US equity indexes closed on the weaker side, sp -1.8pts at 2470. The

two leaders - Trans/R2K, settled lower by -0.5% and -0.3% respectively.

VIX settled -0.3% at 10.26. Near term outlook offers a sig' down day to at least partly fill the gap

zone of 2435/25.

sp'daily5

VIX'daily3

Summary

US equities opened moderately mixed, and remained that way into the monthly close. The Dow did break a new historic high, whilst the sp' closed net lower for a third day. There is indeed some disparity between the indexes.

YTD performance, 6 indexes...

--

Market volatility remains very subdued, and its notable that despite equities leaning a little lower in the closing minutes, there were some 'games' being played, with the VIX actually knocked from 10.64 to 10.26. Near term offers sp'2435, and that should equate to VIX in the 12s, the 13/14s on a stretch.. and briefly!

A very bullish July, sp'monthly

A fourth consecutive net monthly gain of 46pts (1.9%) to 2470, with a notable new historic high of 2484.

-

... a short term bearish ray of light for the equity bears to sp'2435.

Goodnight from London

--

Monday, 31 July 2017

Saturday, 29 July 2017

Weekend update - US weekly indexes

It was a very mixed week for US equity indexes,

with net weekly changes ranging from +1.2%

(Dow), u/c (sp'500), -0.5% (R2K), to

-2.6% (Transports). Near term outlook offers weakness of around 1.5% to sp'2435. Broadly, the 2500s look due by September. The year end target of 2683 remains on track.

Lets take our regular look at six of the main US indexes

sp'500

The sp'500 effectively settled the week u/c at 2472, but with a notable new historic high of 2484. The key 10MA is currently at 2441. Underlying MACD (blue bar histogram) cycle is fractionally positive. Its notable the upper bollinger will be offering the 2500s by mid August.

Best guess: near term weakness to 2435, before resuming upward to the 2500s in August. By mid/late Sept', the 2525/50 zone, then a 4-5% retrace... no lower than 2400. A fed rate rise in September would help raise capital market confidence, and offer a powerful climb to the 2600/700s by year end.

Equity bears have nothing to tout unless short term price action <2425. Mid term rising trend will be around 2360 next week, and that looks out of range. Further, with the August open next Tuesday, the monthly 10MA will jump to around 2350. Unless that is broken and closed under, the broader bullish trend - from Feb'2016, is unquestionably intact.

--

Nasdaq comp'

The Nasdaq settled -0.2% at 6374, but with a notable new historic high of 6460. Near term is bearish, but there is huge support in the 6100s which should hold. Things only turn bearish with a break of rising trend, which next week will be around the 6k threshold. Upper bollinger will be offering the 6500s in August. The 7000s are well within range before year end. At the current rate of increase - since early 2016, the Nasdaq comp' will hit 10k within 2.5-3.0 years.

Dow

The mighty Dow was the leader this week, settling higher by a significant 1.2% to 21830, with a notable new historic high of 21841. There is threat of a little cooling early next week, but the 22000s now look highly probable by late August. Underlying MACD has turned positive for the first time since late March. In theory, the Dow could see cyclical upside into mid/late September. The 23000s are now within range before year end.

NYSE comp'

The master index settled +0.2% at 11954, with a notable new historic high of 11985. Short term is a touch bearish, but rising trend - which will be around 11650 next week, should comfortably hold. The 12000s look probable by mid September. The broader market outlook would likely turn bearish if <11400, or certainly <11200.

R2K

The second market leader - R2K, settled -0.5% at 1429, but with a notable (if fractional) historic high of 1452.09. Price momentum has turned fractionally negative around the zero threshold, which is rather bearish. Rising trend will be around 1415 next week, and that does look very vulnerable to being broken, which would offer downside to 1350/40s. The R2K is the most vulnerable index to breaking mid term rising trend - from early 2016, and it merits attention as a possible early warning of trouble.

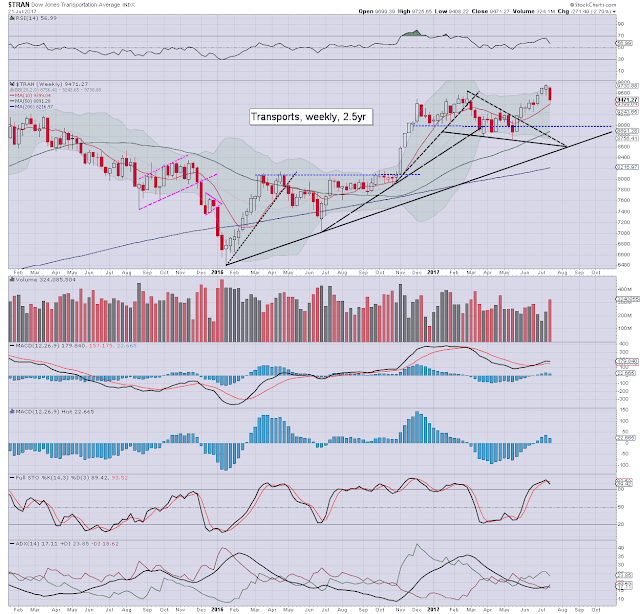

Trans

The 'old leader' - Transports, settled significantly lower for a second consecutive week, -2.6% to 9227. MACD cycle has turned negative, and offers further near term downside to around the 9k threshold. Any break <9k would offer a bonus washout to the 8700/600s.

--

Summary

The US equity market remains broadly strong.

All six indexes are still regularly breaking new historic highs.

Most indexes have around 5% of downside buffer, before key aspects of mid term support are challenged.

--

Looking ahead

A monstrously filled week of corp' earnings and econ-data is ahead...

M - Chicago PMI, Pending home sales

T - Vehicle sales, Pers' income/outlays, PMI/ISM manu' construction

W - ADP jobs, EIA Pet' report

T - weekly jobs, PMI/ISM serv', factory orders, EIA Nat' gas

F - monthly jobs, intl' trade

*keep in mind, Monday is end month, and thus price action will likely be more dynamic, with higher volume, esp' in the late afternoon.

**Fed officials Mester and Williams are both scheduled for Wed'.

--

If you value my work, subscribe to me.

Have a good weekend

--

*the next post on this page will likely appear 6pm EST on Monday.

Lets take our regular look at six of the main US indexes

sp'500

The sp'500 effectively settled the week u/c at 2472, but with a notable new historic high of 2484. The key 10MA is currently at 2441. Underlying MACD (blue bar histogram) cycle is fractionally positive. Its notable the upper bollinger will be offering the 2500s by mid August.

Best guess: near term weakness to 2435, before resuming upward to the 2500s in August. By mid/late Sept', the 2525/50 zone, then a 4-5% retrace... no lower than 2400. A fed rate rise in September would help raise capital market confidence, and offer a powerful climb to the 2600/700s by year end.

Equity bears have nothing to tout unless short term price action <2425. Mid term rising trend will be around 2360 next week, and that looks out of range. Further, with the August open next Tuesday, the monthly 10MA will jump to around 2350. Unless that is broken and closed under, the broader bullish trend - from Feb'2016, is unquestionably intact.

--

Nasdaq comp'

The Nasdaq settled -0.2% at 6374, but with a notable new historic high of 6460. Near term is bearish, but there is huge support in the 6100s which should hold. Things only turn bearish with a break of rising trend, which next week will be around the 6k threshold. Upper bollinger will be offering the 6500s in August. The 7000s are well within range before year end. At the current rate of increase - since early 2016, the Nasdaq comp' will hit 10k within 2.5-3.0 years.

Dow

The mighty Dow was the leader this week, settling higher by a significant 1.2% to 21830, with a notable new historic high of 21841. There is threat of a little cooling early next week, but the 22000s now look highly probable by late August. Underlying MACD has turned positive for the first time since late March. In theory, the Dow could see cyclical upside into mid/late September. The 23000s are now within range before year end.

NYSE comp'

The master index settled +0.2% at 11954, with a notable new historic high of 11985. Short term is a touch bearish, but rising trend - which will be around 11650 next week, should comfortably hold. The 12000s look probable by mid September. The broader market outlook would likely turn bearish if <11400, or certainly <11200.

R2K

The second market leader - R2K, settled -0.5% at 1429, but with a notable (if fractional) historic high of 1452.09. Price momentum has turned fractionally negative around the zero threshold, which is rather bearish. Rising trend will be around 1415 next week, and that does look very vulnerable to being broken, which would offer downside to 1350/40s. The R2K is the most vulnerable index to breaking mid term rising trend - from early 2016, and it merits attention as a possible early warning of trouble.

Trans

The 'old leader' - Transports, settled significantly lower for a second consecutive week, -2.6% to 9227. MACD cycle has turned negative, and offers further near term downside to around the 9k threshold. Any break <9k would offer a bonus washout to the 8700/600s.

--

Summary

The US equity market remains broadly strong.

All six indexes are still regularly breaking new historic highs.

Most indexes have around 5% of downside buffer, before key aspects of mid term support are challenged.

--

Looking ahead

A monstrously filled week of corp' earnings and econ-data is ahead...

M - Chicago PMI, Pending home sales

T - Vehicle sales, Pers' income/outlays, PMI/ISM manu' construction

W - ADP jobs, EIA Pet' report

T - weekly jobs, PMI/ISM serv', factory orders, EIA Nat' gas

F - monthly jobs, intl' trade

*keep in mind, Monday is end month, and thus price action will likely be more dynamic, with higher volume, esp' in the late afternoon.

**Fed officials Mester and Williams are both scheduled for Wed'.

--

If you value my work, subscribe to me.

Have a good weekend

--

*the next post on this page will likely appear 6pm EST on Monday.

Friday, 28 July 2017

Weakness into the weekend

US equity indexes closed moderately mixed, sp -3pts at 2472. The two

leaders - Trans/R2K, settled +0.4% and -0.3% respectively. VIX settled 1.8% at 10.29. Near term

outlook offers a sig' wave lower to sp'2435 on Monday. Things would only

get marginally exciting with any price action <2425, but that looks

very unlikely.

sp'daily5

VIX'daily3

Summary

US equities ended the week with a fair amount of moderate chop. The settling candle was of the reversal type, but there is little reason to believe the market won't resume lower next Monday. Underlying MACD (blue bar histogram) cycle is set for a bearish cross late Monday, or certainly at the Tuesday open. Prime target remains sp'2435.

Things would get 'interesting' with any price action <2425, but that looks very unlikely. Keep in mind, today saw the Dow break (if fractional) a new historic high. Broader price action remains 'scary strong'.

As for volatility, the VIX saw a high of 11.30, but with a moderate equity recovery into the late afternoon, the VIX cooled. However, its notable that the VIX managed a fifth consecutive net daily gain, the best run since mid April. Further, the fact this occurred within a week where we saw VIX break a historic low of 8.84, is rather notable indeed.

Goodnight from London

--

*the weekend post will appear Sat'12pm EST, and detail the US weekly indexes

sp'daily5

VIX'daily3

Summary

US equities ended the week with a fair amount of moderate chop. The settling candle was of the reversal type, but there is little reason to believe the market won't resume lower next Monday. Underlying MACD (blue bar histogram) cycle is set for a bearish cross late Monday, or certainly at the Tuesday open. Prime target remains sp'2435.

Things would get 'interesting' with any price action <2425, but that looks very unlikely. Keep in mind, today saw the Dow break (if fractional) a new historic high. Broader price action remains 'scary strong'.

As for volatility, the VIX saw a high of 11.30, but with a moderate equity recovery into the late afternoon, the VIX cooled. However, its notable that the VIX managed a fifth consecutive net daily gain, the best run since mid April. Further, the fact this occurred within a week where we saw VIX break a historic low of 8.84, is rather notable indeed.

Goodnight from London

--

*the weekend post will appear Sat'12pm EST, and detail the US weekly indexes

Thursday, 27 July 2017

A very mixed day

US equity indexes closed very mixed, sp -2pts at 2475 (intra range

2484/59). The two leaders - Trans/R2K, settled lower by -3.1% and -0.6%

respectively. VIX settled +5.3% at 10.11. Near term outlook offers a partial gap fill to sp'2435,

before resuming upward in August.

sp'daily5

VIX'daily3

Summary

*note how the Tues/Wed' black-fail candles in the sp'500 were subtle warnings of today's break lower.

--

US equities opened very mixed, but with a notable trio of new historic highs for the sp', nasdaq comp', and the Dow. There was a very strong swing lower from 12pm onward, with the market filling the first, and secondary gap zones.

The third gap zone of sp'2435/25 remains set to be at least partly filled, before the market has a better chance at pushing into the 2500s.

Market volatility saw a morning low of 9.16, but with equities swinging lower, the VIX saw a mini explosion into the mid 11s. If sp'2430s, VIX will see the 12s.

--

A note on AMZN

Earnings were lousy, with headline EPS of just 40 cents, with operating costs+ 28.2% to $37.33bn. If you extrapolate, that makes for an annual $1.60, giving a PE of 625 with the stock around $1000.

see: https://finance.yahoo.com/news/amazon-profit-slumps-77-pct-201026358.html

Ms. Link - whom I've never been a fan of, noted how "... you buy Amazon for top line growth, not profits'. Well, being within the mainstream, I can't blame her for towing that party line, but the financial historians won't look kindly on that kind of batshit crazy investment opinion.

To be clear, I like the service, but as a company, its pure garbage. No significant profits, no dividends, and unquestionably, causing problems for thousands of retailers across the globe.

Its notable that one of the few who is actually deriving an income from Amazon is Bezos. Perhaps he'll make it to Mars via Blue Origin, before this South Sea-esque bubble bursts?

--

Here in the metropolis...

Goodnight from London

--

sp'daily5

VIX'daily3

Summary

*note how the Tues/Wed' black-fail candles in the sp'500 were subtle warnings of today's break lower.

--

US equities opened very mixed, but with a notable trio of new historic highs for the sp', nasdaq comp', and the Dow. There was a very strong swing lower from 12pm onward, with the market filling the first, and secondary gap zones.

The third gap zone of sp'2435/25 remains set to be at least partly filled, before the market has a better chance at pushing into the 2500s.

Market volatility saw a morning low of 9.16, but with equities swinging lower, the VIX saw a mini explosion into the mid 11s. If sp'2430s, VIX will see the 12s.

--

A note on AMZN

Earnings were lousy, with headline EPS of just 40 cents, with operating costs

see: https://finance.yahoo.com/news/amazon-profit-slumps-77-pct-201026358.html

Ms. Link - whom I've never been a fan of, noted how "... you buy Amazon for top line growth, not profits'. Well, being within the mainstream, I can't blame her for towing that party line, but the financial historians won't look kindly on that kind of batshit crazy investment opinion.

To be clear, I like the service, but as a company, its pure garbage. No significant profits, no dividends, and unquestionably, causing problems for thousands of retailers across the globe.

Its notable that one of the few who is actually deriving an income from Amazon is Bezos. Perhaps he'll make it to Mars via Blue Origin, before this South Sea-esque bubble bursts?

--

Here in the metropolis...

|

| Sunshine between the showers |

--

Wednesday, 26 July 2017

Fed day chop

US equity indexes closed moderately mixed, sp +0.7pts at 2477. The two

leaders - Trans/R2K, settled lower by -0.1% and -0.5% respectively. VIX settled +1.8% at 9.60. Near

term outlook still offers a swing lower to the sp'2430s. Its notable

though, that more within the mainstream are starting to tout the

2600/700s for year end.

sp'daily5

VIX'daily3

Summary

US equities saw a day of fed chop, with the sp' seeing a trading range of just 6.75pts. There were new historic highs (if only fractional) in the sp', nasdaq comp', and dow.

--

Bonus chart for poster 'Kin'...

NYSE comp'.

The NYSE comp' - or the 'master index', as I call it, settled with a black- fail candle, having fallen a touch shy of breaking a new historic high. Rising trend is currently in the 11770s. If that is broken, along with the 50dma, then yes... things would get interesting.

--

Its notable that today saw semi-regular guest Prof' Siegel tout another '10% of upside before year end'.

... equating to the sp'2720s and Dow 23900s. My year end target of 2683 remains on track, and is broadly shared by Oscar Carboni and Morgan Stanley.

-

Market volatility was stuck in the 9s until the fed press release, which then saw a flash-print of 8.84.. a new historic low.

--

... and as the closing bell was about to ring... the grey horror clears for a few minutes of golden light. Yours truly should be somewhat far further south.

If musically inspired.. extra charts in AH @ https://twitter.com/permabear_uk

Goodnight from London

--

If you think I'm worth at least $1 per trading day... subscribe.

... or you should be able to buy 2 shares of SNAP within the relatively near term each month.

sp'daily5

VIX'daily3

Summary

US equities saw a day of fed chop, with the sp' seeing a trading range of just 6.75pts. There were new historic highs (if only fractional) in the sp', nasdaq comp', and dow.

--

Bonus chart for poster 'Kin'...

NYSE comp'.

The NYSE comp' - or the 'master index', as I call it, settled with a black- fail candle, having fallen a touch shy of breaking a new historic high. Rising trend is currently in the 11770s. If that is broken, along with the 50dma, then yes... things would get interesting.

--

Its notable that today saw semi-regular guest Prof' Siegel tout another '10% of upside before year end'.

... equating to the sp'2720s and Dow 23900s. My year end target of 2683 remains on track, and is broadly shared by Oscar Carboni and Morgan Stanley.

-

Market volatility was stuck in the 9s until the fed press release, which then saw a flash-print of 8.84.. a new historic low.

--

|

| Not the best of summer days |

... and as the closing bell was about to ring... the grey horror clears for a few minutes of golden light. Yours truly should be somewhat far further south.

If musically inspired.. extra charts in AH @ https://twitter.com/permabear_uk

Goodnight from London

--

If you think I'm worth at least $1 per trading day... subscribe.

... or you should be able to buy 2 shares of SNAP within the relatively near term each month.

Tuesday, 25 July 2017

The historically low VIX

US equity indexes closed moderately higher, sp +7pts at 2477 (intra high

2481). The two leaders - Trans/R2K, settled higher by 0.7% and 0.9%

respectively. VIX settled u/c at 9.43. There are three open price gaps to the sp'2430s, and it'd

be even more bizarre than VIX 8s, if those aren't filled within the near

term.

sp'daily5

VIX'daily3

Summary

US equities opened moderately mixed, and battle slowly upward into the early afternoon, but that was enough to generate new historic highs in the sp'500, NYSE comp', and the R2K.

Its notable that the settling daily candle for the sp'500 was a black-fail doji. Those are suggestive of near term weakness. I fully admit I have been calling this for some days, but a retrace to at least partly fill the sp'2435/25 gap zone remains due. In the scheme of things, its only a small swing lower, 37pts (1.5%), and is entirely viable across just a few days.

--

Meanwhile...

In pre-market, the VIX printed 9.04, which was yet another new historic low. The actual intraday historic low was 9.05, with the VIX settling u/c at 9.43.

VIX, monthly - historic, 30yr

I have regularly touted - since last July, that the VIX-long trade is dead. Sure, we can see brief spikes, but the highs continue to be lower... with lower lows. Even if sp'2435 in the near term, that probably won't even be enough to generate VIX 13s.

For those curious on the background for the VIX... https://en.wikipedia.org/wiki/VIX

--

Goodnight from London

--

sp'daily5

VIX'daily3

Summary

US equities opened moderately mixed, and battle slowly upward into the early afternoon, but that was enough to generate new historic highs in the sp'500, NYSE comp', and the R2K.

Its notable that the settling daily candle for the sp'500 was a black-fail doji. Those are suggestive of near term weakness. I fully admit I have been calling this for some days, but a retrace to at least partly fill the sp'2435/25 gap zone remains due. In the scheme of things, its only a small swing lower, 37pts (1.5%), and is entirely viable across just a few days.

--

Meanwhile...

In pre-market, the VIX printed 9.04, which was yet another new historic low. The actual intraday historic low was 9.05, with the VIX settling u/c at 9.43.

VIX, monthly - historic, 30yr

I have regularly touted - since last July, that the VIX-long trade is dead. Sure, we can see brief spikes, but the highs continue to be lower... with lower lows. Even if sp'2435 in the near term, that probably won't even be enough to generate VIX 13s.

For those curious on the background for the VIX... https://en.wikipedia.org/wiki/VIX

--

|

| Hyper bullish sunshine |

--

Monday, 24 July 2017

Starting weak

US equity indexes closed moderately mixed, sp -2.6pts at 2469. The two

leaders - Trans/R2K, settled -0.4% and +0.1% respectively. VIX settled +0.7% at 9.43. Near term

outlook offers a brief foray to the sp'2430s. Mid term outlook remains

bullish, supported by 'reasonable' earnings, and an economy that is

ticking along with 2.0% growth.

sp'daily5

VIX'daily3

Summary

US equities opened on a fractionally weak note, and saw minor chop - leaning on the weaker side, across the day. The trading range was a notably tight 6.78pts.

Market volatility remains exceptionally subdued, and its notable that the VIX broke a new HISTORIC low of 9.26 in the closing hour. Pretty incredible, as the 8s are clearly viable at any point.

Best guess remains: near term weakness to sp'2430s - with VIX 11/12s, before resuming upward.

--

Extra charts in AH @ https://twitter.com/permabear_uk

Goodnight from London

--

sp'daily5

VIX'daily3

Summary

US equities opened on a fractionally weak note, and saw minor chop - leaning on the weaker side, across the day. The trading range was a notably tight 6.78pts.

Market volatility remains exceptionally subdued, and its notable that the VIX broke a new HISTORIC low of 9.26 in the closing hour. Pretty incredible, as the 8s are clearly viable at any point.

Best guess remains: near term weakness to sp'2430s - with VIX 11/12s, before resuming upward.

--

|

| Not exactly the best of summer days |

Extra charts in AH @ https://twitter.com/permabear_uk

Goodnight from London

--

Saturday, 22 July 2017

Weekend update - US weekly indexes

It was a somewhat mixed week for US equity indexes,

with net weekly changes, ranging from +1.2%

(Nasdaq comp'), +0.5% (sp'500, R2K), -0.3% (Dow), to

-2.8% (Transports). Near term outlook offers brief cooling of around 1.5% to the sp'2430s, before making a more serious push to the 2500s in August.

Lets take our regular look at six of the main US indexes

sp'500

The sp' settled net higher by 13pts (0.5%) to 2472, with a notable new historic high of 2477. Underlying MACD (blue bar histogram) ticked higher for a second week, remains fractionally negative, and is due a bullish cross within 1-2 weeks. The key 10MA is at 2432, and by September, will be close to 2500.

Best guess: near term cooling to the 2430s, before resuming upward into end month. August looks set for further upward melt, with the 2500s highly probable by early September. A 5% retrace seems viable within the 'delicate period' of Sept/Oct. The year end target of 2683 remains on track, but will require at least one further rate hike, to help kick the financials upward.

Equity bears have nothing to tout unless the mid term upward trend - from Feb'2016 is broken. As of early August, that will be around 2370.

--

Nasdaq comp'

Tech continues to lead the way upward, with the Nasdaq settling +1.2% at 6387, with a notable new historic high of 6398. Price momentum is set to turn positive next week, as the 6500s seem viable by September. The 7000s are just about within range by year end. Does anyone seriously think we'll trade under 5k any time soon?

Dow

The mighty Dow saw a minor net weekly decline of -0.3% to 21580. Underlying MACD remains fractionally negative, but will surely turn positive within 1-2 weeks. Upper bollinger will be offering the 22000s in August. Things will only turn provisionally bearish if the Dow is trading <21k from September onward.

NYSE comp'

The master index settled +0.2% at 11924, with a notable new historic high of 11963. Broader price action remains very strong. The 12000s look a given by late summer. Things would only turn bearish if a break <11800, from Sept' onward.

R2K

The second market leader - R2K, settled higher for a fifth consecutive week, +0.5% at 1435, with a notable new historic high of 1452. Underlying MACD has turned fractionally positive for the first time since mid February. Core rising trend will be around 1410 next week. Many now seem resigned to the 1500s.. or even 1600s by spring 2018. I will continue to note that its ironic that I seem to be the only one suggesting 'R2K @ 2K'.

Trans

The 'old leader' - Transports, had the worse week since (at least) April, settling -2.8% at 9471. Its notable though that last week saw a new historic high, as the equity bulls have very little to prove. The psy' level of 10k remains probable by late September, especially if WTIC/fuel prices see another significant wave lower.

--

Summary

All US equity indexes remain within their mid term upward trends from early 2016

The US equity market is regularly breaking new historic highs in ALL six indexes

There is downside buffer of around 5-7% for most indexes, before multiple aspects of support would be challenged.

--

Looking ahead

In addition to a truck load of corp' earnings...

M - Existing home sales

T - FHFA house price index, Case-Shiller HPI, consumer con', Richmond fed'

W - New home sales, EIA Pet' report

FOMC: a press release will be issued at 2pm. No policy change is expected. There will NOT be a press' conf'.

T - weekly jobs, durable goods orders, intl' trade, EIA Nat' gas

F - Employment costs, consumer sent', GDP Q2 - market is seeking growth of 2.6%, against Q1 1.4%. Arguably, any number >2.5% will put renewed pressure on the fed to raise rates in Sept', or certainly by Dec'.

*the only fed official scheduled is Kashkari (Friday), whom has notably dissented against both rate hikes this year.

--

If you value my work, subscribe to me.

Have a good weekend

--

*the next post on this page will likely appear 6pm EST on Monday.

Lets take our regular look at six of the main US indexes

sp'500

The sp' settled net higher by 13pts (0.5%) to 2472, with a notable new historic high of 2477. Underlying MACD (blue bar histogram) ticked higher for a second week, remains fractionally negative, and is due a bullish cross within 1-2 weeks. The key 10MA is at 2432, and by September, will be close to 2500.

Best guess: near term cooling to the 2430s, before resuming upward into end month. August looks set for further upward melt, with the 2500s highly probable by early September. A 5% retrace seems viable within the 'delicate period' of Sept/Oct. The year end target of 2683 remains on track, but will require at least one further rate hike, to help kick the financials upward.

Equity bears have nothing to tout unless the mid term upward trend - from Feb'2016 is broken. As of early August, that will be around 2370.

--

Nasdaq comp'

Tech continues to lead the way upward, with the Nasdaq settling +1.2% at 6387, with a notable new historic high of 6398. Price momentum is set to turn positive next week, as the 6500s seem viable by September. The 7000s are just about within range by year end. Does anyone seriously think we'll trade under 5k any time soon?

Dow

The mighty Dow saw a minor net weekly decline of -0.3% to 21580. Underlying MACD remains fractionally negative, but will surely turn positive within 1-2 weeks. Upper bollinger will be offering the 22000s in August. Things will only turn provisionally bearish if the Dow is trading <21k from September onward.

NYSE comp'

The master index settled +0.2% at 11924, with a notable new historic high of 11963. Broader price action remains very strong. The 12000s look a given by late summer. Things would only turn bearish if a break <11800, from Sept' onward.

R2K

The second market leader - R2K, settled higher for a fifth consecutive week, +0.5% at 1435, with a notable new historic high of 1452. Underlying MACD has turned fractionally positive for the first time since mid February. Core rising trend will be around 1410 next week. Many now seem resigned to the 1500s.. or even 1600s by spring 2018. I will continue to note that its ironic that I seem to be the only one suggesting 'R2K @ 2K'.

Trans

The 'old leader' - Transports, had the worse week since (at least) April, settling -2.8% at 9471. Its notable though that last week saw a new historic high, as the equity bulls have very little to prove. The psy' level of 10k remains probable by late September, especially if WTIC/fuel prices see another significant wave lower.

--

Summary

All US equity indexes remain within their mid term upward trends from early 2016

The US equity market is regularly breaking new historic highs in ALL six indexes

There is downside buffer of around 5-7% for most indexes, before multiple aspects of support would be challenged.

--

Looking ahead

In addition to a truck load of corp' earnings...

M - Existing home sales

T - FHFA house price index, Case-Shiller HPI, consumer con', Richmond fed'

W - New home sales, EIA Pet' report

FOMC: a press release will be issued at 2pm. No policy change is expected. There will NOT be a press' conf'.

T - weekly jobs, durable goods orders, intl' trade, EIA Nat' gas

F - Employment costs, consumer sent', GDP Q2 - market is seeking growth of 2.6%, against Q1 1.4%. Arguably, any number >2.5% will put renewed pressure on the fed to raise rates in Sept', or certainly by Dec'.

*the only fed official scheduled is Kashkari (Friday), whom has notably dissented against both rate hikes this year.

--

If you value my work, subscribe to me.

Have a good weekend

--

*the next post on this page will likely appear 6pm EST on Monday.

Friday, 21 July 2017

Opex weakness

US equities closed moderately weak, sp -0.9pts at 2472. The two leaders -

Trans/R2K, settled lower by -0.1% and -0.5% respectively. VIX settled -2.3% at 9.36. Near term

outlook offers further weakness to at least partly fill the gap zone of

sp'2435/25. Mid term outlook remains 'scary strong', as earnings are

coming in reasonable.

sp'daily5

VIX'daily3

Summary

US equities opened a little weak, and saw chop across the day, but that was somewhat natural for what was option expiration. We have two entirely open gaps of 2463/60 and 2435/25. Some cooling to at least 2435 seems very probable by next Wednesday.

Market volatility remains very low, with the VIX settling lower for a third consecutive day.

Today's closing hour intra low of 9.30 is (I believe) the lowest EVER VIX.

The daily/weekly close of 9.36 is the LOWEST ever daily/weekly close.

--

Goodnight from London

---

The weekend post will appear Sat'12pm, and detail the US weekly indexes

sp'daily5

VIX'daily3

Summary

US equities opened a little weak, and saw chop across the day, but that was somewhat natural for what was option expiration. We have two entirely open gaps of 2463/60 and 2435/25. Some cooling to at least 2435 seems very probable by next Wednesday.

Market volatility remains very low, with the VIX settling lower for a third consecutive day.

Today's closing hour intra low of 9.30 is (I believe) the lowest EVER VIX.

The daily/weekly close of 9.36 is the LOWEST ever daily/weekly close.

--

|

| Sunshine before another storm |

Goodnight from London

---

The weekend post will appear Sat'12pm, and detail the US weekly indexes

Thursday, 20 July 2017

A little cooling

US equity indexes closed moderately mixed, sp -0.4pts at 2473. The two

leaders - Trans/R2K, settled -1.0% and u/c respectively. VIX settled -2.1% at 9.58. Near term

outlook offers opex-chop into the weekend, with weakness to at least

partly fill the gap of sp'2435/25 next week.

sp'daily5

VIX'daily3

Summary

US equities opened a little higher, with a quartet of new index highs for the sp'500, Nasdaq comp', nyse comp' and the R2K. There was an opening reversal, but it never lasted long, with equities challenging a new high in the late afternoon.. but getting stuck.

Market volatility remains very subdued, with the VIX still unable to break and hold the 10s. If sp'2435 next week, that should equate to VIX 11/12s. The low teens look out of range for the rest of the month.

--

Extra charts in AH @ https://twitter.com/permabear_uk

Goodnight from London

--

sp'daily5

VIX'daily3

Summary

US equities opened a little higher, with a quartet of new index highs for the sp'500, Nasdaq comp', nyse comp' and the R2K. There was an opening reversal, but it never lasted long, with equities challenging a new high in the late afternoon.. but getting stuck.

Market volatility remains very subdued, with the VIX still unable to break and hold the 10s. If sp'2435 next week, that should equate to VIX 11/12s. The low teens look out of range for the rest of the month.

--

|

| Just another summer's day |

Extra charts in AH @ https://twitter.com/permabear_uk

Goodnight from London

--

Subscribe to:

Posts (Atom)