WTIC Oil has rallied from the Feb' low of $26.05 to last week's high of $46.78. A large part of the recent rally since Feb' has been the weakening USD. If the USD can at least hold the DXY 91s, considering the over supply issue remaining completely unresolved, Oil remains vulnerable to renewed downside into the summer.

WTIC, daily

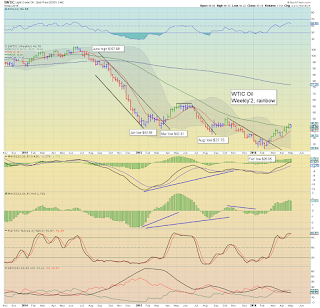

WTIC, weekly

Summary

The current blue candle on the weekly chart is marginally interesting, but we're still holding above the rising trend/support from the February low.

Oil bears need to see a weekly/monthly close under the $40 threshold to have any initial confidence that the low 30s or even a return to test the $26 low is possible this summer.

Considering the over-supply issue, I'm still of the view that WTIC oil in the teens would make for a far more natural capitulation for the energy industry.

--

Market/Gold chatter from Schiff

--

Looking ahead

Thursday will see the usual weekly jobless claims.

*Fed official Bullard - the bane of the equity bears (remember Oct'2014?), is due to speak in late morning.

In AH, a quartet of fed presidents are at a conf' in Stanford.

--

Goodnight from London