Most of the US indexes closed with net-gains for the week, although with both a lower weekly high, and a lower low. Near term trend into September looks weak. Downside looks to be around sp'1600/1575, which should equate to VIX briefly in the lows 20s.

Lets take a look at six of the main US indexes

sp'500

Despite weakness earlier in the week, the Sp' still managed net gains of almost 0.5% this week. The close under the 10MA is kinda bearish, although bears will need to see net declines next week.

Primary downside target remains the lower weekly bollinger, which at the Monday open will jump to around 1570. The June low of 1560 is now looking very difficult to hit in September Interestingly though, the lower channel/trend from the Oct'2011 lows, will be around 1550/60 in September.

Underlying MACD (blue bar histogram) cycle ticked lower for a third week, and we now also have a bearish cross.

Nasdaq Comp

The Nasdaq saw a rather significant bounce of 1.5%. Bears should be mindful of the recent high of 3694. If that is exceeded next week, that would be a very serious problem. Despite the bounce, the MACD cycle ticked lower for the third week, and is set to go negative cycle within the next 1-2 weeks.

Dow

The mighty Dow was especially weak, slipping 0.5%, with a decisive break of the channel that extends back to the Nov'2012 lows. For the bears, this is one of the most bearish signs. Underlying MACD cycle is now quite low, with a primary target of 14500/250. A break <14k does not look viable in the current multi-week down cycle.

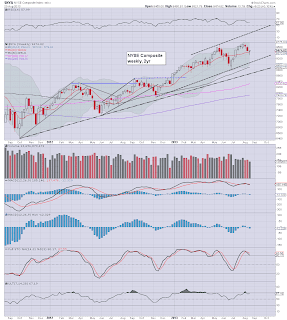

NYSE Comp

The master index closed the week with fractional gains, and there remains moderate downside. First target is 9200/9000 level. A break <8800 does not look viable in September.

R2K

The second market leader managed gains of 1.4% this week. Underlying MACD cycle ticked lower for the third week, and is set to go negative cycle next week. Primary downside target remains 950/925. Sub 900s do not look viable in the current down cycle.

Trans

The 'old leader' saw a little weakness to start the week, but closed with net gains of almost 1.7%. Equity bears should beware of any daily closes in the 6600s. A weekly close >6600 would be bullish. Primary downside target for mid-September is the 6100/6000 zone.

Summary

So, it was a bit of a mixed week for the market. The Dow remains the most bearish index now, especially with the break of the channel. As ever, the two market leaders Trans/R2K saw the strongest bounce-gains, but so long as they don't close with another net-weekly gain, bears can remain hopeful for the first half of September.

Regardless of any further gains early next week, equity bears need to see at least minor net-losses next week. In terms of the sp'500, a further bounce to 1675/85 looks very viable. From there, I would want to see a close next Friday back in the 1650s.

The bigger bearish picture

The following remains the most bearish outlook I can come up with...

sp'weekly'9d

Most importantly, unless I see a hit of the lower weekly bollinger (1570 as of next Monday..and rising) in the current multi-week down cycle, this scenario will get dropped.

Looking ahead

There are a fair few things next week for Mr Market to deal with. The week begins with Durable Good Orders. Tuesday, case-shiller HPI and consumer confidence. Wednesday has pending home sales. Thursday has GDP Q2 (second reading/guess). Friday has personal income/outlays, consumer sentiment, and the Chicago PMI - market is seeking a non-recessionary reading of 53.

*there is very significant QE-pomo: Tues' 4-5bn, Wed' 3bn.

Trading outlook

First, keep in mind the following...

sp'60min'4 - broader outlook

The H/S projection (pink dashed line) was to around sp'1643...and we exceeded that by just 4pts, so that kinda worked out rather well.

I'd argue half the bounce is already done, and that we'll get stuck in the 1675/85 area early next week. Certainly, I remain seeking to launch a heavy index re-short, my only concern are the two large QEs of Tue/Wed.

Finally, it is probably important to note that the following Monday of Sept'2 - US markets are closed for Labor day. So..Friday Aug'30' could be very quiet once the market has dealt with the econ-data in early morning.

back on Monday :)

--

Video update (a somewhat rare free/open posting) from Ron Walker - main page

He seems inclined for a larger H/S formation, with a projected downside to the low 1400s. Effectively, its the same as my weekly9d chart that I've been posting a few times lately.

I have to say, I sure didn't copy him..and I doubt he even heard of my pages. Its kinda good to see someone have the same scenario outlook. Of course, it is just one of a number of scenarios I am keeping in mind.

*futures look flat (as of 9pm EST, Sunday), general upside seems likely

Saturday, 24 August 2013

Bearish outlook still on schedule

The equity market closed the week with moderate gains. Despite most indexes seeing net weekly gains, the past few days are likely just a bounce. Further significant downside into September is expected, with a target zone of sp'1600/1575, the 1560s look...'overly difficult'.

sp'weekly7 - near term bearish outlook

Summary

Another week comes to a close, and I'm kinda tired.

The one thing I want to especially highlight is the weekly 'rainbow' charts still closed with a blue candle...despite the net gains. This is good, and is the typical sort of thing we see in many multi-week down cycles.

So long as the bulls don't get a closing green candle at the end of next week, I have few concerns about the outlook into September.

Yields still broadly rising

The bond market used the weak homes data this Friday as an excuse to fall back, with the 10yr yield dropping 8bps to 2.82. The broad trend though, remains strongly to the upside...

10yr, monthly

For those looking for the sp' back under 1600 within the next 2-3 weeks, the 10yr breaking >3% would certainly help! First key target remains a rather obvious 3.25%.

Doomster autumnal dreams

Something to close the week with, and why not make it bearish..right?

sp'weekly9c - lower trend to hit

The aspect I'd like to note is that before point'1 (week of June'13 2011), the low from the previous cycle (week of March'14 2011) was sp'1249. The actual low for point'1 was 1258.

Our recent low was 1560, so...maybe a slightly higher low in the weeks ahead? I'd argue anything in the 1570/80s would be acceptable to keep the broader scenario on track.

Now, as I keep noting, the target remains the lower weekly bol' - currently 1558, but rising around 13pts a week. At the Mon' Aug'26 open, it'll likely jump to around 1570.

Its going to be real difficult for the bears to push the market down to the 1570/60s, but if we do hit this level , then I'll keep the weekly'9c scenario in mind. Its been two years since the last major correction, we're more than due something 'significant'..

Goodnight from London

--

*next main post, late Saturday, on the US weekly indexes

sp'weekly7 - near term bearish outlook

Summary

Another week comes to a close, and I'm kinda tired.

The one thing I want to especially highlight is the weekly 'rainbow' charts still closed with a blue candle...despite the net gains. This is good, and is the typical sort of thing we see in many multi-week down cycles.

So long as the bulls don't get a closing green candle at the end of next week, I have few concerns about the outlook into September.

Yields still broadly rising

The bond market used the weak homes data this Friday as an excuse to fall back, with the 10yr yield dropping 8bps to 2.82. The broad trend though, remains strongly to the upside...

10yr, monthly

For those looking for the sp' back under 1600 within the next 2-3 weeks, the 10yr breaking >3% would certainly help! First key target remains a rather obvious 3.25%.

Doomster autumnal dreams

Something to close the week with, and why not make it bearish..right?

sp'weekly9c - lower trend to hit

The aspect I'd like to note is that before point'1 (week of June'13 2011), the low from the previous cycle (week of March'14 2011) was sp'1249. The actual low for point'1 was 1258.

Our recent low was 1560, so...maybe a slightly higher low in the weeks ahead? I'd argue anything in the 1570/80s would be acceptable to keep the broader scenario on track.

Now, as I keep noting, the target remains the lower weekly bol' - currently 1558, but rising around 13pts a week. At the Mon' Aug'26 open, it'll likely jump to around 1570.

Its going to be real difficult for the bears to push the market down to the 1570/60s, but if we do hit this level , then I'll keep the weekly'9c scenario in mind. Its been two years since the last major correction, we're more than due something 'significant'..

Goodnight from London

--

*next main post, late Saturday, on the US weekly indexes

Daily Index Cycle update

The main indexes all closed moderately higher, with the sp +6pts @ 1663, a net weekly gain of around 8pts. The two leaders - Trans/R2K, were weak for much of the day, but still managed gains of 0.1% and 0.2% respectively. Equities looks set for further moderate gains next week.

sp'daily5

R2K

Trans

Summary

For the bears, it was an annoying (but not unexpected) end to the week, with moderate index gains.

Yet, the market was very weak this week, hitting a low of sp'1639, which certainly surprised a fair few people out there.

Best guess remains, a bounce into the sp'1675/85 zone early next week, before renewed..and significant falls into September. Downside target is 1600/1575. The 1560s will be very difficult to hit.

*I remain on the sidelines, and am patiently awaiting to launch an index re-short in the 1675/85 target zone.

a little more later...

sp'daily5

R2K

Trans

Summary

For the bears, it was an annoying (but not unexpected) end to the week, with moderate index gains.

Yet, the market was very weak this week, hitting a low of sp'1639, which certainly surprised a fair few people out there.

Best guess remains, a bounce into the sp'1675/85 zone early next week, before renewed..and significant falls into September. Downside target is 1600/1575. The 1560s will be very difficult to hit.

*I remain on the sidelines, and am patiently awaiting to launch an index re-short in the 1675/85 target zone.

a little more later...

Subscribe to:

Comments (Atom)