Mr Market has a real problem in the days ahead. There are frankly, monumental downside risks ahead. A lack of fiscal cliff resolution, and Mr Market will have to adjust to GDP -2 to -4% lower in Q1 2013 - and that's assuming no other problematic economic issues.

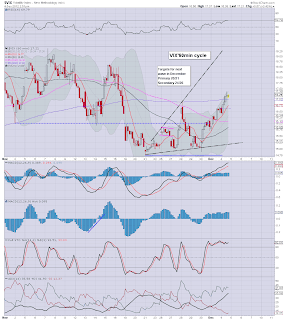

sp'60min

vix'60min

Summary

There are dozens, if not a few hundred charts I could highlight, all say the same story. The AAPL daily chart alone should be enough to scare any tech sector permabull.

Wave'2 is 'probably' done, and we're on the way down.

We'll know soon enough, and more than anything, if we see VIX >20, it'll be a major red flag.

Something for the bears (over the age of 35) on this winters day..

Lets see how we close!

--

UPDATE 3.30pm, Baby bear flag on the Sp'500.

Bears wants a close at least <1412, preferably a break of the flag <1405

back after the close