With US equities closing broadly weak, the VIX finally managed a net daily gain, settling +9.3% @ 17.67. Near term outlook is for renewed equity upside to the sp'2030/40s.. and that will likely equate to VIX 15/14s.

VIX'60min

VIX'daily3

Summary

*the key 20 threshold looks out of range until the next FOMC of Oct'28th

--

Little to add. After 10 consecutive net daily declines, equity bears really need to be careful not to get overly excited about a single daily gain... and we're still only dealing with a VIX in the 17s.

--

more later... on the indexes

Tuesday, 13 October 2015

Closing Brief

US equity indexes closed broadly lower, sp -13pts @ 2003 (intra high 2022). The two leaders - Trans/R2K, settled significantly lower by -2.2% and -1.4% respectively. Near term outlook is for renewed upside to the 2030/40s.. with critical resistance within the 2040/60 zone.

sp'60min

Summary

*Closing hour action: a new intra low of sp'2001 (21pt swing from the high), but still above the 2K threshold.

--

Broadly.. a day of chop... mere consolidation before the next push higher.

-

Awaiting earnings from INTC...

--

*I hold long-USO overnight.. seeking an exit before the weekend, preferably in the $16s.

-

more later... on the VIX

sp'60min

Summary

*Closing hour action: a new intra low of sp'2001 (21pt swing from the high), but still above the 2K threshold.

--

Broadly.. a day of chop... mere consolidation before the next push higher.

-

Awaiting earnings from INTC...

--

*I hold long-USO overnight.. seeking an exit before the weekend, preferably in the $16s.

-

more later... on the VIX

3pm update - more of the same

US equities remain in minor chop mode.. leaning on the slightly weak side, but remaining above the psy' level of sp'2000. Current price action is highly suggestive of another push higher to the 2030/40s later this week, and that will likely equate to VIX resume cooling to the 15/14s.

sp'60min

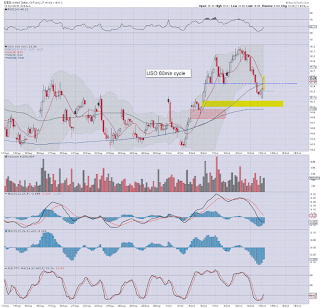

USO'60min

Summary

*having watched USO, am LONG from $15.20 in the past hour, seeking an exit in the 15.75/16.25 zone before the weekend.

The next EIA oil report is not due until Thursday.. due to Columbus day semi-holiday.

--

Well... so far, the bears are still unable to break under 2000. Today's high of 2022 makes little sense as a key high, and I'd have to assume we see another push higher.. whether tomorrow.. or across Thurs/Friday.

-

back at the close.

sp'60min

USO'60min

Summary

*having watched USO, am LONG from $15.20 in the past hour, seeking an exit in the 15.75/16.25 zone before the weekend.

The next EIA oil report is not due until Thursday.. due to Columbus day semi-holiday.

--

Well... so far, the bears are still unable to break under 2000. Today's high of 2022 makes little sense as a key high, and I'd have to assume we see another push higher.. whether tomorrow.. or across Thurs/Friday.

-

back at the close.

2pm update - grey skies for the bears

US equities remain in moderate chop mode, sp -7pts @ 2010... brushing along the hourly lower bollinger band. Sustained action <2000 looks highly unlikely, and the market appears to be waiting on more significant earnings reports, as the excuse for a break into the 2030/40s.

sp'60min

USO'60min

Summary

*Oil remains an interesting one.. having cooled from morning gains of around 1.7% to -0.5%. For now... I'm content to watch.

---

So we're net lower again.. but really... there is still ZERO sign that the equity bears are going to be able to muster any sig' downside power this week... even if a few of the bigger companies miss on earnings.

Besides, when you have corp' giants like Johnson and Johnson launching giant share buy backs.. we're back to that old game again... in which case... shorting such stocks becomes mission impossible... even for Ethan Hunt.

-

As for the grey...

Only another SIX full months until summer. The horror.

-

back at 3pm.. unless a 'surprise' break under 2K.. but really.. that looks difficult, with price action as muted as it currently remains.

-

2.18pm... LONG-USO.. from $15.20... will hold overnight.. and probably into Thursday/Friday.

2.34pm.. Naturally Oil falls into the gap zone after I buy...

60min

In any case... cyclically, it should rally from here for a few days.

sp'60min

USO'60min

Summary

*Oil remains an interesting one.. having cooled from morning gains of around 1.7% to -0.5%. For now... I'm content to watch.

---

So we're net lower again.. but really... there is still ZERO sign that the equity bears are going to be able to muster any sig' downside power this week... even if a few of the bigger companies miss on earnings.

Besides, when you have corp' giants like Johnson and Johnson launching giant share buy backs.. we're back to that old game again... in which case... shorting such stocks becomes mission impossible... even for Ethan Hunt.

-

As for the grey...

Only another SIX full months until summer. The horror.

-

back at 3pm.. unless a 'surprise' break under 2K.. but really.. that looks difficult, with price action as muted as it currently remains.

-

2.18pm... LONG-USO.. from $15.20... will hold overnight.. and probably into Thursday/Friday.

2.34pm.. Naturally Oil falls into the gap zone after I buy...

60min

In any case... cyclically, it should rally from here for a few days.

1pm update - a micro down wave

US equities see another micro wave lower.. from sp'2022 to 2013... soft support is at the hourly lower bollinger of 2010/09. VIX is +4%.. but still in the 16s. Oil is holding moderate gains of 0.5%. Gold +$3... with Silver +0.5%..the weaker USD, -0.1% in the DXY 94.70s is no doubt helping.

sp'60min

USO'60min

Summary

Well, there is little reason to believe the market won't continue in chop mode for the rest of today.

From a purely cyclical perspective..the longer we trade sideways.. it is just increasingly resetting the cycles.. in prep' for a move to the 2030/40s... for later this week.

--

notable strength: DIS +0.7% in the $107s.... having cleared key resistance... first target is 113/115 zone.

sp'60min

USO'60min

Summary

Well, there is little reason to believe the market won't continue in chop mode for the rest of today.

From a purely cyclical perspective..the longer we trade sideways.. it is just increasingly resetting the cycles.. in prep' for a move to the 2030/40s... for later this week.

--

notable strength: DIS +0.7% in the $107s.... having cleared key resistance... first target is 113/115 zone.

12pm update - moderate chop

US equities are holding well above the earlier morning of sp'2006, having already reached 2022. VIX is battling to hold minor gains of 1% in the 16.40s. Commodities are broadly higher, Gold +$5, whilst Oil is +0.5% in the $48s.

sp'weekly7

USO'60min

Summary

Its starting to get somewhat quiet again. Market is no doubt waiting on further earnings as the excuse to push into the 2030s.

notable strength: TWTR +4.5%.. but really, that company is a mess.. but that probably doesn't merit being tweeted.

--

*I've eyes on Oil, but not at these levels.. nor time. Will consider in the 2pm hour.

-

VIX update from Mr T.

-

time for tea... or something

sp'weekly7

USO'60min

Summary

Its starting to get somewhat quiet again. Market is no doubt waiting on further earnings as the excuse to push into the 2030s.

notable strength: TWTR +4.5%.. but really, that company is a mess.. but that probably doesn't merit being tweeted.

--

*I've eyes on Oil, but not at these levels.. nor time. Will consider in the 2pm hour.

-

VIX update from Mr T.

-

time for tea... or something

11am update - already positive

US equity indexes have already managed to swing from sp'2006 to 2018, a daily close in the 2020s is now on the menu.. along with an eleventh consecutive net daily decline in the VIX. Oil has similarly swung upward, currently +1.6% in the $48s.

sp'60min

USO'60min

Summary

Well.. those equity bears getting overly excited at the open are now already getting close to throwing bricks at their trading screens.

There is clearly no downside power... and the scary aspect remains if that we see any sustained action >2060.. its over for the bears.. for a very long time. It ain't looking good.

--

notable weakness: TVIX -1.7% in the $7.30s.

--

*having got my ass kicked a week ago, I am extremely cautious in taking any further trades, and have naturally not got involved... after an opening reversal candle in Oil (5min cycle).

So I'm sitting here knowing I could have made an easy 20/25% on USO Dec calls. Its broadly... depressing.

-

back at 12pm... probably.

sp'60min

USO'60min

Summary

Well.. those equity bears getting overly excited at the open are now already getting close to throwing bricks at their trading screens.

There is clearly no downside power... and the scary aspect remains if that we see any sustained action >2060.. its over for the bears.. for a very long time. It ain't looking good.

--

notable weakness: TVIX -1.7% in the $7.30s.

--

*having got my ass kicked a week ago, I am extremely cautious in taking any further trades, and have naturally not got involved... after an opening reversal candle in Oil (5min cycle).

So I'm sitting here knowing I could have made an easy 20/25% on USO Dec calls. Its broadly... depressing.

-

back at 12pm... probably.

10am update - opening weakness

US equity indexes open moderately lower, with the sp - pts @ 20 . A test of the 2000 threshold would be very natural by 11am.. before latter day strength. VIX is a little higher, but if equities do recover into the afternoon, an eleventh net daily decline will occur.

sp'60min

USO'60min

Summary

*opening reversal candle in Oil

I am increasingly tempted to pick up USO-long... but for now, would prefer to wait another 30-60mins.. see if the main market has another down wave.

--

So.. opening weakness.. but really.. it should be clear.. this is very likely just another tease to the equity bears.. and we'll be trading into the sp'2020/30s by end week.

notable strength: TWTR +4.4%.. but really.. those gains sure look shaky.

-

10.08am.. Market and Oil in tandem.

USO 5min

Micro cycles are now on the high end.... seeking renewed weakness.

sp'60min

USO'60min

Summary

*opening reversal candle in Oil

I am increasingly tempted to pick up USO-long... but for now, would prefer to wait another 30-60mins.. see if the main market has another down wave.

--

So.. opening weakness.. but really.. it should be clear.. this is very likely just another tease to the equity bears.. and we'll be trading into the sp'2020/30s by end week.

notable strength: TWTR +4.4%.. but really.. those gains sure look shaky.

-

10.08am.. Market and Oil in tandem.

USO 5min

Micro cycles are now on the high end.... seeking renewed weakness.

Pre-Market Brief

Good morning. Equity futures are moderately lower, sp -7pts, we're set to open at 2010. USD is broadly flat in the DXY 94.80s. Metals are weak, Gold -$5.... whilst Oil is trading flat in the $47s.

sp'60min

USO'60min

Summary

The smaller 15/60min equity cycles are already on the low side... sustained action <sp'2000 looks out of range today.

More probable, morning weakness until 11am, and then a latter day rally...if somewhat choppy. Market is likely just waiting to rally on any earnings excuse.

early movers...

FCX -1.9%... miners remain seeing some strong swings.

TSLA -1.4%, continuing to have real problems

TWTR -1.5% in the $28s.. as the novelty of a new CEO is already wearing off

--

Update from Oscar

--

--

Overnight Asia action

Japan: -1.1% @ 18234

China, +0.2% @ 3293... struggling a little, but certainly not falling!

--

Have a good Tuesday

-

9.34am Eyes on Oil.. USO -0.9%

sp'60min

USO'60min

Summary

The smaller 15/60min equity cycles are already on the low side... sustained action <sp'2000 looks out of range today.

More probable, morning weakness until 11am, and then a latter day rally...if somewhat choppy. Market is likely just waiting to rally on any earnings excuse.

early movers...

FCX -1.9%... miners remain seeing some strong swings.

TSLA -1.4%, continuing to have real problems

TWTR -1.5% in the $28s.. as the novelty of a new CEO is already wearing off

--

Update from Oscar

--

--

Overnight Asia action

Japan: -1.1% @ 18234

China, +0.2% @ 3293... struggling a little, but certainly not falling!

--

Have a good Tuesday

-

9.34am Eyes on Oil.. USO -0.9%

China will be a key signal

Whilst US equity indexes saw a day of very muted price action, there were notable gains in the Chinese Shanghai comp', which settled +3.3% @ 3287. A few daily closes >3400 would be suggestive the communist leadership have finally achieved their aim of stalling the down wave from June.

China, daily

Summary

Clearly, the SSEC is challenging the declining resistance/trend, but infinitely more important is the 3400 threshold.

Lets be clear...

A failure to clear 3400 would be a real problem for the bull maniacs, and offer renewed weakness, with viable new lows into November.

On the flip side.. a few daily closes in the 3400s will offer the first real sign that the collapse wave (from the 5100s).. is probably complete.

--

Looking ahead

There is very little scheduled tomorrow... just US Treasury budget data at 2pm.

*Fed official Bullard is due to speak in the early morning, and that might make for an excuse for an initial moderate sell down before resuming higher.

--

Goodnight from London

China, daily

Summary

Clearly, the SSEC is challenging the declining resistance/trend, but infinitely more important is the 3400 threshold.

Lets be clear...

A failure to clear 3400 would be a real problem for the bull maniacs, and offer renewed weakness, with viable new lows into November.

On the flip side.. a few daily closes in the 3400s will offer the first real sign that the collapse wave (from the 5100s).. is probably complete.

--

Looking ahead

There is very little scheduled tomorrow... just US Treasury budget data at 2pm.

*Fed official Bullard is due to speak in the early morning, and that might make for an excuse for an initial moderate sell down before resuming higher.

--

Goodnight from London

Daily Index Cycle update

US equity indexes closed moderately mixed, sp

+2pts @ 2017. The two leaders - Trans/R2K, settled +0.1% and -0.1%

respectively. Near term outlook is for further upside to the 2040/60

zone before the next FOMC of Oct' 28th.

sp'daily5

Trans

Summary

Most indexes settled net higher for the 9th of 10 trading days.

-

With the 'old leader' -Transports, breaking above declining resistance/trend, it looks headed for the 200dma in the 8500s... along with sp'2060.

-

a little more later...

sp'daily5

Trans

Summary

Most indexes settled net higher for the 9th of 10 trading days.

-

With the 'old leader' -Transports, breaking above declining resistance/trend, it looks headed for the 200dma in the 8500s... along with sp'2060.

-

a little more later...

Subscribe to:

Comments (Atom)