With equities putting in an early low of sp'2085, the VIX spiked higher, maxing out at 15.65. With equities recovering into the afternoon, the VIX cooled, settling -3.4% @ 14.21. Near term outlook is for renewed equity upside, which should equate to VIX remaining subdued for at least another few weeks.

VIX'60min

VIX'daily3

VIX'weekly

Summary

*the VIX saw a net weekly gain of 2.7%

--

Suffice to say, VIX remains very reflective of a market that has near zero concern of anything, least of all a GREXIT.

The big 20 threshold looks out of range until after the FOMC of June 17th.

--

more later.. on the indexes

Friday, 5 June 2015

Closing Brief

US equities closed moderately mixed, sp -3pts @ 2092 (intra low 2085). The two leaders - Trans/R2K, settled higher by 0.9% and 0.8% respectively. Near term outlook is for renewed upside, with new historic highs viable in 'some' indexes. A broader market correction looks increasingly probable this summer/early autumn.

sp'60min

Summary

*as expected, closing hour was minor chop

--

... and another week comes to a close.

Certainly, it was a bit of a messy week, not least Wednesday, with the failed upside break (above resistance of 2115), but then reversing back lower.

All things considered, there is viable upside in the near term, and we could easily be trading in the 2140/50s by the FOMC of June 17th. For me, the only issue is whether we'll manage to keep clawing higher into the July 4th holiday period... to the sp'2160/80 zone.

Have a good weekend

-

*the usual bits and pieces across the evening.. to wrap up the week

sp'60min

Summary

*as expected, closing hour was minor chop

--

... and another week comes to a close.

Certainly, it was a bit of a messy week, not least Wednesday, with the failed upside break (above resistance of 2115), but then reversing back lower.

All things considered, there is viable upside in the near term, and we could easily be trading in the 2140/50s by the FOMC of June 17th. For me, the only issue is whether we'll manage to keep clawing higher into the July 4th holiday period... to the sp'2160/80 zone.

Have a good weekend

-

*the usual bits and pieces across the evening.. to wrap up the week

3pm update - chop into the weekend

US equities look set for minor chop into the weekly close, having put in a spike floor of sp'2085, with VIX 15.65. Renewed strength looks due with net historic highs viable for some indexes in the coming weeks. However.. a summer/early autumn correction looks extremely probable.

sp'60min

VIX'60min

Summary

*note the opening black-fail spiky candle on the VIX.

--

Well, its been a long week, and I've nothing to add!

back at the close.. to wrap up the week

sp'60min

VIX'60min

Summary

*note the opening black-fail spiky candle on the VIX.

--

Well, its been a long week, and I've nothing to add!

back at the close.. to wrap up the week

2pm update - holding the floor

Despite a minor pull back from the earlier high of sp'2100, US equities are comfortably holding together into the weekend. VIX looks set to cool into the 13s. USD is continuing to cool from the open, +0.9% in the DXY 96.30s. Metals are well above the opening low, Gold -$7, whilst Oil is back to u/c.

sp'60min

Summary

Little to add... on what is turning out to be a rather 'on track' Friday.

--

Here in the city... its about as good as it gets...

back at 3pm

sp'60min

Summary

Little to add... on what is turning out to be a rather 'on track' Friday.

--

Here in the city... its about as good as it gets...

|

| Not too hot... not too cool. |

back at 3pm

1pm update - spike floor from 2085

US equities are offering a rather clear spike floor of sp'2085, with the VIX having maxed out at 15.65. New historic highs in 'some' indexes look due across the next month or two... as the USD is set to resume cooling to the DXY 92/90 zone.

sp'60min

UUP, daily2

Summary

*note the black-fail candle on the USD - via UUP... it bodes for renewed weakness next week.. which will be somewhat bullish for the metals/oil... and to some extent.. equities.

--

Little to add.

I am still seeing some call for much lower levels.. even to the 2020/00 zone.. but that seems highly unlikely.

--

back at 2pm

sp'60min

UUP, daily2

Summary

*note the black-fail candle on the USD - via UUP... it bodes for renewed weakness next week.. which will be somewhat bullish for the metals/oil... and to some extent.. equities.

--

Little to add.

I am still seeing some call for much lower levels.. even to the 2020/00 zone.. but that seems highly unlikely.

--

back at 2pm

12pm update - chop chop

US equities are in minor chop mode, having bounced from sp'2085 to an initial bounce of 2100, a weekly close in the low 2100s looks probable. Transports is showing a notable higher low... viable upside to 8900/9K by early July. VIX is reflecting a market will no concern about the weekend, -1% in the mid 14s.

sp'60min

Trans, daily

Summary

*Fed official Dudley is due to speak this hour, I'm not sure if the media will be paying any attention though

--

Suffice to add... things are panning out as kinda expected.

Regardless of the exact close... I do not expect the equity market to unravel at this time.

New historic highs in a few indexes look due in the coming weeks.

-

VIX update from Mr T.

--

time for a cool drink... on what is a rather nice summers day in London city.

sp'60min

Trans, daily

Summary

*Fed official Dudley is due to speak this hour, I'm not sure if the media will be paying any attention though

--

Suffice to add... things are panning out as kinda expected.

Regardless of the exact close... I do not expect the equity market to unravel at this time.

New historic highs in a few indexes look due in the coming weeks.

-

VIX update from Mr T.

--

time for a cool drink... on what is a rather nice summers day in London city.

11am update - morning reversal

US equities have seemingly floored at sp'2085, and have already tested the hourly 10MA @ 2100. A weekly close >2100 looks probable.. along with VIX 13s. USD has significantly cooled from opening highs, +1.0% @ DXY 96.40s, weakness to the 92/90 zone looks probable... which has bullish implications for metals/oil.

sp'60min

UUP, daily2, outlook

Summary

*equity price action is still somewhat weak, but overall.. it doesn't favour the bears, as the hourly/daily cycles are arguably floored.

--

So... we have something of a significant reversal already... and it does look like market has floored.

I realise some will be looking for a GREXIT in the immediate term, but I'm guessing that will not occur until late June at the earliest.

*metals have certainly rebounded.. as the USD cooled (note the black-fail candle on the UUP chart)... Gold swung from -13 to -6.. a net daily gain is viable.

I will consider another Gold-short, when DXY 92/90... in 3-5 weeks.

--

time to cook

sp'60min

UUP, daily2, outlook

Summary

*equity price action is still somewhat weak, but overall.. it doesn't favour the bears, as the hourly/daily cycles are arguably floored.

--

So... we have something of a significant reversal already... and it does look like market has floored.

I realise some will be looking for a GREXIT in the immediate term, but I'm guessing that will not occur until late June at the earliest.

*metals have certainly rebounded.. as the USD cooled (note the black-fail candle on the UUP chart)... Gold swung from -13 to -6.. a net daily gain is viable.

I will consider another Gold-short, when DXY 92/90... in 3-5 weeks.

--

time to cook

10am update - opening weakness

US equities open moderately lower, with the sp' slipping to 2085. Sustained price action <2080 looks unlikely in the near term, and indeed, there remains high threat of new historic highs within a few weeks. USD is powerfully higher, +1.3% @ DXY 96.70s, but looks vulnerable to cooling... which would help metals/Oil recover.

sp'60min

VIX'60min

Summary

So, opening declines, but there really isn't much power behind it.

There remains a high opportunity that this cycle has floored in the sp'2080s.

I fear renewed upside to the 2160/80 zone.. .before next viable opportunity to short the indexes, ahead of a summer/autumnal retrace.

--

I EXITED a GLD short at the open.. a trade that dragged on for way longer than I expected.. but its the third consecutive Gold-short net gain, so I'm very pleased... and I am done for this week.

GLD, daily

-

time to shop.. back soon...

10.37am.... a weekly close >2110 now looks probable.

Those equity bears not already stopped out.... not so pretty.

*I realise some are non-leveraged with 2130s stops.. but still... 2080s very a natural level to bail.

sp'60min

VIX'60min

Summary

So, opening declines, but there really isn't much power behind it.

There remains a high opportunity that this cycle has floored in the sp'2080s.

I fear renewed upside to the 2160/80 zone.. .before next viable opportunity to short the indexes, ahead of a summer/autumnal retrace.

--

I EXITED a GLD short at the open.. a trade that dragged on for way longer than I expected.. but its the third consecutive Gold-short net gain, so I'm very pleased... and I am done for this week.

GLD, daily

-

time to shop.. back soon...

10.37am.... a weekly close >2110 now looks probable.

Those equity bears not already stopped out.... not so pretty.

*I realise some are non-leveraged with 2130s stops.. but still... 2080s very a natural level to bail.

Pre-Market Brief

Good morning. Futures are effectively flat ahead of the jobs data, we're set to open at sp'2095. USD is bouncing, +0.2% @ DXY 95.60s. Metals remain weak, Gold -$2. Oil is battling to rebound, +0.2%.

sp'60min

Summary

.... little to add.

Awaiting the monthly jobs data @ 8.30am.....

--

Update from Oscar

Kinda unusual to see Oscar start turning bearish after just a minor down wave from 2134 to 2093, although I realise he is focusing more on the style of price action than actual levels right now.

--

End week doom chatter from Hunter

--

Have a good Friday.

-

8.31am.. Monthly jobs data: 280k net gains, headline rate: 5.5%

Market is NOT happy about it... indexes snap lower... metals ain't happy either... Gold -$11

So.. its a case of 'good news is bad news'.

sp -8pts.... 2087

USD soaring...... +0.9% @ 96.30s

-

8.36am.... secondary bounce wave.... sp -3pts... but overall.. we're set for a negative open... pressured by a higher USD.. as market is now concerned about rate hikes.

8.40am Gold -$9... I am short Gold - via GLD, will look to exit at the open, as I fear a Euro bounce back next week.

9.05am.... chop chop... sp -3pts... 2092.... it'd seem we'll slip to the low 2080s today... but I do NOT expect sustained trading <2070.

*I've a tight stop on a Gold-short... will likely get kicked at the open.

9.23am.. sp' set to open FLAT.

Equity bears should be mindful of a reversal anywhere in the 2090/85 zone...

-

Gold -$12... looks like I might get to tighten my stop :)

9.33am.. KICKED from GLD-short. :)

9.35am.. sp'2090.... there will be some sig' support here.... equity bears... BEWARE!

9.39am.. Eyes on the VIX... +5% in the mid 15s.... 16s looking tough...

It does look like we'll level out in the 2080s... and the nonsense resumes higher next week.. and at least into the next FOMC (June 17th).

sp'60min

Summary

.... little to add.

Awaiting the monthly jobs data @ 8.30am.....

--

Update from Oscar

Kinda unusual to see Oscar start turning bearish after just a minor down wave from 2134 to 2093, although I realise he is focusing more on the style of price action than actual levels right now.

--

End week doom chatter from Hunter

--

Have a good Friday.

-

8.31am.. Monthly jobs data: 280k net gains, headline rate: 5.5%

Market is NOT happy about it... indexes snap lower... metals ain't happy either... Gold -$11

So.. its a case of 'good news is bad news'.

sp -8pts.... 2087

USD soaring...... +0.9% @ 96.30s

-

8.36am.... secondary bounce wave.... sp -3pts... but overall.. we're set for a negative open... pressured by a higher USD.. as market is now concerned about rate hikes.

8.40am Gold -$9... I am short Gold - via GLD, will look to exit at the open, as I fear a Euro bounce back next week.

9.05am.... chop chop... sp -3pts... 2092.... it'd seem we'll slip to the low 2080s today... but I do NOT expect sustained trading <2070.

*I've a tight stop on a Gold-short... will likely get kicked at the open.

9.23am.. sp' set to open FLAT.

Equity bears should be mindful of a reversal anywhere in the 2090/85 zone...

-

Gold -$12... looks like I might get to tighten my stop :)

9.33am.. KICKED from GLD-short. :)

9.35am.. sp'2090.... there will be some sig' support here.... equity bears... BEWARE!

9.39am.. Eyes on the VIX... +5% in the mid 15s.... 16s looking tough...

It does look like we'll level out in the 2080s... and the nonsense resumes higher next week.. and at least into the next FOMC (June 17th).

Looking forward to Friday

Friday should make for a rather entertaining day in market land. Not only will there be the usual monthly jobs data, there is the bi-annual OPEC meeting. Perhaps even more important, the Greek 'issue' rumbles on, as the pressure builds for a GREXIT.

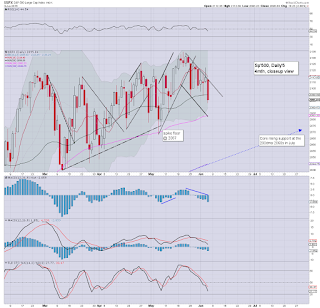

sp'weekly7

Summary

*its been a long day, I really want to keep this brief!

--

With the move under sp'2100, the weekly 'rainbow' candle has turned outright bearish red. A net weekly decline looks probable for most indexes.

The lower bol' is offering 'best case' downside to the 2020s, although recent price action strongly argues against anything much below 2080 in the current down wave from 2134.

-

Looking ahead

Friday will see the monthly jobs data, market is expecting 220k net job gains, with a static headline jobless rate of 5.4%. That does not look overly optimistic... and a fair few are looking for 250/275k.

There is also consumer credit data (3pm).

*Fed official Dudley is speaking around lunch, and Mr Market will likely be listening.

--

Mid term bearish... but not quite yet.

I am still seeking another little wave higher in the coming weeks, perhaps to tag the upper bol' on the weekly and monthly cycles - somewhere in the sp'2160/80 zone.

In terms of the Dow...

Dow, weekly'2, with fibs.

Best guess... 18400/600s... then downside to 16500/000 by early autumn. With continuing QE, low rates, and stock buy backs, I can't see anything lower than that.

I realise some of you believe a grand multi-year top is soon to pass (if not already), but I can't accept it, as much as a part of me would like to.

Goodnight from London

sp'weekly7

Summary

*its been a long day, I really want to keep this brief!

--

With the move under sp'2100, the weekly 'rainbow' candle has turned outright bearish red. A net weekly decline looks probable for most indexes.

The lower bol' is offering 'best case' downside to the 2020s, although recent price action strongly argues against anything much below 2080 in the current down wave from 2134.

-

Looking ahead

Friday will see the monthly jobs data, market is expecting 220k net job gains, with a static headline jobless rate of 5.4%. That does not look overly optimistic... and a fair few are looking for 250/275k.

There is also consumer credit data (3pm).

*Fed official Dudley is speaking around lunch, and Mr Market will likely be listening.

--

Mid term bearish... but not quite yet.

I am still seeking another little wave higher in the coming weeks, perhaps to tag the upper bol' on the weekly and monthly cycles - somewhere in the sp'2160/80 zone.

In terms of the Dow...

Dow, weekly'2, with fibs.

Best guess... 18400/600s... then downside to 16500/000 by early autumn. With continuing QE, low rates, and stock buy backs, I can't see anything lower than that.

I realise some of you believe a grand multi-year top is soon to pass (if not already), but I can't accept it, as much as a part of me would like to.

Goodnight from London

Daily Index Cycle update

US equities closed significantly lower, sp -18pts @ 2095 (intra low

2093). The two leaders - Trans/R2K, settled lower by -0.9% and -1.0%

respectively. Near term outlook is for further weakness to the low

sp'2080s, a break into the 2070s will be very difficult. Renewed

strength looks due next week.

sp'daily5

R2K

Trans

Summary

Little to add.

An interesting day, market battled hard to hold the double low of sp'2099... but with that failure, saw further weakness to 2093.

Regardless of how we open Friday... the market should at least see the low 2080s.. if briefly.

--

Closing update from Riley

--

a little more later...

sp'daily5

R2K

Trans

Summary

Little to add.

An interesting day, market battled hard to hold the double low of sp'2099... but with that failure, saw further weakness to 2093.

Regardless of how we open Friday... the market should at least see the low 2080s.. if briefly.

--

Closing update from Riley

--

a little more later...

Subscribe to:

Comments (Atom)