The old leader, the Transportation index remains weak. It has completely failed to confirm the rally in the Dow'30 index.

Whether you hold a primarily bullish or bearish outlook for the rest of 2012, it has to be acknowledged that the Tranny is still warning of a potencial further wave lower later this year.

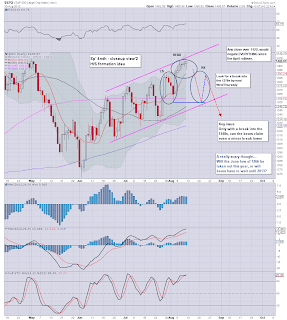

Transports, daily

Transports, daily, rainbow

Absolutely no sign of the tranny participating in the rally that the Sp'500/Dow'30 are still experiencing. From a MACD cycle perspective, the tranny is primed to rollover and go negative cycle early next week.

Transports, weekly

Transports, monthly

Summary

Along with all other indexes, the tranny soared after the June low, putting in a hyper rally from 4800 to 5300 is just over two trading weeks - a very impressive performance. Yet, since late June, the tranny has been putting in a very consistant series of lower highs. Note, that so far, we're not seeing lower lows. I would argue this lack of lower lows is probably due to the strength still being seen in the other indexes.

Bearish downside target for the transports in early autumn remains somewhere in the 4400/4600 level. That would equate to around sp'1200.

More QE before 2012 concludes

Considering 'everything' going on right now, and the key issue that the Bernanke will be looking to do QE3, I find it hard to imagine the sp breaking under 1200.

It also seems likely that with the US elections soon, the Bernanke will delay QE until the FOMC* of Wed' Dec'12. That is certainly a long way off right now, and its arguably too close to Christmas to inspire much of a euphoria for the US consumer.

*There is an October FOMC - Wed' Oct'24, but I find it almost impossible for the Fed to initiate anything then, whilst so close to the election. Unless the markets are 'upset' for whatever reason, I'd guess the committee will wait until mid December.

Eyes on the tranny

So, as I been saying for months, keep your eyes on the transports. What will be important at the end of this month, will be whether the tranny gets a monthly close under the big 5000 level. If we do, then that would be suggestive of weakness in the wider market, with a further wave lower in Sept/Oct. Whether you want to call that a wave'C, or a 3, doesn't matter. What does matter is whether the transports will play catch up to the other indexes that are still rising, or whether its going to lead the way down.

Good wishes from London

Saturday, 11 August 2012

The SP' monthly cycle remains bullish

A very quiet week for the main markets, but still a net gain of around 1%. The SP'500 is now very close to taking out the April peak of 1422.

Some are calling for a double top..others.. 'a minor fifth wave higher'. Regardless, we've seen one mighty jump off the June low of 1266, and there is currently no sign of it stopping.

sp, monthly,

Summary

For the bears, this simple rainbow chart has to be painful to look at. The bounce off the 1266 low was - (myself included), expected to get stuck somewhere in the 1350/75 range. Yet, we've now got a weekly closing over 1400, and there is no sign of a turn lower.

The 2007/8 parallel

I suppose those looking for a second deflationary collapse wave - on the scale of the original financial panic, could argue we are trading similar to Sept/Oct 2007.

If that is the case, we'd need to see an equivalent hit of the lower bollinger band - around sp'1200, by late Oct/November of this year. Its possible I suppose, and I'll certainly keep it in mind.

---

So, here we are, another strange week in market land. Very low volume, virtually no news - Europe seems fast asleep, and it now appears that Mr Market is right back to the infamous low volume melt up.

Have a great weekend

....Goodnight from London.

Some are calling for a double top..others.. 'a minor fifth wave higher'. Regardless, we've seen one mighty jump off the June low of 1266, and there is currently no sign of it stopping.

sp, monthly,

Summary

For the bears, this simple rainbow chart has to be painful to look at. The bounce off the 1266 low was - (myself included), expected to get stuck somewhere in the 1350/75 range. Yet, we've now got a weekly closing over 1400, and there is no sign of a turn lower.

The 2007/8 parallel

I suppose those looking for a second deflationary collapse wave - on the scale of the original financial panic, could argue we are trading similar to Sept/Oct 2007.

If that is the case, we'd need to see an equivalent hit of the lower bollinger band - around sp'1200, by late Oct/November of this year. Its possible I suppose, and I'll certainly keep it in mind.

---

So, here we are, another strange week in market land. Very low volume, virtually no news - Europe seems fast asleep, and it now appears that Mr Market is right back to the infamous low volume melt up.

Have a great weekend

....Goodnight from London.

Daily Index Cycle update

Marginal gains for the main indexes today, with most closing the week around 1% higher.

IWM

Sp

Transports

Summary

The Rus'2000 and the Transports remain weak, they are certainly not matching the gains seen in the big Sp'500 or the dow'30 these past 5 weeks.

We can be clear about this, there is NO sign of a turn lower yet, although a few indexes are showing signs of levelling out on the MACD (blue bar histogram) cycle.

Even if somehow we do start to cycle lower by the middle of next week, it seems likely we'd get a bounce somewhere in the sp'1360s. Whether that eventually comes to form a H/S formation, we'll just have to see.

A little more later.

IWM

Sp

Transports

Summary

The Rus'2000 and the Transports remain weak, they are certainly not matching the gains seen in the big Sp'500 or the dow'30 these past 5 weeks.

We can be clear about this, there is NO sign of a turn lower yet, although a few indexes are showing signs of levelling out on the MACD (blue bar histogram) cycle.

Even if somehow we do start to cycle lower by the middle of next week, it seems likely we'd get a bounce somewhere in the sp'1360s. Whether that eventually comes to form a H/S formation, we'll just have to see.

A little more later.

Subscribe to:

Comments (Atom)