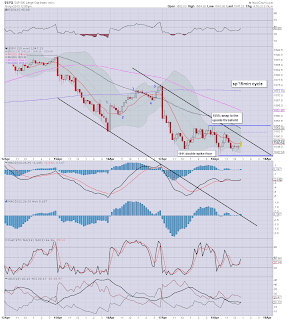

The VIX opened a touch weak, but saw two surges today, with the second one managing to briefly break into the low 18s. The VIX is gaining power, and closed +6.4% @ 17.56. Near term hourly charts offer a drop back into the 16/15s. VIX 20s now look likely within 5-7 days.

VIX'60min

VIX'daily3

Summary

More than anything today - even more surprising than the sp' breaking <1538, was the strength in the VIX. The 18s were not at all expected, and it has to be said, they are unquestionably a warning that all is no longer calm in market land.

I still expect a minor 2-3 day bounce in the main indexes, to around sp'1570s, and that should in theory cool the VIX back down to the 16/15s.

VIX 20s..on the way

What now seems clear, the equity bears - especially the option traders, can look forward to VIX breaking above the key 20 threshold. This seems very likely before April comes to a close.

With a break into the 20s, the only issue then is where does it stop.

Note that the 2012 VIX high was a mere 27, right now...I have to think that will be greatly exceeded this coming May.

more later..on the indexes

Thursday, 18 April 2013

Closing Brief

A pretty fierce battle across the day in market land, with the sp' taking out the critical low of 1538. Yet, near term count is still suggestive of upside in Friday opex, target remains the low 1570s, but with the strong VIX, maybe it will only back to the 15s.

sp'60min

Summary

Today was certainly a busy one, and all things considered, things are still broadly looking on track.

Yes, the critical 1538 low was taken out, and that IS a serious issue now, but that doesn't mean we can't still see a 2-3 day jump into the 1570s again.

I remain comfortably on the sidelines, seeking a major re-short, which now seems more likely on Monday, than near the Friday close.

--

the usual bits and pieces across the evening

sp'60min

Summary

Today was certainly a busy one, and all things considered, things are still broadly looking on track.

Yes, the critical 1538 low was taken out, and that IS a serious issue now, but that doesn't mean we can't still see a 2-3 day jump into the 1570s again.

I remain comfortably on the sidelines, seeking a major re-short, which now seems more likely on Monday, than near the Friday close.

--

the usual bits and pieces across the evening

3pm update - bulls battling to close in the 1540s

Its turned into something of a battle this afternoon. The bears have just managed to break lower again, taking out the March'19 low, and we're now trading in the 1537s, below the critical March'19th low. Upside to the sp'1570s still seems viable though, with opex tomorrow.

sp'60min

vix'60min

Summary

The VIX has broken into the 18s, taking out the Wednesday high.

--

Indeed, the VIX has been a lot stronger than I had expected - along with weaker indexes. Perhaps we'll only see a pull back into the 15s.

Regardless, I'm very content to sit on the sidelines, and wait for a bounce.

Bears.....arguably need to be patient, and wait for a better entry level.

*Only the Dow and Transports are yet to break the recent lows. Those still seeking upside, thats really the only sign left that this is not an actual major fail.

--

I won't be chasing this though, even if tomorrow wasn't opex.

-

3.05pm Bulls need to get >1545, to escape the current down channel. Thats clearly possible by the close. VIX in the low 18s, +9%...hmm

3.20pm..we're due another up cycle on the small 15min...

Bulls just need to break >1545..to escape the down channel. VIX is cooling down..again

--

3.30pm... Ending diagonal ?

Whatever it is, I ain't short, ahead of tomorrows opex!

3.34pm...okay, here is the thing, we're only talking about 25/30pts upside here, so I'm not proclaiming 'moon ramp', but as an options play, they'll whack 35/45% off the puts from here.

high risk for bears holding overnight.

--

back at the close.

sp'60min

vix'60min

Summary

The VIX has broken into the 18s, taking out the Wednesday high.

--

Indeed, the VIX has been a lot stronger than I had expected - along with weaker indexes. Perhaps we'll only see a pull back into the 15s.

Regardless, I'm very content to sit on the sidelines, and wait for a bounce.

Bears.....arguably need to be patient, and wait for a better entry level.

*Only the Dow and Transports are yet to break the recent lows. Those still seeking upside, thats really the only sign left that this is not an actual major fail.

--

I won't be chasing this though, even if tomorrow wasn't opex.

-

3.05pm Bulls need to get >1545, to escape the current down channel. Thats clearly possible by the close. VIX in the low 18s, +9%...hmm

3.20pm..we're due another up cycle on the small 15min...

Bulls just need to break >1545..to escape the down channel. VIX is cooling down..again

--

3.30pm... Ending diagonal ?

Whatever it is, I ain't short, ahead of tomorrows opex!

3.34pm...okay, here is the thing, we're only talking about 25/30pts upside here, so I'm not proclaiming 'moon ramp', but as an options play, they'll whack 35/45% off the puts from here.

high risk for bears holding overnight.

--

back at the close.

2pm update - inclination remains to the upside

Mr Market is certainly still struggling, but then neither are the bears smashing their way through the critical 1538 level. General upside into Friday opex is likely, with the sp'1570s, and VIX 14/13s. Precious metals and Oil are holding gains, and will probably build upon them,

sp'15min

sp'60min

Summary

Certainly, market is kinda weak, but bears have surely had their fun for this week. We have opex tomorrow, and you just know the market makers will want to kill as many of the put options as possible.

Baring a VIX breaking into the 18s, those currently long, should have no concerns for holding overnight.

--

2.10pm... Its important to note that whilst the SP' broke a new low this morning, the Transports AND R2K did not.

IWM'60min

It counts pretty good as a 5 wave, with a target of 91.25/92.00 by the Friday close. Target for next week is 86/84, which will be a good 5-6% lower - aka, sp'1500/1480

2.15pm..yes, another wave of weakness, but again, not all indexes have broken the recent lows..and unless VIX in the 18s...I'm still looking for upside.

Those bears still short should arguably be tightening stops..and looking to get kicked.

USO is still kinda weak, but its still battling higher overall.

Target remains the 31.75/32.25 zone, at which point I seek a reshort.

2.25pm..sp'1539s....1pt away from the critical March 19'th low.!

I STILL guessing we will rally..but yes...this is very much 'on the edge'.

sp'15min

sp'60min

Summary

Certainly, market is kinda weak, but bears have surely had their fun for this week. We have opex tomorrow, and you just know the market makers will want to kill as many of the put options as possible.

Baring a VIX breaking into the 18s, those currently long, should have no concerns for holding overnight.

--

2.10pm... Its important to note that whilst the SP' broke a new low this morning, the Transports AND R2K did not.

IWM'60min

It counts pretty good as a 5 wave, with a target of 91.25/92.00 by the Friday close. Target for next week is 86/84, which will be a good 5-6% lower - aka, sp'1500/1480

2.15pm..yes, another wave of weakness, but again, not all indexes have broken the recent lows..and unless VIX in the 18s...I'm still looking for upside.

Those bears still short should arguably be tightening stops..and looking to get kicked.

USO is still kinda weak, but its still battling higher overall.

Target remains the 31.75/32.25 zone, at which point I seek a reshort.

2.25pm..sp'1539s....1pt away from the critical March 19'th low.!

I STILL guessing we will rally..but yes...this is very much 'on the edge'.

1pm update - upside into the close

Mr Market still looks like it did a major fake out earlier this morning. General upside into Friday opex seems likely, with sp'1570s, and VIX back in the 14/13s. With the USD moderately lower, precious metals and Oil are starting to build gains again.

sp'15min

Summary

Bulls should look for a close >1555, which should see a futher snap higher. We could even close in the low 1560s..which no doubt would see many bears dismayed.

*I am tired..back in an hour...or two.

--

sp'15min

Summary

Bulls should look for a close >1555, which should see a futher snap higher. We could even close in the low 1560s..which no doubt would see many bears dismayed.

*I am tired..back in an hour...or two.

--

12pm update - its (probably) a fake

Baring a break under the morning low of 1541, and the even more critical 1538 (March'19) low, this market is merely messing with traders heads today. I hold to the original 'bounce into opex' outlook, seeking sp'1570s with VIX falling into the 14/13s.

sp'60min

VIX'60min

Summary

A real mess of a morning in market land, and I'm pretty confident its just a nasty fake out. Kicking the weak bulls out, and sucking in the bears hoping to chase it lower.

I just can't see any major downside until next week.

--

Whilst some indexes broke new lows today, the VIX was 3 ticks UNDER its 17.90 Wednesday high . That is probably the tell.

--

VIX update

Interesting day, I remain holding that its just a fake out, with upside still coming into Friday opex.

12.19pm... market still holding above the earlier 1541 spike low.

If the bulls can break into the mid 1550s later, that will secure upside into late Friday.

sp'60min

VIX'60min

Summary

A real mess of a morning in market land, and I'm pretty confident its just a nasty fake out. Kicking the weak bulls out, and sucking in the bears hoping to chase it lower.

I just can't see any major downside until next week.

--

Whilst some indexes broke new lows today, the VIX was 3 ticks UNDER its 17.90 Wednesday high . That is probably the tell.

--

VIX update

Interesting day, I remain holding that its just a fake out, with upside still coming into Friday opex.

12.19pm... market still holding above the earlier 1541 spike low.

If the bulls can break into the mid 1550s later, that will secure upside into late Friday.

11am update - its a nasty market

It looks like Mr Market has done its worse to annoy every day trader today. Opening moderate gains, then a reversal...breaking the recent 1543 low, but then a reversal BACK to the upside. VIX did NOT break a new high, and I'm holding to the original count/outlook.

sp'60min

VIX'60min

Summary

This was almost certainly just a very nasty fake out by Mr Market.

Not only did the bears get stopped out at the open...then the bulls - buying the open get kicked, as we reversed lower.

Now the bears chasing the open lower get stopped out, as we reverse to the upside!

Its darkly funny, dare I say.

--

*I'm sitting back, until late Friday...for a major re-short.

UPDATE 11.28am... Market sells off a little, but its still comfortably holding higher.

Underlying hourly MACD cycles all saying UP UP UP.

The sp'1560s by the close...very viable.

--

sp'60min

VIX'60min

Summary

This was almost certainly just a very nasty fake out by Mr Market.

Not only did the bears get stopped out at the open...then the bulls - buying the open get kicked, as we reversed lower.

Now the bears chasing the open lower get stopped out, as we reverse to the upside!

Its darkly funny, dare I say.

--

*I'm sitting back, until late Friday...for a major re-short.

UPDATE 11.28am... Market sells off a little, but its still comfortably holding higher.

Underlying hourly MACD cycles all saying UP UP UP.

The sp'1560s by the close...very viable.

--

10am update - early weakness, before latter day recovery

The market was +5pts in pre market, but has seen some very early weakness. Yet, considering the hourly index/VIX charts, we'll likely see upside as the day progresses. Target for the Friday opex close remains sp'1570s, with VIX in the 14/13s. Oil/metals will likely both battle higher.

sp'60min

vix'60min

Summary

So, a touch of weakness to scare out the weaker bulls, and draw in the most naive of bears.

Nothing has changed since yesterdays analysis, I'm seeking general 'moderate' upside into the Friday opex.

--

*I exited USO (long Oil) at the open, and now intend to sit back until near the Friday close.

--

10.05am...well, we've broken new lows on the sp'.. 1541... interesting, not that I'm going to chase it.

--

10.11am I think this is a nasty fake out by Mr Market.

Baring a breaK <1538, I'm still seeking a move into the 1570s.

UPDATE 10.29am ...I STILL think this is a NASTY market fake out to the bears..and bulls.

sp'15min

seeking a major turn upward...10.30/11am was always a good turning time zone.

10.31am...I'm calling the floor @ 1541....looking for 1560s by late afternoon.

Its a nasty market...a real morning fake out.

sp'60min

vix'60min

Summary

So, a touch of weakness to scare out the weaker bulls, and draw in the most naive of bears.

Nothing has changed since yesterdays analysis, I'm seeking general 'moderate' upside into the Friday opex.

--

*I exited USO (long Oil) at the open, and now intend to sit back until near the Friday close.

--

10.05am...well, we've broken new lows on the sp'.. 1541... interesting, not that I'm going to chase it.

--

10.11am I think this is a nasty fake out by Mr Market.

Baring a breaK <1538, I'm still seeking a move into the 1570s.

UPDATE 10.29am ...I STILL think this is a NASTY market fake out to the bears..and bulls.

sp'15min

seeking a major turn upward...10.30/11am was always a good turning time zone.

10.31am...I'm calling the floor @ 1541....looking for 1560s by late afternoon.

Its a nasty market...a real morning fake out.

Pre-Market Brief

Good morning. Futures are moderately higher, sp +5pts, we're set to open around 1557. USD is a touch lower, which is no doubt helping the Precious metals and Oil, both of which are seeing significant jumps higher. VIX will probably open 7-10% lower

sp'60min

vix'60min

Summary

Well, it looks like we're seeing sub'2 now playing out into the Friday close.

Primary target zone is the 1570/75 area where there are MANY levels of resistance.

Best guess, we close Friday around sp'1570, with VIX in the 14/13s.

--

*I am long USO, and will seek an exit at the open - although I believe 32s are still likely by the Friday close.

UPDATE 9.31am..exited USO at the open.

Looks like market is cooling off a little already, everything slipping lower.

*anyone long needs to beware of two econ-data points @ 10am. We should briefly drop back into the 1540s., before probable latter day recovery/rally

9.39am...indexes red..as I feared.

I can't see the lows from yesterday being breached. For anyone wanting to go long..it makes for an easy stop level @ 1543/42.

--

sp'60min

vix'60min

Summary

Well, it looks like we're seeing sub'2 now playing out into the Friday close.

Primary target zone is the 1570/75 area where there are MANY levels of resistance.

Best guess, we close Friday around sp'1570, with VIX in the 14/13s.

--

*I am long USO, and will seek an exit at the open - although I believe 32s are still likely by the Friday close.

UPDATE 9.31am..exited USO at the open.

Looks like market is cooling off a little already, everything slipping lower.

*anyone long needs to beware of two econ-data points @ 10am. We should briefly drop back into the 1540s., before probable latter day recovery/rally

9.39am...indexes red..as I feared.

I can't see the lows from yesterday being breached. For anyone wanting to go long..it makes for an easy stop level @ 1543/42.

--

Something for the doomer bears

Another rather sharp daily decline for the US indexes, yet the current action is still relatively minor. We will likely see much more severe falls of 3-5% when the market breaks the key floor of sp'1538, the only issue is whether the important 1480/70 zone will hold as support.

sp'daily5a - H/S idea

sp'daily3 - fib levels

sp'weekly2, rainbow

Summary

So, a big down Monday, a ramp/bounce Tuesday, and now we've had another big drop. These type of swings are clearly going to be causing a lot of confusion for many out there, but I think the count I have suggested, has a fairly high chance of broadly being correct.

The daily5a chart is one scenario I am keeping in mind. Certainly, a break <1538 opens up an arguably 'easy' move to the 1480/70s. I'd have to expect major support there. However, if the market is really rattled, with the bears having the bulls on the run, then there is the chance for something much more exciting.

Consideration of a possible 'flash-crash' scenario

First, take a look at the following...

sp'weekly - historical, May 2010

Now, the point I want to highlight is the issue of what level the bears should be seeking if the market falls off a mini-cliff. In my view, a look back at the 2010 flash-crash low is very appropriate. At that time we saw a drop to the 50 MA - which was also at the bollinger/Keltner lower band.

Where is the 50MA on the weekly right now? Its @ 1434, which is clearly a rather large drop from where we currently are.

As I've been highlighting for many months, the importance of the lower bollinger on the weekly charts can't be over stated. That lower band (still rising) is currently now 1396...so, a hit of the 50MA IS viable, without needing to break under the weekly bollinger.

Keeping scenarios in mind

Let me be clear, I am NOT currently expecting a drop <1470 next week, but it IS a valid scenario to keep in mind.

The price action in the past few days reeks of market instability, and I have to wonder, what happens when we break under sp'1538 - as I am now 95% certain of occurring.

If sp'1480/70 equates to VIX 25s - and that's a conservative outlook, then what would sp'1430s equate to? I'd have to guess a brief 'spike' into the low 30s. It would be the sort of action we've not seen since Oct'2011 - see the following...

VIX'weekly, 2yr

As noted on the chart, I think the 200MA on the weekly is very important. A weekly close above VIX 21 next week..would open the door to the 30/40s. It certainly doesn't guarantee it, but I'd give a high probability on it.

Dr Copper - the big deflationary warning

At the start of the year, it seemed Copper might make a break into the low $4s, but no, it failed. Copper now looks set to instead break into the $2s within months..if not weeks.

For those bears seeking a broad deflationary scenario into 2014-16, Copper is sounding the strongest warning. All that's left to breach is the $3.00 psy' level. A weekly/monthly close under $3, and frankly, I'll start to get back on board the 'sp'500 doomer train'.

I'm sure the above chart is giving the Bernanke nightmares

*In early overnight futures trading, Copper was trading @ $3.06

--

*Bonus chart

Okay, this is something I have updated this evening. It is just one of a number of scenarios, but its a particularly attractive one...

sp'daily5b - best guess + count

If wave'1 (black) was indeed completed today, I'd like a 2-3 day bounce - (black) wave'2, before a rather impressive wave'3 next week. I suppose we might hit 1500 and bounce a few days, or just go straight through it.

As for the large red down wave in mid/late May, well, thats just an idea, but its based on the notion that Copper, Oil, and even the precious metals, are warning of deflation and general future market weakness/instability, with a return back to the low 1400s possible.

This scenario is largely based on the idea that we'll set up a large H/S formation, but that is arguably all mere 'wishful' thinking right now.

Looking ahead...

Thursday we have the usual jobs data, but we also have the Phil' Fed survey and 'leading indicators - both at 10am.

Interestingly, if the market manages to gap higher by 0.75/1.0%, don't be surprised if either of those two data points give the market an excuse to see some weakness, before renewed upside into the Friday opex.

--

*I hold long Oil (via USO) overnight, seeking the low 32s.

--

Goodnight from London

sp'daily5a - H/S idea

sp'daily3 - fib levels

sp'weekly2, rainbow

Summary

So, a big down Monday, a ramp/bounce Tuesday, and now we've had another big drop. These type of swings are clearly going to be causing a lot of confusion for many out there, but I think the count I have suggested, has a fairly high chance of broadly being correct.

The daily5a chart is one scenario I am keeping in mind. Certainly, a break <1538 opens up an arguably 'easy' move to the 1480/70s. I'd have to expect major support there. However, if the market is really rattled, with the bears having the bulls on the run, then there is the chance for something much more exciting.

Consideration of a possible 'flash-crash' scenario

First, take a look at the following...

sp'weekly - historical, May 2010

Now, the point I want to highlight is the issue of what level the bears should be seeking if the market falls off a mini-cliff. In my view, a look back at the 2010 flash-crash low is very appropriate. At that time we saw a drop to the 50 MA - which was also at the bollinger/Keltner lower band.

Where is the 50MA on the weekly right now? Its @ 1434, which is clearly a rather large drop from where we currently are.

As I've been highlighting for many months, the importance of the lower bollinger on the weekly charts can't be over stated. That lower band (still rising) is currently now 1396...so, a hit of the 50MA IS viable, without needing to break under the weekly bollinger.

Keeping scenarios in mind

Let me be clear, I am NOT currently expecting a drop <1470 next week, but it IS a valid scenario to keep in mind.

The price action in the past few days reeks of market instability, and I have to wonder, what happens when we break under sp'1538 - as I am now 95% certain of occurring.

If sp'1480/70 equates to VIX 25s - and that's a conservative outlook, then what would sp'1430s equate to? I'd have to guess a brief 'spike' into the low 30s. It would be the sort of action we've not seen since Oct'2011 - see the following...

VIX'weekly, 2yr

As noted on the chart, I think the 200MA on the weekly is very important. A weekly close above VIX 21 next week..would open the door to the 30/40s. It certainly doesn't guarantee it, but I'd give a high probability on it.

Dr Copper - the big deflationary warning

At the start of the year, it seemed Copper might make a break into the low $4s, but no, it failed. Copper now looks set to instead break into the $2s within months..if not weeks.

For those bears seeking a broad deflationary scenario into 2014-16, Copper is sounding the strongest warning. All that's left to breach is the $3.00 psy' level. A weekly/monthly close under $3, and frankly, I'll start to get back on board the 'sp'500 doomer train'.

I'm sure the above chart is giving the Bernanke nightmares

*In early overnight futures trading, Copper was trading @ $3.06

--

*Bonus chart

Okay, this is something I have updated this evening. It is just one of a number of scenarios, but its a particularly attractive one...

sp'daily5b - best guess + count

If wave'1 (black) was indeed completed today, I'd like a 2-3 day bounce - (black) wave'2, before a rather impressive wave'3 next week. I suppose we might hit 1500 and bounce a few days, or just go straight through it.

As for the large red down wave in mid/late May, well, thats just an idea, but its based on the notion that Copper, Oil, and even the precious metals, are warning of deflation and general future market weakness/instability, with a return back to the low 1400s possible.

This scenario is largely based on the idea that we'll set up a large H/S formation, but that is arguably all mere 'wishful' thinking right now.

Looking ahead...

Thursday we have the usual jobs data, but we also have the Phil' Fed survey and 'leading indicators - both at 10am.

Interestingly, if the market manages to gap higher by 0.75/1.0%, don't be surprised if either of those two data points give the market an excuse to see some weakness, before renewed upside into the Friday opex.

--

*I hold long Oil (via USO) overnight, seeking the low 32s.

--

Goodnight from London

Daily Index Cycle update

The market continues to twist and turn, with today seeing significant closing declines of around 1.5% for most indexes. The near term hourly count is suggestive of moderate upside into Friday opex, with a break under the key sp'1538 level later next week.

IWM

Sp'daily5

Trans

Summary

Today was a really interesting one to be part of.

I exited early in the morning, - largely due to my Tuesday entry being not so great. Anyway, a gain is a gain, and I even took a minor Long Oil (via USO) position around lunch time - which I'm holding overnight.

It does look like we can now say this...

1. sp'1597 was the multi-month cyclical high

2. We've now seen an initial wave'1 down, which comprised 5 waves.

3. We're due a small wave'2 UP, which will probably take 2-3 days.

Where it gets exciting is considering what will happen when we break below the key low of sp'1538.

I think there is 'free money' of 60pts to the downside, taking us on a VERY swift and fierce move down to the 1480/70 zone - where there is very significant support. Considering the action of the VIX in the past few days, I believe the sp'1480s would probably equate to VIX in the mid/upper 20s.

There is a 'small chance' of flashing to much lower index levels.

A little more later...on that rather interesting scenario.

IWM

Sp'daily5

Trans

Summary

Today was a really interesting one to be part of.

I exited early in the morning, - largely due to my Tuesday entry being not so great. Anyway, a gain is a gain, and I even took a minor Long Oil (via USO) position around lunch time - which I'm holding overnight.

It does look like we can now say this...

1. sp'1597 was the multi-month cyclical high

2. We've now seen an initial wave'1 down, which comprised 5 waves.

3. We're due a small wave'2 UP, which will probably take 2-3 days.

Where it gets exciting is considering what will happen when we break below the key low of sp'1538.

I think there is 'free money' of 60pts to the downside, taking us on a VERY swift and fierce move down to the 1480/70 zone - where there is very significant support. Considering the action of the VIX in the past few days, I believe the sp'1480s would probably equate to VIX in the mid/upper 20s.

There is a 'small chance' of flashing to much lower index levels.

A little more later...on that rather interesting scenario.

Subscribe to:

Comments (Atom)