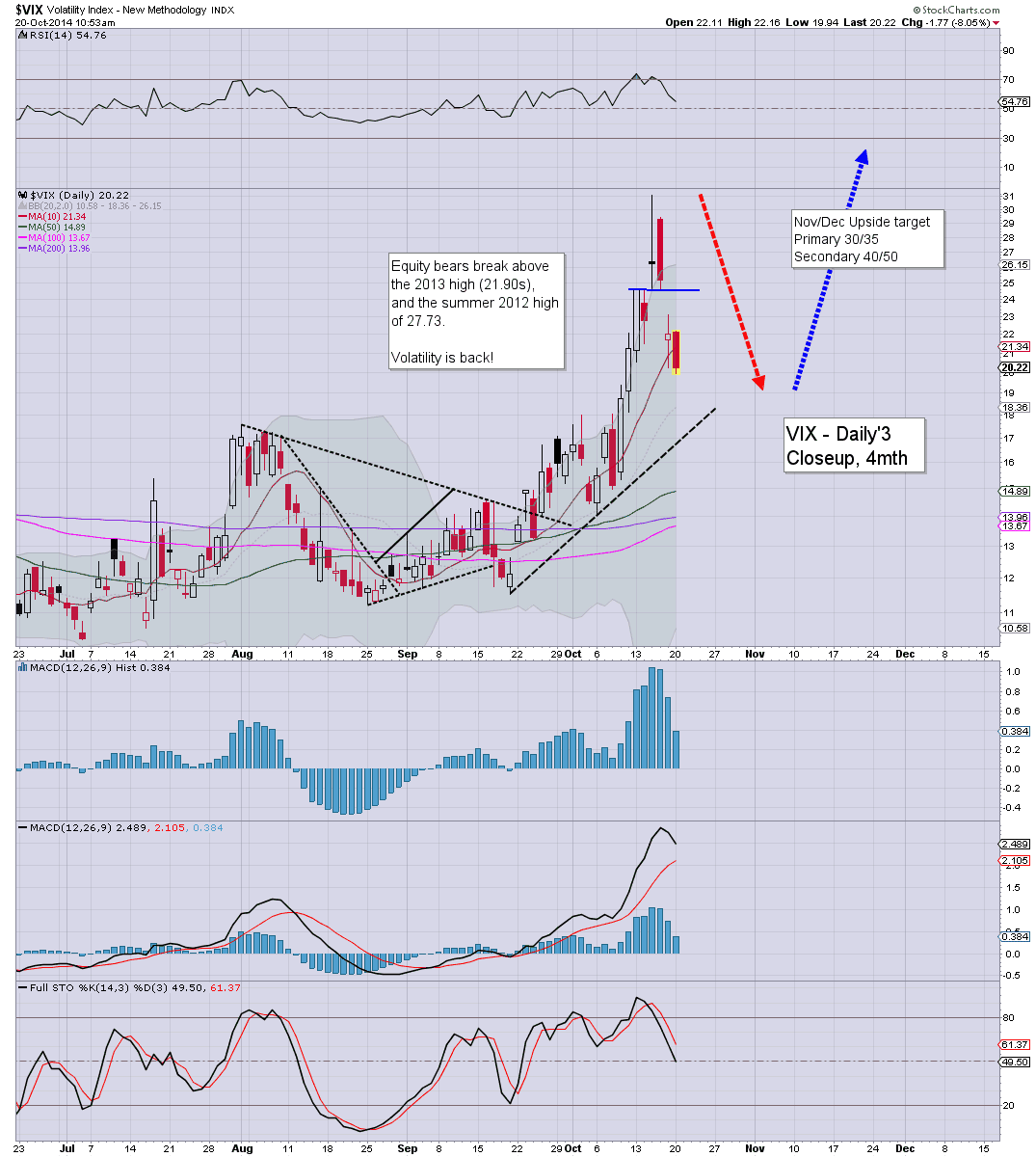

US equities remain stuck between the resistance zone of sp'1900/05 and the short term floor of 1880. The daily close... either side of that, will likely determine the rest of the week. VIX is showing nothing good for the bears, -8%, having briefly lost the 20 threshold.

sp'60min

VIX'daily3

Summary

It remains a bit of a messy start to the week, but what is clear, the bulls are not seeing the follow through from last week.

Considering the ramp from last Wednesday, bears need a daily close <1880.

-

Notable strength: airlines, DAL, UAL, both +2.7%, as Ebola travel fears subside (if briefly)