Introduction to the

fair value series

Its been my intention

for some time to do a 'fair value' series for a wide variety of

stocks. Yes, there are the crazy over-priced ones that many traders

are fully aware of, but I also aim to get around to looking

at...(wait for it)...under-priced stocks! Yes, even a permabear

should look for under-valued (but high quality) stocks to purchase.

This first posting for

the fair value series will be longer than subsequent ones, so that I

can hopefully convey the underlying philosophy. Taken together, I

believe fundamental + technical analysis are important for any

trader. Clearly, this is just the start, and with more posts,

hopefully the standard will develop to become something worthwhile.

Fair Value theory

verses an ocean of lunatic and misguided analysts

Fair value is a concept

I've been touting massively for a few years now. It has almost become

a long time joke where if someone touted one of the momentum (momo)

stocks (like NFLX, GMCR, AMZN), I'd just say 'divide by 10', and then

give my 'fair value' price.

Dividing by 10 is

admittedly overly harsh for even some of the very worse momo stocks,

but the point stands, most of them were – and still are, grossly

overvalued.

What is fair value?

Say you're an investor

with $10,000. How many years do you want to endure before your

investment provides a 100% gain. Lets not get into the sub issues of

'how' the returns are generated, whether by capital gain or via

dividends. The issue is about return on investment.

Would a century be too

long? Ohh, then I guess you don't much like stocks with a Price

Earnings (PE) ratio of 100?

How about 15 years,

does that seem like a reasonably good time frame to get a 100% return

on your investment? Arguably, for most people, 15 years is a

reasonable time frame.

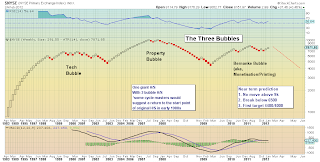

Historically (and

interestingly!), the PE for the US equity market is usually somewhere

in the 10-15 range. During the bubble periods, ratios of 30, even low

40s have occurred. Similarly, a 'depression era' PE of 5 is also

important to recognise.

As at Feb'22 2012: S&P

500 PE Ratio: 22

Now, one final issue

about PE ratios. There will of course be a range between different

stock types during any given era, such as the following that I

suggest we presently have...

Slow growth/stable

companies: 10/15

Mid-level growth: 25/40

Hyper-growth

50/75..even 100

*there have of course

been some insane tech/social media IPOs in recent years where the PE

is 1000/1500 or worse.

There are many other

smaller issues about PE ratios. Most notably, there is no PE ratio of

course is a company is losing money. Secondly, if a company is making

a VERY small amount relative to number of shares, its possible we get

bizarre PE ratios of 5000, or even higher.

The PE ratio is

certainly not everything when considering a company, but contrary to

what many have come to forget, it is still usually a great starting

place.

A brief reminder on

2011's greatest decliner

Look at the Netflix

chart. It had a superb run, truly amazing – justifiably based on

massive revenue growth and ever increasing profits. Such

near-exponential growth though could never last. Besides having to

deal with the 2008 collapse wave, increasing competition (legal or

otherwise), NFLX faced a number of problems – not least shooting

itself in the foot via changing its price structure which really

annoyed its unreliable customer base.

The point is that in a

matter of just a few months, the once beloved NFLX became a horror

story. No company, no matter how many cheerleaders on either of the

financial clown channels it has, is immune to real world

problems/corporate mistakes.

AMZN – the online

retailer almost everyone uses

So where do we start

with this retail behemoth? Current market cap of $82bn

Current PE: 131

Forward: 67 (fiscal

yr-end Dec'2013)

Profit margin: 1.3%

operating margin: 1.8%

Cash/Debt: 9.6/1.8bn

*for some good details

on AMZN's key numbers

Initial summary: The

obvious problem is profit margins are razor thin, plenty of cash,

debt is not a problem – and thus AMZN is at least not significantly

exposed to any future rise in interest rates.

So, what would 'fair

value' be for AMZN.

All other things being

equal, lets take 3 scenarios.

A. AMZN - starts

posting losses...and losses increase through 2012.

B.AMZN – remains

posting in-line earnings, but growth remains low

C. AMZN – profit

margins start to rapidly increase, and growth accelerates

Fair value philosophy –

a summary

First, the chosen PE

ratios 15, 25, and 35. Why have I chosen these? I'm trying to take

the more 'bullish' approach, and thus the eventual $ price levels are

the minimum targets, rather than what might be the ultra doomish

ones.

Frankly, being a

permabear-doomster, I would be more inclined to look for PE's of 5,

10, 15. After all, if a company is regularly losing money, why would

it not be slammed under PE'10?

The three ratios:

15 is a good historic

average for a stable and comfortably profitable company.

25 is a touch above the

current market average, and considerably over the long term average

of 15

35 is historically on

the high end, even the most bullish cheerleaders would struggle to

justify this.

If Scenario'A, then how

could anyone justify a PE over 15?

If B', how could AMZN

be justified to hold a PE of even 25 ?

If C', despite

recovering profit margins, would AMZN really be justified PE'35 ?

That would still be historically high for a stock – no matter how

good the company.

With AMZN currently

trading at $180 per share, what does that mean for a 'fair value'

price?

A. $21 (180/131 x15)

B. $34 (180/131 x25)

C. $48 (180/131 x35)

The above uses the

current PE of 131 as guidance. Lets also use the forward PE of 67–

as projected for year end 2013.

A. $40 (180/67 x15)

B. $67 (180/67 x25)

C. $94 (180/67 x35)

So, let me state

clearly, even under the 'bullish' scenario – where 'everything in

the world is a-okay', AMZN should not be trading above $94. The $100

level is obviously a huge psychological support level for AMZN, so

its kinda interesting that my own rough estimates fail to even

support AMZN above this level.

Worse case for AMZN,

are we really looking at AMZN in the 20s? From a chart/technical

perspective, the old $40 level was a huge issue for AMZN.

Baseline 'fair

value' for AMZN is between $21 and $48

Best case 'fair

value' for AMZN is between $40 and $94

One thing I will note

at this point, is that of course there are so many variables, and at

Q1 earnings, these 'fair value' targets would need to be re-assessed.

However, based on historic data and standards, I believe the 3 ratios

are very balanced, and in fact are overly fair to the bullish

persuasion.

Will 2012 be the year

AMZN acts like NFLX'2011 ?

The absolute

determining factor will be earnings of course. Can AMZN stabilise

falling profit margins, or will it start posting increasingly large

losses? Q1 earnings (due late April) will be fascinating to see. I

certainly would not be surprised to see a minor loss. The market

appears to be looking for another minor EPS profit of around 10

cents.

A secondary issue will

of course be the wider equity/capital market mood. If the doomster

wave'3 were to occur, then it'd seem likely that AMZN will at least

test the big $100 level sometime this year.

Great company - but not

making enough profit.

Let me end this first

posting for this 'fair value' series, by noting that AMZN is clearly

a superb company. Since its incorporation in 1994 it has managed to

become one of the worlds leading online retailers, and has seized a

huge amount of sales from the old brick & mortar retailers. It

has near saturation brand recognition, and has become a very

established corporation, and doubtless has a strong future ahead.

Yet, in the immediate

term AMZN does face serious issues. Those profit margins are truly

razor thin. With just a minor increase in its cost base (whether its

through wage inflation, energy costs, taxation), the point stands -

AMZN either starts to rapidly expand – with good growth in revenue

and much higher profit margins (to around the 8/10% level), or my

fair value target 'should' in theory be attained at some point within

the next 6-18mths.

When you take into

consideration the larger economy, the stage of the economic cycle we

are in, and the various chart support/resistance levels:

AMZN: fair value: $95,

with potential for downside to the permabear-doomster level of $40