With the main indexes seeing the traditional 'latter day recovery', the VIX naturally failed to hold the morning gains of 3%, and closed -3.9% @ 12.31. The market remains laughably complacent, and VIX 11s look 'briefly' possible on any attempt to re-take the sp'1700s.

VIX'60min

VIX'daily3

Summary

So..once again...opening minor gains in the VIX...only to close lower. Rinse..repeat...probably tomorrow, Thursday..and Friday too. Why wouldn't it? Not least with two blocks of QE, and an opex..where we'll probably see micro-chop into the Friday close.

--

For the option trader 'bears' out there (which includes yours truly), this is a market to leave alone. To be clear, I am still very bearish into September, I'm more than content to let this week of minor chop just pass by.

-

more later..on the indexes

Tuesday, 13 August 2013

Closing Brief

The main indexes closed moderately higher, after yet another latter day recovery - and that was with no QE! The VIX declined around 4%, and despite a lot of looming issues for September, the market remains fearless. Gold was weak, closing -$13

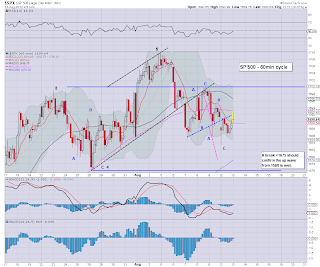

sp'60min

Summary

I suppose I could have gone long in the morning in the low 1680s, but really, I just don't like meddling when the cycles are so small.

--

I still think the bulls won't be able to bust over sp'1700 in the near term. Even if they do, the 1709 high will be many times harder.

--

*as ever, if you like the posts, and have your own site, add me to your site/blog links!

bits and pieces across the evening!

sp'60min

Summary

I suppose I could have gone long in the morning in the low 1680s, but really, I just don't like meddling when the cycles are so small.

--

I still think the bulls won't be able to bust over sp'1700 in the near term. Even if they do, the 1709 high will be many times harder.

--

*as ever, if you like the posts, and have your own site, add me to your site/blog links!

bits and pieces across the evening!

3pm update - weakness into the close

The market has maxed out at sp'1696, and a close in the 1700s looks completely out of range. Slight weakness into the close looks likely, and bears should be seeking anything <1690. VIX remains red, but a fractionally higher close is viable.

sp'60min

R2K, 5min

Summary

*The R2K is a good example of a leading index putting in a black-fail candle at the open, whilst the other indexes held up..before falling away.

--

Well, the smaller 5/15/60min cycles all look maxed out, and bears have another opportunity to push lower.

On any basis though, the key 1675 low should comfortably hold into opex.

-

I remain content to sit this tiresome nonsense out,

--

Ohh..and its somewhat amusing to see AAPL on the border of the $490s.

Didn't I mention that one yesterday..and earlier today?

I sure don't expect $500 though in the current wave..not if the main market is going to roll lower next week.

-

UPDATE 3.12pm..hmm, its a bit of a mess. There could even be a small bull flag, but then, how are the bull maniacs going to break >1700?

Interesting action in AAMRQ - the airline

Good example of stability at the 200 day MA

Sp'5min...

If that is a bull flag, a close in the 1697/99 area should concern those on the short side, for overnight trading.

3.25pm.. sp'1696...hmm, will the algo-bots want to do a stop run of the 1700/02 stops?

They must be a fair few there to trigger...if not today..then tomorrow.

-

Certainly, I'm glad to just sit this nonsense out. Things will be a lot simpler next week.

3.38pm.. AAPL shorts getting cooked, +$26 at $494... lol

sp'60min

R2K, 5min

Summary

*The R2K is a good example of a leading index putting in a black-fail candle at the open, whilst the other indexes held up..before falling away.

--

Well, the smaller 5/15/60min cycles all look maxed out, and bears have another opportunity to push lower.

On any basis though, the key 1675 low should comfortably hold into opex.

-

I remain content to sit this tiresome nonsense out,

--

Ohh..and its somewhat amusing to see AAPL on the border of the $490s.

Didn't I mention that one yesterday..and earlier today?

I sure don't expect $500 though in the current wave..not if the main market is going to roll lower next week.

-

UPDATE 3.12pm..hmm, its a bit of a mess. There could even be a small bull flag, but then, how are the bull maniacs going to break >1700?

Interesting action in AAMRQ - the airline

Good example of stability at the 200 day MA

Sp'5min...

If that is a bull flag, a close in the 1697/99 area should concern those on the short side, for overnight trading.

3.25pm.. sp'1696...hmm, will the algo-bots want to do a stop run of the 1700/02 stops?

They must be a fair few there to trigger...if not today..then tomorrow.

-

Certainly, I'm glad to just sit this nonsense out. Things will be a lot simpler next week.

3.38pm.. AAPL shorts getting cooked, +$26 at $494... lol

2pm update - looking stuck

The main indexes are looking maxed out at sp'1696, with the VIX -3% in the 12.30s. Despite the earlier fed chatter on taper, bulls look highly unlikely to close in the 1700s. The key high of 1709 still looks fine in the mid-term. Metals remain weak, Gold -$14

sp'60min

Summary

Hmm, it is somewhat tempting to launch a re-short of the indexes, but really, I just don't see any downside power until next week.

Bears also face two major QEs on Thur/Friday, never mind a likely choppy opex.

--

*AAPL still looks good for 485/490 by opex.

stay tuned

sp'60min

Summary

Hmm, it is somewhat tempting to launch a re-short of the indexes, but really, I just don't see any downside power until next week.

Bears also face two major QEs on Thur/Friday, never mind a likely choppy opex.

--

*AAPL still looks good for 485/490 by opex.

stay tuned

1pm update - same old nonsense

The market is back in rally mood, partly inspired on comments from one of the Fed people. After all, gods forbid QE being reduced this September, the system might implode! Thus..indexes are making a play for the sp'1698/1700 zone. VIX is -3% in the 12.30s.

sp'60min

Summary

Hourly charts were warning of trouble for the bears all morning, and we're seeing it.

Despite the current gains, I don't think the bulls can break into the 1700s again.

Lets see how many of the bull maniacs sell into this latest little micro-rally.

--

UAL having problems

Next support is the obvious $30 level. Even if that fails, there is the rising 200 MA in the mid $28s.

sp'60min

Summary

Hourly charts were warning of trouble for the bears all morning, and we're seeing it.

Despite the current gains, I don't think the bulls can break into the 1700s again.

Lets see how many of the bull maniacs sell into this latest little micro-rally.

--

UAL having problems

Next support is the obvious $30 level. Even if that fails, there is the rising 200 MA in the mid $28s.

12pm update - afternoon melt

The main indexes have already significantly recovered from the morning downside. The hourly charts continue to offer a challenge of the sp'1698/1700 area...which is even viable by late today. With the bears still powerless...VIX is back to red.

sp'60min

VIX'60min

Summary

There really isn't much to say, its just the same minor moves.

1675 doesn't look likely to break until next week, and neither do the bulls look able to break 1700.

--

VIX update from Mr T.

Kinda interesting

sp'60min

VIX'60min

Summary

There really isn't much to say, its just the same minor moves.

1675 doesn't look likely to break until next week, and neither do the bulls look able to break 1700.

--

VIX update from Mr T.

Kinda interesting

11am update - minor declines won't hold

The indexes have seen a 10pt swing from sp'1692 to '82, yet..it all appears as 'mere noise'. The bears look weak, and the key 1675 level looks impossible to break soon. Similarly, bulls will be stuck at 1700. Metals remain weak, Gold -$9

sp'60min

VIX'60min

Summary

*VIX similarly putting in a failed/spike higher.

--

The 15/60min cycles look like a spike-floor has been put in at 1682, with VIX maxing out in the mid 13s.

I guess some will be still trying to trade these tiny moves....but not me.

This minor-chop nonsense looks set to continue into Friday.

--

Notable movers, UAL, along with the whole airline sector.

AAPL looks pretty good for 485/490 by opex.

sp'60min

VIX'60min

Summary

*VIX similarly putting in a failed/spike higher.

--

The 15/60min cycles look like a spike-floor has been put in at 1682, with VIX maxing out in the mid 13s.

I guess some will be still trying to trade these tiny moves....but not me.

This minor-chop nonsense looks set to continue into Friday.

--

Notable movers, UAL, along with the whole airline sector.

AAPL looks pretty good for 485/490 by opex.

10am update - opening chop

The hourly index charts are offering upside to sp'1698/1700 by early afternoon, but bulls seem unlikely to have the strength to close in the 1700s Metals are mixed, Gold -$8, but Silver is holding slight gains. Oil is a touch weak...with the higher dollar no doubt being a pressure.

sp'60min

sp'daily5

Summary

A quiet and dull open..and that will probably remain the case until early next week.

---

*It will be moderately tempting to launch an index re-short if we can get into the 1698/1700 area. The only problem is the threat of a gap higher straight >1709..which would open up 1740/60.

As it is, weekly charts are highly suggestive the market will not take out 1709 high.

-

*daily MACD cycle is already pretty low, bears have a problem!

10.07am.. sp'1684...back to the Monday lows..hmm.

This all feels like utter noise. A few pts up..a few pts down.

With no QE today..or tomorrow..bears have small chance of testing 1675..but really..there is still no downside power.

--

10.30am.. I can't take the declines seriously. we're already showing signs of a spike-floor.

Another test of 1700 still looks very viable

From a bearish perspective, the 15/60min cycles look VERY floored, and would be a lousy place to remain short.

sp'60min

sp'daily5

Summary

A quiet and dull open..and that will probably remain the case until early next week.

---

*It will be moderately tempting to launch an index re-short if we can get into the 1698/1700 area. The only problem is the threat of a gap higher straight >1709..which would open up 1740/60.

As it is, weekly charts are highly suggestive the market will not take out 1709 high.

-

*daily MACD cycle is already pretty low, bears have a problem!

10.07am.. sp'1684...back to the Monday lows..hmm.

This all feels like utter noise. A few pts up..a few pts down.

With no QE today..or tomorrow..bears have small chance of testing 1675..but really..there is still no downside power.

--

10.30am.. I can't take the declines seriously. we're already showing signs of a spike-floor.

Another test of 1700 still looks very viable

From a bearish perspective, the 15/60min cycles look VERY floored, and would be a lousy place to remain short.

Pre-Market Brief

Good morning. Futures are moderately higher, sp +3pts, we're set to open at 1692. Precious metals are a touch weak, Gold -$5, no doubt pressured by the stronger dollar +0.5%. Bulls are going to have serious problems breaking sp'1700.

sp'60min

Summary

So..we're set to open a little higher, but its still far short of what the bulls need.

Arguably, the only way they are going to clear 1700..or even more importantly, 1709, is with a giant gap higher, and I sure don't expect that this week.

--

*retail sales come in a touch lighter than expected, +0.2%...pretty lame for summer.

-

I remain on the sidelines, and have no real inclination to re-short the indexes until after the QEs of Thur/Friday...and opex.

-

VIdeo update from Mr Carboni

Hmm, it would seem Permabull is still on the 'Europe is coming online/recovery' nonsense wagon..

*Hey Oscar want to come visit this side of the Ocean, how about Greece, Spain, Portugal, Ireland..ohh, or maybe Italy too ? Or perhaps the 'we don't need to manufacture anything' UK ?

sp'60min

Summary

So..we're set to open a little higher, but its still far short of what the bulls need.

Arguably, the only way they are going to clear 1700..or even more importantly, 1709, is with a giant gap higher, and I sure don't expect that this week.

--

*retail sales come in a touch lighter than expected, +0.2%...pretty lame for summer.

-

I remain on the sidelines, and have no real inclination to re-short the indexes until after the QEs of Thur/Friday...and opex.

-

VIdeo update from Mr Carboni

Hmm, it would seem Permabull is still on the 'Europe is coming online/recovery' nonsense wagon..

*Hey Oscar want to come visit this side of the Ocean, how about Greece, Spain, Portugal, Ireland..ohh, or maybe Italy too ? Or perhaps the 'we don't need to manufacture anything' UK ?

Bearish into September

The market looks set for minor price chop for the rest of this week, but things should get more dynamic in the latter half of August. So long as the sp'1709 high holds, bears should have some good short-side opportunities in the weeks ahead.

sp'weekly7 - bearish outlook

sp'weekly8 - 'best guess', post September

Summary

To start the week, we have our second blue candle on the 'rainbow' weekly charts. Certainly, we could see another 2-4 blue candles, before any significant downside in September. Most previous multi-week down cycles usually take a good month or two to solidify a top.

I am keeping an open mind on the sp'1709 high being taken out, but I'm guessing no. Market looks tired, and stuck <1700.

As for chart'8, yes..that remains the more 'balanced' best guess. I'm sure not liking the idea of a rally all the way into spring 2014, but baring a FULL end to QE-pomo, the market does look set for much higher levels.

There is a viable scenario where a Blue V wave (or however you want to count it), might put in a lower high in late Sept/October, but for now..that is a mere 'distant hope'.

Special note

The downside target in the next multi-week down wave remains the lower weekly bollinger...currently @ 1544..but rising each and every day. By mid/late September, bears are going to face a wall in the sp'1600/1575 zone.

Looking ahead

Tuesday has retail sales, import/export prices, and business inventories.

*there is no sig' QE until Thursday.

--

So...I remain on the sidelines (having bailed at the Monday open of sp'1684), and will be seeking an index re-short, possibly this Thur/Friday, but maybe as late as next Monday. I'm in no hurry, whilst volatility remains this low.

Goodnight from London

sp'weekly7 - bearish outlook

sp'weekly8 - 'best guess', post September

Summary

To start the week, we have our second blue candle on the 'rainbow' weekly charts. Certainly, we could see another 2-4 blue candles, before any significant downside in September. Most previous multi-week down cycles usually take a good month or two to solidify a top.

I am keeping an open mind on the sp'1709 high being taken out, but I'm guessing no. Market looks tired, and stuck <1700.

As for chart'8, yes..that remains the more 'balanced' best guess. I'm sure not liking the idea of a rally all the way into spring 2014, but baring a FULL end to QE-pomo, the market does look set for much higher levels.

There is a viable scenario where a Blue V wave (or however you want to count it), might put in a lower high in late Sept/October, but for now..that is a mere 'distant hope'.

Special note

The downside target in the next multi-week down wave remains the lower weekly bollinger...currently @ 1544..but rising each and every day. By mid/late September, bears are going to face a wall in the sp'1600/1575 zone.

Looking ahead

Tuesday has retail sales, import/export prices, and business inventories.

*there is no sig' QE until Thursday.

--

So...I remain on the sidelines (having bailed at the Monday open of sp'1684), and will be seeking an index re-short, possibly this Thur/Friday, but maybe as late as next Monday. I'm in no hurry, whilst volatility remains this low.

Goodnight from London

Daily Index Cycle update

The main indexes recovered from opening moderate declines, with the sp' settling -2pts at 1689. The two market leaders - Trans/R2K. managed gains of 0.2% and 0.5% respectively. Near term outlook is for moderately chop, in the sp'1700/1675 zone.

sp'daily5

R2K

Trans

Summary

For the bears, it was just another deeply frustrating day. Despite the indexes opening lower, those declines sure didn't last long, and it was merely a case of 'minor price chop..with bias to the upside'.

Underlying MACD (blue bar histogram) cycle ticked higher for the R2K, but still slipped on the other indexes.

In general, it doesn't look like the bears..or bulls will be able to make anything from this week. The bulls do have two large QEs at the tail end of the week, along with opex

-

a little more later...

sp'daily5

R2K

Trans

Summary

For the bears, it was just another deeply frustrating day. Despite the indexes opening lower, those declines sure didn't last long, and it was merely a case of 'minor price chop..with bias to the upside'.

Underlying MACD (blue bar histogram) cycle ticked higher for the R2K, but still slipped on the other indexes.

In general, it doesn't look like the bears..or bulls will be able to make anything from this week. The bulls do have two large QEs at the tail end of the week, along with opex

-

a little more later...

Subscribe to:

Comments (Atom)