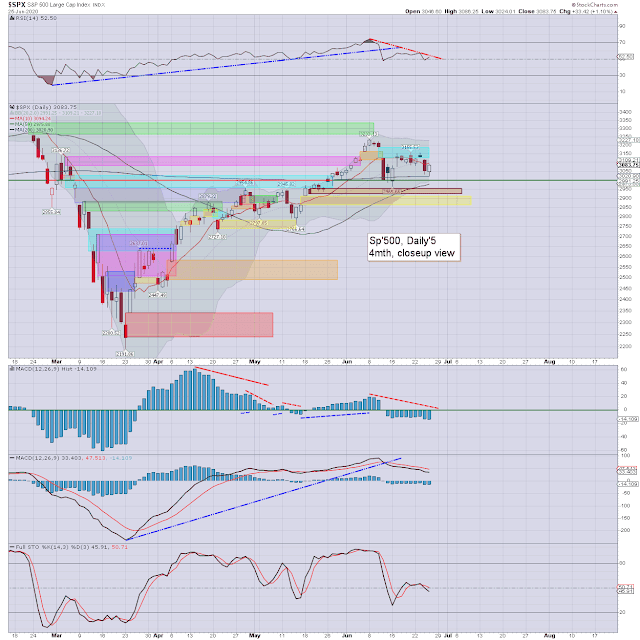

It was a bearish week for US equity indexes, with net

weekly declines ranging from -3.3% (Dow), -3.1% (NYSE comp'), -3.0% (Trans), -2.9% (SPX), to -1.9% (Nasdaq comp').

Lets take our regular look at five of the main US indexes

sp'500

Nasdaq comp'

Dow

NYSE comp'

Trans

–

Summary

All five US equity indexes settled net lower for the week.

The Dow lead the way lower, with the Nasdaq comp' most resilient.

The Nasdaq comp' broke a new historic high.

More broadly, four indexes are below their respective monthly 10MA, the exception being the Nasdaq comp'.

–

Looking ahead

It will be a short four day holiday week, ahead of Q2 earnings season.

Earnings:

M - MU

T - CAG, AYI, FDX

W - GIS, STZ

T -

F --

-

Econ-data:

M - Pending home sales

T - Case-Shiller HPI, Chicago PMI, consumer con'

W - ADP jobs, PMI/ISM manu', construction, vehicle sales, FOMC mins (2pm)

T - Weekly jobs, monthly jobs, factory orders, EIA Pet'

F - *CLOSED* - US Independence Day.

*As Tuesday will be the end of June, Q2, and H1, I would expect considerably higher volume.

**As Thursday will be the lead into a long weekend, once the econ-data is out of the way, trading could be expected to be on the lighter side.

-

Final note

The monthly settlement is always important, not least for the chartists. As things are, we can be certain that the Dow, Transports, and NYSE comp' will settle June outright bearish. Further, the monthly candles are very spiky, with clear failures to break and hold above the monthly 10MA.

The SPX is currently borderline, just 2pts under the monthly 10MA of 3011. Equity bears need a June settlement under 3K to make things decisive. Otherwise, I would seek the mid/low 2800s, before resuming upward.

After this week's net decline, there is already renewed mainstream chatter that further US Govt' stimulus (package number'4) will be needed. The Fed themselves have repeatedly stated their support for such further fiscal stimulus.

There is the issue of Corona of course. It has been interesting to see how the cheerleaders are again starting to recognise the economic recovery might not be V-shaped, as businesses are actually increasing the degree of medical theatrics, rather than continue to ease toward normalcy.

Finally, we're now just over four months from a US election. Whilst the media are loudly touting that Trump will be replaced by Biden, these are the same hacks who never saw him winning in the first instance. Do I have to dig up all the 'Hillary ahead by 16pts' screen captions/video from CNN, MSNBC, and others, that spanned summer 2016?

Anyway, lets see how June/Q2/H1 settles... in the twilight zone.

If you value my work on Blogger and Twitter, subscribe to my

intraday service.

For details/latest offers, see:

Permabeardoomster.com

Have a good weekend

--

*the next post on this page will likely appear 5pm EDT on Monday.