US equity indexes are set for a third consecutive net weekly decline, having broken a new cycle low of sp'1857.. the lowest level since Oct'2014. VIX is holding gains of around 20% in the 28s... which considering the equity market weakness, is arguably somewhat subdued.

sp'weekly1b

sp'60min2

Summary

Regardless of the closing hour - which frankly.. could see almost anything happen, its a third week for the equity bears.

Clearly, any bounces are to be shorted in the weeks and months ahead.

The sp'1600/1500s look a rather easy target.

From a pure technical perspective, by this April, the leading/headline indexes (sp'500, dow, nasdaq) will have the same MACD setup as Sept'2008.. and we remember how that month traded, right?

-

Say hello...

I'll keep DISQUS open for the 3pm post on my screen in the closing hour.. so.. if you want to say hello... please do !

yours.... not short... but neither getting his ass kicked on the long side.

I live to fight another day :)

-

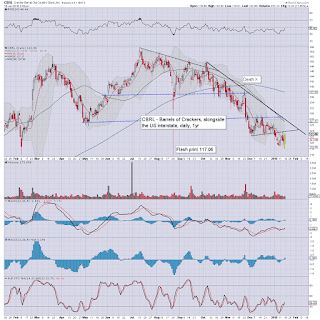

3.04pm.. I can't remember who highlighted CBRL to me recently.....

Today its offering a rather powerful hyper-reversal candle. First upside target would be the 50dma in the $127s

-

Another sign of a 'natural floor'...

APA, daily

H/S formation has played out... a bounce to 40/42 zone would not be overly bold.

-

3.09pm

'hollow red' reversal candles appearing all over the place...

AAPL, daily

First target is the 102/105 zone.

-

3.12pm.. As things are, the hourly MACD cycle is set to turn positive early Tuesday, but who wants to seriously go long on such a trend, whilst price action remains broadly weak?

Today was day'12.. and typically... that is usually the max number of days in a short term down wave.

Arguing against that is that the VIX remains relatively subdued, and there is no sign of capitulation.

--

Market twitchy... sp -43pts @ 1878 VIX 27.90

-

3.27pm... We could still close as high as 1890.. as there might be a fair few short side traders who fear the PBOC doing something this weekend.

-

3.37pm... Increasingly looking like the market makers are striving to pin the market at sp'1885/90