Despite the current gains, one of the most notable aspects is that today will be the third consecutive close under the important 50 day MA - currently @ sp'1844. With the weekly charts outright bearish, the bull maniacs face underlying weakness for the rest of this week.

sp'daily5

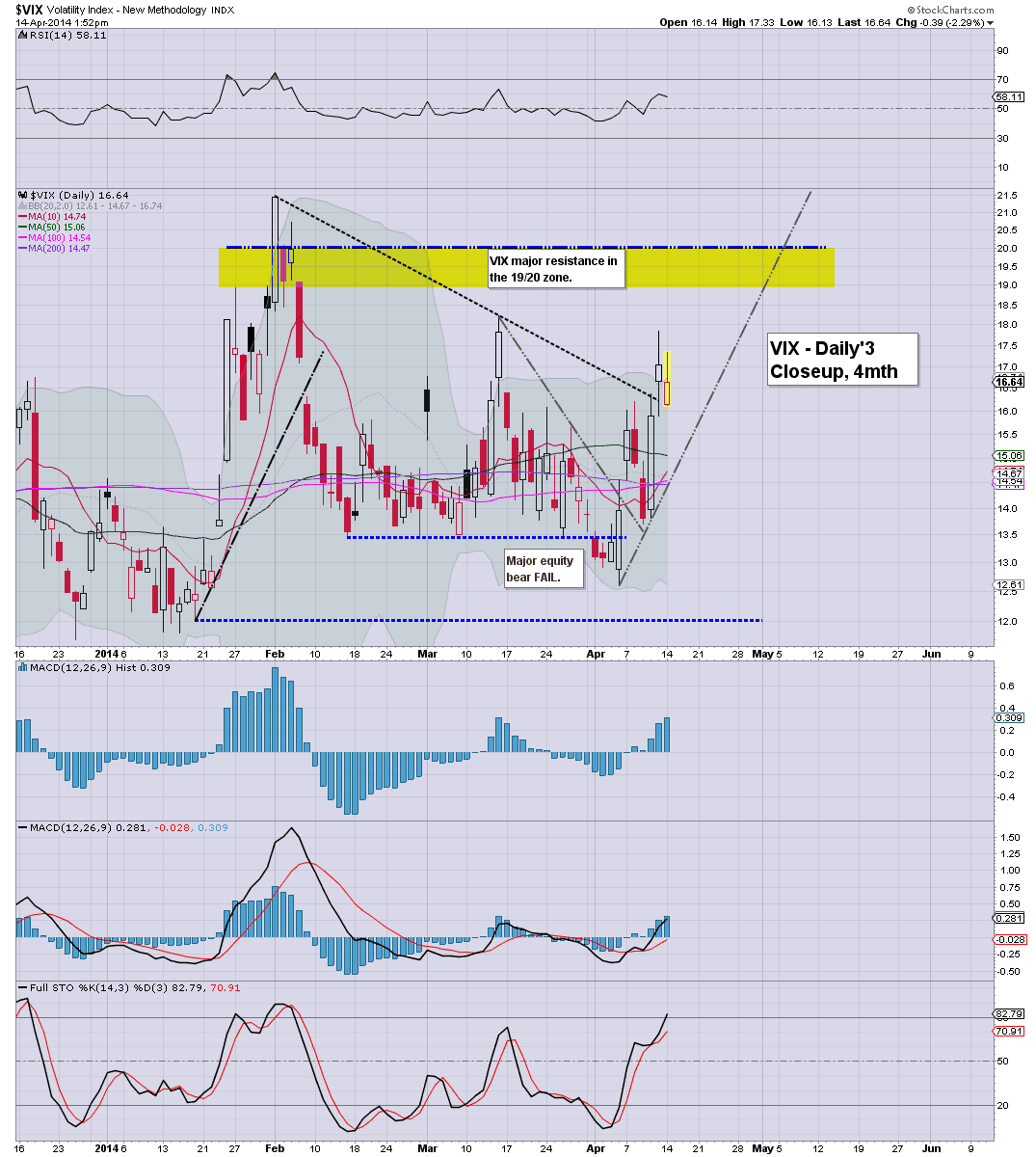

vix'daily3

Summary

*ignoring the minor waves for this hour....

--

Indeed, another daily close under the 50 day MA, and bounces should still be treated as...bounces.

I'm holding to the original outlook, seeking the sp'1770/60s, but yes..that won't be easy. Yet...we're only talking about 50/60pts or so...something we've seen done twice in the previous two down waves.

Bears..need to remain patient.

ps. note the reversal candle on the daily VIX...despite the current index gains.

-

2.01pm.. Equity bears should be content with any daily close <1825...I sure would be one of them!

-

2.16pm.. To me, the VIX remains the tell, it is only a little lower, -1.8% in the 16.70s..and a green close is very viable. Regardless, the index gains are not showing any kick - much like last Tue/Wed.

We're headed lower t his week, but the issue is how far?

Considering the earlier gains, I expect no lower than 1770/60s..and even then, that will be 'briefly'.

2.30pm.. VIX turning positive. Bulls...beware!

2.37pm... Check out the R2K,, daily... black-fail candle...ugly city for the small caps.