With equity indexes climbing for a second consecutive day, the VIX was naturally still in cooling mode, settling -5.1% @ 24.11. Near term outlook threatens a minor equity retrace, but broadly, the VIX looks set for broad cooling to around the key 20 threshold. Upper teens seem 'briefly' viable.

VIX'60min

VIX'daily3

Summary

Suffice to add... equities up... VIX naturally lower.

However, it is notable that the VIX held up relatively well, and again, its highly suggestive that US equities will be vulnerable to much lower levels this spring, with VIX likely to explode back into the 40/50s.

Last weeks VIX peak of 30 is clearly no capitulation in the bigger picture.

--

more later... on the indexes

Tuesday, 16 February 2016

Closing Brief

US equities closed significantly higher for the second consecutive day, sp +30pts @ 1895. The two leaders - Trans/R2K, settled higher by 2.3% and 2.4% respectively. Near term outlook offers threat of a minor retrace to 1871/64, but in any case.. the 1920/30s are highly probable before next opportunity of another major rollover.

sp'60min

Summary

*closing hour action: a lot of minor chop.. with buying into the close

--

The hourly MACD (blue bar histogram) cycle ticked lower. At the current rate, we'll see a bearish cross tomorrow afternoon... ahead of the next pair of oil inventory reports.

So... threat of some cooling, but broadly... the market looks headed another 1.5-2.0% higher.

Time remains an issue, and if you start the bounce count from last Thursday, there is threat the market will hold together for at least 3-4 weeks.

-

In far more important developments... the closing bell was rung by the swimmers.

--

more later... on the VIX

sp'60min

Summary

*closing hour action: a lot of minor chop.. with buying into the close

--

The hourly MACD (blue bar histogram) cycle ticked lower. At the current rate, we'll see a bearish cross tomorrow afternoon... ahead of the next pair of oil inventory reports.

So... threat of some cooling, but broadly... the market looks headed another 1.5-2.0% higher.

Time remains an issue, and if you start the bounce count from last Thursday, there is threat the market will hold together for at least 3-4 weeks.

-

In far more important developments... the closing bell was rung by the swimmers.

|

| Bullish. |

--

more later... on the VIX

3pm update - a second day of gains

Regardless of the exact close, US equity indexes are set for a second consecutive day of net gains, with the sp' likely to settle in the 1880s... with VIX 24/25s. USD is holding sig' gains of 1.0% in the DXY 96.80s. Metals remain under strong downward pressure, Gold -$32, with Silver -3.1%.

sp'60min

GLD, daily2

Summary

The hourly equity chart is showing a few baby candles....its looking increasingly toppy... as the 1871/64 zone looks viable by Thursday... not least if the next Oil inventories are again monstrous.

So.... the market is leaning bearish... for a day or two... but broadly.. we still look headed UP into next week.

-

notable weakness... miners, GDX, daily

Not surprisingly, miners are getting trashed as the metals are in cooling mode. Even Goldman is saying gold is now an outright sell.

-

*re: messages... just realised Disqus is not sending me alerts that I've been receiving messages across today... urghh.... will get back to YOU.

-

back at the close.

sp'60min

GLD, daily2

Summary

The hourly equity chart is showing a few baby candles....its looking increasingly toppy... as the 1871/64 zone looks viable by Thursday... not least if the next Oil inventories are again monstrous.

So.... the market is leaning bearish... for a day or two... but broadly.. we still look headed UP into next week.

-

notable weakness... miners, GDX, daily

Not surprisingly, miners are getting trashed as the metals are in cooling mode. Even Goldman is saying gold is now an outright sell.

-

*re: messages... just realised Disqus is not sending me alerts that I've been receiving messages across today... urghh.... will get back to YOU.

-

back at the close.

2pm update - viable retrace

US equities break a new cycle high of sp'1894, but look vulnerable to cooling to the gap zone of 1871/64. Broadly though, the short term outlook is bullish, with the 1900s due. VIX is finally showing more notable cooling, -5% in the low 24.10s.

sp'60min

VIX'60min

Summary

From a pure hourly cycle perspective.. we're on the high side.. a retrace is due.

Regardless of any such retrace though... a number of consecutive daily closes in the sp'1900s look extremely probable into end month.

--

notable strength... CREE, daily

A 5% gain... back into the $30s... next level is the gap zone of 34/35s. Everyone needs lighting, right?

--

back at 3pm

sp'60min

VIX'60min

Summary

From a pure hourly cycle perspective.. we're on the high side.. a retrace is due.

Regardless of any such retrace though... a number of consecutive daily closes in the sp'1900s look extremely probable into end month.

--

notable strength... CREE, daily

A 5% gain... back into the $30s... next level is the gap zone of 34/35s. Everyone needs lighting, right?

--

back at 3pm

1pm update - somewhat over-stretched

US equities have managed to claw from sp'1810 to 1890 (4.4%), across just 12 trading hours, with the hourly cycles now getting on the overly high side. Metals remain in cooling mode, Gold -$26, with Silver -2.7%. Oil remains choppy, -0.7% in the $29s.. as market is realising supply is NOT being cut.

sp'60min

VIX'60min

Summary

So.. short term... arguably overbought... but with underlying upward pressure into next week... as the sp'1920/30 zone looks highly probable.

Hell, I'm seeing some 'reasonable' talk of 1950/70 before the next rollover.

-

*am updating dozens of individual stock charts... almost all of them remain on the low side... with high probability of broad upside into next week.

--

On CFTV... guest from Deloitte.... highlighting the issue of looming bankruptcies in many energy companies...

The guest wouldn't name any listed names though... not surprisingly.

--

back at 2pm

sp'60min

VIX'60min

Summary

So.. short term... arguably overbought... but with underlying upward pressure into next week... as the sp'1920/30 zone looks highly probable.

Hell, I'm seeing some 'reasonable' talk of 1950/70 before the next rollover.

-

*am updating dozens of individual stock charts... almost all of them remain on the low side... with high probability of broad upside into next week.

--

On CFTV... guest from Deloitte.... highlighting the issue of looming bankruptcies in many energy companies...

The guest wouldn't name any listed names though... not surprisingly.

--

back at 2pm

12pm update - holding gains

US equities remain broadly higher, with the sp'500 headed for the 1900 threshold, which appears viable tomorrow. VIX continues to reflect a market that is somewhat twitchy, only -3% in the 24s. With the the USD +1.0% in the DXY 96.80s, metals are in cooling mode, Gold -$23, with Silver -2.6%.

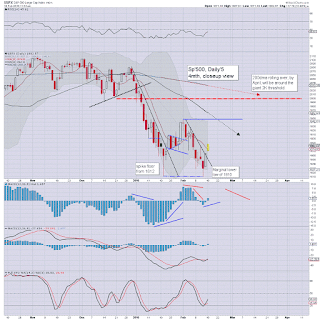

sp'daily5

VIX'daily3

Summary

Seen on the bigger daily cycles, the bounce from sp'1810 looks secure into next week.

The bigger weekly cycles remain on the low side, and in theory.. 4 weeks battling up.. some chop.. and then breaking lower.

The monthly cycles are offering a major break lower across March/April.. and unquestionably..the default trade remains bearish.

--

Meanwhile.. at the NYSE.. some traders have eyes on...

I guess it makes for a valid segment on CFTV.

--

VIX update from Mr T.

--

time for tea

sp'daily5

VIX'daily3

Summary

Seen on the bigger daily cycles, the bounce from sp'1810 looks secure into next week.

The bigger weekly cycles remain on the low side, and in theory.. 4 weeks battling up.. some chop.. and then breaking lower.

The monthly cycles are offering a major break lower across March/April.. and unquestionably..the default trade remains bearish.

--

Meanwhile.. at the NYSE.. some traders have eyes on...

|

| Sports Illustrated at the NYSE |

I guess it makes for a valid segment on CFTV.

--

VIX update from Mr T.

--

time for tea

11am update - bear market under construction

US equities remain broadly higher, but as ever.. there are sellers out there, already cooling the sp'500 from an early high of 1887 to 1876. It is notable that the VIX is so far relatively holding up, -2% in the 24s. Metals remain in cooling mode, Gold -$23, with Silver -2.5%.

sp'60min

Summary

Little to add.

Without getting lost in the minor noise, I'm merely inclined to call today, day'3, of a possible 20 day bounce/rally.

-

notable weakness.. miners, GDX, daily

Not surprisingly, despite a broadly higher market, the gold/silver mining stocks are significantly lower, as the precious metals are cooling from last week's hyper gains. The 200dma should hold into mid March, along with Gold $1180/70.

--

Here in London city...

... much like the bear market......... under construction.

--

time to cook

sp'60min

Summary

Little to add.

Without getting lost in the minor noise, I'm merely inclined to call today, day'3, of a possible 20 day bounce/rally.

-

notable weakness.. miners, GDX, daily

Not surprisingly, despite a broadly higher market, the gold/silver mining stocks are significantly lower, as the precious metals are cooling from last week's hyper gains. The 200dma should hold into mid March, along with Gold $1180/70.

--

Here in London city...

... much like the bear market......... under construction.

--

time to cook

10am update - opening gains

US equities open to the upside, and the market looks set for a significant net daily gain. The sp'1900s are clearly probable, with multiple aspects of resistance in the 1920/30s. Metals are notably weak, cooling from recent hyper gains, Gold -$28, with Silver -2.7%.

sp'60min

VIX'60min

GLD, daily2

Summary

Well, the casino wheel is spinning once more.

Not surprisingly, the cheerleaders on clown finance TV are rather pleased with themselves, although they do seem to recognise that the recent oil inspired ramp is based on very little of substance.

Mr Market is increasingly realising that rumoured talks are more about 'maintaining current supply'... not actual supply cuts.

--

Having broken a marginal lower low in the sp'500 last Thursday, I'm increasingly starting to realise I should maybe start the 20 day bounce clock again.

That doesn't mean we won't max out next week around 1920/30, but it does likely mean the equity bears won't get to see any sustained sig' downside until the latter half of March.

To me, there seems ZERO reason to get involved on the short side until next week at the earliest. Even then, for the option/leverage ETF/ETN players... decay will be an issue.

Anyone playing with March index puts/ VIX calls are likely to get ground to dust.

--

time for some sun

sp'60min

VIX'60min

GLD, daily2

Summary

Well, the casino wheel is spinning once more.

Not surprisingly, the cheerleaders on clown finance TV are rather pleased with themselves, although they do seem to recognise that the recent oil inspired ramp is based on very little of substance.

Mr Market is increasingly realising that rumoured talks are more about 'maintaining current supply'... not actual supply cuts.

--

Having broken a marginal lower low in the sp'500 last Thursday, I'm increasingly starting to realise I should maybe start the 20 day bounce clock again.

That doesn't mean we won't max out next week around 1920/30, but it does likely mean the equity bears won't get to see any sustained sig' downside until the latter half of March.

To me, there seems ZERO reason to get involved on the short side until next week at the earliest. Even then, for the option/leverage ETF/ETN players... decay will be an issue.

Anyone playing with March index puts/ VIX calls are likely to get ground to dust.

--

time for some sun

Pre-Market Brief

Good morning. US equity futures are significantly higher, sp +23pts, we're set to open around 1887. USD is +0.6% in the DXY 96.60s. Metals are rapidly cooling, Gold -$24, with Silver -2.3%. Oil is bouncing, +3.2% in the $39s.

sp'60min

Summary

I noted last Friday, an opening Tuesday gap higher of 20/25pts seemed probable, and here we are.. .set for the sp'1885/95 zone.

Its difficult to say if we'll see a daily close in the 1900s today, but it looks a given as the week proceeds.

Equity bulls look set to continue a bounce into next week.... before the market will likely get stuck around 1920/30.

*I'm well aware some are now touting 2000, 2040/50... or even an attempt at new historic highs. Frankly. even the 2K threshold seems like crazy talk to me.

--

re: Gold, GLD, daily2

We're naturally seeing a retrace of last weeks hyper gains. GLD looks set for 113/112... aka... Gold $1180/70. It is notable that overnight futures saw Gold hit $1191.

Broadly, the $1300 threshold looks an easy target on the next up cycle.

--

Update from Oscar

---

Overnight action

Japan: somewhat choppy, settling +0.2% @ 16054. It is of course notable that the Monday session saw a bizarre hyper gain of >1000pts ... although it seems most acknowledge it was mostly about shorts covering.

China: first trading day of Monkey year.......... +3.3% @ 2836

Germany: currently -0.4% @ 9169

--

Have a good Tuesday

sp'60min

Summary

I noted last Friday, an opening Tuesday gap higher of 20/25pts seemed probable, and here we are.. .set for the sp'1885/95 zone.

Its difficult to say if we'll see a daily close in the 1900s today, but it looks a given as the week proceeds.

Equity bulls look set to continue a bounce into next week.... before the market will likely get stuck around 1920/30.

*I'm well aware some are now touting 2000, 2040/50... or even an attempt at new historic highs. Frankly. even the 2K threshold seems like crazy talk to me.

--

re: Gold, GLD, daily2

We're naturally seeing a retrace of last weeks hyper gains. GLD looks set for 113/112... aka... Gold $1180/70. It is notable that overnight futures saw Gold hit $1191.

Broadly, the $1300 threshold looks an easy target on the next up cycle.

--

Update from Oscar

---

Overnight action

Japan: somewhat choppy, settling +0.2% @ 16054. It is of course notable that the Monday session saw a bizarre hyper gain of >1000pts ... although it seems most acknowledge it was mostly about shorts covering.

China: first trading day of Monkey year.......... +3.3% @ 2836

Germany: currently -0.4% @ 9169

--

Have a good Tuesday

Subscribe to:

Comments (Atom)