US equity indexes look set for a second day of broad declines, having achieved more trend/support breaks. Next week offers at least the sp'2040s - which will equate to VIX 17/18s. There are a great many aspects of support in the 2030/20s. A break <2K looks unlikely in first half of May.

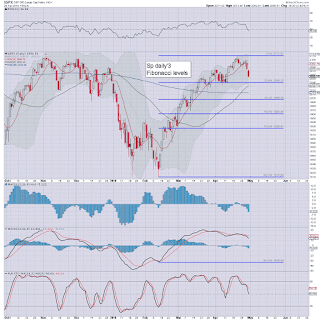

sp'daily3 - fib retraces.

sp'weekly1c - time fibs

Summary

re: daily3, the lower daily bol' is around 2035... close to the 50dma.

If sp'2020s.... if will break the two soft lows of 2039/33.. and that would give initial confidence that 2111 is a key mid term high.-

--

re: weekly1c: Yes, time fibs are pretty kooky, but still.. a snap lower late May would make sense.

-

Best guess? 2040/35 zone... then bouncing for at least 3-5 days to 2070/80

--

notable strength: miners, GDX 4.7%.... having doubled since the Jan' low. Incredible strength.

--

back at 3pm