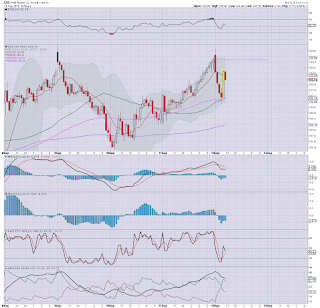

With US equities closing moderately lower, the VIX settled +4.4% @ 24.23. Near term outlook offers relatively subdued equity price action into Thursday, before a probable snap higher, into the sp'2000s.. and that should see the VIX lose the key 20 threshold.

VIX'60min

VIX'daily3

Summary

Despite closing net higher, the VIX remains in broad cooling mode from the hyper-spike of August 24'th. Sub 20s VIX look a given if sp'2000s.

To be clear though, even if the equity market can see a post FOMC ramp... renewed downside of some sig' degree seems highly probable into October.

*I will consider a long-VIX position in the 17/15 zone.

--

more later... on the indexes

Monday, 14 September 2015

Closing Brief

US equities closed moderately weak, sp -8pts @ 1953 (intra low 1948). The two leaders - Trans/R2K, both settled lower by around -0.4%. Near term outlook is for subdued price action into Thursday, before a major break... to the upside. The sp'2000s still look probable before the bears have another opportunity of downside.

sp'60min

Summary

A relatively quiet start to the week... and really, little else needs to be said.

Best guess remains... a hyper-spike on the FOMC decision (regardless of whatever they decide).

--

*for now, I won't be short this market... would consider DIS in the $102s.

--

more later... on the VIX

sp'60min

Summary

A relatively quiet start to the week... and really, little else needs to be said.

Best guess remains... a hyper-spike on the FOMC decision (regardless of whatever they decide).

--

*for now, I won't be short this market... would consider DIS in the $102s.

--

more later... on the VIX

3pm update - not entirely surprising

In many ways, today's day of chop should not be entirely surprising. With the FOMC on Thursday afternoon, the market will be increasingly inclined to trade in a more subdued manner. So long as the rising trend holds... the bull maniacs have little to be concerned about.. the sp'2000s still look due.

sp'60min

VIX'60min

Summary

Little to add... on what is indeed a relatively quiet start to the week... but which will end with some wild action... one way or another.

--

*after some fair consideration, I'll not getting involved in DIS.. unless the mid $102s... considering the broader market.. that might not happen now.

Instead, I'll just hold a micro USO-long position... price structure remains a bull flag... but as ever.. the Wed' EIA report will be a key determinant.

-

back at the close

sp'60min

VIX'60min

Summary

Little to add... on what is indeed a relatively quiet start to the week... but which will end with some wild action... one way or another.

--

*after some fair consideration, I'll not getting involved in DIS.. unless the mid $102s... considering the broader market.. that might not happen now.

Instead, I'll just hold a micro USO-long position... price structure remains a bull flag... but as ever.. the Wed' EIA report will be a key determinant.

-

back at the close

2pm update - chop chop

US equities remain in minor chop mode... as the market seems more than capable of holding rising support.. into the coming FOMC this Thursday afternoon. There remains very high threat the market will want to sweep out the equity bears before the next opportunity of a major down wave.

sp'60min

Summary

Little to add.

--

*Oil making a vain attempt to rally from earlier lows. It would seem first real chance of Oil breaking higher is the next EIA report this Wed'... and then perhaps to gain extra help after a market hyper-ramp this Thursday.

I hold a micro USO-long position... so I am not particularly rattled at the ongoing weakness. I can wait.

sp'60min

Summary

Little to add.

--

*Oil making a vain attempt to rally from earlier lows. It would seem first real chance of Oil breaking higher is the next EIA report this Wed'... and then perhaps to gain extra help after a market hyper-ramp this Thursday.

I hold a micro USO-long position... so I am not particularly rattled at the ongoing weakness. I can wait.

1pm update - remaining weak

US equities remain moderately weak, as the market is seeing some mild concern ahead of the Thursday FOMC decision. The equity bull maniacs really need to hold rising trend.. currently @ sp'1935... but at the Thursday open will be 1950. Oil remains notably weak, -2.3% in the $44s.

sp'60min

Summary

Little to add.

I realise to some out there, the notion of sp'2000s later this week is crazy talk, but really, it is well within range.

Market IS coiling.. the only issue is which way will it break?

Best guess.. UP.. in the short term.

--

Eyes still on DIS

15min

The $102s would be tempting.. for the moment.. I see ZERO hurry to chase.

sp'60min

Summary

Little to add.

I realise to some out there, the notion of sp'2000s later this week is crazy talk, but really, it is well within range.

Market IS coiling.. the only issue is which way will it break?

Best guess.. UP.. in the short term.

--

Eyes still on DIS

15min

The $102s would be tempting.. for the moment.. I see ZERO hurry to chase.

12pm update - tiresome chop

US equities remain in moderate chop mode... clearly leaning on the weak side. Key rising support is currently @ sp'1935. Unless the bears can muster some sig' downside power - seemingly very unlikely.... this is merely another buying level.. ahead of the FOMC.

sp'60min

Summary

Little to add.

The weather in the city is grey and rainy.. and that ain't exactly helping my mood. I guess you could call it bear weather.

*for the moment, I'm still watching DIS...

... but unless i see the $102s.. I'll let it go.

-

VIX update from Mr T'

--

back at 1pm

sp'60min

Summary

Little to add.

The weather in the city is grey and rainy.. and that ain't exactly helping my mood. I guess you could call it bear weather.

*for the moment, I'm still watching DIS...

... but unless i see the $102s.. I'll let it go.

-

VIX update from Mr T'

--

back at 1pm

11am update - weak chop

US equities continue to see some weak chop.. with the sp' so far hitting 1949. Further weakness to the 1947/45 zone looks easily viable.. before the market stabilises into the late afternoon. Metals are a touch lower, Gold -$1, whilst Oil is holding around the opening decline, -1.2% in the $44s.

sp'5min

Summary

Little to add.

There is no real downside power.. that should be clear to everyone.. ahead of the Fed.

The bigger daily/weekly cycles threaten the sp'2000s before next opportunity of a rollover.

--

I've eyes on DIS...

15min

102.99 hit earlier... but I didn't like the time frame... still waiting for another micro wave lower.

--

time for an early lunch

-

11.32am... almost there........

DIS -$1.00 :)

sp'5min

Summary

Little to add.

There is no real downside power.. that should be clear to everyone.. ahead of the Fed.

The bigger daily/weekly cycles threaten the sp'2000s before next opportunity of a rollover.

--

I've eyes on DIS...

15min

102.99 hit earlier... but I didn't like the time frame... still waiting for another micro wave lower.

--

time for an early lunch

-

11.32am... almost there........

DIS -$1.00 :)

10am update - opening weakness

US equities start the week a little choppy, and are leaning on the downside.. at least until the typical turn time of 11am. Broadly though, the market looks set to battle upward into the FOMC.. and possibly somewhat beyond.. the sp'2050/70 zone remains a very serious threat to those short ahead of the fed.

sp'60min

Summary

So... early pre-market gains sure didn't hold.. and we've already hit sp'1949... just 14pts above rising support.

VIX is +4% in the 24s.... but certainly... nothing for the equity bulls to be overly concerned of.

--

I've eyes on QCOM...

If I do pick it up.. it'll be a moderate position, one I'd want to drop if sp'2000s later this week.

For the moment... I'm just watching.

-

10.03am.. DIS is almost lower by $1... and that seems a better play than QCOM.

sp -7pts .. 1953. Hmmm

-

10.07am. . DIS -$1.05... yeah.. this is getting tempting.

10.11am...

sp'5min

Best guess 1949/47 by 11am.

-

10.23am.. DIS -$1.46... now super tempting... I'm waiting on sp'1949/47.. by 11am.

10.37am.. market is twitchy... still... no hurry.

time to cook............. back soon

sp'60min

Summary

So... early pre-market gains sure didn't hold.. and we've already hit sp'1949... just 14pts above rising support.

VIX is +4% in the 24s.... but certainly... nothing for the equity bulls to be overly concerned of.

--

I've eyes on QCOM...

If I do pick it up.. it'll be a moderate position, one I'd want to drop if sp'2000s later this week.

For the moment... I'm just watching.

-

10.03am.. DIS is almost lower by $1... and that seems a better play than QCOM.

sp -7pts .. 1953. Hmmm

-

10.07am. . DIS -$1.05... yeah.. this is getting tempting.

10.11am...

sp'5min

Best guess 1949/47 by 11am.

-

10.23am.. DIS -$1.46... now super tempting... I'm waiting on sp'1949/47.. by 11am.

10.37am.. market is twitchy... still... no hurry.

time to cook............. back soon

Pre-Market Brief

Good morning. US equity futures are moderately higher, sp +5pts, we're set to open at 1966. USD is broadly flat in the DXY 95.20s. Metals are a touch weak, Gold -$1, whilst Oil is -0.7% in the $44s.

sp'daily5

Summary

Well, its Fed week, perhaps the most important week since the Fed started cutting rates in 2007.

Will they raise? With equities battling upward from sp'1867... it is certainly possible. After all, when its comes to 'data dependency'.. the only data point the fed really cares about is the level of the sp'500/Dow... that should be clear to most after all these years.

If rates are raised this Thursday though, many will not be pleased... not least the IMF.

-

early mover... AAPL +1.0% in the $115s.

As someone seeking renewed downside after the Fed, I really don't want to see AAPL sustainably holding above the old broken $119s. Its something to keep in mind.

--

Overnight China action: A weak start to the week, with the Shanghai comp' settling -2.7% @ 3114. Despite the decline, I'm still seeking further upside to the 3400/500s. The pressure will be building though... with a serious threat of the 2500/2000 zone by early November.

-

What am I doing?

Just holding a micro USO-long position

Seeking a break >15.00.. and that will open the door to the 16/17s. Other than USO, I don't much want to add anything ahead of the Fed. Most certainly... no shorts until after the Yellen is out of the way.

Have a good Monday.

sp'daily5

Summary

Well, its Fed week, perhaps the most important week since the Fed started cutting rates in 2007.

Will they raise? With equities battling upward from sp'1867... it is certainly possible. After all, when its comes to 'data dependency'.. the only data point the fed really cares about is the level of the sp'500/Dow... that should be clear to most after all these years.

If rates are raised this Thursday though, many will not be pleased... not least the IMF.

-

early mover... AAPL +1.0% in the $115s.

As someone seeking renewed downside after the Fed, I really don't want to see AAPL sustainably holding above the old broken $119s. Its something to keep in mind.

--

Overnight China action: A weak start to the week, with the Shanghai comp' settling -2.7% @ 3114. Despite the decline, I'm still seeking further upside to the 3400/500s. The pressure will be building though... with a serious threat of the 2500/2000 zone by early November.

-

What am I doing?

Just holding a micro USO-long position

Seeking a break >15.00.. and that will open the door to the 16/17s. Other than USO, I don't much want to add anything ahead of the Fed. Most certainly... no shorts until after the Yellen is out of the way.

Have a good Monday.

Subscribe to:

Comments (Atom)