With equity indexes closing significantly lower, the VIX finally managed to break/hold the teens, settling +15.9% @ 14.06. Near term outlook offers the 16/17s if sp'2080/75 zone. Mid term outlook will be dependent upon whether the USD continues to climb... or cools lower to the DXY 90/89s.

VIX'60min

VIX'daily3

Summary

Finally, the VIX is back in the teens.

As ever though, the VIX never stays high for very long, and even the closing hour saw some moderate cooling from the earlier high of 14.63.

Best guess... VIX 16/17s by Thursday.

Unless DXY 98s... the broader market will be highly vulnerable to resumed upside in June.

-

*I have zero interest in being long the VIX whilst most of the broader equity index trends remain outright bullish.

-

more later.. on the indexes

Tuesday, 26 May 2015

Closing Brief

US equity indexes closed significantly weak, sp -21pts @ 2104. The two leaders - Trans/R2K, settled lower by -1.5% and -1.1% respectively. Near term outlook is bearish to the sp'2080/75 zone. The mid term outlook is seemingly dependent upon whether the USD continues to climb... or starts to cool from the DXY 97/98s.

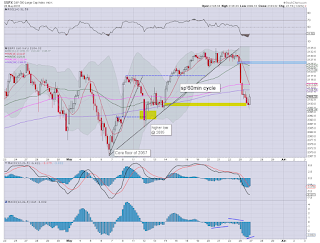

sp'60min

Summary

*a touch of strength in the closing hour, but clearly.... a day for the equity bears.

--

A short 4 day trading week has begun with some rather interesting price action across just about all asset classes.

The USD is arguably a key variable here.. and is particularly putting downward pressure on commodities.. with related energy/miner stocks getting whacked lower.

-

*I remain short Gold - via GLD, will hold another day, and then look for my next exit. If DXY 98s in the coming days, I'll reshort Gold... for the fourth time in a month.

--

the usual bits and pieces across the evening...

sp'60min

Summary

*a touch of strength in the closing hour, but clearly.... a day for the equity bears.

--

A short 4 day trading week has begun with some rather interesting price action across just about all asset classes.

The USD is arguably a key variable here.. and is particularly putting downward pressure on commodities.. with related energy/miner stocks getting whacked lower.

-

*I remain short Gold - via GLD, will hold another day, and then look for my next exit. If DXY 98s in the coming days, I'll reshort Gold... for the fourth time in a month.

--

the usual bits and pieces across the evening...

3pm update - Transports wrecked

The equity market 'old leader' - Transports, can't stop unravelling.. now -1.6% @ 8342. Next support is not until the psy' level of 8K... which is another 4% lower. USD is set to hold sig' gains of 1.3% in the DXY 97.30s. Metals remain broadly weak, Gold -$16, with Silver -1.9%. Oil is -3.0%

Trans, daily

sp'daily5

Summary

The daily, weekly, and even monthly cycles are starting to look a real problem - for the Transports.

-

The sp'500 looks set to lose the 50dma.. with 2080/75 by Thursday.. along with VIX 16/17s.

For me.. it is ALL about the USD... if it doesn't start to cool within days.... a real problem is ahead.

-

notable weakness: GDX -3.0%.. as the precious metals look vulnerable into tomorrow.

Trans, daily

sp'daily5

Summary

The daily, weekly, and even monthly cycles are starting to look a real problem - for the Transports.

-

The sp'500 looks set to lose the 50dma.. with 2080/75 by Thursday.. along with VIX 16/17s.

For me.. it is ALL about the USD... if it doesn't start to cool within days.... a real problem is ahead.

-

notable weakness: GDX -3.0%.. as the precious metals look vulnerable into tomorrow.

2pm update - equities continue to slide

US equity indexes are significantly lower, sp -24pts @ 2101. Considering the USD, VIX, and Bonds, it would seem another day of downside is due... with the 50dma (2097) set to fail... offering 2080/75 zone by Thursday morning. Metals remain weak, Gold -$18, whilst Oil is lower by a very significant -3.4%.

sp'daily5

VIX'daily3

Summary

*VIX looks set to hit the low 15s... although if sp'2080, that might equate to VIX 16/17s... briefly.

-

With continued strength in the USD, today has certainly turned out to be a lot more dynamic than expected, with sig' declines across all indexes... and most commodities.

It really is a case of whether the USD cools to 90/89... or just pushes straight up to the 120s.

If there is no cooling to the low 90s across June/July.. then 120s are due by the autumn.. and that would make for a broader market shock.

--

notable weakness: copper miners, FCX -4.9%, TCK -6.2%...

AAPL -1.9%... with the Nasdaq comp' -1.2% at 5026...

sp'daily5

VIX'daily3

Summary

*VIX looks set to hit the low 15s... although if sp'2080, that might equate to VIX 16/17s... briefly.

-

With continued strength in the USD, today has certainly turned out to be a lot more dynamic than expected, with sig' declines across all indexes... and most commodities.

It really is a case of whether the USD cools to 90/89... or just pushes straight up to the 120s.

If there is no cooling to the low 90s across June/July.. then 120s are due by the autumn.. and that would make for a broader market shock.

--

notable weakness: copper miners, FCX -4.9%, TCK -6.2%...

AAPL -1.9%... with the Nasdaq comp' -1.2% at 5026...

1pm update - USD not cooling

The USD is not seeing any kind of intraday retrace, holding sig' gains of 1.2% in the DXY 97.20s. The precious metals are (naturally) under strong downward pressure, Gold -$18, having lost the psy' level of $1200, Silver -2.0%. Oil is similarly weak, -3.4%

USO, daily

GLD, daily

Summary

*USO looks vulnerable to at least another 3% lower, with mainstream chatter of Oil falling to $55 or so.. which does look probable.

--

Without question... most should be placing their attention on the USD. Unless it stops going up... major problems are ahead, especially in commodity land.

-

notable weakness, coal miners, BTU -5.7%.. breaking a new historic low of $3.42... utter sector destruction, with ACI, ANR, and WLT all on the path to disappearing entirely.

-

Bonds...

TLT, daily

Increasing strength - higher for the fourth consecutive day, and now its a case of whether TLT can break a new historic high (>137.38).

-

stay tuned !

USO, daily

GLD, daily

Summary

*USO looks vulnerable to at least another 3% lower, with mainstream chatter of Oil falling to $55 or so.. which does look probable.

--

Without question... most should be placing their attention on the USD. Unless it stops going up... major problems are ahead, especially in commodity land.

-

notable weakness, coal miners, BTU -5.7%.. breaking a new historic low of $3.42... utter sector destruction, with ACI, ANR, and WLT all on the path to disappearing entirely.

-

Bonds...

TLT, daily

Increasing strength - higher for the fourth consecutive day, and now its a case of whether TLT can break a new historic high (>137.38).

-

stay tuned !

12pm update - Trans remains ugly

Whilst the sp'500 is -18pts @ 2107, there is particular weakness in the Transports -1.1% in the 8300s, with a clear break of trend on the weekly cycle. USD continue to hold sig' gains, +1.2% in the DXY 97.10s, which is pressuring the metals and Oil.

Trans, daily

Trans'weekly2

Summary

For now.. it remains just one index breaking the broader trend - from 2012.. but it certainly merits increasing attention.

From a pure cyclical perspective the Trans is due another up wave.. but clearly.. there is ZERO sign of a turn right now.

More than anything.. eyes to the USD. If it doesn't stop rising... then all sorts of interesting things are going to happen.

-

notable weakness: copper miners, FXX -3.5%, with TCK -4.9%

-

VIX update from Mr T.

--

time for lunch

Trans, daily

Trans'weekly2

Summary

For now.. it remains just one index breaking the broader trend - from 2012.. but it certainly merits increasing attention.

From a pure cyclical perspective the Trans is due another up wave.. but clearly.. there is ZERO sign of a turn right now.

More than anything.. eyes to the USD. If it doesn't stop rising... then all sorts of interesting things are going to happen.

-

notable weakness: copper miners, FXX -3.5%, with TCK -4.9%

-

VIX update from Mr T.

--

time for lunch

11am update - USD on the border

Whilst equities remain broadly weak, the USD remains on the edge of what is either the top end of a bounce (from DXY 93s).. or merely the start of a hyper-ramp to the 120s. Any sustained action >98.. and certainly any break >101, would bode for a straight up move that would result in all manner of capital market turmoil.

UUP, daily2, outlook

sp'daily5

Summary

The levels are very clear for the USD... any further higher... and the secondary downside target of DXY 90/89s will be out of range... not just for weeks/months.. but YEARS.

The implications should be clear to anyone... not least in terms of Oil and the Precious metals.

--

notable weakness: coal miners, ACI -10%, ANR -12%, BTU -4%... the sector destruction continues.

-

VIX is reflecting a moderately concerned market...

Next resistance is a rather obvious 15.00. The big 20 threshold is still a very long way up.. and would require USD > 100...

In either case... an interesting start to a short week.

UUP, daily2, outlook

sp'daily5

Summary

The levels are very clear for the USD... any further higher... and the secondary downside target of DXY 90/89s will be out of range... not just for weeks/months.. but YEARS.

The implications should be clear to anyone... not least in terms of Oil and the Precious metals.

--

notable weakness: coal miners, ACI -10%, ANR -12%, BTU -4%... the sector destruction continues.

-

VIX is reflecting a moderately concerned market...

Next resistance is a rather obvious 15.00. The big 20 threshold is still a very long way up.. and would require USD > 100...

In either case... an interesting start to a short week.

10am update - strong dollar causing problems

With the USD +1.0% in the DXY 97.00s, most $ denominated asset classes are under significant downward pressure.. even equities. Metals are especially weak, Gold -$16, with Silver -1.6%. Oil is similarly on the slide, -1.9% in the $58s.

sp'daily5

GLD, daily

Summary

*metals look very vulnerable... and if the USD doesn't start to cool... the Nov' 2014 floor will be taken out.

--

As for equities... a retrace to the 50dma is now on the menu.. but still.. its nothing of any particular significance.

The wild card remains Greece, but I would guess they'll kick the can out another month or two.

VIX is building strong early gains +15% @ 13.90s.... next resistance is not until 15.00.... which would bode for sp'2100.. where the 50dma will soon be lurking.

-

notable weakness: GDX -2.5%.. as the metals see sig' declines

coal miners, ANR -12%.... BTU -3%.... dire sector.

-

awaiting a trio of data at 10am...

-

Overnight gains in China, +2.0% @ 4910.... truly incredible.. with the giant 5K threshold viable in the next session.

sp'daily5

GLD, daily

Summary

*metals look very vulnerable... and if the USD doesn't start to cool... the Nov' 2014 floor will be taken out.

--

As for equities... a retrace to the 50dma is now on the menu.. but still.. its nothing of any particular significance.

The wild card remains Greece, but I would guess they'll kick the can out another month or two.

VIX is building strong early gains +15% @ 13.90s.... next resistance is not until 15.00.... which would bode for sp'2100.. where the 50dma will soon be lurking.

-

notable weakness: GDX -2.5%.. as the metals see sig' declines

coal miners, ANR -12%.... BTU -3%.... dire sector.

-

awaiting a trio of data at 10am...

-

Overnight gains in China, +2.0% @ 4910.... truly incredible.. with the giant 5K threshold viable in the next session.

Pre-Market Brief

Good morning. Futures are moderately lower, sp -4pts, we're set to open at 2122. The USD continues to climb, +0.9% in the DXY 96.80s. Metals are under pressure, Gold -$10, having lost the psy' level of $1200, with Silver -1.5%. Oil is similarly on the slide, -1.4%.

sp'daily5

GLD, daily

Summary

*I'm not surprised to see the metals (finally) see a break back under $1200.. as the USD is naturally pressuring most $ asset classes lower.

-

As for equities... I don't expect any sig' downside this week.

All things considered, the sp'2150s look due within two weeks, and 2170s by the next FOMC of June 17th.

-

To be clear.... DXY to break into the 97s... but then turning lower for a month or two.

However, any sustained action in the 98s would be too high to be considered a bounce/retrace... and would instead by suggestive of a straight run to the 120s... before year end.

-

*awaiting a truck load of econ-data this morning.

.. also notable.. Fed official Fischer is speaking on 'The Fed and the global economy' this lunch time in Israel. Mr Market will be listening.

-

Have a good week

8.36am Durable Good orders, -0.5%.. not so pretty... but ironically above market expectations.

Indexes continue to cool.. if slowly, sp -5pts... 2121.

Metals are where the early sig' weakness remains, Gold -$16, with Silver -2.1%...

.. as the USD +1.1% in the DXY 97.00s.....

8.56am... the USD continues to climb.. pressuring everything....

sp-7pts 2119...

Gold -$18.... having lost the 50dma

Oil -2.0%.... looking problematic.. back in the $58s.

sp'daily5

GLD, daily

Summary

*I'm not surprised to see the metals (finally) see a break back under $1200.. as the USD is naturally pressuring most $ asset classes lower.

-

As for equities... I don't expect any sig' downside this week.

All things considered, the sp'2150s look due within two weeks, and 2170s by the next FOMC of June 17th.

-

To be clear.... DXY to break into the 97s... but then turning lower for a month or two.

However, any sustained action in the 98s would be too high to be considered a bounce/retrace... and would instead by suggestive of a straight run to the 120s... before year end.

-

*awaiting a truck load of econ-data this morning.

.. also notable.. Fed official Fischer is speaking on 'The Fed and the global economy' this lunch time in Israel. Mr Market will be listening.

-

Have a good week

8.36am Durable Good orders, -0.5%.. not so pretty... but ironically above market expectations.

Indexes continue to cool.. if slowly, sp -5pts... 2121.

Metals are where the early sig' weakness remains, Gold -$16, with Silver -2.1%...

.. as the USD +1.1% in the DXY 97.00s.....

8.56am... the USD continues to climb.. pressuring everything....

sp-7pts 2119...

Gold -$18.... having lost the 50dma

Oil -2.0%.... looking problematic.. back in the $58s.

Subscribe to:

Comments (Atom)