The sp' is hovering just 3pts shy of breaking a new high. Will the market spite the bears into the weekly close, with a break into the 1760s? Regardless of whether we close in the 1760s, or 50s, this was the third consecutive weekly gain, and sp'1646 now looks a very long way down.

sp'weekly8

Summary

Unquestionably, the trend remains very much to the upside.

There is zero sign of a levelling/turn phase, and bulls look likely to claw into the 1760/70s next week..perhaps even higher if the market likes what the FOMC have to say.

-

There will certainly be opportunity for a turn on the weekly cycles by mid-November, but based on previous cycles, we look more likely to just keep crawling higher into mid December, before year end profit taking.

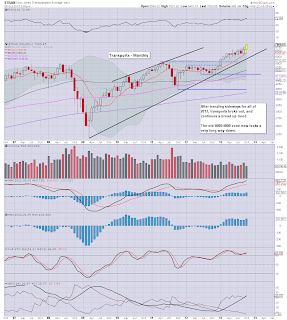

Transports is trying for a weekly close in the 7000s...

The monthly chart shows the most powerful bullish candle since January. Near term upside remains 7200/7300.

-

3.30pm....interesting chat on clown finance TV, even featuring Greenspan..urghh.

Every Friday afternoon, CNBC usually wheel out a doomer bear. I'm not sure what their game is here, but whatever it is..its laughable.

How is it no one is open to 1800s within the next week or two? We're only talking about another 3-4% higher, which is easily done across 2-3 weeks.

3.47pm..as I feared..Mr Market wants to spite the bears into the close...urghhh

3.58pm...well, almost the 1760s...nasty market!