US equities see a micro wave to the upside.. and whether you want to call it a B wave, 2, or whatever.. a retrace appears underway from a cycle peak of sp'1991... to the 1950s. VIX is seeing the usual minor chop, +1.5% in the 19.80s. Any sustained action >22/23 looks unlikely this week.

sp'60min

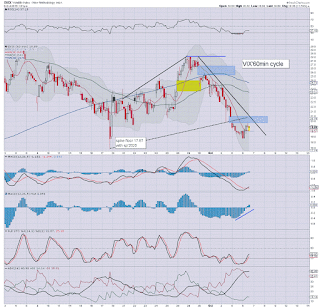

vix'60min

Summary

Utterly tiresome.

-

*if we're in the 1950s tomorrow.. or Thursday.... what do I do then?

Pick up a moderate long position, in what? I like DIS, AAPL, but both of those remain weaker than the main market.

INTC... but that has seen a powerful ramp to the $31s already... I am not in the mood to chase that one up.

-

notable weakness, airlines (no doubt pressured via Oil), DAL -3.3% @ $45.40s.. still a full $2.00 above my short-EXIT. I suppose its a viable short if main market maxed out... with DAL no higher than 47/48.