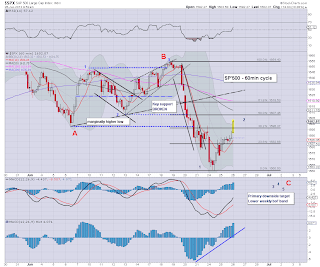

The market has managed to hit some short-stops in pre-market, and we've opened above sp'1600. Next level is 1607/08, where a 50% fib retrace and an old low reside. The VIX has possible completed a gap-fill in the mid 17s, and is offering a reversal candle!

sp'60min

vix'60min

Summary

*I am HEAVY short the market from VIX 17.50s, and sp'1601.

--

This was actually the open I was hoping for, its knocked another 10/15% off the 'bearish' side in options land, and I'm considering it as a bonus discount.

Lets be clear, there IS risk of continued rally to the 1620s - as many recognise, but that is only another 1% higher, and downside is arguably all the way to sp'1510/00, about 6% lower.

So...1% risk of upside... 6% downside, thats pretty good in my view.

-

Now...its back to the waiting game.

-

Here is the thing..if you believe this is merely the bounce, then on any basis, this is the place to be taking a new short, at the top of the hourly bol/Keltner bands.

We're seen a good 40pt bounce since the Monday low, I think the bounce is at least 'largely' complete, if not fully.

10.10am.. first soft downside target is the rising hourly 10MA @ 1587. A daily close under that..and the bounce will indeed be confirmed as complete.

10.17am...sp'1598...hmm...interesting...but a long day ahead. I will be holding short overnight anyway, I ain't in this for a 5/10pt down move, I want 50pts down.