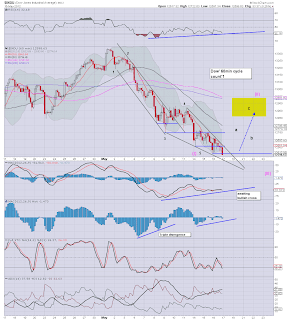

A rough day for those holding long from the previous few days, and even for those who went long in the mid sp'1330s today who are already underwater. However, the 60min cycle is showing a number of signs suggesting there is a reasonable chance for a break higher - the minor wave'2 of 3.

IWM'60min

Sp'60min, count'1

Dow'60min

Summary

So, what about Thursday and Friday? I've seen in a fair few places people suggest max-pain is sp'1380. Clearly, we're not going up to that level across the next two days. A tough battle to 1350 remains a fair target though, considering it is opex, with what are at least marginally oversold conditions, and we have the Facebook hysteria of course.

Sp'1422 is now a long way up. Almost a 100pt fall across 11 trading days. A typical fib' retacement of 50% of that move would be 50pts..to around 1375/80 - which is exactly where the severe resistance is. Further, the H/S formation chart I've posted a great deal would similarly support a target in the 1370/80.

Were this day'3 or 5 of a down cycle - and I was long (and underwater!), I would be really concerned. However, we are 11 days down - that is just 1 short of the July/August 2011 collapse wave move of 12 days.

We ARE due a significant bounce.

--

More across the evening, dealing with the VIX, Daily Index Charts, and the bigger picture - which is always a good thing to keep in mind.