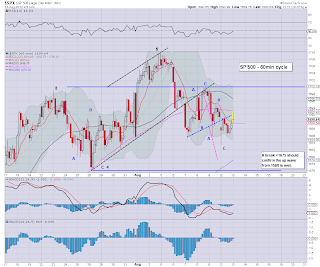

The hourly index charts are offering upside to sp'1698/1700 by early afternoon, but bulls seem unlikely to have the strength to close in the 1700s Metals are mixed, Gold -$8, but Silver is holding slight gains. Oil is a touch weak...with the higher dollar no doubt being a pressure.

sp'60min

sp'daily5

Summary

A quiet and dull open..and that will probably remain the case until early next week.

---

*It will be moderately tempting to launch an index re-short if we can get into the 1698/1700 area. The only problem is the threat of a gap higher straight >1709..which would open up 1740/60.

As it is, weekly charts are highly suggestive the market will not take out 1709 high.

-

*daily MACD cycle is already pretty low, bears have a problem!

10.07am.. sp'1684...back to the Monday lows..hmm.

This all feels like utter noise. A few pts up..a few pts down.

With no QE today..or tomorrow..bears have small chance of testing 1675..but really..there is still no downside power.

--

10.30am.. I can't take the declines seriously. we're already showing signs of a spike-floor.

Another test of 1700 still looks very viable

From a bearish perspective, the 15/60min cycles look VERY floored, and would be a lousy place to remain short.