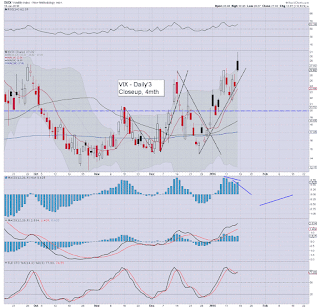

With equities settling lower for a third consecutive week, the VIX was naturally continuing to rise, settling the day +12.8% @ 27.02. Across the week, the VIX attained a fractional net weekly gain of 0.04%. Relative to equities, the VIX is relatively subdued, threatening a short term equity rebound into the next FOMC (Jan'27th).

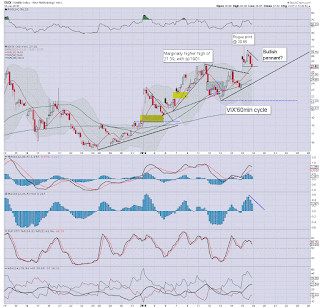

VIX'60min

VIX'daily3

VIX'weekly

Summary

*there was a 'rogue print' of 30.95 at 10.40am, and I am dismissing it as such.

--

Suffice to add, relative to equities, VIX remains surprisingly subdued.

Just consider that when sp'1867 in Aug'24th 2015, the VIX exploded into the 50s. Yet today.. with sp'1857, the VIX was not able to hold the 30 threshold.

Of course, the style of equity price action is somewhat different, but still, I'd have expected to see front month VIX at least in the 35/40 zone.

In any case.. much higher VIX levels look due in the weeks and months ahead.. as the market increasingly unravels.

--

more later... on the indexes