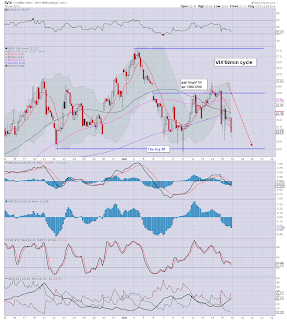

VIX closed lower today, confirming the action in the main equity indexes. Next week looks set for further VIX declines, first target is 20..then 18.

VIX, 60min

VIX, daily, rainbow

VIX, weekly

Summary

Next week should be the completion of wave'2.. around VIX 18.

Wave'3 VIX should be at least in the mid 30s...probably 40s, sometime in July.

As noted last weekend, if VIX breaks 50 at ANY time, then we are in a whole different scenario, and a number of VERY seriously bearish outlooks will come into play.

Friday, 15 June 2012

Closing Brief

Welcome to the weekend! As expected, with the break of 1340..looks like some bears covered into the close. A few will be holding across the weekend of course, looking for a Monday collapse....no, thats just not likely with the underlying momentum as it is.

The closing hourly index charts...

IWM

Dow

Sp

Summary

All indexes have confirmed and closed above their bull flags. That makes for a very bullish end to the week, and next week should have at least 2% follow through - which would equate to around sp'1360/70.

A little more later...

The closing hourly index charts...

IWM

Dow

Sp

Summary

All indexes have confirmed and closed above their bull flags. That makes for a very bullish end to the week, and next week should have at least 2% follow through - which would equate to around sp'1360/70.

A little more later...

3pm update - a rumourless closing hour..probably

I can only hope the closing hour is dull, it does no one any good what we saw yesterday.

With the market now hitting 1340, there will surely be some bear stops about to be taken out, a little move to the next fib' level of 1344/45 seems viable by the close. A little extra salt to rub into the bears scorched fur to end a tricky trading week.

sp' daily, 4mth

Summary

When you consider there is the VERY high likelihood of the Fed extending op-twist on Wednesday, purple box 1380/90 looks within range for next Wed/Thursday. That will make for a very good shorting level.

Almost time for England v Sweden.

yours...bullish Sweden.

With the market now hitting 1340, there will surely be some bear stops about to be taken out, a little move to the next fib' level of 1344/45 seems viable by the close. A little extra salt to rub into the bears scorched fur to end a tricky trading week.

sp' daily, 4mth

Summary

When you consider there is the VERY high likelihood of the Fed extending op-twist on Wednesday, purple box 1380/90 looks within range for next Wed/Thursday. That will make for a very good shorting level.

Almost time for England v Sweden.

yours...bullish Sweden.

2pm update - did they vote yet?

The market seems stuck at sp'1336. All things considered, bears have to concede this week was one for the bulls. We had clear bull flags on the indexes..and we're now above them. All that's missing now is the first snap up move - which could easily come on Monday. That will get us straight into the 1350s..and then its a case of waiting for the Bernanke on Wednesday.

sp'60min

Summary

Not much to add...all the various little things are moving as expected, except for Oil which is a touch lower. The first 3 or 4 days of next week should get Oil into the high 80s...where it can then fail..and begin its descent to $60..along with the rest of the market. Too bold a call?

...now back to the France/Ukraine match...

sp'60min

Summary

Not much to add...all the various little things are moving as expected, except for Oil which is a touch lower. The first 3 or 4 days of next week should get Oil into the high 80s...where it can then fail..and begin its descent to $60..along with the rest of the market. Too bold a call?

...now back to the France/Ukraine match...

1pm update - noise, mere noise

The hourly index cycles are looking a bit toppy, but its most likely just noise, doubltess a few bears will be shorting into this.

sp'60min

Summary

The hourly 10MA of 1330 will be acting as first soft support. I'd be surprised if we break under that by the close.

More later...

sp'60min

Summary

The hourly 10MA of 1330 will be acting as first soft support. I'd be surprised if we break under that by the close.

More later...

12pm update - the trend is clear

A lot of traders are getting overly wrapped up in the hysteria talk about the coming Greek election weekend. I see other traders shorting at these levels..urghh. I guess they might get lucky, but the daily chart sure says 'hell no!..don't short yet'.

sp' daily 4month

Summary

Just look at the daily 10MA (the red line!). With the snap higher last Wednesday June'6th, that was our first proper buy signal. Even the size of that candle was a huge warning to the bears to close any remaining positions.

Today, the daily 10MA is 1313, and is now starting to ramp higher. At current trend it will be 1350 by the end of next week. So...it is very feasible market will be 20/30pts above that level sometime late next week....hence my secondary zone of 1380/90.

Arguably, only with a break below sp'1313 do we have an initial sell signal, and even then I'd be reluctant ahead of the Fed next Wednesday.

The trend IS clear, we're headed up in the near term, no matter how sickening that is to the many doomers out there, and those bearish traders who are shorting today 'hoping' for a major gap lower on Monday.

A close today over 1340 would be a bonus to the bulls, its certainly not necessary though. Even a minor red close would be fine.

Ironically, it looks again like what was initially a seemingly very bearish news event, will end with the market gapping higher on Monday morning. I sympathise with those bears who are short right now, but they are currently fighting the trend.

sp' daily 4month

Summary

Just look at the daily 10MA (the red line!). With the snap higher last Wednesday June'6th, that was our first proper buy signal. Even the size of that candle was a huge warning to the bears to close any remaining positions.

Today, the daily 10MA is 1313, and is now starting to ramp higher. At current trend it will be 1350 by the end of next week. So...it is very feasible market will be 20/30pts above that level sometime late next week....hence my secondary zone of 1380/90.

Arguably, only with a break below sp'1313 do we have an initial sell signal, and even then I'd be reluctant ahead of the Fed next Wednesday.

The trend IS clear, we're headed up in the near term, no matter how sickening that is to the many doomers out there, and those bearish traders who are shorting today 'hoping' for a major gap lower on Monday.

A close today over 1340 would be a bonus to the bulls, its certainly not necessary though. Even a minor red close would be fine.

Ironically, it looks again like what was initially a seemingly very bearish news event, will end with the market gapping higher on Monday morning. I sympathise with those bears who are short right now, but they are currently fighting the trend.

11am update - are we closed yet?

Maybe its just me, but I'm already tired of today. I guess its the waiting. Can we just jump ahead to Sunday night futures wheel already?

The cheerleading maniacs on clown channel are annoying me more than usual so far today. During pre-market they were touting futures incorrectly, out by over 50 dow points. Idiots! How hard is it for them to check the quotes for DIA or SPY?

sp'60min

sp'daily, 4month

Summary

So yeah, I'm tired. Anyone trading across the weekend is arguably stupidly reckless. This market is technically inclined to move to at least 1350/60..the inverse H/S says 1380/90. Yet of course..if the Greeks vote for more anti-bailout representatives, then Mr Market might get real upset.

Better to sit this entire nonsense out until AFTER the Fed next Wednesday afternoon (2pm). Even then, better to give it a further day to shake things out.

So..right now.. a short sometime next Thursday...that's the plan.

The cheerleading maniacs on clown channel are annoying me more than usual so far today. During pre-market they were touting futures incorrectly, out by over 50 dow points. Idiots! How hard is it for them to check the quotes for DIA or SPY?

sp'60min

sp'daily, 4month

Summary

So yeah, I'm tired. Anyone trading across the weekend is arguably stupidly reckless. This market is technically inclined to move to at least 1350/60..the inverse H/S says 1380/90. Yet of course..if the Greeks vote for more anti-bailout representatives, then Mr Market might get real upset.

Better to sit this entire nonsense out until AFTER the Fed next Wednesday afternoon (2pm). Even then, better to give it a further day to shake things out.

So..right now.. a short sometime next Thursday...that's the plan.

10am update - witchy twitchy market

Its quadruple witching today, so things could be even more twitchy/choppy than yesterday. We've already seen the VIX flip from +5% to -2 and back to +5 in the first few minutes. Healthy markets huh?

Today's econ-data all sucked, and it is further confirmation of major underlying trouble ahead. It remains laughable how with Japan, the EU/UK now in recession, there remain a majority who still think the US will be immune. Yeah...I remember hearing the same thing in late 2007, hell, even the Bernanke was suggesting no recession as late as summer 2008.

*consumer sentiment: 74.1, vs 77.5 expected... more lousy data.

sp'60min

vix'60min

Summary

Holding to original target zone of sp'1350/60, that seems unlikely to be hit until the middle of next week. If they can keep the momentum strong enough, then 1380/90 is possible.

Right now I'd guess the Fed' will extend QE-twist next Wednesday. That might be enough to kick the market up above my target zone. Of course, twist is not real QE, its just bond yield curve manipulation So..any market gains will be VERY short lived.

Let them ramp it up.....wave'3 is coming.....be patient my bear legion :)

Today's econ-data all sucked, and it is further confirmation of major underlying trouble ahead. It remains laughable how with Japan, the EU/UK now in recession, there remain a majority who still think the US will be immune. Yeah...I remember hearing the same thing in late 2007, hell, even the Bernanke was suggesting no recession as late as summer 2008.

*consumer sentiment: 74.1, vs 77.5 expected... more lousy data.

sp'60min

vix'60min

Summary

Holding to original target zone of sp'1350/60, that seems unlikely to be hit until the middle of next week. If they can keep the momentum strong enough, then 1380/90 is possible.

Right now I'd guess the Fed' will extend QE-twist next Wednesday. That might be enough to kick the market up above my target zone. Of course, twist is not real QE, its just bond yield curve manipulation So..any market gains will be VERY short lived.

Let them ramp it up.....wave'3 is coming.....be patient my bear legion :)

Pre-Market Brief

Good morning. After yesterdays closing hour madness, I'm not sure what to expect today.

Futures are showing sp+6pts though right now, that will take us to around 1335 - equal to the recent high. So...just a little more..and the door will be OPEN to 1340s..even 1350 if the market really wants to go crazy today.

I will be sorely tempted to re-short if we are over 1345 near the close of today ahead of the Greek elections.

Empire state survey: 2.29 vs 13.8 expected - urgh! That is BAD..worse number since last November.

Two further pieces of econ-data later before 10am...if they come in good, market will be given the excuse to rally.

Sp'60min

Summary

The closing hour was a crazy way to break over the bull flag, yet it does look we are getting the follow through so far in pre-market trading.

The primary target remains 1350/60. There is very clear fib' resistance around 1345, but the inverse H/S formation would target as high as 1380/90 next week.

Good wishes for Friday trading!

Futures are showing sp+6pts though right now, that will take us to around 1335 - equal to the recent high. So...just a little more..and the door will be OPEN to 1340s..even 1350 if the market really wants to go crazy today.

I will be sorely tempted to re-short if we are over 1345 near the close of today ahead of the Greek elections.

Empire state survey: 2.29 vs 13.8 expected - urgh! That is BAD..worse number since last November.

Two further pieces of econ-data later before 10am...if they come in good, market will be given the excuse to rally.

Sp'60min

Summary

The closing hour was a crazy way to break over the bull flag, yet it does look we are getting the follow through so far in pre-market trading.

The primary target remains 1350/60. There is very clear fib' resistance around 1345, but the inverse H/S formation would target as high as 1380/90 next week.

Good wishes for Friday trading!

Oil - minor bounce before collapse

The deflationists are looking for a secondary collapse wave beginning this summer. One of the key signs will be the price of Oil. The price of Oil is certainly not the be-all of the deflationary argument though. After all, the price of Oil is meddled and fixed partly by the cartel of OPEC. However, many of the economic fundamentals do come out via the price of Oil.

Lets take a look at three of the main cycles, which should provide a good overview of where we have come from, where we are, and where we might be going.

WTIC, daily

WTIC, weekly

WTIC, monthly, 20yr historic

Summary

The deflationists should be looking for a key break of the $80 level. It is a very important trend line stretching back to summer 2009.

A fail to hold above $80, with 2 or 3 successive daily closes below, will open up the first target of $60. Secondary target is $50 - a hugely massive psychological/natural support level.

The move lower would probably be very fast, spanning no more than a few months.

The big $50

I can't imagine WTIC below $50 this year..or even next year, even if the market collapsed to sp'800, and the USA was officially in recession again. Not only would OPEC fight against any prices drops all the way down, but there are the usual 'middle east tensions' that always help to instill some fear amongst the Oil traders.

Near term outlook

I'm looking for a move higher next week for Oil, a target range of $88/92 looks very reasonable. My best guess would be we max out around 89/90 - the weekly 10MA will offer some strong resistance around the $90 level. Only if Oil re-takes the big $100 level would I get bullish on both Oil, and the wider equity/commodity markets.

--

Certainly, today ended turbulently...I'm sure Friday - 'Quadruple Witching', will be just as dynamic.

Goodnight from London

Lets take a look at three of the main cycles, which should provide a good overview of where we have come from, where we are, and where we might be going.

WTIC, daily

WTIC, weekly

WTIC, monthly, 20yr historic

Summary

The deflationists should be looking for a key break of the $80 level. It is a very important trend line stretching back to summer 2009.

A fail to hold above $80, with 2 or 3 successive daily closes below, will open up the first target of $60. Secondary target is $50 - a hugely massive psychological/natural support level.

The move lower would probably be very fast, spanning no more than a few months.

The big $50

I can't imagine WTIC below $50 this year..or even next year, even if the market collapsed to sp'800, and the USA was officially in recession again. Not only would OPEC fight against any prices drops all the way down, but there are the usual 'middle east tensions' that always help to instill some fear amongst the Oil traders.

Near term outlook

I'm looking for a move higher next week for Oil, a target range of $88/92 looks very reasonable. My best guess would be we max out around 89/90 - the weekly 10MA will offer some strong resistance around the $90 level. Only if Oil re-takes the big $100 level would I get bullish on both Oil, and the wider equity/commodity markets.

--

Certainly, today ended turbulently...I'm sure Friday - 'Quadruple Witching', will be just as dynamic.

Goodnight from London

Daily Cycle Update - ready to snap higher

The market has a very clear inverse H/S formation, everything is set up for a move higher next week. Were it not for the great uncertainty with the Greek election - and the FOMC next Wednesday, I myself would be part of this..and be long.

As it is, this lunacy could still fail on Sunday night..and that would probably break the recent low of 1266. That's too risky a gap down for me to be involved with.

Sp' daily, rainbow (Elder impulse)

IWM, bearish outlook

Sp, bearish, 4mth

Summary

The first 'rainbow' chart (as I like to call them) shows a VERY clear inverse H/S formation on the Sp. A simple projection upwards would be to around 1380/90. That is certainly higher than my primary target of 1350/60..and anyone planning to re-short later next week will need to be careful they don't get short too early.

-

Despite today's lunacy, nothing has changed in the bigger picture...primary outlook is that we are in wave'2, and wave'3 will bring a move to around sp'1150/00 by late July.

A little more later...(probably on Oil, which is going to be a key indicator of what I believe is a deflationary collapse wave).

As it is, this lunacy could still fail on Sunday night..and that would probably break the recent low of 1266. That's too risky a gap down for me to be involved with.

Sp' daily, rainbow (Elder impulse)

IWM, bearish outlook

Sp, bearish, 4mth

Summary

The first 'rainbow' chart (as I like to call them) shows a VERY clear inverse H/S formation on the Sp. A simple projection upwards would be to around 1380/90. That is certainly higher than my primary target of 1350/60..and anyone planning to re-short later next week will need to be careful they don't get short too early.

-

Despite today's lunacy, nothing has changed in the bigger picture...primary outlook is that we are in wave'2, and wave'3 will bring a move to around sp'1150/00 by late July.

A little more later...(probably on Oil, which is going to be a key indicator of what I believe is a deflationary collapse wave).

Subscribe to:

Posts (Atom)