ahead to 2017

Its that time of year again... where I'd like to hear YOUR outlook for the year ahead.

Primarily... what is your end 2017 target for the sp'500 ?

Secondary: ANY other issues you'd like to raise.. whether equity indexes or individual stocks, GDP, jobs, inflation, oil, gold/silver/copper, bonds. You can even highlight anything socio-political.

Recently... CBNC highlighted...

I remain inclined to broad upside for next year. Frankly, the 2400/500s seem a realistic target by next summer. I'll only turn provisonally bearish if we see a monthly close under the 10MA, and that will be in the 2200s by next spring. I'll post my outlook in early Jan', and its likely to be somewhere around 2700/800.

So.. what is YOUR outlook?

--

For those curious.. here are last years submissions: http://permabeardoomster.blogspot.co.uk/2016/01/the-outlook-for-2016.html I will post a review of those... in early January.

--

I'm not sure when I'll post your submissions up - along with my own, perhaps not until the weekend of Jan' 7/8.

In any case, I hope to hear from some of you out there. Submissions, preferably by end of this weekend please.

Goodnight from London

Wednesday 28 December 2016

Sunset on an old hope

US equity indexes closed a little higher, sp +5pts @ 2268. The two

leaders - Trans/R2K, settled higher by 0.1% and 0.4% respectively. VIX settled higher by 4.8% @ 11.99. Near

term outlook offers little to the equity bears, as even a retrace to the

2240/30s looks difficult.

sp'daily5

VIX'daily3

Summary

The short four day week began on a moderately positive note, and it was more than enough to generate another pair of new historic highs in the Dow (19980) and Nasdaq comp' (5512).

Underlying MACD (blue bar histogram) for the sp'500 continues to tick lower. Its a case of the market consolidating sideways.. whilst short term momentum cycles partly reset from overbought.

VIX managed a notable third consecutive net daily gain, although the black-fail candle doesn't bode well for the volatility bulls. The 13/14s seem probable before year end.

--

As for hope...

Another part of the 80s has left this world...

Princess Leia's theme was always one of my favourites from the master that is Williams.

-

Goodnight from London

sp'daily5

VIX'daily3

Summary

The short four day week began on a moderately positive note, and it was more than enough to generate another pair of new historic highs in the Dow (19980) and Nasdaq comp' (5512).

Underlying MACD (blue bar histogram) for the sp'500 continues to tick lower. Its a case of the market consolidating sideways.. whilst short term momentum cycles partly reset from overbought.

VIX managed a notable third consecutive net daily gain, although the black-fail candle doesn't bode well for the volatility bulls. The 13/14s seem probable before year end.

--

As for hope...

Another part of the 80s has left this world...

Princess Leia's theme was always one of my favourites from the master that is Williams.

-

Goodnight from London

Sunday 25 December 2016

Merry Christmas

Merry Christmas to my readers across the

world.

Whether its your favourite, or most stressful time of year...

Merry Christmas from London.

--

If there is one movie I'd recommend, and its not one that is particularly well known...

'Krampus', from 2015.

There are many recent versions of 'Krampus', look for the one with actress Toni Collette. Its an almost perfect movie... one that even those who are anti-Christmas should like.

--

*the next post on this page will likely appear Tuesday Dec'27th @ 7pm EST.

**I will be seeking YOUR outlook for 2017 next week... and will do a review of last year's outlook (both from yours truly.. but also some of your submissions).. in early January.

Whether its your favourite, or most stressful time of year...

Merry Christmas from London.

--

If there is one movie I'd recommend, and its not one that is particularly well known...

'Krampus', from 2015.

There are many recent versions of 'Krampus', look for the one with actress Toni Collette. Its an almost perfect movie... one that even those who are anti-Christmas should like.

--

*the next post on this page will likely appear Tuesday Dec'27th @ 7pm EST.

**I will be seeking YOUR outlook for 2017 next week... and will do a review of last year's outlook (both from yours truly.. but also some of your submissions).. in early January.

Saturday 24 December 2016

Weekend update - US weekly indexes

It was a moderately choppy week for US equity indexes, with net weekly changes ranging from +0.5% (Dow, Nasdaq comp', R2K), +0.2% (sp'500, Trans), to u/c (NYSE comp'). Near term outlook threatens cooling of around 1-1.5%, but broadly, the US - and most other world markets, remain very strong.

Lets take our regular look at six of the main US indexes

sp'500

A net weekly gain of 5pts (0.2%), settling @ 2263. Underlying MACD (blue bar histogram) cycle continues to tick upward, and is now on the slightly high side. Its notable that we're scraping along the upper weekly bollinger. The key 10MA will be in the 2200s next week, and indeed, price action <2200 looks unlikely any time soon.

Best guess: near term weakness to the 2240/30s, before renewed upside across January, when the 2300s seem extremely probable.The 2400/500s seem a viable target in summer 2017, if WTIC oil is at least around $60, with copper >$3.00.

Nasdaq comp'

A new historic high of 5489, settling +0.5% @ 5462. There is a lot of support around the 5300s, with core support at the giant psy' level of 5K. The 6000s are a valid target for spring 2017.

Dow

A new historic high of 19987, settling higher for a seventh consecutive week, the best run since Dec'2015. Underlying MACD is on the very high side, with an RSI of 75 - the highest since May 2013. Regardless of any near term cooling, the 20K threshold looks a given.

The mainstream are (understandably) obsessing about 20000. Its interesting that I'm starting to hear talk of 24-26k by end 2017. Things only turn bearish with price action <19k this spring. Even then, core support of 18k looks concrete.

NYSE comp'

The master index closed broadly flat, settling +3pts @ 11128. With the 2015 high of 11252 broken above last week, next big upside target is the 12k threshold. That will clearly take at least another 2-3 months.

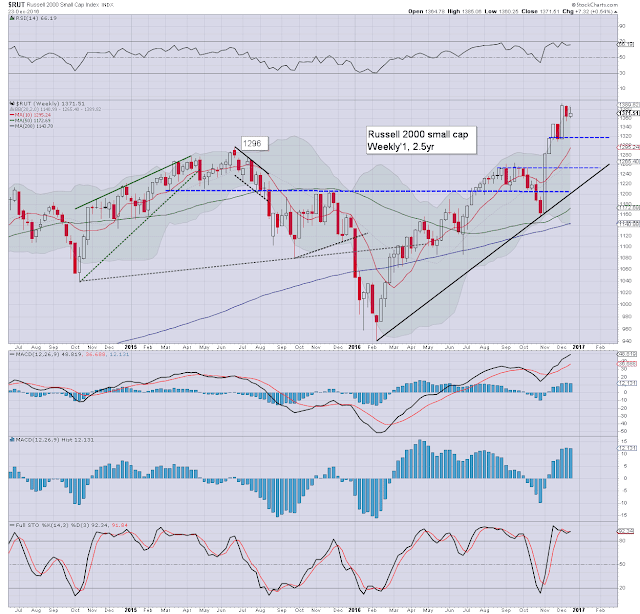

R2K

The second market leader - R2K, settled +0.5% @ 1371. Underlying MACD cycle is on the very high side, and is starting to tick lower. Clearly though, even if the market consistantly cooled, it would take at least 6-8 weeks just to see price momentum reach neutral. On balance, R2K in the 1500s is a valid target for spring 2017.

Trans

The 'old leader' - Transports, settled +0.2% @ 9190. Its notable that the key 10MA will soon be in the 9000s, which is now first soft support. Like the broader market, the tranny is short-term over-stretched, but its hard to imagine the Trans' not hitting 10k in the spring.

--

Summary

Despite a naturally subdued pre-Christmas trading week, the US equity market still managed to achieve another pair of historic highs in the Dow and Nasdaq comp'.

All US indexes are trading close to historic highs.

There is downside buffer for most indexes of around 5%, before the equity bears even test mid term rising trend/support.

Equity bears have nothing to tout unless they can break the market back under the monthly 10MA - which in Jan' will be around sp'2170/80.

--

Looking ahead

It will be a short 4 day trading week (as it will be next week too!), and there isn't much scheduled.

M - CLOSED

T - Case-Shiller HPI, Richmond Fed' , consumer con'

W - Pending home sales

T - weekly jobs, EIA report, intl' trade

F - Chicago PMI

As Friday is the last trading day of 2016, expect higher vol' and more dynamic price action, especially in the late afternoon.

--

Join me for 2017

If you value these posts here, you can support me via a monthly subscription, which will also give you access to my continued intraday postings at permabeardoomster.com.

If you think I'm worth around $1 per trading day... subscribe. Or you could buy two shares of Disney by the end of 2017.

In any case.... Merry Christmas from London

Lets take our regular look at six of the main US indexes

sp'500

A net weekly gain of 5pts (0.2%), settling @ 2263. Underlying MACD (blue bar histogram) cycle continues to tick upward, and is now on the slightly high side. Its notable that we're scraping along the upper weekly bollinger. The key 10MA will be in the 2200s next week, and indeed, price action <2200 looks unlikely any time soon.

Best guess: near term weakness to the 2240/30s, before renewed upside across January, when the 2300s seem extremely probable.The 2400/500s seem a viable target in summer 2017, if WTIC oil is at least around $60, with copper >$3.00.

Nasdaq comp'

A new historic high of 5489, settling +0.5% @ 5462. There is a lot of support around the 5300s, with core support at the giant psy' level of 5K. The 6000s are a valid target for spring 2017.

Dow

A new historic high of 19987, settling higher for a seventh consecutive week, the best run since Dec'2015. Underlying MACD is on the very high side, with an RSI of 75 - the highest since May 2013. Regardless of any near term cooling, the 20K threshold looks a given.

The mainstream are (understandably) obsessing about 20000. Its interesting that I'm starting to hear talk of 24-26k by end 2017. Things only turn bearish with price action <19k this spring. Even then, core support of 18k looks concrete.

NYSE comp'

The master index closed broadly flat, settling +3pts @ 11128. With the 2015 high of 11252 broken above last week, next big upside target is the 12k threshold. That will clearly take at least another 2-3 months.

R2K

The second market leader - R2K, settled +0.5% @ 1371. Underlying MACD cycle is on the very high side, and is starting to tick lower. Clearly though, even if the market consistantly cooled, it would take at least 6-8 weeks just to see price momentum reach neutral. On balance, R2K in the 1500s is a valid target for spring 2017.

Trans

The 'old leader' - Transports, settled +0.2% @ 9190. Its notable that the key 10MA will soon be in the 9000s, which is now first soft support. Like the broader market, the tranny is short-term over-stretched, but its hard to imagine the Trans' not hitting 10k in the spring.

--

Summary

Despite a naturally subdued pre-Christmas trading week, the US equity market still managed to achieve another pair of historic highs in the Dow and Nasdaq comp'.

All US indexes are trading close to historic highs.

There is downside buffer for most indexes of around 5%, before the equity bears even test mid term rising trend/support.

Equity bears have nothing to tout unless they can break the market back under the monthly 10MA - which in Jan' will be around sp'2170/80.

--

Looking ahead

It will be a short 4 day trading week (as it will be next week too!), and there isn't much scheduled.

M - CLOSED

T - Case-Shiller HPI, Richmond Fed' , consumer con'

W - Pending home sales

T - weekly jobs, EIA report, intl' trade

F - Chicago PMI

As Friday is the last trading day of 2016, expect higher vol' and more dynamic price action, especially in the late afternoon.

--

Join me for 2017

If you value these posts here, you can support me via a monthly subscription, which will also give you access to my continued intraday postings at permabeardoomster.com.

If you think I'm worth around $1 per trading day... subscribe. Or you could buy two shares of Disney by the end of 2017.

In any case.... Merry Christmas from London

Naturally... exceptionally subdued

US equity indexes closed the week on a slightly positive note, sp +2pts @

2263. The two leaders - Trans/R2K, settled higher by 0.3% and 0.6%

respectively. VIX settled +0.1% @ 11.44. Near term outlook offers renewed weakness to test the low

of sp'2248, if not the 2243/31 zone.

sp'daily5

VIX'daily3

Summary

It was naturally an exceptionally subdued day in equity land, ahead of the three day Christmas break.

Its notable that the equity underlying MACD (blue bar histogram) cycle continues to tick lower, and that increased downward pressure should present itself in lower prices, when the market re-opens next Tuesday.

VIX remains broadly subdued. At best.. if sp'2240/30s, that might equate to VIX 13s. Even the 14s look a stretch before end year. The key 20 threshold looks out of range for at least a month.

Goodnight from London

--

*the weekend post will appear Sat' 12pm EST, and will fully detail the US weekly indexes

sp'daily5

VIX'daily3

Summary

It was naturally an exceptionally subdued day in equity land, ahead of the three day Christmas break.

Its notable that the equity underlying MACD (blue bar histogram) cycle continues to tick lower, and that increased downward pressure should present itself in lower prices, when the market re-opens next Tuesday.

VIX remains broadly subdued. At best.. if sp'2240/30s, that might equate to VIX 13s. Even the 14s look a stretch before end year. The key 20 threshold looks out of range for at least a month.

Goodnight from London

--

*the weekend post will appear Sat' 12pm EST, and will fully detail the US weekly indexes

Friday 23 December 2016

Leaning weak into Christmas

US equity indexes closed moderately weak, sp -4pts @ 2260. The two

leaders - Trans/R2K, settled lower by -0.8% and -0.9% respectively. VIX settled +1.4% @ 11.43. Near

term outlook offers further weakness to the 2243/31 zone. Broadly

though, the 2400/500s seem a realistic target for summer 2017.

sp'daily5

VIX'daily3

Summary

The market opened a little weak, but it was more than enough to break rising trend that stretches back to early November.

VIX reflected the equity break of trend, breaking above the short term downward trend.

On balance, the sp'2243/31 zone - which might equate to a brief spike to VIX 13/14s. The key 20 threshold looks out of range for at least a month.

--

The days are getting longer.. and the nights are getting shorter. The long battle toward summer 2017 has begun :)

Goodnight from London

sp'daily5

VIX'daily3

Summary

The market opened a little weak, but it was more than enough to break rising trend that stretches back to early November.

VIX reflected the equity break of trend, breaking above the short term downward trend.

On balance, the sp'2243/31 zone - which might equate to a brief spike to VIX 13/14s. The key 20 threshold looks out of range for at least a month.

--

The days are getting longer.. and the nights are getting shorter. The long battle toward summer 2017 has begun :)

Goodnight from London

Thursday 22 December 2016

The sleepy equity market

US equity indexes closed moderately weak, sp -5pts @ 2265. The two

leaders - Trans/R2K, settled lower by -0.8% and -0.6% respectively. VIX settled -1.6% @ 11.27. Near

term outlook still threatens the sp'2243/31 zone.. as the daily price

momentum cycles are set to turn bearish before the Christmas break.

sp'daily5

VIX'daily3

Summary

It was an especially sleepy day in equity land, with the sp' seeing a trading range just 6pts wide.

VIX opened with a flash print spiky low of 10.93 - the lowest level since Aug'2015. Despite some moderate equity weakness, the VIX still closed lower, for a fifth consecutive day - the worse run since mid October. A sporadic jump to the 12/13s is possible before the three day Christmas break. Certainly though, the key 20 threshold looks out of range for at least another month.

--

My home market of the UK...

FTSE 100, monthly, 20yr

The FTSE is currently trading above multi-decade resistance of 7k. Any Dec', or Jan' close >7K would be exceptionally bullish, and bode for 8k by late spring. Things only turn bearish with another 1 or 2 months of repeated failures to break/hold 7K.

--

Today was the winter solstice...

... the long march toward summer 2017 can begin :) Thats bullish, right?

Goodnight from London

sp'daily5

VIX'daily3

Summary

It was an especially sleepy day in equity land, with the sp' seeing a trading range just 6pts wide.

VIX opened with a flash print spiky low of 10.93 - the lowest level since Aug'2015. Despite some moderate equity weakness, the VIX still closed lower, for a fifth consecutive day - the worse run since mid October. A sporadic jump to the 12/13s is possible before the three day Christmas break. Certainly though, the key 20 threshold looks out of range for at least another month.

--

My home market of the UK...

FTSE 100, monthly, 20yr

The FTSE is currently trading above multi-decade resistance of 7k. Any Dec', or Jan' close >7K would be exceptionally bullish, and bode for 8k by late spring. Things only turn bearish with another 1 or 2 months of repeated failures to break/hold 7K.

--

Today was the winter solstice...

... the long march toward summer 2017 can begin :) Thats bullish, right?

Goodnight from London

Wednesday 21 December 2016

Another day for the equity bulls

US equity indexes closed moderately higher, sp +8pts @ 2270. The two

leaders - Trans/R2K, settled higher by 0.8% and 0.9% respectively. VIX settled -2.2% @ 11.45. Near

term outlook still threatens a relatively small retrace to the 2243/31

zone. Broadly though, the market remains super strong.

sp'daily5

VIX'daily3

Summary

It was just another day for the equity bulls, as the Dow and Nasdaq comp' both broke new historic highs of 19987 and 5489 respectively.

Underlying price momentum remains net positive. Equity bears need to break the rising daily 10MA - currently @ 2258, just to offer any hope of a mini washout to the 2240/30s. Frankly, anything <2200 looks unlikely for a very considerable time.

--

Strength: WTIC oil, weekly

A net daily gain of $0.24 (0.4%) to $53.30. Seen on the bigger weekly cycle, we're now seeing sustained price action above the key $50 thershold. Further mid term upside to at least $60 seems highly probable. Keep in mind, an inverse H/S formation - as also seen in many energy stocks, was suggestive of 70/75 by next summer. If that is the case, its difficult not to see the sp'2400/500s.

Goodnight from London

sp'daily5

VIX'daily3

Summary

It was just another day for the equity bulls, as the Dow and Nasdaq comp' both broke new historic highs of 19987 and 5489 respectively.

Underlying price momentum remains net positive. Equity bears need to break the rising daily 10MA - currently @ 2258, just to offer any hope of a mini washout to the 2240/30s. Frankly, anything <2200 looks unlikely for a very considerable time.

--

Strength: WTIC oil, weekly

A net daily gain of $0.24 (0.4%) to $53.30. Seen on the bigger weekly cycle, we're now seeing sustained price action above the key $50 thershold. Further mid term upside to at least $60 seems highly probable. Keep in mind, an inverse H/S formation - as also seen in many energy stocks, was suggestive of 70/75 by next summer. If that is the case, its difficult not to see the sp'2400/500s.

Goodnight from London

Tuesday 20 December 2016

Santa will soon be here

US equity indexes closed moderately higher, sp +4pts @ 2262. The two

leaders - Trans/R2K, settled higher by 0.7% and 0.6% respectively. VIX settled -4.0% @ 11.71. A

Christmas mini-washout to the low sp'2230s still seems viable, before

the next big multi-week up wave into 2017.

sp'daily5

VIX'daily3

Summary

It was a very subdued day in market land, leaning moderately positive, as short term.. we've been a little oversold.

The daily equity MACD (blue bar histogram) will likely see a bearish cross late tomorrow/Wednesday, and that does offer a brief foray to the 2240/30s, before the next big surge into early 2017.

VIX remains especially subdued. At best, if sp'2230s, VIX 14/15s. The key 20 threshold looks out of range until late Jan/early Feb'... at the earlier.

Goodnight from London

sp'daily5

VIX'daily3

Summary

It was a very subdued day in market land, leaning moderately positive, as short term.. we've been a little oversold.

The daily equity MACD (blue bar histogram) will likely see a bearish cross late tomorrow/Wednesday, and that does offer a brief foray to the 2240/30s, before the next big surge into early 2017.

VIX remains especially subdued. At best, if sp'2230s, VIX 14/15s. The key 20 threshold looks out of range until late Jan/early Feb'... at the earlier.

Goodnight from London

Saturday 17 December 2016

Weekend update - US weekly indexes

It was a very mixed week for US equity indexes, with net weekly changes ranging from +0.4% (Dow), -0.1% (sp'500), to -2.5% (Trans). Near term outlook offers a retrace of 1-3%. With the market still regularly breaking new historic highs, the mid term outlook remains strongly bullish.

Lets take our regular look at six of the main US indexes

sp'500

A new historic high of 2277, but settling the week broadly flat, -1pt @ 2258. Underlying MACD (blue bar histogram) continues to tick higher, as the US market remains super strong.

It is notable that the 10MA is at 2175, and will be around 2200 at year end. On no fair outlook does sustained action <2200 look viable for at least a few months.

Best guess: a relatively minor retrace to around 2230, and then upward into year end, and carrying across into late Jan/early Feb. Next big upside target zone is 2325/50. The 2500s seem viable by June/July, if commodities can rally (CRB >220).. with WTIC oil at least around $60.

Equity bears have nothing to tout unless a monthly close under the monthly 10MA, which will be around 2160/70 in January.

--

Nasdaq comp'

A new historic high of 5486, but settling the week -0.1% at 5437. First soft support is around 5300. Core support remains at the giant psy' level of 5K. The 6000s are a valid target for late spring/early summer 2017.

Dow

The mighty Dow climbed for a sixth consecutive week, the best run since Nov'2015. The weekly RSI is in the mid 70s, which could be seen as indicative of a mid/long term breakout, but also short-term overbought. First support is the 19k threshold, which is around 4% lower. The old resistance of 18k is now a very secure mid term floor.

NYSE comp'

The master index has finally followed the rest of the market, breaking the 2015 high, with a new historic high of 11256. The NYSE comp' settled net lower by a moderate -0.6%. Near term outlook is bearish, with viable cooling to 11000/10900. Next big upside target is the 12k threshold, which seems probable by late spring 2017.

R2K

The second market leader saw some significant cooling, with a net weekly decline of -1.7% to 1364. Near term outlook offers 1350/40, before resuming higher into the 1400s in Jan'2017. The 1500s are now a valid target by late spring 2017.

Trans

The 'old leader' - Trans, is leading the way lower, with a net weekly decline of -2.5% to 9167. First support is the 9k threshold. Talk of 'tranny 10k' should have already begun in the mainstream. It is notable though that if WTIC oil can claw and hold above the $60 threshold in 2017, the trans will be increasingly restrained, as higher oil/fuel costs will be especially problematic for transportation companies.

--

Summary

All US equity indexes are trading close to historic highs.

The NYSE comp' has finally matched other indexes, and broken above the 2015 high.

There is downside buffer of 5-6% for most indexes, before doing ANY kind of damage to the upward trend that began in Jan/Feb'.

--

Looking ahead

Its Christmas week, and there is indeed not much scheduled.

M - PMI serv'

T -

W - existing home sales, EIA report

T - weekly jobs, durable goods orders, Q3 GDP (rev'2), pers' income/outlays, leading indicators

F - new home sales, consumer sent'.

*Yellen is due to speak (Monday, 1.30pm) at the Univ' of Maryland on the state of the US job market. That will likely garner some media coverage.

**The US equity market will close normally at 4pm on Friday, The following Monday of Dec'26th is CLOSED. Friday Dec'23rd can be expected to see exceptionally subdued price action, probably no more than a few points range.

--

As ever, if you value these posts, you can support me via a monthly subscription, which will give you access to my intraday updates @ permabeardoomster.com

Have a good weekend

--

*the next post on this page will appear Monday @ 7pm EST

Lets take our regular look at six of the main US indexes

sp'500

A new historic high of 2277, but settling the week broadly flat, -1pt @ 2258. Underlying MACD (blue bar histogram) continues to tick higher, as the US market remains super strong.

It is notable that the 10MA is at 2175, and will be around 2200 at year end. On no fair outlook does sustained action <2200 look viable for at least a few months.

Best guess: a relatively minor retrace to around 2230, and then upward into year end, and carrying across into late Jan/early Feb. Next big upside target zone is 2325/50. The 2500s seem viable by June/July, if commodities can rally (CRB >220).. with WTIC oil at least around $60.

Equity bears have nothing to tout unless a monthly close under the monthly 10MA, which will be around 2160/70 in January.

--

Nasdaq comp'

A new historic high of 5486, but settling the week -0.1% at 5437. First soft support is around 5300. Core support remains at the giant psy' level of 5K. The 6000s are a valid target for late spring/early summer 2017.

Dow

The mighty Dow climbed for a sixth consecutive week, the best run since Nov'2015. The weekly RSI is in the mid 70s, which could be seen as indicative of a mid/long term breakout, but also short-term overbought. First support is the 19k threshold, which is around 4% lower. The old resistance of 18k is now a very secure mid term floor.

NYSE comp'

The master index has finally followed the rest of the market, breaking the 2015 high, with a new historic high of 11256. The NYSE comp' settled net lower by a moderate -0.6%. Near term outlook is bearish, with viable cooling to 11000/10900. Next big upside target is the 12k threshold, which seems probable by late spring 2017.

R2K

The second market leader saw some significant cooling, with a net weekly decline of -1.7% to 1364. Near term outlook offers 1350/40, before resuming higher into the 1400s in Jan'2017. The 1500s are now a valid target by late spring 2017.

Trans

The 'old leader' - Trans, is leading the way lower, with a net weekly decline of -2.5% to 9167. First support is the 9k threshold. Talk of 'tranny 10k' should have already begun in the mainstream. It is notable though that if WTIC oil can claw and hold above the $60 threshold in 2017, the trans will be increasingly restrained, as higher oil/fuel costs will be especially problematic for transportation companies.

--

Summary

All US equity indexes are trading close to historic highs.

The NYSE comp' has finally matched other indexes, and broken above the 2015 high.

There is downside buffer of 5-6% for most indexes, before doing ANY kind of damage to the upward trend that began in Jan/Feb'.

--

Looking ahead

Its Christmas week, and there is indeed not much scheduled.

M - PMI serv'

T -

W - existing home sales, EIA report

T - weekly jobs, durable goods orders, Q3 GDP (rev'2), pers' income/outlays, leading indicators

F - new home sales, consumer sent'.

*Yellen is due to speak (Monday, 1.30pm) at the Univ' of Maryland on the state of the US job market. That will likely garner some media coverage.

**The US equity market will close normally at 4pm on Friday, The following Monday of Dec'26th is CLOSED. Friday Dec'23rd can be expected to see exceptionally subdued price action, probably no more than a few points range.

--

As ever, if you value these posts, you can support me via a monthly subscription, which will give you access to my intraday updates @ permabeardoomster.com

Have a good weekend

--

*the next post on this page will appear Monday @ 7pm EST

Subscribe to:

Posts (Atom)