US equity indexes settled September/Q3 on a positive note, sp +14pts (0.5%) at 2976. Nasdaq comp' +0.7%. Dow +0.4%. The two leaders - Trans/R2K, both settled +0.2%.

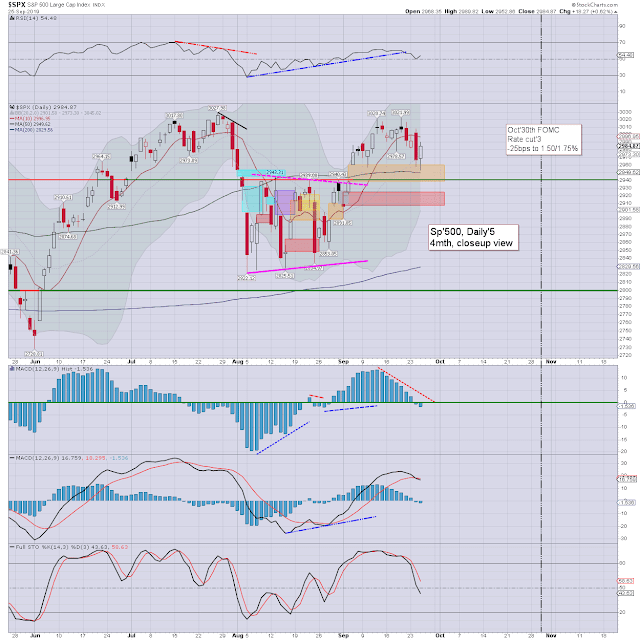

sp'daily5

VIX'daily3

Summary

US equities ended September/Q3 on a positive note, with the SPX moderately higher by 14pts (0.5%) to 2976. The s/t downward trend remains intact though, as price remains moderately negative.

Volatility was in melt mode, with the VIX settling -5.7% at 16.24. S/t outlook leans to another swing lower, with prime target of the sp'2920s with VIX 19/20.

--

Extra charts in AH (usually around 5pm EDT) @

https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For

details and the latest offers, see: permabeardoomster.com

Monday 30 September 2019

Saturday 28 September 2019

Weekend update - US equity indexes

It was a bearish week for US equity indexes,

with net weekly declines ranging from -2.5%

(R2K), -2.2% (Nasdaq comp'), -1.1% (Trans), -1.0% (SPX), -0.9% (NYSE comp'), to

-0.4% (Dow). Near term outlook offers another 1-2% of cooling.

Lets take our regular look at six of the main US indexes

sp'500

The SPX cooled for a second consecutive week, -30pt (1.0%) to 2961. Weekly price momentum ticked back lower, and remains fractionally negative. Note the August low of 2822, which is just under the monthly 10MA (2833). Best guess: cooling to the 2920s, but then finding a floor, and resuming upward. Alarm bells if any daily close <2900 and/or VIX >20.00.

--

Nasdaq comp'

A second week lower for tech, settling -178pts (2.2%) to 7939. Note the settlement under the key 10MA, which threatens a test of the August low of 7662. Weekly price momentum ticked back lower, having failed to re-take the key zero threshold.

Dow

The mighty Dow settled -114pts (0.4%) to 26820. Weekly price momentum remained fractionally positive for a second week.

NYSE comp'

The master index cooled for a second week, settling -121pts (0.9%) to 12971. Price structure since February could be argued is a giant H/S formation. Equity bears would need to see at least the 12500s to keep that scenario/structure valid. Like most other indexes, price momentum has stalled at the zero threshold.

R2K

The second market leader settled -39pts (2.5%) to 1520. Weekly price momentum ticked lower, but remains fractionally positive. I would note the four key cycle highs of 1602, 1618, 1599, and 1590.

Note m/t rising trend from Dec'2018, which was broken in early August. We have effectively back-tested the old broken trend, and have resumed lower. Its 'curious', and threatens a serious break under key price threshold of the 1430s. Its something most will have overlooked.

Trans

The 'old leader' - Transports, settled -113pts (1.1%) at 10341. Weekly price momentum ticked lower, but remains fractionally positive. Price structure is rather similar to the R2K, as the US market has been broadly stuck since early 2018.

–

Summary

All six of the US equity indexes saw net weekly declines.

The R2K and Nasdaq lead the way lower, with the Dow most resilient.

More broadly, all six indexes are currently above their respective monthly 10MA.

YTD price performance:

The Nasdaq comp' continues to lead for the year, currently +19.7%. The SPX is +18.1%, the Dow +15.0%, with the NYSE comp' +14.0%. The Transports are +12.8%, and the R2K +12.7%.

--

Looking ahead

Earnings: LEN, BBBY (Wed'), PEP, STZ (Thurs').

Econ-data:

M - Chicago PMI

T - PMI/ISM manu', construction

W - Vehicle sales, ADP jobs, EIA Pet'

T - Weekly jobs, PMI/ISM serv', factory orders

F - Monthly jobs, intl' trade

*Monday will be end month/Q3. I would expect higher volume, with more dynamic price action.

--

Final note

Whilst the s/t outlook offers a little further cooling, it should be clear, the US equity market and economy is still pretty strong. All the main indexes are holding m/t bullish trends.

Just so there is no misunderstanding...

SPX, monthly'5, fib' levels

First, the current m/t trend IS bullish. That would arguably only change with a monthly settlement under the key 10MA, currently at 2833.

Note the next giant Fibonacci extrapolation of 3047. If we break above that, then I would have to seek far higher levels in 2020/21, arguably to at least 3900/4000. Whilst that might sound crazy, the crazy train does already have some passengers...

If we do break above 3047, Lee's hyper bullish call will have to be seen as one of the best market calls in some years.

Arguing against such upside are the bond and precious metals markets. Those signals would only be negated if the US 10yr >2.25%, and Gold <$1370s. Neither of those appear likely before year end. As ever, one day at a time.

If you value my work on Blogger and Twitter, subscribe to me.

For details/latest offers, see: Permabeardoomster.com

Have a good weekend

--

*the next post on this page will likely appear 5pm EDT on Monday.

Lets take our regular look at six of the main US indexes

sp'500

The SPX cooled for a second consecutive week, -30pt (1.0%) to 2961. Weekly price momentum ticked back lower, and remains fractionally negative. Note the August low of 2822, which is just under the monthly 10MA (2833). Best guess: cooling to the 2920s, but then finding a floor, and resuming upward. Alarm bells if any daily close <2900 and/or VIX >20.00.

--

Nasdaq comp'

A second week lower for tech, settling -178pts (2.2%) to 7939. Note the settlement under the key 10MA, which threatens a test of the August low of 7662. Weekly price momentum ticked back lower, having failed to re-take the key zero threshold.

Dow

The mighty Dow settled -114pts (0.4%) to 26820. Weekly price momentum remained fractionally positive for a second week.

NYSE comp'

The master index cooled for a second week, settling -121pts (0.9%) to 12971. Price structure since February could be argued is a giant H/S formation. Equity bears would need to see at least the 12500s to keep that scenario/structure valid. Like most other indexes, price momentum has stalled at the zero threshold.

R2K

The second market leader settled -39pts (2.5%) to 1520. Weekly price momentum ticked lower, but remains fractionally positive. I would note the four key cycle highs of 1602, 1618, 1599, and 1590.

Note m/t rising trend from Dec'2018, which was broken in early August. We have effectively back-tested the old broken trend, and have resumed lower. Its 'curious', and threatens a serious break under key price threshold of the 1430s. Its something most will have overlooked.

Trans

The 'old leader' - Transports, settled -113pts (1.1%) at 10341. Weekly price momentum ticked lower, but remains fractionally positive. Price structure is rather similar to the R2K, as the US market has been broadly stuck since early 2018.

–

Summary

All six of the US equity indexes saw net weekly declines.

The R2K and Nasdaq lead the way lower, with the Dow most resilient.

More broadly, all six indexes are currently above their respective monthly 10MA.

YTD price performance:

The Nasdaq comp' continues to lead for the year, currently +19.7%. The SPX is +18.1%, the Dow +15.0%, with the NYSE comp' +14.0%. The Transports are +12.8%, and the R2K +12.7%.

--

Looking ahead

Earnings: LEN, BBBY (Wed'), PEP, STZ (Thurs').

Econ-data:

M - Chicago PMI

T - PMI/ISM manu', construction

W - Vehicle sales, ADP jobs, EIA Pet'

T - Weekly jobs, PMI/ISM serv', factory orders

F - Monthly jobs, intl' trade

*Monday will be end month/Q3. I would expect higher volume, with more dynamic price action.

--

Final note

Whilst the s/t outlook offers a little further cooling, it should be clear, the US equity market and economy is still pretty strong. All the main indexes are holding m/t bullish trends.

Just so there is no misunderstanding...

SPX, monthly'5, fib' levels

First, the current m/t trend IS bullish. That would arguably only change with a monthly settlement under the key 10MA, currently at 2833.

Note the next giant Fibonacci extrapolation of 3047. If we break above that, then I would have to seek far higher levels in 2020/21, arguably to at least 3900/4000. Whilst that might sound crazy, the crazy train does already have some passengers...

If we do break above 3047, Lee's hyper bullish call will have to be seen as one of the best market calls in some years.

Arguing against such upside are the bond and precious metals markets. Those signals would only be negated if the US 10yr >2.25%, and Gold <$1370s. Neither of those appear likely before year end. As ever, one day at a time.

If you value my work on Blogger and Twitter, subscribe to me.

For details/latest offers, see: Permabeardoomster.com

Have a good weekend

--

*the next post on this page will likely appear 5pm EDT on Monday.

Thursday 26 September 2019

More failing garbage

US equity indexes closed on a weak note, sp -7pts (0.2%) at 2977. Nasdaq comp' -0.6%. Dow -0.3%. The two leaders - Trans/R2K, settled -0.2% and -1.1% respectively.

sp'daily5

VIX'daily3

Summary

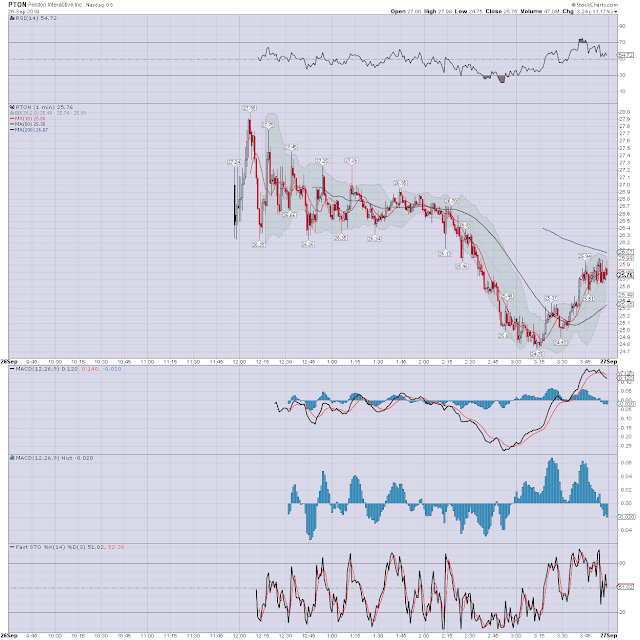

US equities opened in minor chop mode, and soon leaned a little weak. With the early pricing for Peloton IPO offering $26/25s, the market turned moderately lower to 2963. There was yet another latter day recovery to turn fractionally positive in the closing hour, but settling -7pts to 2977.

Volatility saw a mixed day, with the VIX printing a high of 17.09, and settling +0.7% at 16.07. S/t outlook favours further equity cooling to the sp'2920s, which would arguably sync with VIX 19/20s.

More failing garbage

The cheerleaders were naturally rather pleased with the opening bell at the Nasdaq...

Peloton (PTON) eventually opened at $27.00, saw an early high of $27.98, a closing hour low of $24.75, with a micro rally to settle -11.2% at $25.76.

1min candle chart

On any basis... it was a gross failure, with most other recently listed stocks - such as SDC, CHWY, and NET, similarly getting the smack down.

It is the case that Mr Market is increasingly intolerant of tier'1 loss making corporate garbage. This is perhaps one of the healthiest signs we've seen in some years. We actually have a market that is discriminating against newly listed companies that don't turn a profit.

--

--

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

sp'daily5

VIX'daily3

Summary

US equities opened in minor chop mode, and soon leaned a little weak. With the early pricing for Peloton IPO offering $26/25s, the market turned moderately lower to 2963. There was yet another latter day recovery to turn fractionally positive in the closing hour, but settling -7pts to 2977.

Volatility saw a mixed day, with the VIX printing a high of 17.09, and settling +0.7% at 16.07. S/t outlook favours further equity cooling to the sp'2920s, which would arguably sync with VIX 19/20s.

More failing garbage

The cheerleaders were naturally rather pleased with the opening bell at the Nasdaq...

Peloton (PTON) eventually opened at $27.00, saw an early high of $27.98, a closing hour low of $24.75, with a micro rally to settle -11.2% at $25.76.

1min candle chart

On any basis... it was a gross failure, with most other recently listed stocks - such as SDC, CHWY, and NET, similarly getting the smack down.

It is the case that Mr Market is increasingly intolerant of tier'1 loss making corporate garbage. This is perhaps one of the healthiest signs we've seen in some years. We actually have a market that is discriminating against newly listed companies that don't turn a profit.

|

| Garbage! |

|

| Darkening skies |

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

Wednesday 25 September 2019

Midweek swing

US equity indexes closed broadly higher, sp +18pts (0.6%) at 2984. Nasdaq comp' +1.0%. Dow +0.6%. The two leaders - Trans/R2K, settled +1.0% and +1.1% respectively.

sp'daily5

VIX'daily3

Summary

US equities opened in minor chop mode, saw a mini washout to sp'2952, before battling back upward into the late afternoon. The closing hour saw a new intraday high of 2989, and settling at 2984.

Meanwhile...

Print Central wheeled out Bullard onto CNBC, who touted that the biggest threat is trade. Powell's (eventual) successor also called for at least one further rate cut of -25bps before year end.

Volatility saw a morning spike high of 18.45, but then melted back lower, with the VIX settling -6.4% at 15.96. S/t outlook offers another swing lower to the sp'2920s, which would likely equate to VIX 19/20s.

--

--

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

sp'daily5

VIX'daily3

Summary

US equities opened in minor chop mode, saw a mini washout to sp'2952, before battling back upward into the late afternoon. The closing hour saw a new intraday high of 2989, and settling at 2984.

Meanwhile...

Print Central wheeled out Bullard onto CNBC, who touted that the biggest threat is trade. Powell's (eventual) successor also called for at least one further rate cut of -25bps before year end.

Volatility saw a morning spike high of 18.45, but then melted back lower, with the VIX settling -6.4% at 15.96. S/t outlook offers another swing lower to the sp'2920s, which would likely equate to VIX 19/20s.

--

| Through the trees |

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

Tuesday 24 September 2019

Turnaround Tuesday

US equity indexes closed broadly weak, sp -25pts (0.8%) at 2966. Nasdaq comp' -1.5%. Dow -0.5%. The two leaders - Trans/R2K, settled -0.5% and -1.6% respectively.

sp'daily5

VIX'daily3

Summary

They don't call it turnaround Tuesday for nothing. In today's case, equities opened moderately higher, with the SPX maxing out at 3007. The morning saw minor cooling to fractional declines. News that Lewis proposed Trump to be impeached, gave the algo-bots the excuse to drive the market lower.

The afternoon saw the market whipsaw from 2957, on Trump announcing he will release a full transcript of a phone call with the Ukrainian PM.

Volatility saw an early low of 14.33, and spiked to 17.55 on the impeachment chatter, with the VIX settling +14.3% to 17.05.

S/t outlook offers early Wednesday upside, but renewed downside to the sp'2920s with VIX 19/20 appears probable within a few days.

Meanwhile...

The BREXIT chaos continues, as the UK supreme court ruled that PM Johnson's suspension of parliament was unlawful.

Whilst Johnson continues to tout he'll get BREXIT done by Halloween, I don't see it happening. Instead, another election is probable, this time with Corbyn's Labour party winning (or at least leading a coalition). Any subsequent deal would then be put to the UK populace via a referendum, and I'd expect them to vote against ANY kind of deal, and thus the UK would remain part of the EU.

--

--

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

sp'daily5

VIX'daily3

Summary

They don't call it turnaround Tuesday for nothing. In today's case, equities opened moderately higher, with the SPX maxing out at 3007. The morning saw minor cooling to fractional declines. News that Lewis proposed Trump to be impeached, gave the algo-bots the excuse to drive the market lower.

The afternoon saw the market whipsaw from 2957, on Trump announcing he will release a full transcript of a phone call with the Ukrainian PM.

Volatility saw an early low of 14.33, and spiked to 17.55 on the impeachment chatter, with the VIX settling +14.3% to 17.05.

S/t outlook offers early Wednesday upside, but renewed downside to the sp'2920s with VIX 19/20 appears probable within a few days.

Meanwhile...

The BREXIT chaos continues, as the UK supreme court ruled that PM Johnson's suspension of parliament was unlawful.

Whilst Johnson continues to tout he'll get BREXIT done by Halloween, I don't see it happening. Instead, another election is probable, this time with Corbyn's Labour party winning (or at least leading a coalition). Any subsequent deal would then be put to the UK populace via a referendum, and I'd expect them to vote against ANY kind of deal, and thus the UK would remain part of the EU.

--

| Sunshine for the equity bears |

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

Monday 23 September 2019

Sleepy start to autumn

US equity indexes closed a little mixed, sp -0.3pts at 2991. Nasdaq comp' -0.1%. Dow +0.1%. The two leaders - Trans/R2K, settled -0.7% and -0.1% respectively.

sp'daily5

VIX'daily3

Summary

US equities began the first day of autumn on a pretty sleepy note. The SPX saw early weakness to 2982, but then clawed back upward into the late afternoon to 2999, with a touch of cooling into the close.

Volatility was itself subdued, with the VIX settling -2.7% at 14.91. S/t outlook offers some market drama. In theory, the SPX should at least tag the upper end of secondary downside gap to the 2920s, which would likely equate to VIX near the key 20 threshold.

--

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

sp'daily5

VIX'daily3

Summary

US equities began the first day of autumn on a pretty sleepy note. The SPX saw early weakness to 2982, but then clawed back upward into the late afternoon to 2999, with a touch of cooling into the close.

Volatility was itself subdued, with the VIX settling -2.7% at 14.91. S/t outlook offers some market drama. In theory, the SPX should at least tag the upper end of secondary downside gap to the 2920s, which would likely equate to VIX near the key 20 threshold.

--

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

Saturday 21 September 2019

Weekend update - US equity indexes

It was a bearish week for US equity indexes,

with net weekly declines ranging from -3.3%

(Trans), -1.2% (R2K), -1.0% (Dow), -0.7% (Nasdaq comp'), -0.5% (SPX), to

-0.2% (NYSE comp'). Near term outlook threatens cooling of 2-3%.

Lets take our regular look at six of the main US indexes

sp'500

The SPX broke a new multi-month high of 3021.99, but settled -15pts (0.5%) at 2992. Weekly price momentum ticked higher for a fourth week, but remains fractionally negative. S/t outlook threatens downside to tag the upper end of secondary gap to the 2920s, and that would likely equate to VIX near the key 20 threshold. Right now, I don't see any price action <2900 in the near term.

Nasdaq comp'

The Nasdaq settled -59pts (0.7%) to 8117. Weekly price momentum remains fractionally negative.

Dow

The mighty Dow cooled by -284pts (1.0%) to 26935. Weekly price momentum still managed to turn positive though. Note the July historic high of 27398.

NYSE comp'

The master index settled -30pts (0.2%) to 13093. Weekly price momentum continues to tick upward.

R2K

The R2K settled -18pts (1.2%) to 1559. Price has notably reversed on the underside of m/t rising trend, and it leans s/t bearish. First support in the 1520s.

Trans

The 'old leader' - Transports, settled -359pts (3.3%) to 10454. Weekly support in the 10300s.

–

Summary

All six of the US equity indexes saw net weekly declines.

The two leaders - Transport and R2K, lead the way lower, whilst the NYSE comp' was most resilient.

YTD price performance:

The Nasdaq comp' continues to lead for the year, currently +22.3%. The SPX is +19.4%, R2K +15.7%, and the Dow +15.5%. The NYSE comp' +15.1%, with the Transports lagging at +14.0%.

--

Looking ahead

Earnings: NIO, BB, NKE (Tues'), KBH (Wed'), ACN, CAG, MU (Thurs')

Econ-data:

M - PMI comp'

T - Case-Shiller HPI, FHFA HPI, consumer sent', Rich' fed

W - New home sales, EIA Pet'

T - Weekly jobs, Q2 GDP (third/final print), intl' trade, pending home sales

F - Durable goods, Pers' income/outlays, consumer sent'

--

If you value my work on Blogger and Twitter, subscribe to me.

For details/latest offers, see: Permabeardoomster.com

Have a good weekend

--

*the next post on this page will likely appear 5pm EDT on Monday.

Lets take our regular look at six of the main US indexes

sp'500

The SPX broke a new multi-month high of 3021.99, but settled -15pts (0.5%) at 2992. Weekly price momentum ticked higher for a fourth week, but remains fractionally negative. S/t outlook threatens downside to tag the upper end of secondary gap to the 2920s, and that would likely equate to VIX near the key 20 threshold. Right now, I don't see any price action <2900 in the near term.

Nasdaq comp'

The Nasdaq settled -59pts (0.7%) to 8117. Weekly price momentum remains fractionally negative.

Dow

The mighty Dow cooled by -284pts (1.0%) to 26935. Weekly price momentum still managed to turn positive though. Note the July historic high of 27398.

NYSE comp'

The master index settled -30pts (0.2%) to 13093. Weekly price momentum continues to tick upward.

R2K

The R2K settled -18pts (1.2%) to 1559. Price has notably reversed on the underside of m/t rising trend, and it leans s/t bearish. First support in the 1520s.

Trans

The 'old leader' - Transports, settled -359pts (3.3%) to 10454. Weekly support in the 10300s.

–

Summary

All six of the US equity indexes saw net weekly declines.

The two leaders - Transport and R2K, lead the way lower, whilst the NYSE comp' was most resilient.

YTD price performance:

The Nasdaq comp' continues to lead for the year, currently +22.3%. The SPX is +19.4%, R2K +15.7%, and the Dow +15.5%. The NYSE comp' +15.1%, with the Transports lagging at +14.0%.

--

Looking ahead

Earnings: NIO, BB, NKE (Tues'), KBH (Wed'), ACN, CAG, MU (Thurs')

Econ-data:

M - PMI comp'

T - Case-Shiller HPI, FHFA HPI, consumer sent', Rich' fed

W - New home sales, EIA Pet'

T - Weekly jobs, Q2 GDP (third/final print), intl' trade, pending home sales

F - Durable goods, Pers' income/outlays, consumer sent'

--

If you value my work on Blogger and Twitter, subscribe to me.

For details/latest offers, see: Permabeardoomster.com

Have a good weekend

--

*the next post on this page will likely appear 5pm EDT on Monday.

Friday 20 September 2019

Mostly quad-opex chop

US equity indexes closed moderately weak, sp -14pts (0.5%) at 2992. Nasdaq comp' -0.8%. Dow -0.6%. The two leaders - Trans/R2K, settled -0.5% and -0.1% respectively.

sp'daily5

VIX'daily3

Summary

With it being quad-opex, it was a natural day of (mostly) minor chop. I note mostly, as there was a brief upset in early afternoon, on a headline that a Chinese delegation had cancelled a visit to some farm in Montana. Seriously, did that really merit an SPX drop from 3009 to the 2984s? The late afternoon saw minor chop resume, with the SPX settling -14pts at 2992.

Volatility picked up a little, with the VIX settling +9.0% at 15.32. S/t outlook leans bearish for equities, especially from Tuesday onward.

--

--

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

sp'daily5

VIX'daily3

Summary

With it being quad-opex, it was a natural day of (mostly) minor chop. I note mostly, as there was a brief upset in early afternoon, on a headline that a Chinese delegation had cancelled a visit to some farm in Montana. Seriously, did that really merit an SPX drop from 3009 to the 2984s? The late afternoon saw minor chop resume, with the SPX settling -14pts at 2992.

Volatility picked up a little, with the VIX settling +9.0% at 15.32. S/t outlook leans bearish for equities, especially from Tuesday onward.

--

|

| Another group making an escape |

| Still a touch of summer sun |

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

Thursday 19 September 2019

Post FOMC chop

US equity indexes closed mostly on a weak note, spx +0.1pts at 3006. Nasdaq comp' +0.1%. Dow -0.2%. The two leaders - Trans/R2K, settled -0.7% and -0.4% respectively. Near term outlook offers chop into quad-opex.

sp'daily5

VIX'daily3

Summary

Suffice to note, it was a day of moderate chop in equity land, although the SPX did come very close to the July historic high of 3027.98, maxing out at 3021.99. The afternoon saw a s/t cyclical rollover, with the SPX cooling to 3003, and settling effectively flat at 3006.

Volatility was ground to 13.31, but settled +0.7% at 14.05. S/t outlook offers quad-opex chop, with the market makers inclined to try to settle the week around the sp'3000 threshold.

--

--

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

sp'daily5

VIX'daily3

Summary

Suffice to note, it was a day of moderate chop in equity land, although the SPX did come very close to the July historic high of 3027.98, maxing out at 3021.99. The afternoon saw a s/t cyclical rollover, with the SPX cooling to 3003, and settling effectively flat at 3006.

Volatility was ground to 13.31, but settled +0.7% at 14.05. S/t outlook offers quad-opex chop, with the market makers inclined to try to settle the week around the sp'3000 threshold.

--

| Summer fading away |

|

| ... the moon also fading away. |

Extra charts in AH (usually around 5pm EDT) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: permabeardoomster.com

Subscribe to:

Posts (Atom)