With equities weak, the VIX opened moderately higher, and generally climbed (if slowly) all the way into the Friday close, settling +6.1% @ 14.13. Near term outlook offers a minor chance of upside into the low 15s, before falling back into the 13/12s.

vix'60min

vix'daily3

vix'weekly

Summary

*across the week, the VIX gained a moderate 5.8%

--

Suffice to say, the VIX remains very low, despite today's moderate gains. The big VIX 20 threshold remains a considerable way higher, and I don't expect that to be hit for some weeks.

--

more later...on the indexes

Friday, 25 April 2014

Closing Brief

US indexes closed the week on a particularly weak note, sp -15pts @ 1863. The two leaders - Trans/R2K, settled very significantly lower, -1.6% and -1.9% respectively. Near term outlook is for a renewed push higher next week.

sp'60min

Summary

...and another week comes to a close...thank the gods!

Overall, I've done okay this week, but I'm seeking much stronger price action next week, with GDP/FOMC Wednesday, and Jobs Friday.

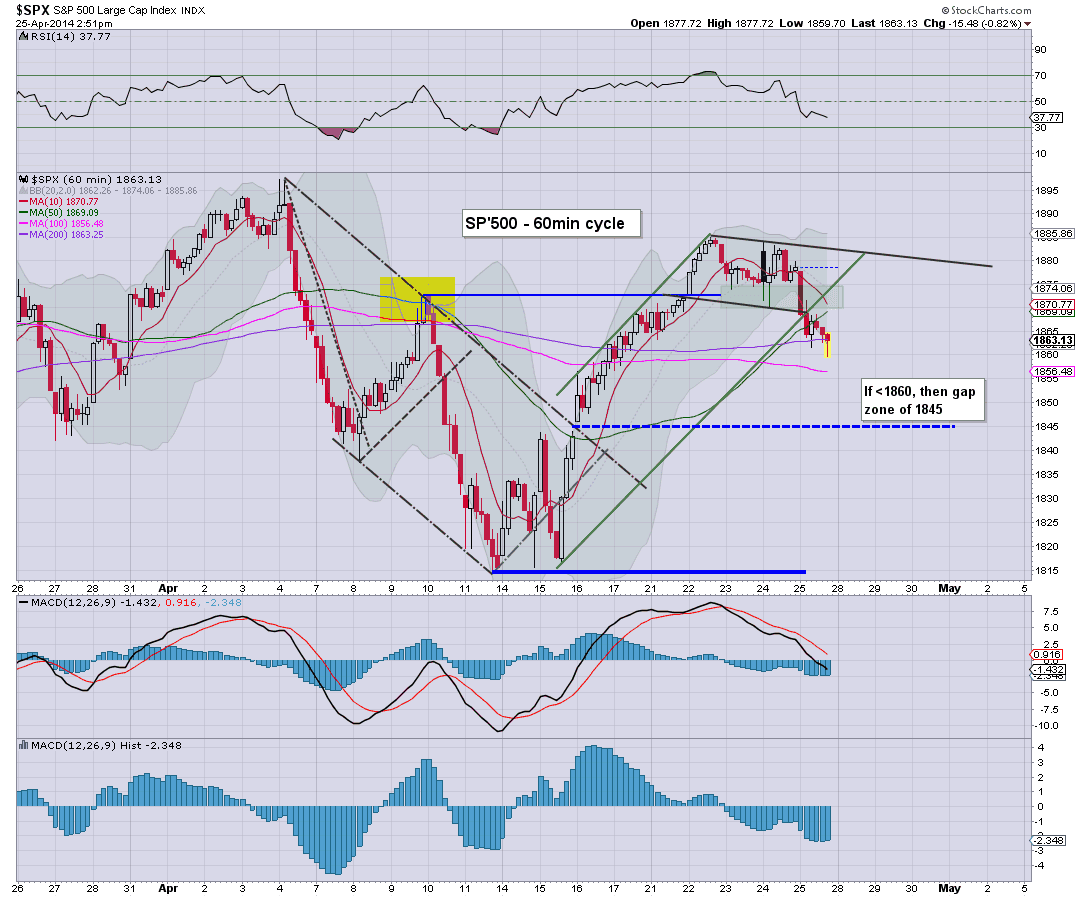

Hourly index charts are pretty close to flooring, but there remains a gap zone of sp'1845, with VIX 15s, that is viable on Monday.

Have a good weekend everyone!

--

The weekend post will be on the US weekly indexes

sp'60min

Summary

...and another week comes to a close...thank the gods!

Overall, I've done okay this week, but I'm seeking much stronger price action next week, with GDP/FOMC Wednesday, and Jobs Friday.

Hourly index charts are pretty close to flooring, but there remains a gap zone of sp'1845, with VIX 15s, that is viable on Monday.

Have a good weekend everyone!

--

The weekend post will be on the US weekly indexes

3pm update - weakness into the weekend

US equities have slipped into the sp'1850s, although the really significant weakness remains within the R2K, Trans, and Nasdaq. Taken as a whole though, nothing overly 'dire' has occurred today, and the equity bulls still have a fair chance of another up wave next week.

sp'60min

Summary

Well, another week is coming to a close.

Today's weakness is interesting (more so in the R2K, Trans, Nasdaq), but I am still looking for the sp'1900s. Hourly MACD (blue bar histogram) cycle looks floored, although there is clearly no turn..yet.

--

I will hold long across the weekend, CHK, STX, and short- SLV. Will be seeking to pick up RIG (again) next Monday in the 42.25/41.75 zone.

-

updates into the close....

3.25pm.. not much happening...just minor weak chop.

Notable that AMZN held the big $300 level, whilst AAPL is still actually net higher!

3.33pm.. RIG continues to weaken..and another 50/75 cents lower on Monday..and I'll pick that one up again.

Next week is a HUGE week, especially Wednesday with ADP jobs, GDP Q1, and the FOMC.

So, one way or another, we're going to see some strong price action.

3.46pm.. Well, the sp' held the 50 day MA..so.. that is something for the bull maniacs to be relieved about. VIX is +7%, and really, that is kinda lame in the scheme of things. Even the mid teens seem hard to achieve.

3.55pm... been a good week...back at the close!

sp'60min

Summary

Well, another week is coming to a close.

Today's weakness is interesting (more so in the R2K, Trans, Nasdaq), but I am still looking for the sp'1900s. Hourly MACD (blue bar histogram) cycle looks floored, although there is clearly no turn..yet.

--

I will hold long across the weekend, CHK, STX, and short- SLV. Will be seeking to pick up RIG (again) next Monday in the 42.25/41.75 zone.

-

updates into the close....

3.25pm.. not much happening...just minor weak chop.

Notable that AMZN held the big $300 level, whilst AAPL is still actually net higher!

3.33pm.. RIG continues to weaken..and another 50/75 cents lower on Monday..and I'll pick that one up again.

Next week is a HUGE week, especially Wednesday with ADP jobs, GDP Q1, and the FOMC.

So, one way or another, we're going to see some strong price action.

3.46pm.. Well, the sp' held the 50 day MA..so.. that is something for the bull maniacs to be relieved about. VIX is +7%, and really, that is kinda lame in the scheme of things. Even the mid teens seem hard to achieve.

3.55pm... been a good week...back at the close!

2pm update - the chop continues

US indexes remain choppy, holding moderate declines, although we do have much more significant weakness in the R2K -1.6%, and the Trans -1.5%. VIX is +8%, but still 'only' in the mid 14s. Metals are mixed, Gold +$7, whilst Silver is fractionally red.

sp'60min

Summary

*Arguably, based on the past few weeks, today is an opportunity for those on the short side to bail into the weekend. I realise though, some will be calling for much lower levels next week.

-

So...some weakness to end the week, especially in the two leaders. Personally, I think everyone should be pleased with today. Bulls are getting a new entry level, whilst bears are getting a chance to bail at somewhat lower levels.

--

re: RIG. I continue to have a major interest in this stock..

exited LONG at 43.30...now have a new long-entry target of the low 42s next Monday.

Something I will consider across the weekend

-

2.16pm.. VIX is creeping higher....'weakness into the weekend'. but to be clear, I'd still be seeking the sp'1900s within the near term.

RIG continues to melt lower, and a re-purchase in the low 42s next Monday...very viable.

2.25pm.. new low. 1860..and here come the 1850s... there will be STRONG support at the 50 day MA of 1858, so we might get stuck there.

Regardless.. the weaker bull hands are getting washed out today.

-

2.42pm.. a spike floor. just above the 50 day MA? Hmm

I have to think bears are still getting an opportunity to exit here..before the 1900s.

sp'60min

Summary

*Arguably, based on the past few weeks, today is an opportunity for those on the short side to bail into the weekend. I realise though, some will be calling for much lower levels next week.

-

So...some weakness to end the week, especially in the two leaders. Personally, I think everyone should be pleased with today. Bulls are getting a new entry level, whilst bears are getting a chance to bail at somewhat lower levels.

--

re: RIG. I continue to have a major interest in this stock..

exited LONG at 43.30...now have a new long-entry target of the low 42s next Monday.

Something I will consider across the weekend

-

2.16pm.. VIX is creeping higher....'weakness into the weekend'. but to be clear, I'd still be seeking the sp'1900s within the near term.

RIG continues to melt lower, and a re-purchase in the low 42s next Monday...very viable.

2.25pm.. new low. 1860..and here come the 1850s... there will be STRONG support at the 50 day MA of 1858, so we might get stuck there.

Regardless.. the weaker bull hands are getting washed out today.

-

2.42pm.. a spike floor. just above the 50 day MA? Hmm

I have to think bears are still getting an opportunity to exit here..before the 1900s.

1pm update - chop into the afternoon

US indexes are holding moderate declines, with the sp' in the mid 1860s, a fair way below the Thursday high of 1884. Equity bulls should be seeking a weekly close back in the 1870s, which would set up the first half of next week.

sp'60min

Summary

Barring a secondary wave lower this afternoon..into the sp'1850s, with VIX 15s, I can't consider today as anything but a minor retrace.

Bears been teased time and time again lately..I don't see this as any different.

-

Out of RIG

I was intentionally stopped out of RIG just earlier at 43.30, which I'm very pleased with.. Price structure on the hourly looks like a castle top...and I'm glad to be out!.

60min

A retrace into the low 42s into Monday..would make for an interesting pickup level.

-

1.21pm.. Another minor wave lower, and VIX is back on the climb.

Best case for the bears remains 1850/45... with VIX 15s.

sp'60min

Summary

Barring a secondary wave lower this afternoon..into the sp'1850s, with VIX 15s, I can't consider today as anything but a minor retrace.

Bears been teased time and time again lately..I don't see this as any different.

-

Out of RIG

I was intentionally stopped out of RIG just earlier at 43.30, which I'm very pleased with.. Price structure on the hourly looks like a castle top...and I'm glad to be out!.

60min

A retrace into the low 42s into Monday..would make for an interesting pickup level.

-

1.21pm.. Another minor wave lower, and VIX is back on the climb.

Best case for the bears remains 1850/45... with VIX 15s.

12pm update - intraday floor... probably

The market has seen some interesting weakness, but appears to have likely floored for the day in the typical turn time of the 11am hour. Bull maniacs should be seeking a weekly close in the sp'1875/80 zone, with VIX back in the 13s. Metals are starting to slide, with Silver fractionally lower.

sp'60min

vix'60min

Summary

I think we have a floor, but there remains risk of a secondary wave lower into the close - although weekly charts argue against it.

-

So...I'm long, and I still have ZERO intention of meddling on short side for some time.

-

VIX update from Mr T

--

time to cook

--

12.20pm..RIG looks a little toppy on the smaller cycles..I'm on a huge gain...seeking to get stopped out...at 43.30.

12.22pm.. KICKED from long- RIG.... frankly, a great gain to end the week. Will probably pick up again next week.

sp'60min

vix'60min

Summary

I think we have a floor, but there remains risk of a secondary wave lower into the close - although weekly charts argue against it.

-

So...I'm long, and I still have ZERO intention of meddling on short side for some time.

-

VIX update from Mr T

--

time to cook

--

12.20pm..RIG looks a little toppy on the smaller cycles..I'm on a huge gain...seeking to get stopped out...at 43.30.

12.22pm.. KICKED from long- RIG.... frankly, a great gain to end the week. Will probably pick up again next week.

11am update - continuing weakness

US equities are lower, but nothing 'significant yet'. Any break <sp'1860, will offer the best bear case of a gap zone fill around 1845. Metals are holding moderate gains, Gold +$8. VIX is higher by 8%, but that amounts to the 14.40s - not exactly 'market fear'.

sp'60min

Summary

We're now at the typical turn/floor time of 11am..so lets see if the bull maniacs can turn this around, and battle back into the 1870s by 1pm or so.

-

Notable weakness, AMZN -9% at $304. If the 300s are lost, then 260/40, but that would be something of a surprise.

-

VIX is trying to make a break for the low 15s

sp'1845 wit VIX 15s..and then a turn?

-

11.07am... VIX +9%...seemingly headed for 15.25 or so...with sp'1850s.

11.27am.. market trying to put in a spike floor... bears...beware!

*notable strength in the Oil/Gas service sector...RIG already green, and set for the 44/45s.

sp'60min

Summary

We're now at the typical turn/floor time of 11am..so lets see if the bull maniacs can turn this around, and battle back into the 1870s by 1pm or so.

-

Notable weakness, AMZN -9% at $304. If the 300s are lost, then 260/40, but that would be something of a surprise.

-

VIX is trying to make a break for the low 15s

sp'1845 wit VIX 15s..and then a turn?

-

11.07am... VIX +9%...seemingly headed for 15.25 or so...with sp'1850s.

11.27am.. market trying to put in a spike floor... bears...beware!

*notable strength in the Oil/Gas service sector...RIG already green, and set for the 44/45s.

10am update - opening moderate weakness

US indexes are seeing another bout of moderate weakness, with the support zone of sp'1875/70 marginally broken. Equity bulls should push higher into the late afternoon, for a weekly close in the 1880s. Metals are holding moderate gains, Gold +$8.

sp'60min

Summary

*I picked up a third long position, STX, from the 53.50s. Seeking a provisional exit in the 57/58s, and will thus hold across the weekend.

--

So..a little weakness, but still...I just don't see any significant power on the downside.

With 2 sig' QE next Mon/Tuesday, bears face problems into Wednesday afternoon.

-

Notable weakness, OPEN -3%...having broken the floor yesterday.

A look at AMZN...

AMZN needs to hold the $300s, or next level is around $260/40 zone. I guess the notion of PE 300s is not exactly enticing many today. Shame.

10.22am... market stabilising, and bears are in trouble again.

sp'60min

Summary

*I picked up a third long position, STX, from the 53.50s. Seeking a provisional exit in the 57/58s, and will thus hold across the weekend.

--

So..a little weakness, but still...I just don't see any significant power on the downside.

With 2 sig' QE next Mon/Tuesday, bears face problems into Wednesday afternoon.

-

Notable weakness, OPEN -3%...having broken the floor yesterday.

A look at AMZN...

AMZN needs to hold the $300s, or next level is around $260/40 zone. I guess the notion of PE 300s is not exactly enticing many today. Shame.

10.22am... market stabilising, and bears are in trouble again.

Pre-Market Brief

Good morning. Futures are moderately lower, sp -5pts, we're set to open at 1873. Metals are higher, Gold +$8. Equity bulls should be seeking a weekly close in the sp'1880s, with likely follow through 1890/1900 by next Wednesday.

sp'60min

Summary

*awaiting PMI service and consumer sentiment data later this morning

--

Ford (F) earnings - missed, stock -2.3% in the upper 15s.

--

So, we're set to open a little lower.

Notably, there remain geo-political 'rumblings' in the Ukraine, but that sure hasn't much helped the equity bears lately.

What matters more than anything though is price, and the broader weekly index cycles are suggestive of at least a few more weeks of upside, and that will get us comfortably into early May.

-

Friday update from Hunter

I would certainly agree that China/Japan remains a major simmering issue - more important than the Ukraine in my view. China wants those rocks...and what is underneath.

-

Good wishes for Friday..its almost the weekend!

-

9.00am... Notable weakness in AMZN, -5%. I guess a PE ratio of 320 is a little pricey for Mr Market?

*I'm looking at STX, as my next earnings play. Great company, although the setup is not as good as RIG/CHK. hmm

9.37am.. minor morning washout.... little reason why this will last.

AMZN -8%...which is certainly amusing to see, but even there, the momo chasers might appear pretty soon.

9.42am.. LONG STX, from the 53.50s.. will likely hold across next week or two.

sp'60min

Summary

*awaiting PMI service and consumer sentiment data later this morning

--

Ford (F) earnings - missed, stock -2.3% in the upper 15s.

--

So, we're set to open a little lower.

Notably, there remain geo-political 'rumblings' in the Ukraine, but that sure hasn't much helped the equity bears lately.

What matters more than anything though is price, and the broader weekly index cycles are suggestive of at least a few more weeks of upside, and that will get us comfortably into early May.

-

Friday update from Hunter

I would certainly agree that China/Japan remains a major simmering issue - more important than the Ukraine in my view. China wants those rocks...and what is underneath.

-

Good wishes for Friday..its almost the weekend!

-

9.00am... Notable weakness in AMZN, -5%. I guess a PE ratio of 320 is a little pricey for Mr Market?

*I'm looking at STX, as my next earnings play. Great company, although the setup is not as good as RIG/CHK. hmm

9.37am.. minor morning washout.... little reason why this will last.

AMZN -8%...which is certainly amusing to see, but even there, the momo chasers might appear pretty soon.

9.42am.. LONG STX, from the 53.50s.. will likely hold across next week or two.

Upside into the next FOMC

US equities saw minor price chop across the day, with the support zone of sp'1875/70 holding. Market looks set for general upside into the FOMC of next Wednesday. From there, the big unknown is whether the market will begin a significant decline at the announcement of QE-taper'4.

sp'weekly8

Summary

We continue to have the second consecutive green candle on the 'rainbow' weekly charts. Unquestionably, the broader trend remains to the upside, and I certainly have ZERO intention of trying to short this market in the immediate term.

-

Looking ahead

Friday will see PMI services, and consumer sentiment data. If those come in 'reasonable' it'll be probably enough reason for the market to melt higher into the 1890s by the weekly close.

*next sig' QE-pomo is not until next Monday.

-

Permabear still going long

Today was a pretty good day in the London bunker. An early FCX exit (earnings weren't great, but the stock opened higher anyway), and RIG battled strongly higher across the day. The only annoyance was SLV, which saw a sharp opening reversal to the upside. Oh well, I am prepared to wait until next weeks FOMC, at which point I still expect another opportunity for the metals to get smacked lower.

I even picked up a secondary long into the close - CHK, a good company, with what looks to be a reasonable 5-10% of upside into May.

Don't ever tell me 'the Permabear is a one sided trader who never goes long'!

Goodnight from London

sp'weekly8

Summary

We continue to have the second consecutive green candle on the 'rainbow' weekly charts. Unquestionably, the broader trend remains to the upside, and I certainly have ZERO intention of trying to short this market in the immediate term.

-

Looking ahead

Friday will see PMI services, and consumer sentiment data. If those come in 'reasonable' it'll be probably enough reason for the market to melt higher into the 1890s by the weekly close.

*next sig' QE-pomo is not until next Monday.

-

Permabear still going long

Today was a pretty good day in the London bunker. An early FCX exit (earnings weren't great, but the stock opened higher anyway), and RIG battled strongly higher across the day. The only annoyance was SLV, which saw a sharp opening reversal to the upside. Oh well, I am prepared to wait until next weeks FOMC, at which point I still expect another opportunity for the metals to get smacked lower.

I even picked up a secondary long into the close - CHK, a good company, with what looks to be a reasonable 5-10% of upside into May.

Don't ever tell me 'the Permabear is a one sided trader who never goes long'!

Goodnight from London

Daily Index Cycle update

US indexes saw some mixed chop across the day, sp +3pts @ 1878. The two leaders - Trans/R2K, settled -0.4% and -0.2% respectively. Near term outlook is for the sp'1900s, which seems very viable by next Wednesday. How the market copes with QE-taper'4, is another matter entirely.

sp'daily5

R2K

Trans

Summary

Suffice to say, today was pretty interesting to be part of, but many of the daily charts are suggestive that today's weakness was just another little tease to the equity bears.

With sig' QE-pomo next Mon/Tuesday, bears face likely problems for at least the first half of next week.

-

a little more later...

sp'daily5

R2K

Trans

Summary

Suffice to say, today was pretty interesting to be part of, but many of the daily charts are suggestive that today's weakness was just another little tease to the equity bears.

With sig' QE-pomo next Mon/Tuesday, bears face likely problems for at least the first half of next week.

-

a little more later...

Subscribe to:

Comments (Atom)