To all traders, whether you are a deluded bullish maniac, or a doomer bear...sincerely....good holiday wishes to you.

What did I ask for in my Santa wish list?

Besides asking for an end to the US Federal Reserve, fractional banking, and world peace, I'd gladly settle for just Sp'1225.

Although I don't expect delivery on the latter until at least mid-January ;)

--

*Your resident permabear will return on Wednesday.

Monday, 24 December 2012

Daily Market Wrap

The market saw moderate declines for the first time on Christmas Eve since 2007. The sp' closed @ 1426.66 The VIX managed minor gains of 4% @ 18.57, and even Mr $ recovered earlier declines to close fractionally higher @ USD 79.65

Sp'daily5

VIX'daily

Summary

So, a quiet day in market land, but for those seeking major downside later this week, it was a very acceptable way to take us across the Christmas holiday.

The sp' is just 13pts from the key 1413 low, with a secondary key low @ 1398.

If the market can put in a daily close <1398, it should be a VERY decisive moment, and open the door to a 2-3 week decline into the low sp'1200s.

One minor post..to appear late tonight.

Sp'daily5

VIX'daily

Summary

So, a quiet day in market land, but for those seeking major downside later this week, it was a very acceptable way to take us across the Christmas holiday.

The sp' is just 13pts from the key 1413 low, with a secondary key low @ 1398.

If the market can put in a daily close <1398, it should be a VERY decisive moment, and open the door to a 2-3 week decline into the low sp'1200s.

One minor post..to appear late tonight.

Closing Brief

The market closed with very moderate declines. This is the first Christmas Eve since 2007 that we closed lower. A sign? Bears should be seeking a major snap lower <sp'1400, more likely on Thurs/Friday, than Wednesday.

dow'60min

sp'60min

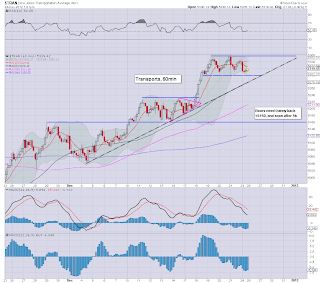

trans'60min

Summary

As I have said all along, no fiscal cliff agreement would be reached..until AFTER the market gets whacked. It happened in 2008 (TARP vote'1), and last summer - with the debt ceiling debacle.

The political maniacs are reactive, NEVER pre-emptive... well, except when its comes to invading other sovereign nations, ;)

I would honestly be utterly bemused and shocked if some 'magical' agreement is announced within the next 3 weeks. Instead, it still looks like NOTHING will be agreed until late January...if at all.

*a wrap up on the bigger daily charts later..and then thats it until Wednesday.

For those not checking up later...

Merry Christmas...from London City.

dow'60min

sp'60min

trans'60min

Summary

As I have said all along, no fiscal cliff agreement would be reached..until AFTER the market gets whacked. It happened in 2008 (TARP vote'1), and last summer - with the debt ceiling debacle.

The political maniacs are reactive, NEVER pre-emptive... well, except when its comes to invading other sovereign nations, ;)

I would honestly be utterly bemused and shocked if some 'magical' agreement is announced within the next 3 weeks. Instead, it still looks like NOTHING will be agreed until late January...if at all.

*a wrap up on the bigger daily charts later..and then thats it until Wednesday.

For those not checking up later...

Merry Christmas...from London City.

12pm update - the closing Santa hour

Market seems content to flat line, with moderate declines, and we're steady around sp'1425/26. Most notable change so far today, Mr $, which is now slightly higher after earlier declines of 0.2%. The VIX is holding onto small gains of 3%

sp'daily5

sp'weekly

Summary

So..not much going on, but..there is certainly a continuation of the trend.

The weekly cycle charts are on the edge. Unless we break back under sp'1400 'soon', the weekly charts will see momentum flip to bullish.

This would break what some - myself included, were seeing as the pattern from July/August 2011, where despite a ramp, there never was a decisive buy signal on the weekly charts.

How we close this week will probably offer a clear indication of whether we'll see a January wash-out to the low sp'1200s.

-

back after the close

sp'daily5

sp'weekly

Summary

So..not much going on, but..there is certainly a continuation of the trend.

The weekly cycle charts are on the edge. Unless we break back under sp'1400 'soon', the weekly charts will see momentum flip to bullish.

This would break what some - myself included, were seeing as the pattern from July/August 2011, where despite a ramp, there never was a decisive buy signal on the weekly charts.

How we close this week will probably offer a clear indication of whether we'll see a January wash-out to the low sp'1200s.

-

back after the close

10am update - problems ahead

The market is seeing a little weakness. The lows from last Friday (sp'1422) could easily be tested. From a technical perspective, the market is very likely to see significant falls this Thursday/Friday.

sp'daily5

VIX, daily

Summary

Just look at the technicals on the daily indexes.

At the current rate, we'll see the MACD (blue bar histogram) go negative cycle this Thursday/Friday, and we should also see a bearish MACD cross (black line under red).

I'm going to stick my neck out and suggest we will be trading in the sp'1390s by the end of this week.

--

Mr $ is a little weak. with VIX slightly higher.

*my key moody/doomer stocks.. BTU, ANR, HPQ, all seeing weakness of 1-2%.

--

UPDATE 11.13 am Weakness still out there....

Seeking a break of the big sp'1400 level this Thursday/Friday.

HPQ...due to bearish later this week

target remains the big 10$

sp'daily5

VIX, daily

Summary

Just look at the technicals on the daily indexes.

At the current rate, we'll see the MACD (blue bar histogram) go negative cycle this Thursday/Friday, and we should also see a bearish MACD cross (black line under red).

I'm going to stick my neck out and suggest we will be trading in the sp'1390s by the end of this week.

--

Mr $ is a little weak. with VIX slightly higher.

*my key moody/doomer stocks.. BTU, ANR, HPQ, all seeing weakness of 1-2%.

--

UPDATE 11.13 am Weakness still out there....

Seeking a break of the big sp'1400 level this Thursday/Friday.

HPQ...due to bearish later this week

target remains the big 10$

Christmas Eve - Pre-Market Brief

Good morning. Just a half trading day today, we close at 1pm. Futures have been consistently lower across the night, it looks like we'll open sp -5pts, @ 1425. Certainly, its nothing for the bears to get excited about.

sp'60min

sp'daily5

Summary

Well, its Christmas Eve 2012, and I'm still here.

I'm not expecting very much today. Its possible we could break <1420, but that will be kinda difficult on very light holiday trading.

I think this time last year the trading range was a mere 2-3pts across as many hours.

--

back at 10am.

sp'60min

sp'daily5

Summary

Well, its Christmas Eve 2012, and I'm still here.

I'm not expecting very much today. Its possible we could break <1420, but that will be kinda difficult on very light holiday trading.

I think this time last year the trading range was a mere 2-3pts across as many hours.

--

back at 10am.

Subscribe to:

Comments (Atom)