With most US equity indexes closing a little higher, the VIX was naturally still in cooling mode, settling -1.1% @ 13.78 (intra high 14.74). Near term outlook is for continued equity strength, which should equate to VIX slipping into the 12/11s.

VIX'60min

VIX'daily3

Summary

Little to add

The broader equity market remains very strong, with a VIX that is struggling just to break back into the mid teens.

The big 20 threshold looks out of range until at least May.

--

more later... on the indexes

Tuesday, 14 April 2015

Closing Brief

US equities closed a little higher, sp +3pts @ 2095. The two leaders - Trans/R2K, settled -0.1% and u/c respectively. Near term outlook is bullish, with new historic highs for all indexes due... inc' the Nasdaq Comp (>5132).

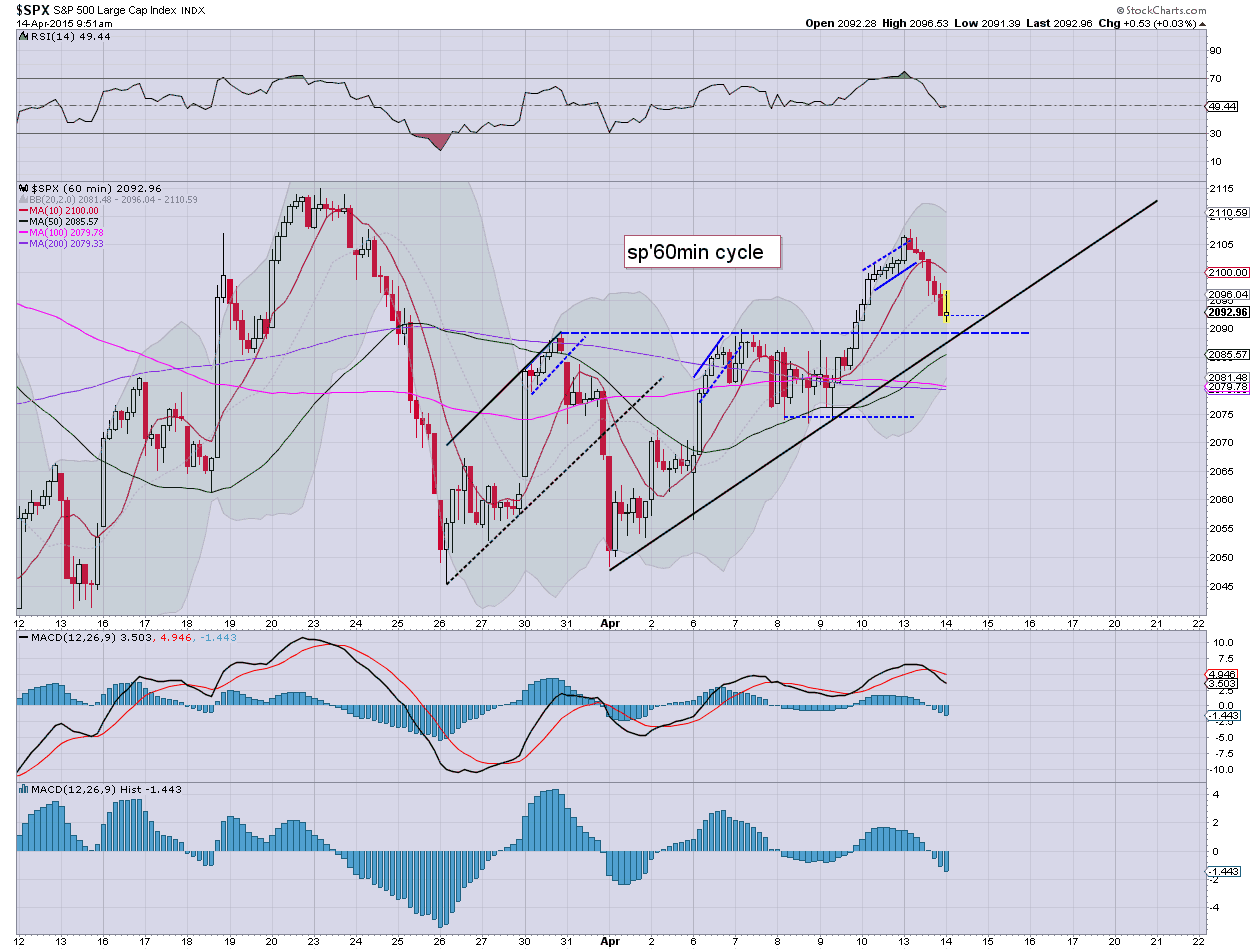

sp'60min

Summary

*awaiting INTC earnings...

--

So.. opening minor gains, with most indexes set for continued upside into May.

--

INTC earnings... inline at 41 cents.. although a touch missed on rev'

60min

Broken key resistance of $32... the door is now open to $33s.. if not the $35s.

*I will look to close a long position in INTC at the Wed' open. :)

--

more later... on the VIX

sp'60min

Summary

*awaiting INTC earnings...

--

So.. opening minor gains, with most indexes set for continued upside into May.

--

INTC earnings... inline at 41 cents.. although a touch missed on rev'

60min

Broken key resistance of $32... the door is now open to $33s.. if not the $35s.

*I will look to close a long position in INTC at the Wed' open. :)

--

more later... on the VIX

3pm update - clawing higher into the close

Most equity indexes are holding minor gains, and look set to claw slowly higher into the close. Metals remain broadly weak, Gold -$7, with Silver -0.5%. Oil has managed to hold sig' gains of 2%, but will be vulnerable as the next inventory reports are due.

sp'60min

Summary

A baby bull flag on the 5/15min cycles.. and overall, it has been a day where the bears saw a bonus opportunity to exit in early morning... ahead of broader strength.

There remain a truck load of earnings due across this week, so there will at least be some dynamic individual stock price action, even if the main market is relatively subdued.

-

notable weakness, INTC, -1.2%... ahead of earnings.

A break <$29 would be a major fail... and open up $25. Conversely.. a move into the $32s would open up $35.

.. certainly, its one to watch in AH.

--

back at the close.

sp'60min

Summary

A baby bull flag on the 5/15min cycles.. and overall, it has been a day where the bears saw a bonus opportunity to exit in early morning... ahead of broader strength.

There remain a truck load of earnings due across this week, so there will at least be some dynamic individual stock price action, even if the main market is relatively subdued.

-

notable weakness, INTC, -1.2%... ahead of earnings.

A break <$29 would be a major fail... and open up $25. Conversely.. a move into the $32s would open up $35.

.. certainly, its one to watch in AH.

--

back at the close.

2pm update - minor gains

US equity indexes are holding minor gains, with the sp' +2pts @ 2095, a daily close in the 2100s still looks very viable. Metals remain weak, Gold -$6. Oil is holding sig' gains of 2.6%.. ahead of the next set of inventory reports.

sp'60min

Summary

Little to add.

It remains a broadly strong market, one that looks set for new historic highs in the days ahead.

Underlying hourly MACD (blue bar histogram) cycle is due to go positive tomorrow.. offering the 2110s.

--

notable weakness, INTC, -0.7%.. ahead of earnings, due at the close..

...a jump into the $33s remains a valid target.. and I will be holding long overnight.

sp'60min

Summary

Little to add.

It remains a broadly strong market, one that looks set for new historic highs in the days ahead.

Underlying hourly MACD (blue bar histogram) cycle is due to go positive tomorrow.. offering the 2110s.

--

notable weakness, INTC, -0.7%.. ahead of earnings, due at the close..

...a jump into the $33s remains a valid target.. and I will be holding long overnight.

1pm update - underlying strength

US equity indexes have largely turned positive, with the sp'500 set for a net daily gain in the 2100s. VIX is naturally cooling, -1.6% in the 13.70s. Metals remain weak, Gold -$7. Oil has built sig' gains of 2.8%.. but will be highly vulnerable into the net set of inventory reports.

sp'daily5

Summary

So... we're already almost back into the sp'2100s. New historic highs >2119, look due in the immediate term.

There is little else to be noted... in what remains a powerfully strong market.

-

notable strength: XOM +2.2%... the oil giants are looking super strong today.

-

stay tuned

sp'daily5

Summary

So... we're already almost back into the sp'2100s. New historic highs >2119, look due in the immediate term.

There is little else to be noted... in what remains a powerfully strong market.

-

notable strength: XOM +2.2%... the oil giants are looking super strong today.

-

stay tuned

12pm update - renewed upside

With a spike floor of sp'2083, equities are already seeing the initial move of what will likely be a rather standard 'latter day recovery'. A daily close in the 2100s is now within range. Metals remain weak, Gold -$3. Oil is holding sig' gains of 2.1%.

sp'60min

Summary

The early morning weakness was merely a bonus down wave for the bears.. anyone still holding short faces broader upside.. as supported on the weekly cycle.

notable weakness, TSLA -1.7%

strength, oil/gas drillers, RIG +5.3%, SDRL 6.8%

-

VIX update from Mr T.

--

time for.. tea.

sp'60min

Summary

The early morning weakness was merely a bonus down wave for the bears.. anyone still holding short faces broader upside.. as supported on the weekly cycle.

notable weakness, TSLA -1.7%

strength, oil/gas drillers, RIG +5.3%, SDRL 6.8%

-

VIX update from Mr T.

--

time for.. tea.

11am update - equity spike floor

The hourly equity cycle is offering a spike floor from sp'2083... just 2pts above the 50dma. A latter day recovery.. with a net daily gain looks due for most indexes. Metals remain weak, Gold -$3. Oil is building strong gains of 2.2%... ahead of the next inventory reports.

sp'60min

GLD, daily

Summary

Overall price action remains very strong... not least reflected in other world markets.

Equity bears really don't have much realistic hope of sustained weakness until next month.

notable strength: CHK +2.2%.. as some legal dispute is apparently resolved.

weakness, Discovery (DISCA), -1.7%... am not sure why though.

-

time to cook...

11.17am.... spike floor seems confirmed with the move to 2094.... the 2100s aren't far off now!

sp'60min

GLD, daily

Summary

Overall price action remains very strong... not least reflected in other world markets.

Equity bears really don't have much realistic hope of sustained weakness until next month.

notable strength: CHK +2.2%.. as some legal dispute is apparently resolved.

weakness, Discovery (DISCA), -1.7%... am not sure why though.

-

time to cook...

11.17am.... spike floor seems confirmed with the move to 2094.... the 2100s aren't far off now!

10am update - opening chop

US equities are seeing some minor chop to start the day. The hourly cycle is offering sustained upside later today. VIX is higher, but looks set to cool from the mid 14s. Metals are weak, Gold -$7. Oil is +1.2%... but will be vulnerable into the next set of inventory reports.

sp'60min

VIX'60min

Summary

*notable opening black-fail candle on the VIX, although I recognise that didn't work out yesterday... but they usually do!

--

Despite what some were recently proclaiming, earnings are coming in at least 'reasonable'.

Price action remains broadly strong, and new historic highs look due for the sp/Dow in the near term.

-

notable strength: oil/gas drillers, RIG/SDRL, both higher by around 3.5%

weakness: TSLA -1.2%

10.06am... moderate weakness... sp'2084.... next support... 50dma @ 2081. A daily close under there would be a problem...

Overall price action though is pretty subdued... a latter day recovery looks probable.

10.25am... looks like we have a morning floor of sp'2083.... just 2pts above the 50dma.

A daily close in the 2100s is just about viable.

In any case... price action does not support the equity bears.

sp'60min

VIX'60min

Summary

*notable opening black-fail candle on the VIX, although I recognise that didn't work out yesterday... but they usually do!

--

Despite what some were recently proclaiming, earnings are coming in at least 'reasonable'.

Price action remains broadly strong, and new historic highs look due for the sp/Dow in the near term.

-

notable strength: oil/gas drillers, RIG/SDRL, both higher by around 3.5%

weakness: TSLA -1.2%

10.06am... moderate weakness... sp'2084.... next support... 50dma @ 2081. A daily close under there would be a problem...

Overall price action though is pretty subdued... a latter day recovery looks probable.

10.25am... looks like we have a morning floor of sp'2083.... just 2pts above the 50dma.

A daily close in the 2100s is just about viable.

In any case... price action does not support the equity bears.

Pre-Market Brief

Good morning. Equity futures are flat, we're set to open at sp'2092. Metals are sharply lower, Gold -$13, with Silver -1.5%. Oil is moderately higher, +0.7%.

sp'daily5

GLD, weekly3

Summary

*awaiting PPI and retail sales data.

--

Another batch of earnings already this morning... seemingly most are coming in moderately above expectations. Some, notably J&J are noting currency issues, but even they surpassed market targets.

notable strength: NFLX +1.4%... which has earnings at the Wed' close.

--

Update from Oscar

I'm certainly with Oscar on a H/S formation for Gold. If correct, in theory it bodes for Gold to fall to the $1000 threshold within the next few months. Best downside case remains 900/875 zone by Sept/Oct, but that will be difficult... unless King Dollar rises to the DXY 120s.

--

Have a good Tuesday

sp'daily5

GLD, weekly3

Summary

*awaiting PPI and retail sales data.

--

Another batch of earnings already this morning... seemingly most are coming in moderately above expectations. Some, notably J&J are noting currency issues, but even they surpassed market targets.

notable strength: NFLX +1.4%... which has earnings at the Wed' close.

--

Update from Oscar

I'm certainly with Oscar on a H/S formation for Gold. If correct, in theory it bodes for Gold to fall to the $1000 threshold within the next few months. Best downside case remains 900/875 zone by Sept/Oct, but that will be difficult... unless King Dollar rises to the DXY 120s.

--

Have a good Tuesday

World markets just keep on rising

Whilst the US market saw a moderate net daily decline, there remains notable hyper-strength in many world markets. China is now higher by 10.0% this month, whilst even Spain - ugliest and most problematic of the EU PIIGS, is +3.0%. Incredible strength... worldwide.

China, monthly, 20yr

Spain, monthly, 20yr

Summary

I am tired... suffice to say... anyone who is getting even moderately bearish should stare at the above charts for a good hour. It would seem the next stop for China is 5K... with the IBEX set to break key multi-year resistance at the 12K threshold.

--

Looking ahead

Tuesday will see PPI, retail sales, bus' invents.

*there is also fed official K' speaking.. after the close.

--

Goodnight from London

China, monthly, 20yr

Spain, monthly, 20yr

Summary

I am tired... suffice to say... anyone who is getting even moderately bearish should stare at the above charts for a good hour. It would seem the next stop for China is 5K... with the IBEX set to break key multi-year resistance at the 12K threshold.

--

Looking ahead

Tuesday will see PPI, retail sales, bus' invents.

*there is also fed official K' speaking.. after the close.

--

Goodnight from London

Daily Index Cycle update

US equities closed moderately weak, sp -9pts @ 2092 (intra high 2107).

The two leaders - Trans/R2K, settled -0.7% and +0.1% respectively. Near

term outlook remains bullish, with new historic highs due for all

indexes.

sp'daily5

R2K

Summary

A moderate net daily decline for most indexes, but overall.. it is arguably just another minor retracement within a broader up trend.

There is simply nothing bearish here.

--

Closing update from Riley

--

a little more later...

sp'daily5

R2K

Summary

A moderate net daily decline for most indexes, but overall.. it is arguably just another minor retracement within a broader up trend.

There is simply nothing bearish here.

--

Closing update from Riley

--

a little more later...

Subscribe to:

Comments (Atom)