The main indexes certainly had a strong day, and are now brushing up against what is the upper channel, from the June low of 1266. Yeah, we're almost 200pts above the June low, after just 3.5 months, incredible.

IWM, daily

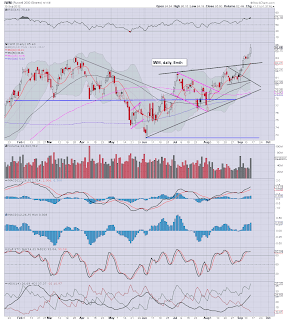

Sp'daily5

Transports

Summary

We're very high on the smaller cycles, so it will very difficult for the market to keep pushing higher tomorrow. When you consider the sp' daily chart, this is especially obvious, with the market now looking very over-extended - closing some 12pts outside the upper bollinger band - a pretty rare thing.

Both IWM and the Transports are sporting a tiny spike on today's candle, but its nothing to be taken seriously yet. Bears will need to see at least a flat close tomorrow, and preferably a decline back into the sp'1440s. That's a 'reasonable' hope for tomorrow.

Friday - LOTS of econ-data

We have retail sales, CPI, industrial production, consumer sentiment, and business inventories. That will really give the market something to think about.

With the 'QE threat' now done with, what are the bull maniacs going to do if the econ-data continues to warn of recession? Maybe Mr Draghi will start talking up things again?

So, even though today was very much a victory for the bulls, it could be back to reality tomorrow, if some of the data comes in worse than the algo-bots are expecting.

A little more later.