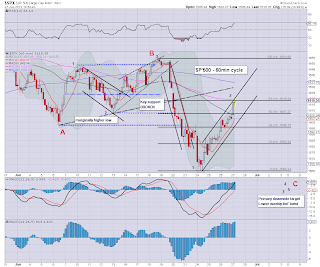

Market has hit sp'1620, a 60pt rally in barely 3 trading days. With the VIX back in the 16s, the cheer leading maniacs on clown finance TV are once again 'happy with the Bernanke' and confident that the 'summer of recovery' (ver 5.0) is back on track.

sp'60min

vix'60min

Summary

*VIX looks 'relatively' floored

--

We're at what is very strong resistance. There is of course the gap-zone, around sp'1625, and we could easily be there later today/early Friday.

It remains a problem how we close the week.

If we close anywhere >1605, that seriously wrecks the broader down cycle since May'22.

Any close >1620, and it arguably destroys the original hopes of a further wave lower to 1530s.

--

The rest of today..and tomorrow will be important.

*I remain heavy short..and now underwater. As noted, a weekly close >1620, and I'll have to seriously consider selling...regardless of price/loss.

-

UPDATE 11.16am, well, we're seeing some kind of reaction from the resistance zone.

As noted..bears just need a daily close <1610, to break the channel