It was a pretty subdued day in the US equity market, with the sp'500 settling +10pts @ 1989. With the ECB on Thursday and the FOMC next Wednesday, equity bulls still look to have the edge for another 5 trading days. On any fair basis though, the market looks highly vulnerable after mid March.

sp'weekly8b

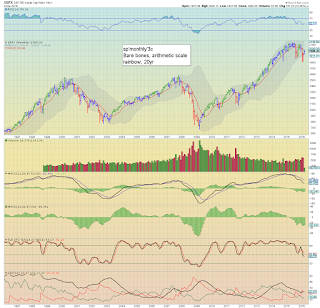

sp'monthly3c

Summary

We continue to have a second consecutive green candle on the weekly 'rainbow' chart. Current trend is clearly outright bullish.

However, the giant monthly cycles are still broadly bearish, and we remain on track for a fourth consecutive monthly close under the 10MA.

--

Looking ahead

Thursday will see the usual weekly jobs, and US Treasury Budget data.

However, the market will really only care about the latest ECB meeting. There will be a press release @ 7.45am EST, with a Draghi press conf' at 8.30am EST.

Market is expecting NIRP to be intensified from -0.2% to -0.3%.. with the ongoing QE program extended and/or increased in size.

--

Goodnight from London