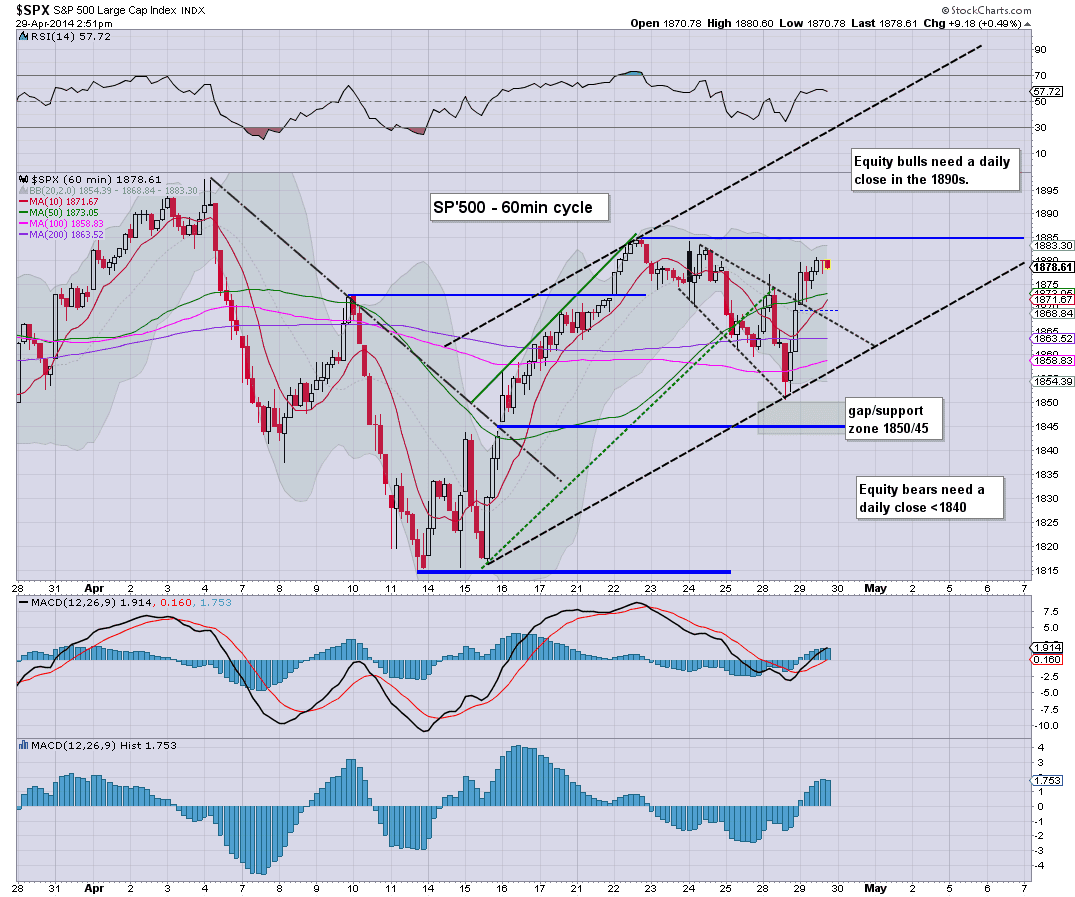

US equities look set to hold moderate gains into the close, with Mr Market comfortably above the Monday spike floor of sp'1850. A weekly close in the 1885/95 zone looks very probable, barring any especially weak econ-data - but as ever, market 'interpretation' of such data is even more important.

sp'60min

Nasdaq, daily

Summary

Well, it has been a day where the equity bears failed to show up.

Daily/weekly cycles are all supportive of the bulls, even for those scenarios calling for a H/S formation on the R2K/Nasdaq.

--

Aside from that, there really isn't much to add.

We do have earnings at the close, EBAY, TWTR, and STX.

--

*I will hold heavy long overnight, via CHK, DO, RIG, SDRL, and STX

-

3.18pm... There is some very significant buying in TWTR and STX ahead of earnings. Both stocks have been somewhat battered lately, so some of the gains are part of a natural recovery bounce.

Certainly, earnings at the close are worth watching.

STX is in the 53s, I would like an exit in the 56/57s but that is probably a very hopeful outlook. 55s would be far more reasonable.

TWTR is a real wild card, and I'd not be surprised to see the big $50 threshold test in AH as the equity bears cover at 'ANY PRICE!'.