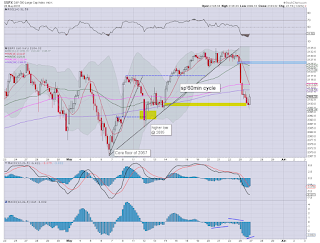

US equity indexes closed significantly weak, sp -21pts @ 2104. The two leaders - Trans/R2K, settled lower by -1.5% and -1.1% respectively. Near term outlook is bearish to the sp'2080/75 zone. The mid term outlook is seemingly dependent upon whether the USD continues to climb... or starts to cool from the DXY 97/98s.

sp'60min

Summary

*a touch of strength in the closing hour, but clearly.... a day for the equity bears.

--

A short 4 day trading week has begun with some rather interesting price action across just about all asset classes.

The USD is arguably a key variable here.. and is particularly putting downward pressure on commodities.. with related energy/miner stocks getting whacked lower.

-

*I remain short Gold - via GLD, will hold another day, and then look for my next exit. If DXY 98s in the coming days, I'll reshort Gold... for the fourth time in a month.

--

the usual bits and pieces across the evening...