US equities settled moderately mixed ahead of the next FOMC announcement. Naturally, the chatter remains one of 'will they.. or won't they remove patience?'. Most notable, today saw the second bullish F flag in three trading days fail. There is high probability of a bearish reversal from sp'2085/90 tomorrow afternoon.

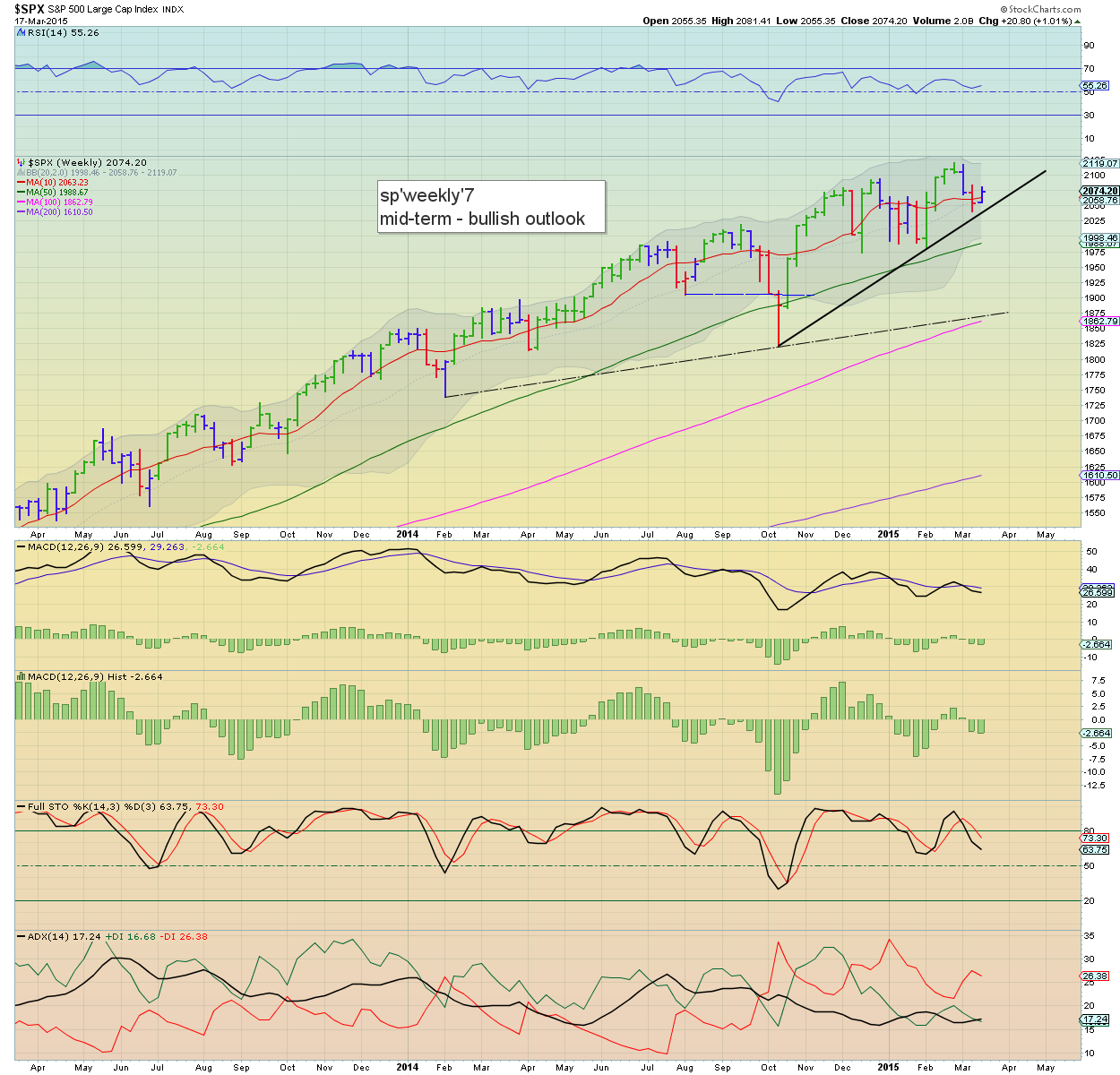

sp'weekly7

sp'daily5b

Summary

*a tiresome day.... this shall be brief

--

Yes, the bulls have managed a significant counter rally from the Wed' low of sp'2039... but there is clear resistance around 2075/80s.

Best guess... market gets stuck tomorrow.. and breaks lower for the rest of the week.

--

Looking ahead

Market will be focused on the FOMC announcement at 2pm.. with a Yellen press conf. around 2.30pm.

*there is the EIA oil report at 10.30am.. any surplus above 7 million barrels would likely kick WTIC Oil into the 41/40s. Sub $40 by the weekend remains VERY viable.

-

Goodnight from London