With equities holding gains into the close, the VIX settled -3.6% @ 13.73 (intra low 13.40). Near term outlook is mixed, with a small opportunity for downside to the sp'2080s - with VIX 16s, before renewed equity upside into the next FOMC of June 17th.

VIX'60min

VIX'daily3

Summary

Market volatility remains incredibly low considering Greece remains on the edge of a cliff.

As things are, I'd guess Greece will manage to kick the can into July.. or August.. but will default/GREXIT later this year.

For the moment, the big VIX 20 threshold looks out of range for some weeks... at least until after the next FOMC (June 17th).

--

more later... on the indexes

Wednesday, 3 June 2015

Closing Brief

US equities closed notably positive, sp +4pts @ 2114 (intra high 2121). The two leaders - Trans/R2K, settled higher by a significant 1.2% and 1.0% respectively. Near term outlook is mixed, with new historic highs due in some (certainly not all) indexes into the next FOMC of June 17th.

sp'60min

Summary

*closing hour was mild chop... nothing much for either side to tout.

--

A bit of a messy day, but there was a clear morning upside break above resistance of sp'2115.

The daily close is borderline within the downward trend (from 2034), although the low sp'2080s look a damn tough challenge before the week concludes.

Best guess? Moderate chance of further weakness before the weekend, but new historic highs - in the 2160/80 zone look due within a few weeks.

-

the usual bits and pieces across the evening to wrap up the day.

sp'60min

Summary

*closing hour was mild chop... nothing much for either side to tout.

--

A bit of a messy day, but there was a clear morning upside break above resistance of sp'2115.

The daily close is borderline within the downward trend (from 2034), although the low sp'2080s look a damn tough challenge before the week concludes.

Best guess? Moderate chance of further weakness before the weekend, but new historic highs - in the 2160/80 zone look due within a few weeks.

-

the usual bits and pieces across the evening to wrap up the day.

3pm update - another weak closing hour?

US equity indexes are holding moderate gains, with the sp'500 above key resistance. The smaller 5/15min cycles are offering a minor snap lower into the close. Equity bears should be desperate for a daily close <sp'2115.. if not <2110. Metals and are both weak, despite the cooling USD.

sp'60min

VIX'60min

Summary

*incredible market complacency -as reflected in the VIX.. as Greek remains close to the edge.

--

We have an interesting closing hour ahead...

A daily close <sp'2110 would keep open the door to a washout in the low sp'2080s before the next wave higher (into FOMC of June 17th).

-

Fed official Bullard (the one who helped mark the mid Oct' low) is holding a press' conf at 4pm.

-

3.05pm... In theory.. a daily close of 2105 is viable.. esp' supported on the smaller 5/15/60min cycles.

Will the bears show up? From a pure cyclical perspective.. the setup is near perfect.

3.18pm.. a touch weakness @ sp'2114.... Hmmmmm. Eyes to the VIX !

3.20pm.. The more important hourly cycle set to turn negative at the Thursday open... certainly favours the bears.

.. seeking a daily VIX close in the low 14s.

sp'60min

VIX'60min

Summary

*incredible market complacency -as reflected in the VIX.. as Greek remains close to the edge.

--

We have an interesting closing hour ahead...

A daily close <sp'2110 would keep open the door to a washout in the low sp'2080s before the next wave higher (into FOMC of June 17th).

-

Fed official Bullard (the one who helped mark the mid Oct' low) is holding a press' conf at 4pm.

-

3.05pm... In theory.. a daily close of 2105 is viable.. esp' supported on the smaller 5/15/60min cycles.

Will the bears show up? From a pure cyclical perspective.. the setup is near perfect.

3.18pm.. a touch weakness @ sp'2114.... Hmmmmm. Eyes to the VIX !

3.20pm.. The more important hourly cycle set to turn negative at the Thursday open... certainly favours the bears.

.. seeking a daily VIX close in the low 14s.

2pm update - time for a fed book

Equities are holding minor gains, sp +4pts @ 2114 - back under (broken) resistance, ahead of the latest Fed beige book (due 2pm). USD has recovered a little from earlier lows, -0.4% in the DXY 95.40s. Metals remain weak, Gold -$9. Oil is seeing some rather severe downside, -3.0% in the $59s.

sp'60min

sp'daily5

Summary

A daily close UNDER resistance of sp'2115 is absolutely essential for ANY hope of the low sp'2080s.. whether tomorrow or Friday.

-

... lets see what the fed have to say....

-

2.01pm... a rosy coloured fed book... largely claiming is fine.

Equities a touch higher.. sp +6pts @ 2115.

As ever.. typical turn time is around 2.30pm... so now its again a case of whether we'll see weakness into the close.

For the bears.. at least the smaller 5/15min cycles are offering a rollover from current levels.

sp'60min

sp'daily5

Summary

A daily close UNDER resistance of sp'2115 is absolutely essential for ANY hope of the low sp'2080s.. whether tomorrow or Friday.

-

... lets see what the fed have to say....

-

2.01pm... a rosy coloured fed book... largely claiming is fine.

Equities a touch higher.. sp +6pts @ 2115.

As ever.. typical turn time is around 2.30pm... so now its again a case of whether we'll see weakness into the close.

For the bears.. at least the smaller 5/15min cycles are offering a rollover from current levels.

1pm update - metals having problems

Whilst equities hold minor gains, there has been a notable snap lower in the precious metals. Broader price formation on the daily and weekly cycles remain bear flags within a viable giant H/S formation... the psy' level of $1000 for Gold looks due this summer/early autumn.

GLD, 5min

GLD, daily

Summary

*understand my focus this hour on Gold.. which I remain short. Relative to the USD weakness, this is a really dire performance for the metalic relic.

--

As for equities, we have an interesting afternoon ahead, with a Fed beige book and two fed officials due to speak.

The daily close will be VERY important. Arguably, equity bears need a sub sp'2110 close to hold out a 'moderate hope' that the low 2080s are still viable before the weekend.

--

stay tuned!

GLD, 5min

GLD, daily

Summary

*understand my focus this hour on Gold.. which I remain short. Relative to the USD weakness, this is a really dire performance for the metalic relic.

--

As for equities, we have an interesting afternoon ahead, with a Fed beige book and two fed officials due to speak.

The daily close will be VERY important. Arguably, equity bears need a sub sp'2110 close to hold out a 'moderate hope' that the low 2080s are still viable before the weekend.

--

stay tuned!

12pm update - failed break?

US equities are cooling ahead of a number of US Fed aspects this afternoon. The equity bears should be desperate for a daily close <sp'2110. USD remains weak, -0.5% @ DXY 95.30s. Metals remain weak, Gold -$3... performing very badly... relative to the USD.

sp'60min

GLD, daily

Summary

*metals not looking great, there is a clear $20 downside viable in the near term for spot Gold prices, equiv to GLD -$2 to the low 112s.

--

Things are getting kinda interesting again.

Equity bears should be desperately clawing for a daily close <2110.

--

VIX update from Mr T.

--

time for lunch :)

sp'60min

GLD, daily

Summary

*metals not looking great, there is a clear $20 downside viable in the near term for spot Gold prices, equiv to GLD -$2 to the low 112s.

--

Things are getting kinda interesting again.

Equity bears should be desperately clawing for a daily close <2110.

--

VIX update from Mr T.

--

time for lunch :)

11am update - resistance FAILS to hold

US equities break above declining resistance of sp'2115... climbing to a morning high of 2121. With the upside break, hopes of 2090/80 zone are now rapidly fading to nothing. If the market likes the Fed beige book (2pm), along with comments from fed officials Evans and Bullard... probable upside into early Thursday.

sp'60min

UUP, daily2

Summary

*despite early strength, the USD is lower for the second day.. and the DXY 94s are now well within range.

--

A clear fail for the equity bears... and there is little reason for any of the short term bears to still be holding.

Price action is pretty lacklustre though, but an upside break IS an upside break. VIX is confirming the utter lack of market concern about Greece, -5% in the mid 13s.

--

time to cook...

sp'60min

UUP, daily2

Summary

*despite early strength, the USD is lower for the second day.. and the DXY 94s are now well within range.

--

A clear fail for the equity bears... and there is little reason for any of the short term bears to still be holding.

Price action is pretty lacklustre though, but an upside break IS an upside break. VIX is confirming the utter lack of market concern about Greece, -5% in the mid 13s.

--

time to cook...

10am update - vulnerable gains

US equity indexes open higher, but the gains look highly vulnerable to reversing. USD has turned lower, -0.2% in the DXY 95.60s... post Draghi depression? Metals are weak, Gold -$3, with Silver -1.1%.

sp'60min

GLD, daily

Summary

*price structure in the metals remains a bear flag... within a viable giant H/S formation. Outlook remains bearish... and I'm still short Gold - via GLD.

--

PMI serv' 56s... inline.

--

In equity land... The battle continues!

It is very clear how important the declining trend/resistance currently is... market is really respecting that line.

Right now.. the door remains open to a mini washout in the low sp'2080s... along with VIX 16s.

-

notable strength, social media, FB/TWTR, both +2%.. as the momo chasers re-appear.

-

10.01am ISM serv' sector, 55.7... not great... but not dire either.

-

awaiting the EIA oil report at 10.30am....

10.45am.. a clear break above resistance... urghh

The weaker USD is really helping prop up a lot of asset classes this morning.

sp'60min

GLD, daily

Summary

*price structure in the metals remains a bear flag... within a viable giant H/S formation. Outlook remains bearish... and I'm still short Gold - via GLD.

--

PMI serv' 56s... inline.

--

In equity land... The battle continues!

It is very clear how important the declining trend/resistance currently is... market is really respecting that line.

Right now.. the door remains open to a mini washout in the low sp'2080s... along with VIX 16s.

-

notable strength, social media, FB/TWTR, both +2%.. as the momo chasers re-appear.

-

10.01am ISM serv' sector, 55.7... not great... but not dire either.

-

awaiting the EIA oil report at 10.30am....

10.45am.. a clear break above resistance... urghh

The weaker USD is really helping prop up a lot of asset classes this morning.

Pre-Market Brief

Good morning. Futures are moderately higher, sp +10pts, we're set to open at 2119. USD is bouncing, +0.4% @ DXY 96.10s. Metals are a little lower, Gold -$2. Oil is shaky, -1.3%, as the OPEC meeting looms this Friday.

sp'60min

Summary

*awaiting a wheel barrow of econ-data today.... and don't forget the Fed beige book due at 2pm

The ECB rate decision: no change. A Draghi press conf. is set for 8.30am EST. That will be market moving.. esp' for the currencies, and by default metals/oil

--

So, we're set to open slightly above declining trend/resistance... currently at sp'2115

Like Mon/Tuesday, a break above would surely negate any chance of renewed weakness to the sp'2080s.

Equity bears should be desperate for a pre-market swing back <2115, or this could spiral out of control to the upside. Right now... it not looking good.

--

Update from a typically loud Oscar

Certainly, I agree with Mr C. on Gold, the H/S formation, if correct would be highly supportive of Gold falling to the giant $1000 threshold by the early autumn.

--

Doomer chat, Hunter with Morgan

As ever, make of that... what you will.

--

Good wishes for Wednesday trading

-

8.16am.. ADP jobs: 201k vs 165k previous... one of the better data points in recent weeks. Bodes 'okay' for the Friday jobs data.

9.00am.. sp +6pts... we're set to open at resistance of 2115. Bears really need an opening reversal...

..Draghi talking.... its getting a little tiresome already, these press' conferences feel like they last many.... many hours.

sp'60min

Summary

*awaiting a wheel barrow of econ-data today.... and don't forget the Fed beige book due at 2pm

The ECB rate decision: no change. A Draghi press conf. is set for 8.30am EST. That will be market moving.. esp' for the currencies, and by default metals/oil

--

So, we're set to open slightly above declining trend/resistance... currently at sp'2115

Like Mon/Tuesday, a break above would surely negate any chance of renewed weakness to the sp'2080s.

Equity bears should be desperate for a pre-market swing back <2115, or this could spiral out of control to the upside. Right now... it not looking good.

--

Update from a typically loud Oscar

Certainly, I agree with Mr C. on Gold, the H/S formation, if correct would be highly supportive of Gold falling to the giant $1000 threshold by the early autumn.

--

Doomer chat, Hunter with Morgan

As ever, make of that... what you will.

--

Good wishes for Wednesday trading

-

8.16am.. ADP jobs: 201k vs 165k previous... one of the better data points in recent weeks. Bodes 'okay' for the Friday jobs data.

9.00am.. sp +6pts... we're set to open at resistance of 2115. Bears really need an opening reversal...

..Draghi talking.... its getting a little tiresome already, these press' conferences feel like they last many.... many hours.

Rough day for King Dollar

As the chatter on Greece continued, the USD saw a major net daily decline of -1.5% @ DXY 95.99 (intra low 95.71). The broader trend remains unquestionably bullish, but a retrace to the low 90s into July now looks increasingly probable.

USD, daily2

USD, monthly'3

Summary

It has been a long day... and I've nothing more to add on the USD.

--

Looking ahead

Wed' will see ADP jobs, intl. trade, ISM/PMI service sector data, with a Fed beige book (2pm).

Fed officials Evans and Bullard are due to speak in the afternoon.

-

Goodnight from a tired London

USD, daily2

USD, monthly'3

Summary

It has been a long day... and I've nothing more to add on the USD.

--

Looking ahead

Wed' will see ADP jobs, intl. trade, ISM/PMI service sector data, with a Fed beige book (2pm).

Fed officials Evans and Bullard are due to speak in the afternoon.

-

Goodnight from a tired London

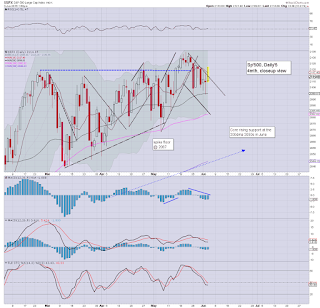

Daily Index Cycle update

US equities closed moderately mixed, sp -2pts @ 2109 (intra low 2099).

The two leaders - Trans/R2K, both settled higher by around 0.2%. Near term

outlook remains for further weakness to the 2090/80 zone, with renewed

strength into the next FOMC of June 17th

sp'daily5

Dow

Summary

Little to add.

A second day of moderate chop.. with marginal lower highs.. and lower lows for most indexes.

Further weakness to the sp'2080s looks due.

--

a little more later..

sp'daily5

Dow

Summary

Little to add.

A second day of moderate chop.. with marginal lower highs.. and lower lows for most indexes.

Further weakness to the sp'2080s looks due.

--

a little more later..

Subscribe to:

Comments (Atom)