The main market saw some weakness in the afternoon, doubtless a result of political appearances, making the market again consider the issue of the fiscal cliff. If no agreement is reached by the end of this week, then Mr Market is going to have to significantly re-price itself.

sp'daily3 - news to come

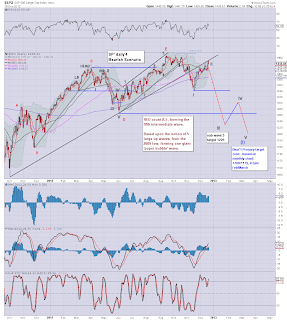

sp'daily4 - original bearish outlook

sp'weekly

sp'monthly2 - Keltner channels

Summary

First, I want to be clear. Until we take out the recent sp'1413 low, no doomer bear can get the least bit confident..nor excited about potential declines into January.

With the move above the FOMC highs from last Wednesday, I think the 'serious money' should probably wait for this 1413 low to be decisively closed below.

--

The weekly chart is starting to look a little spiky, but really, I can't take it seriously yet, and even if we close Friday @ sp'1420, that would still be a net gain on the week.

The monthly chart is still showing two consecutive up candles, and the spike from the November low is a real problem for the bears. In many respects the 'super serious' bear money can't be short until that 1343 low is taken out.

Special note...

Both tomorrow and Friday see a considerable amount of econ-data released. We have a second/final revision for US Q3 GDP tomorrow, with the important Durable Goods Orders data on Friday. Both will be market moving, and obviously, the deflationary doomer bears should look for weakness in both data points.

So, with two trading days left of the week, lets see if we can somehow battle lower, and take out the key sp'1413 low. Were that to be achieved, we'd have TWO consecutive spiky candles on the weekly charts, and the original bearish outlook would be back in play.

Finally, it is important to note the fact we have the last option expiration of the year this Friday. This will likely lead to more choppy and dynamic price action.

--

Highly recommended viewing (I found this via Zerohedge). - Kyle Bass, at AmeriCatalysts

Kyle Bass remains a personal hero of mine. Just like Peter Schiff, Jim Rogers, Marc Faber, and Martin Armstrong, for the past few years, Bass says the things the mainstream media (but also the general populace) never want to hear. There are an awful lot of key issues in this hour long lecture/Q & A, but most notable, is the issue of Japan.

--

Bonus chart to end the day...

VIX, weekly, rainbow, 6yr

At some point the VIX is going to explode into the 30s..and 40s. The two main warning thresholds are clear...first 20..and then 27. If the VIX does break higher next month, it will make for one hell of a way to begin a new year.

Goodnight from London