Market appears very content to stay in the upper 1350s. Clearly, a move into the 1360s is very viable either late today or early tomorrow.

The only question is whether the next target of 1380/90 can occur. If there is QE-twist extension, a brief jump into that zone on what will arguably be 'mass hysteria'. I would short there, if that's the situation.

sp'60min

Vix'60min

Summary

It is amusing to see ever more increasing bullish talk out there - even from the normally bearish posters. I guess they aren't looking at those monthly cycle charts! A lot of contrary indicators maybe ?

From a cycle point of view, the hourly index cycles are very high. Yet, this is still no time to be shorting, with the FOMC tomorrow.

Key support for the bulls..daily 10MA @ 1328 - which is indeed some 30pts lower! So..bulls have a lot of leeway, even if we do fall late Wed/early Thursday.

--

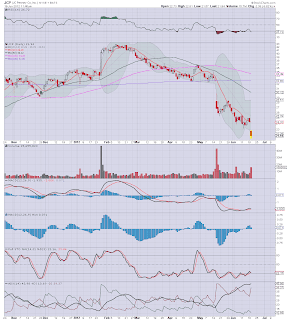

Notable stock of the day...

JCP, daily

Clearly, the guy they just let go deserved more money for his superb performance in the last 9 months.

--

*VEU (world indexes) is at the target zone area too, I'll maybe cover that in the next hour.

Time for lunch!